Market Dislocation: Brookfield's Strategy For Strategic Investments

Table of Contents

Identifying Opportunities in Market Dislocation

Brookfield's success hinges on its unique ability to pinpoint lucrative opportunities born from market instability. This involves a multi-faceted approach combining macroeconomic analysis with deep dives into specific sectors and individual companies.

Recognizing Distressed Assets

Brookfield excels at recognizing undervalued assets and businesses negatively impacted by market dislocations. This isn't a matter of chance; it's a result of rigorous analysis.

- Deep due diligence and fundamental analysis: Their team meticulously examines financial statements, operational efficiencies, and future growth potential, going far beyond surface-level assessments.

- Focus on assets with strong long-term fundamentals despite short-term market pressures: They look beyond the immediate crisis, seeking assets with inherent value that is temporarily obscured by market sentiment. This requires a long-term vision.

- Expertise in various asset classes (real estate, infrastructure, renewable energy): Brookfield's diverse portfolio allows them to identify distressed opportunities across a wide range of sectors, reducing their overall risk exposure.

Leveraging Counter-Cyclical Investing

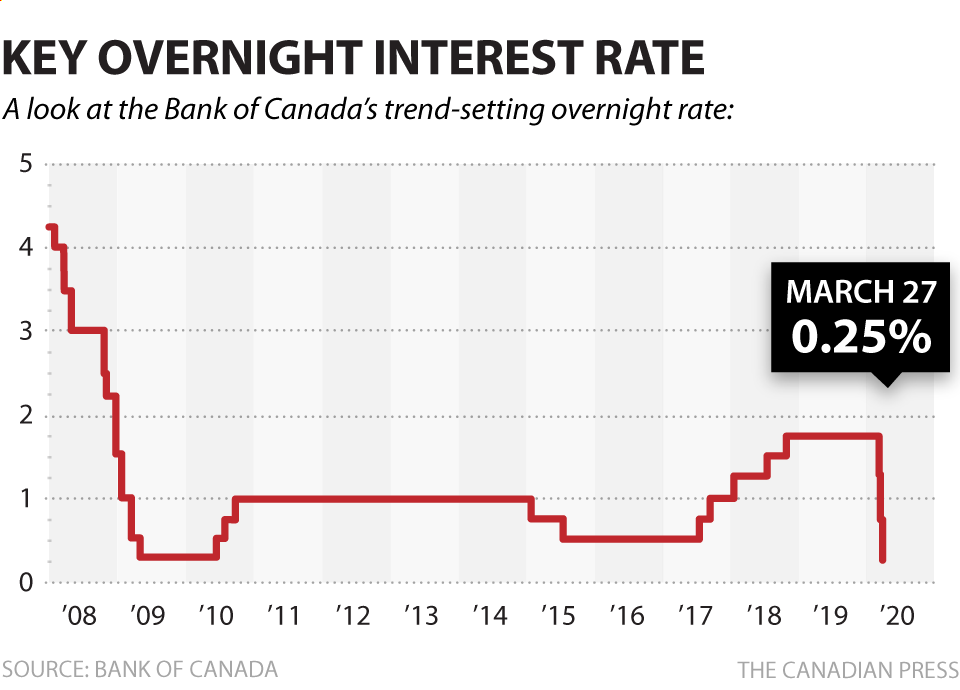

A core tenet of Brookfield's strategy is counter-cyclical investing. While others panic and sell, Brookfield often steps in, buying assets at depressed prices. This approach requires significant patience and a long-term outlook.

- Disciplined approach to risk management: They carefully assess risks and only invest when the potential rewards significantly outweigh the perceived dangers.

- Ability to withstand short-term market volatility: Brookfield understands that market recoveries take time. They are prepared to hold onto their investments through periods of uncertainty.

- Strong balance sheet and access to capital: Their robust financial position allows them to seize opportunities when other investors are constrained by liquidity issues.

Brookfield's Strategic Investment Approach

Brookfield's success isn't merely about identifying distressed assets; it's about a carefully crafted investment philosophy and a strategic approach to diversification.

Value Investing Philosophy

At the heart of Brookfield's strategy lies a deep commitment to value investing. They focus on acquiring assets trading below their intrinsic worth, capitalizing on market mispricing or panic selling.

- Focus on fundamental value rather than market sentiment: They prioritize a company's underlying value over short-term market fluctuations and investor emotion.

- Long-term holding periods allowing for value appreciation: Brookfield isn't interested in quick flips. They take a long-term view, allowing time for their investments to appreciate in value.

- Active portfolio management and value enhancement strategies: They don't just buy and hold; they actively manage their investments, implementing strategies to increase their value.

Diversification Across Asset Classes

Brookfield's portfolio spans diverse asset classes including real estate, infrastructure, renewable energy, and private equity. This diversification is crucial for mitigating risk and seizing opportunities across different market sectors.

- Reduced exposure to sector-specific downturns: A diversified portfolio limits the impact of any single sector's underperformance.

- Enhanced risk-adjusted returns: Diversification enables them to achieve higher returns relative to the level of risk taken.

- Strategic allocation of capital across various opportunities: They can allocate capital efficiently to the most promising opportunities across different sectors, optimizing their returns.

Executing Strategic Investments During Market Dislocation

Brookfield's execution is as impressive as its strategy. They employ sophisticated techniques to secure favorable terms and maximize returns from their investments.

Strategic Partnerships and Deal Structuring

Brookfield leverages its extensive network to create strategic partnerships and structure creative deals. This often involves innovative financing techniques and collaborative arrangements.

- Strong relationships with financial institutions and counterparties: Their network provides access to financing and deal opportunities others might miss.

- Innovative deal structuring capabilities: They possess the expertise to structure complex transactions that benefit their interests.

- Negotiation skills to secure favorable terms: Brookfield's negotiators are skilled at securing advantageous terms for their investments.

Operational Expertise and Value Enhancement

Beyond acquisition, Brookfield actively enhances the value of its assets through operational improvements and strategic initiatives.

- Hands-on operational expertise in diverse asset classes: They possess the skills and experience to improve the efficiency and profitability of their investments.

- Focus on operational efficiency and cost optimization: They identify and implement strategies to streamline operations and reduce costs.

- Implementation of strategic initiatives for growth and value creation: They actively seek ways to grow their investments and enhance their overall value.

Conclusion

Brookfield Asset Management's success in navigating market dislocations is a testament to their well-defined strategy. Their deep understanding of market cycles, disciplined value investing approach, diversification, and operational expertise allows them to consistently capitalize on market turmoil. By recognizing distressed assets, employing counter-cyclical strategies, and structuring creative deals, Brookfield generates superior returns. Understanding their strategy offers invaluable lessons for investors seeking to profit from market dislocations. Learn more about how to capitalize on market volatility by exploring [Link to relevant Brookfield resource or related content]. Start incorporating elements of Brookfield’s approach to market dislocation into your own investment strategy today.

Featured Posts

-

Psg Nantes 0 0 Belirleyici Anlar Ve Oyuncularin Performansi

May 08, 2025

Psg Nantes 0 0 Belirleyici Anlar Ve Oyuncularin Performansi

May 08, 2025 -

Arteta Faces Scrutiny Following Collymores Comments Arsenal News

May 08, 2025

Arteta Faces Scrutiny Following Collymores Comments Arsenal News

May 08, 2025 -

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025 -

Chinas Rate Cuts Easier Bank Lending Amidst Trade Tensions

May 08, 2025

Chinas Rate Cuts Easier Bank Lending Amidst Trade Tensions

May 08, 2025 -

Izjava Pavla Grbovica Psg Komentar Na Predloge Prelazne Vlade

May 08, 2025

Izjava Pavla Grbovica Psg Komentar Na Predloge Prelazne Vlade

May 08, 2025

Latest Posts

-

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian Thriller

May 08, 2025

The Long Walk Trailer A Glimpse Into Stephen Kings Dystopian Thriller

May 08, 2025 -

Grizzlies Thunder Showdown A Key Matchup To Watch

May 08, 2025

Grizzlies Thunder Showdown A Key Matchup To Watch

May 08, 2025 -

The Life Of Chuck Movie Trailer Stephen Kings Positive Reaction

May 08, 2025

The Life Of Chuck Movie Trailer Stephen Kings Positive Reaction

May 08, 2025 -

The Long Walk Trailer Breakdown And Analysis Of Stephen Kings Upcoming Film

May 08, 2025

The Long Walk Trailer Breakdown And Analysis Of Stephen Kings Upcoming Film

May 08, 2025 -

Offseason Trade Analysis Thunder Vs Bulls The Untold Story

May 08, 2025

Offseason Trade Analysis Thunder Vs Bulls The Untold Story

May 08, 2025