China's Rate Cuts: Easier Bank Lending Amidst Trade Tensions

Table of Contents

The Rationale Behind China's Rate Cuts

The decision to lower interest rates stems from a complex interplay of economic factors. China's economy, while still growing, is facing significant headwinds. The ongoing trade disputes with the United States, coupled with weakening domestic demand and decreased exports, have created an environment demanding proactive government intervention. The aim of these China interest rate cuts is multifaceted: stimulating economic growth, mitigating the negative impacts of the trade war, boosting investment, and encouraging consumption.

The current economic climate in China is characterized by:

- Decreased exports due to trade disputes: Tariffs and trade barriers have significantly impacted Chinese export-oriented industries.

- Weakening domestic demand: Consumer confidence and spending have been affected by economic uncertainty.

- Need to maintain financial stability: The government aims to prevent a sharper economic downturn and maintain stability within the financial system.

- Government's focus on supporting small and medium-sized enterprises (SMEs): SMEs form the backbone of the Chinese economy and are particularly vulnerable to economic shocks. Lower borrowing costs can help them stay afloat and continue contributing to growth.

Impact on Bank Lending and Credit Availability

The China interest rate cuts directly influence lending rates offered by Chinese banks. By reducing the benchmark interest rate, the People's Bank of China (PBOC) aims to make borrowing cheaper for both businesses and consumers. This, in turn, should lead to increased credit availability. The potential consequences include:

- Lower borrowing costs for businesses: This encourages investment in new projects, expansion, and job creation.

- Increased investment in infrastructure projects: Government-led infrastructure spending often benefits from lower borrowing costs.

- Potential boost in consumer spending through easier access to loans: Lower interest rates on mortgages and consumer loans can stimulate domestic consumption.

- Impact on loan defaults and non-performing loans: While increased lending can boost the economy, it also carries the risk of increased defaults if borrowers struggle to repay their debts. The PBOC needs to carefully monitor this aspect.

Addressing Trade Tensions Through Monetary Policy

China is using monetary policy, including these rate cuts, as a tool to mitigate the negative consequences of escalating trade tensions. The strategy is to:

- Support domestic industries affected by tariffs: Lower borrowing costs can help these industries adapt and compete.

- Attract foreign investment: A more favorable borrowing environment can make China a more attractive destination for foreign investment.

- Stabilize the yuan exchange rate: Monetary policy can influence the value of the yuan, making it more competitive in international markets.

- The interplay between monetary policy and fiscal policy: The effectiveness of monetary policy is often enhanced when combined with supportive fiscal measures.

However, it's crucial to acknowledge that monetary policy alone cannot fully counteract the effects of external economic pressures. Trade disputes require diplomatic solutions as well.

Potential Risks and Challenges

While the China interest rate cuts aim to stimulate growth, they also carry potential risks:

- Risk of inflationary pressure: Increased money supply can lead to higher prices if not carefully managed.

- Potential for increased debt levels: Easier access to credit can lead to an increase in overall debt, increasing financial vulnerability.

- Challenges in targeting specific sectors of the economy: Monetary policy can be a blunt instrument, making it difficult to target support specifically to the sectors that need it most.

- Effectiveness of transmission mechanisms: The effectiveness of the rate cuts depends on how quickly and efficiently these changes translate into lower borrowing costs for businesses and consumers.

Conclusion: China's Rate Cuts: A Long-Term Strategy for Economic Stability

China's recent interest rate cuts represent a significant strategic response to economic headwinds and trade tensions. While intended to stimulate bank lending, boost investment, and support domestic industries, the effectiveness of these measures will depend on various factors, including the transmission of these changes through the financial system and the interplay with fiscal policy. The potential risks of increased inflation and debt levels also necessitate careful monitoring and management. To fully grasp the long-term implications of these policy decisions, ongoing analysis and further research into the effectiveness of China's rate cuts strategy are crucial. Stay informed about future developments in China's monetary policy and its impact on China interest rate cuts and global markets.

Featured Posts

-

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025

Another Aircraft Lost Second Us Navy Jet Goes Down Near Truman Carrier

May 08, 2025 -

3 Key Factors Suggesting An Upcoming Xrp Parabolic Move

May 08, 2025

3 Key Factors Suggesting An Upcoming Xrp Parabolic Move

May 08, 2025 -

Gjranwalh Wlyme Ke Mwqe Pr Dl Ka Dwrh Prne Se Dlha Ky Mwt

May 08, 2025

Gjranwalh Wlyme Ke Mwqe Pr Dl Ka Dwrh Prne Se Dlha Ky Mwt

May 08, 2025 -

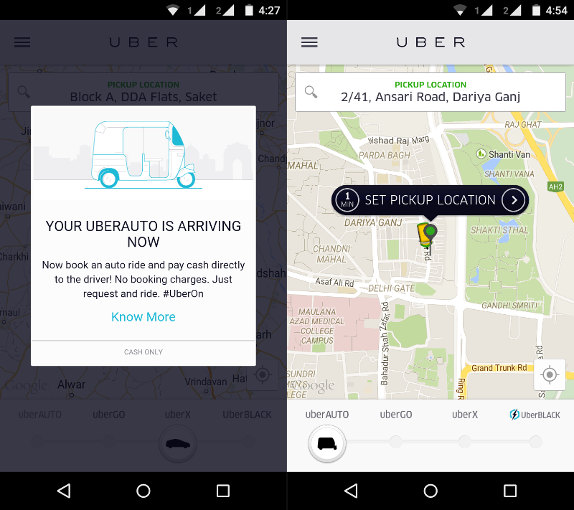

Uber One Launches In Kenya Enjoy Savings On Rides And Food Delivery

May 08, 2025

Uber One Launches In Kenya Enjoy Savings On Rides And Food Delivery

May 08, 2025 -

Arsenal Ps Zh Pregled Na Prviot Mech Od Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Pregled Na Prviot Mech Od Ligata Na Shampionite

May 08, 2025