Malaysian Ringgit (MYR) Exchange Rate: How Front-Loading Benefits Exporters

Table of Contents

Understanding the Malaysian Ringgit (MYR) Exchange Rate and its Volatility

The Malaysian Ringgit (MYR) exchange rate, like any currency, is subject to constant fluctuation influenced by a variety of domestic and international factors. Navigating this volatility is paramount for exporters aiming to secure consistent profits. Key factors impacting the MYR exchange rate include:

-

Global Economic Conditions: Global economic uncertainty, such as recessions or geopolitical instability, significantly impacts the MYR. A weakening global economy often leads to reduced demand for Malaysian exports and a consequent depreciation of the MYR.

-

Political Stability: Political stability within Malaysia plays a crucial role. Political uncertainty or instability can trigger capital flight and weaken the MYR exchange rate.

-

Commodity Prices: Malaysia is a significant exporter of commodities like palm oil and rubber. Fluctuations in global commodity prices directly impact the MYR, as higher prices generally strengthen the currency.

-

Interest Rates: Bank Negara Malaysia's (BNM) monetary policies, particularly interest rate adjustments, influence the MYR's attractiveness to foreign investors. Higher interest rates tend to attract foreign capital, strengthening the MYR.

-

Foreign Direct Investment (FDI): Increased FDI flows into Malaysia bolster the MYR, reflecting confidence in the Malaysian economy. Conversely, reduced FDI can lead to depreciation.

What is Front-Loading in the Context of Exporting?

Front-loading, in the context of exporting, refers to the practice of accelerating export shipments or invoicing to take advantage of a currently favorable MYR exchange rate. This proactive approach helps exporters lock in better exchange rates before anticipated depreciation. The mechanics of front-loading involve:

- Expediting Production: Producers may accelerate their production schedules to complete and ship orders sooner.

- Advancing Shipment Dates: Exporters may negotiate with buyers to bring forward shipment dates, even if it means incurring slightly higher logistics costs.

Benefits of front-loading when the MYR is expected to depreciate:

- Securing higher revenue in MYR terms.

- Reducing the impact of future exchange rate losses.

- Enhancing overall profitability.

Risks associated with front-loading:

- Potential for increased storage costs if goods are ready before the buyer is prepared.

- Higher early production costs due to expedited manufacturing.

Industries where front-loading is particularly beneficial:

- Perishable goods: For exporters of perishable goods, front-loading is crucial to minimize losses from spoilage.

- Time-sensitive orders: Industries with time-critical delivery requirements (e.g., electronics, pharmaceuticals) benefit greatly from front-loading to meet deadlines and secure favorable exchange rates.

How Front-Loading Mitigates Currency Risk for MYR Exporters

Front-loading significantly reduces exposure to MYR exchange rate fluctuations. By locking in a favorable exchange rate, exporters protect their profit margins from potential depreciation. However, successful front-loading depends heavily on accurate forecasting and market analysis.

-

Comparison of profit margins with and without front-loading: A simple comparison showcasing the increased profit margin achieved through front-loading, compared to a scenario where the exporter waits and the MYR depreciates, strongly illustrates the benefits.

-

Strategies for accurate MYR exchange rate forecasting: This involves utilizing technical and fundamental analysis, considering factors outlined in the first section, and consulting with financial experts.

-

The role of financial institutions in facilitating front-loading strategies: Banks and financial institutions offer hedging tools like forward contracts and currency swaps that complement front-loading strategies, offering further protection against adverse exchange rate movements.

Hedging Strategies to Complement Front-Loading

Hedging strategies, such as forward contracts (locking in a future exchange rate) and options contracts (giving the right, but not the obligation, to buy or sell currency at a specific rate), provide additional protection against currency risk. These tools, used in conjunction with front-loading, can significantly reduce the potential downside of exchange rate fluctuations. They act as a safety net, even if the initial MYR exchange rate forecast is slightly off.

Case Studies: Successful Front-Loading by Malaysian Exporters

While specific examples of successful front-loading strategies employed by Malaysian businesses often remain confidential for competitive reasons, hypothetical examples can illustrate the positive impact. For instance, imagine a palm oil exporter anticipating MYR depreciation. By front-loading shipments, securing favorable exchange rates before the anticipated decline, they would have secured higher revenue in MYR, compared to an exporter that did not utilize the strategy.

Conclusion

The Malaysian Ringgit (MYR) exchange rate is a critical factor for Malaysian exporters. Front-loading offers a powerful strategy to mitigate currency risk and improve profitability, especially when the MYR is predicted to weaken. While careful planning and market analysis are essential, combined with potentially hedging strategies, front-loading allows businesses to secure favorable exchange rates and enhance their overall financial performance.

Call to Action: Are you a Malaysian exporter looking to optimize your profits by managing your exposure to MYR exchange rate volatility? Learn more about implementing effective front-loading strategies and hedging techniques to secure your financial future. Contact us today to discuss your specific needs and explore the benefits of managing your Malaysian Ringgit (MYR) exchange rate risk effectively.

Featured Posts

-

Investigating The Use Of Apple Watches By Nhl Referees

May 07, 2025

Investigating The Use Of Apple Watches By Nhl Referees

May 07, 2025 -

Organic Wings For Hawkgirl Isabela Merceds Take On The Superman Character

May 07, 2025

Organic Wings For Hawkgirl Isabela Merceds Take On The Superman Character

May 07, 2025 -

The Young And The Restless Spoilers Summers Apartment Plot Against Claire And Kyle

May 07, 2025

The Young And The Restless Spoilers Summers Apartment Plot Against Claire And Kyle

May 07, 2025 -

La Salud Mental Y Fisica De Simone Biles Tras La Frase Mi Cuerpo Se Derrumbo

May 07, 2025

La Salud Mental Y Fisica De Simone Biles Tras La Frase Mi Cuerpo Se Derrumbo

May 07, 2025 -

Rihannas 5 Minute Masterpiece The 1 6 Billion Stream Song Written For Someone Else

May 07, 2025

Rihannas 5 Minute Masterpiece The 1 6 Billion Stream Song Written For Someone Else

May 07, 2025

Latest Posts

-

The Conclave Begins Electing The Next Pope

May 08, 2025

The Conclave Begins Electing The Next Pope

May 08, 2025 -

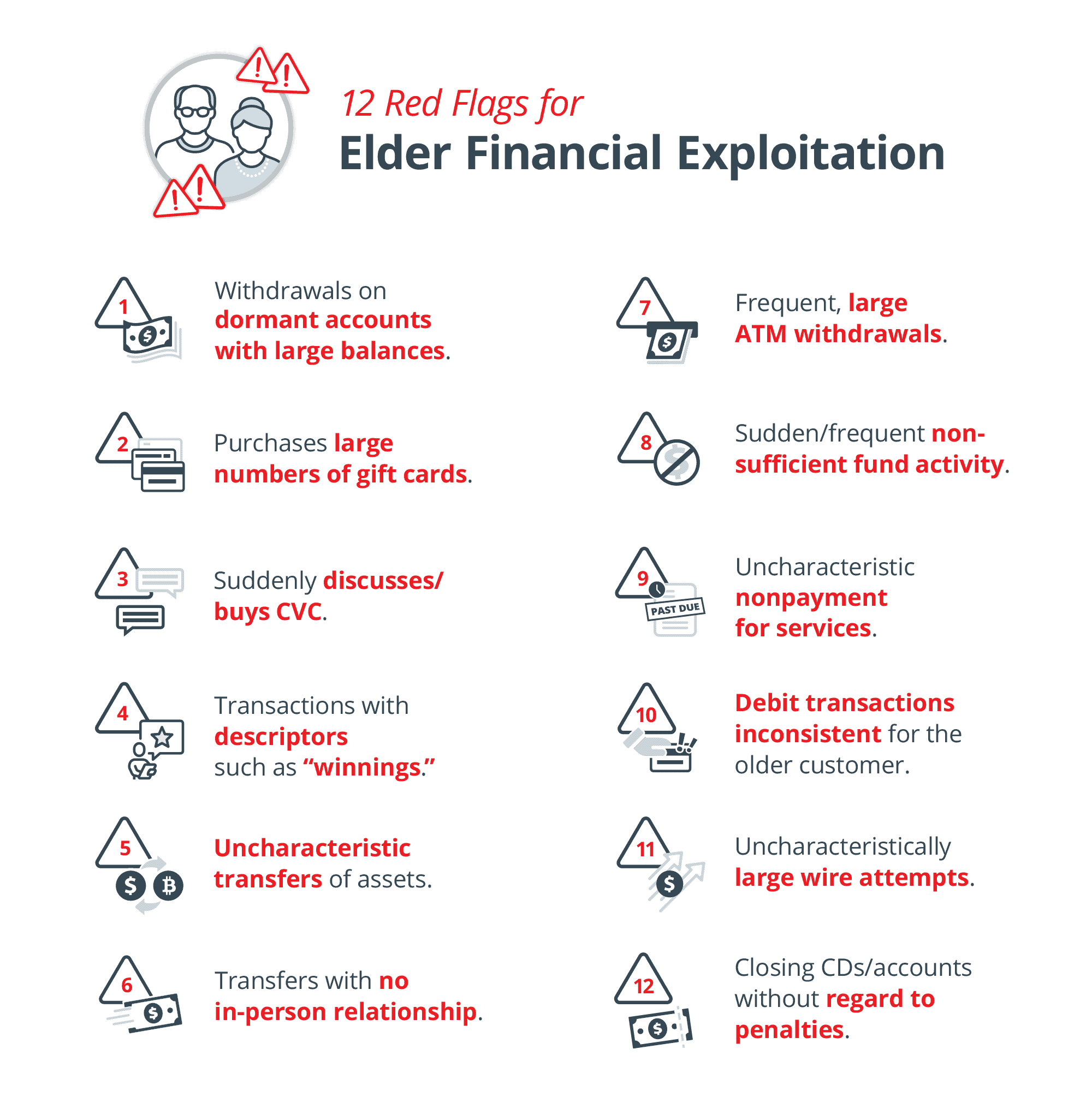

Investigation Corruption And Financial Exploitation In Ukrainian Cemeteries

May 08, 2025

Investigation Corruption And Financial Exploitation In Ukrainian Cemeteries

May 08, 2025 -

Ukraine Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025

Ukraine Cemetery Scandal Corruption And The Exploitation Of War Dead

May 08, 2025 -

Understanding High Stock Market Valuations Bof As Rationale For Investor Confidence

May 08, 2025

Understanding High Stock Market Valuations Bof As Rationale For Investor Confidence

May 08, 2025 -

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025

Bof As Reassuring View Why Current Stock Market Valuations Shouldnt Worry Investors

May 08, 2025