Luxury Real Estate: A Recession-Proof Investment For High-Net-Worth Individuals

Table of Contents

The Inherent Scarcity and Enduring Appeal of Luxury Properties

The inherent value proposition of luxury real estate lies in its scarcity and enduring appeal. These factors combine to create a market that's relatively insulated from broader economic fluctuations.

Limited Supply

Prime luxury properties in desirable locations are, by definition, limited. This inherent scarcity drives up demand and helps maintain value, even during economic downturns.

- Unique architectural designs: Many luxury homes are one-of-a-kind masterpieces, offering unparalleled craftsmanship and design features.

- Prime locations: These properties are typically situated in exclusive areas, offering breathtaking views, convenient access to amenities, and prestigious addresses (e.g., oceanfront properties in Malibu, penthouses in Manhattan, estates in Aspen).

- Limited land availability: The availability of land suitable for luxury development is inherently restricted, especially in desirable locations.

- Extensive construction times: Building a high-end luxury property is a time-consuming process, further limiting the supply.

These factors contribute to price stability and appreciation, even when other asset classes experience volatility. The limited supply ensures that demand consistently outpaces the available inventory, supporting strong price appreciation over the long term.

Timeless Appeal & Desirability

Luxury homes are more than just properties; they represent status, success, and a sophisticated lifestyle. The emotional investment associated with these properties fuels their enduring appeal.

- High-end finishes: Luxury homes are characterized by exquisite materials, superior craftsmanship, and meticulous attention to detail.

- Bespoke features: Many luxury properties offer bespoke features tailored to the owner's specific preferences, enhancing their exclusivity and value.

- Privacy and exclusivity: Luxury properties often offer unparalleled privacy and seclusion, a highly valued attribute for high-net-worth individuals.

- Lifestyle benefits: Many luxury properties come with access to exclusive amenities, such as private pools, golf courses, concierge services, and private beach access, enhancing the overall lifestyle experience.

This enduring appeal translates into consistent demand, regardless of broader economic fluctuations. People seeking prestige and a higher quality of life will continue to invest in luxury properties, even during times of economic uncertainty.

Luxury Real Estate’s Historical Performance During Recessions

Historical data reveals the relative resilience of luxury real estate compared to other asset classes during economic downturns.

Data-Driven Analysis

While all real estate markets can experience temporary dips, luxury real estate typically demonstrates greater stability and quicker recovery compared to other investments.

- Specific examples of market trends: Analyzing historical data from reputable sources like the S&P CoreLogic Case-Shiller Index shows that high-end properties often maintain value or experience slower depreciation during recessions than lower-priced homes.

- Comparison with stocks and bonds: A comparison of the performance of luxury real estate against stocks and bonds during past recessions reveals its relatively stable nature. Luxury real estate often acts as a safe haven asset, preserving capital during periods of market volatility.

(Note: In a real article, charts and graphs would be included here to visually represent this data and enhance reader engagement.)

Diversification & Hedging Against Inflation

Luxury real estate provides significant diversification and inflation-hedging benefits for high-net-worth portfolios.

Portfolio Diversification

Including luxury real estate in a diversified portfolio reduces reliance on volatile stock markets and provides a tangible asset.

- Reduces reliance on volatile stock markets: Luxury real estate offers a hedge against market fluctuations, helping to stabilize overall portfolio performance.

- Provides a tangible asset: Unlike intangible assets like stocks, luxury real estate offers a physical asset with inherent value.

- Complements existing investments: Luxury real estate complements other asset classes, creating a well-rounded investment strategy.

Tangible Asset & Leverage

Luxury real estate's tangible nature allows for leverage and potential rental income.

- Potential for rental income: Luxury properties can generate significant rental income, further enhancing investment returns.

- Ability to secure financing: Luxury real estate often qualifies for favorable financing options.

- Equity building: Owning a luxury property allows for equity building over time, providing further financial security.

Strategic Considerations for High-Net-Worth Investors

Investing in luxury real estate requires careful planning and expert guidance.

Due Diligence and Market Research

Thorough research and the collaboration with experienced professionals are paramount.

- Expert advice: Engaging a real estate agent specializing in luxury properties is crucial for identifying undervalued properties and navigating complex transactions.

- Legal counsel: Legal expertise is essential for reviewing contracts and ensuring compliance with all relevant regulations.

- Financial advisors: Financial advisors can help integrate luxury real estate into an overall investment strategy.

Long-Term Investment Strategy

Luxury real estate is a long-term investment requiring patience and careful consideration of factors like property taxes, maintenance, and capital gains taxes.

- Property taxes: Understanding and accounting for property taxes is essential in determining the overall return on investment.

- Maintenance costs: Luxury properties require ongoing maintenance, which must be factored into the investment plan.

- Capital gains taxes: Understanding potential capital gains taxes upon sale is crucial for financial planning.

Conclusion

Luxury real estate, with its inherent scarcity, enduring appeal, and proven historical resilience, presents a compelling investment opportunity for high-net-worth individuals seeking stability and growth, even amidst economic uncertainties. By carefully considering factors such as location, market trends, and leveraging expert advice, high-net-worth investors can strategically position themselves to benefit from the long-term value appreciation that luxury real estate offers. Contact our team of experts today to explore the world of luxury real estate investment and discover how you can build a robust and recession-proof portfolio with high-value properties.

Featured Posts

-

Where To Invest A Map Of The Countrys Rising Business Areas

May 17, 2025

Where To Invest A Map Of The Countrys Rising Business Areas

May 17, 2025 -

Stay Informed Austintown And Boardman Police Blotter News

May 17, 2025

Stay Informed Austintown And Boardman Police Blotter News

May 17, 2025 -

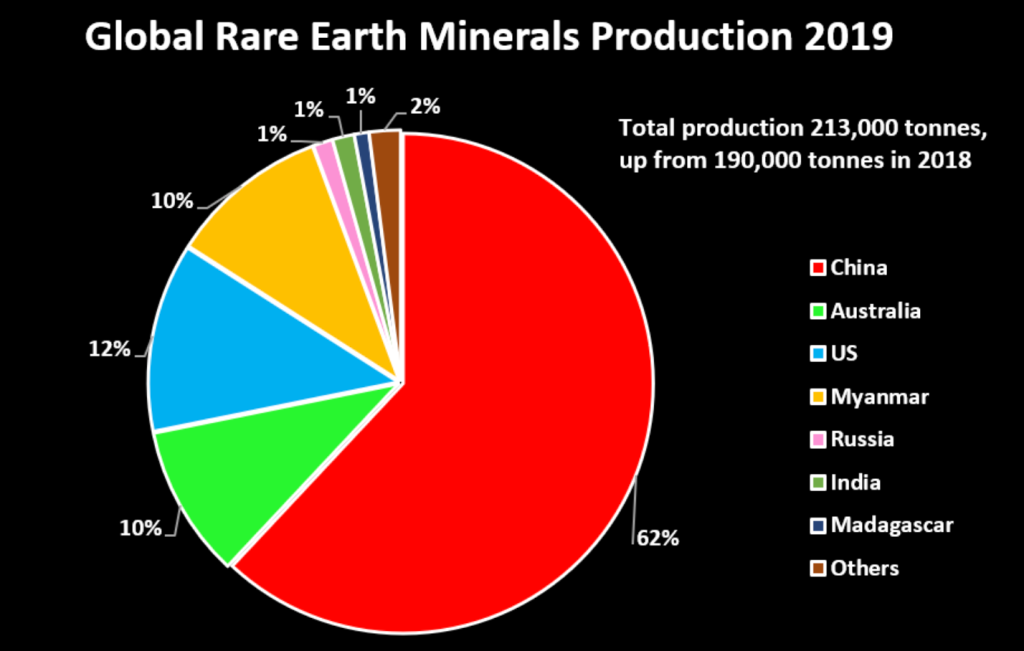

Lynas Breaks Chinese Monopoly Leading Heavy Rare Earths Production Globally

May 17, 2025

Lynas Breaks Chinese Monopoly Leading Heavy Rare Earths Production Globally

May 17, 2025 -

Cassie Venturas Testimony In Sean Combs Trial Details Emerge

May 17, 2025

Cassie Venturas Testimony In Sean Combs Trial Details Emerge

May 17, 2025 -

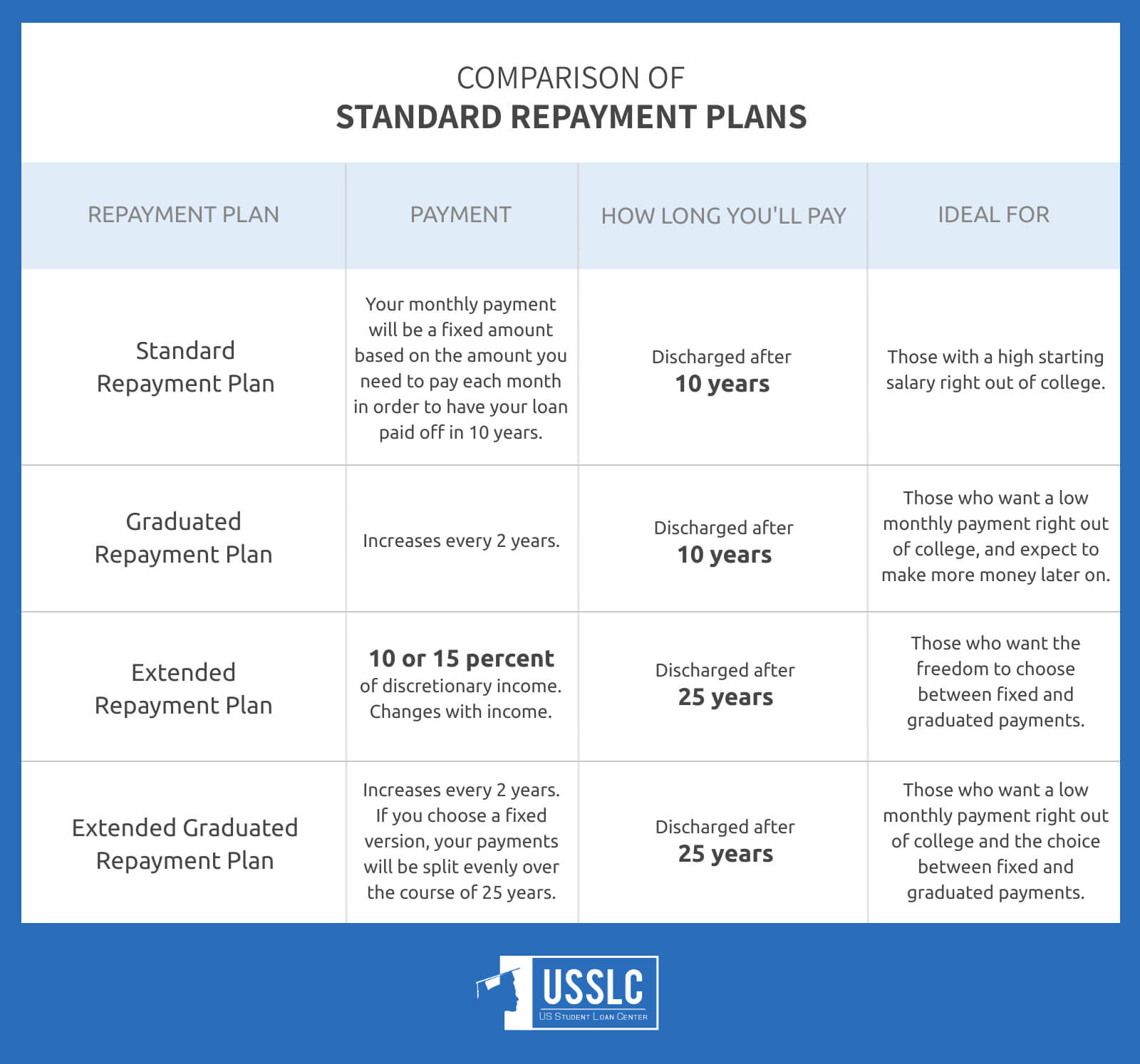

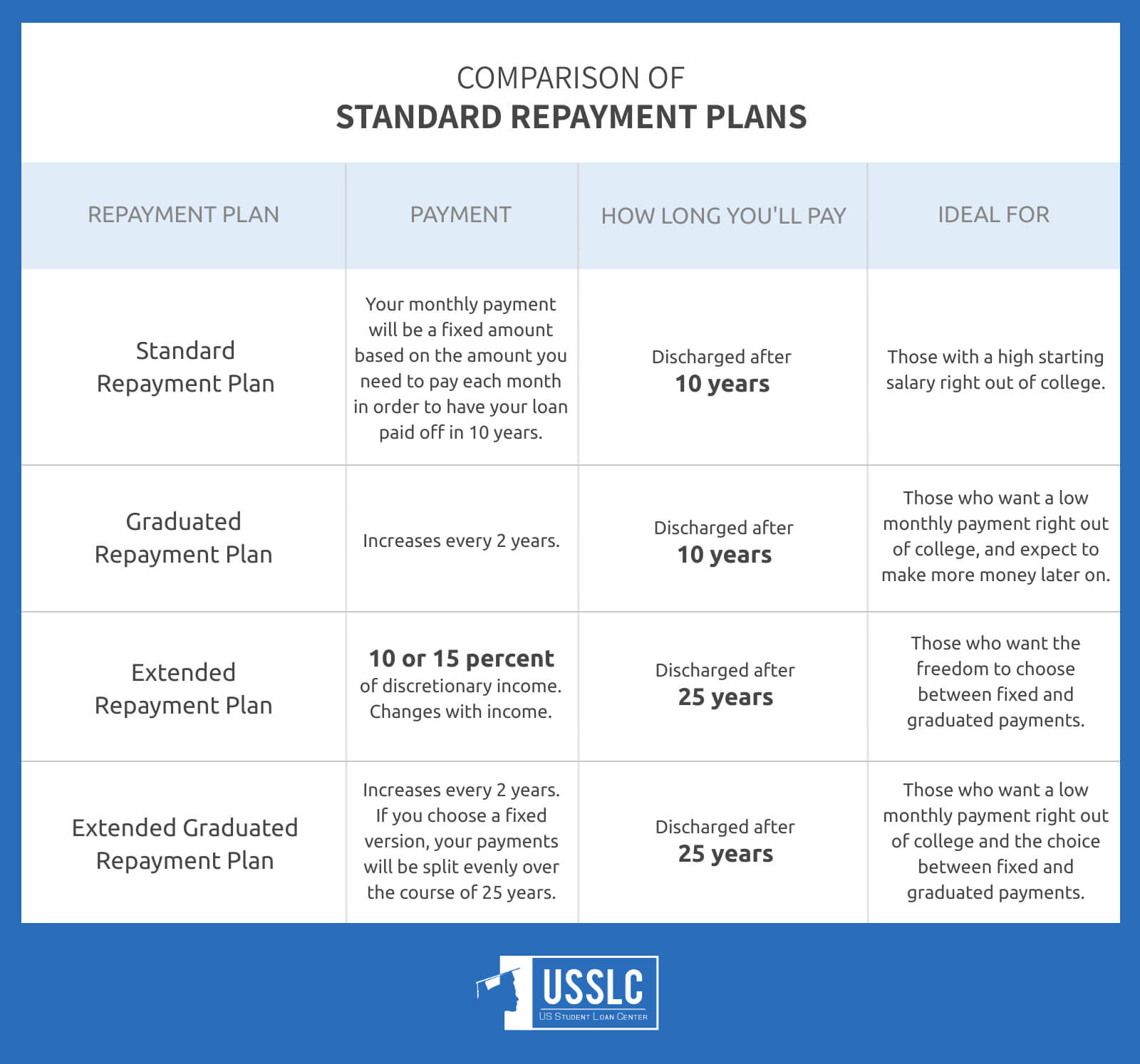

A Financial Planners Guide To Student Loan Repayment

May 17, 2025

A Financial Planners Guide To Student Loan Repayment

May 17, 2025

Latest Posts

-

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025 -

A Financial Planners Guide To Student Loan Repayment

May 17, 2025

A Financial Planners Guide To Student Loan Repayment

May 17, 2025 -

Nba Responds To Questionable No Call In Pistons Game 4 Defeat

May 17, 2025

Nba Responds To Questionable No Call In Pistons Game 4 Defeat

May 17, 2025 -

Pistons Outraged Nba Responds To Costly No Call In Game 4

May 17, 2025

Pistons Outraged Nba Responds To Costly No Call In Game 4

May 17, 2025 -

Nba Playoffs Pistons React To Devastating Missed Foul Call In Game 4

May 17, 2025

Nba Playoffs Pistons React To Devastating Missed Foul Call In Game 4

May 17, 2025