A Financial Planner's Guide To Student Loan Repayment

Table of Contents

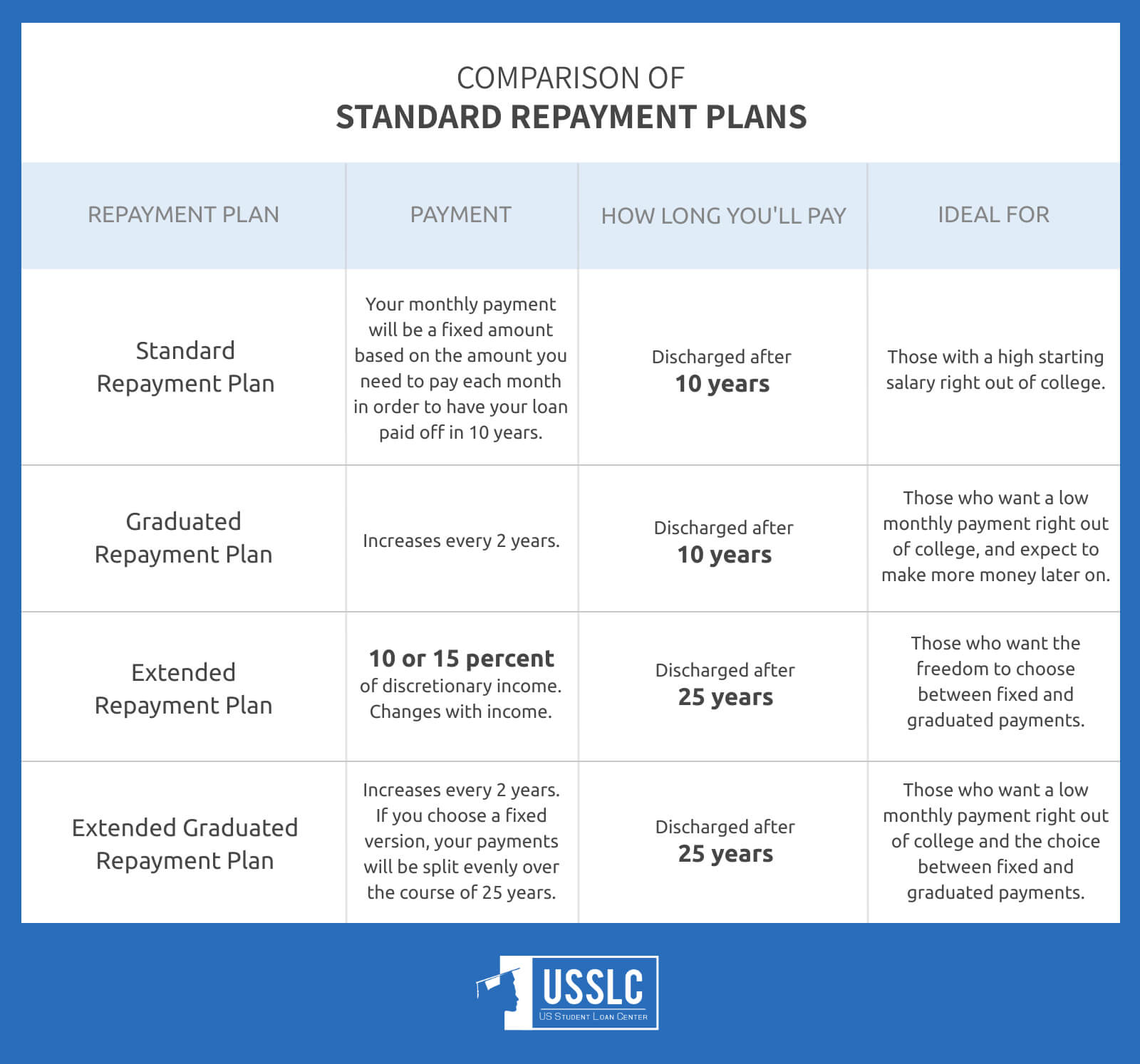

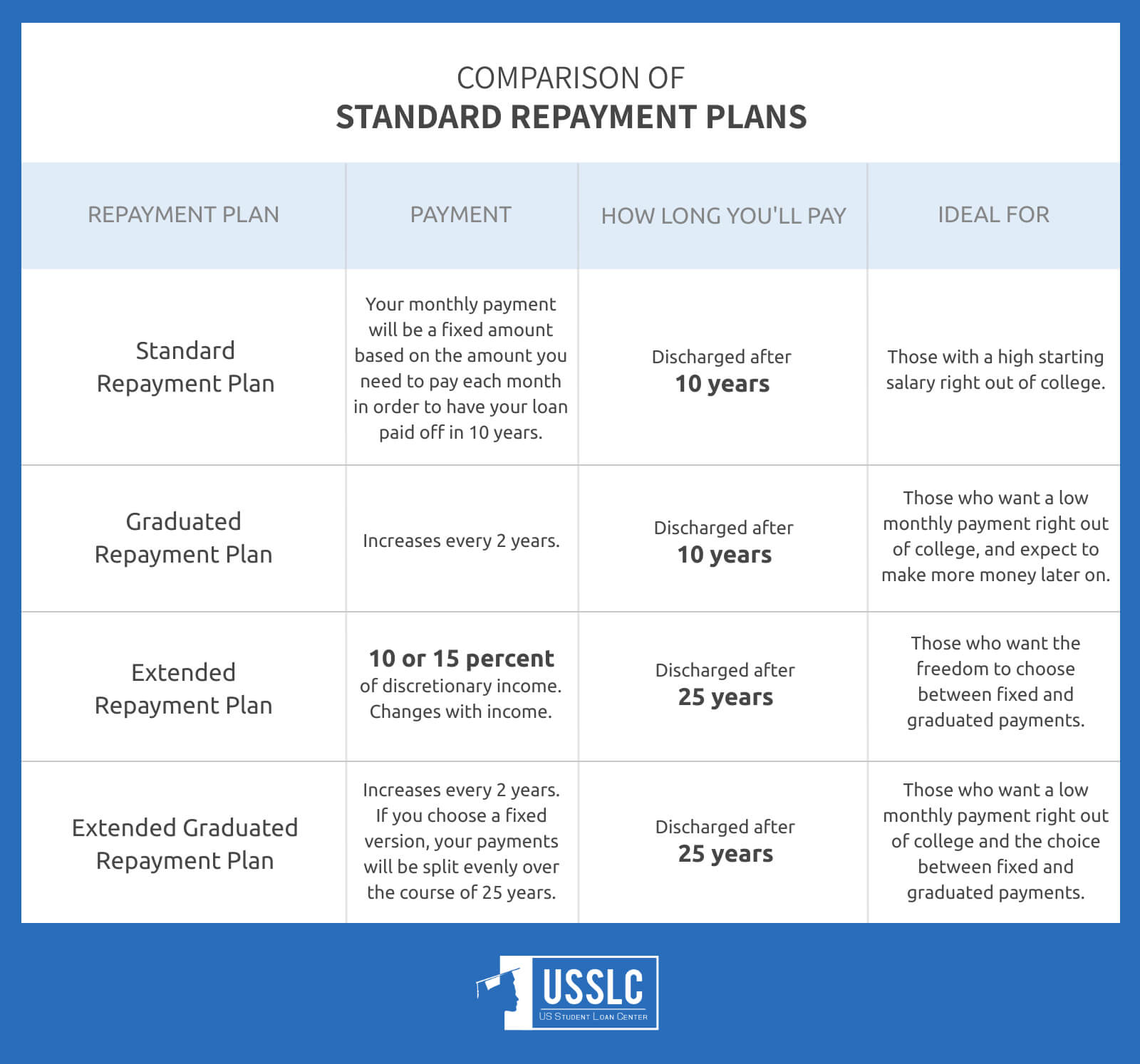

Understanding Different Student Loan Repayment Plans

Choosing the right student loan repayment plan is crucial for long-term financial success. Several plans exist, each with its own features, advantages, and disadvantages. Understanding these nuances is essential for financial planners advising clients on effective student loan repayment strategies.

-

Standard Repayment Plan: This plan involves fixed monthly payments over 10 years. It's straightforward but may result in higher monthly payments compared to other options.

- Pros: Simple, predictable payments. Faster loan payoff.

- Cons: Higher monthly payments can strain budgets. May not be suitable for all income levels.

-

Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), lowering monthly payments. However, it leads to higher overall interest paid.

- Pros: Lower monthly payments. More manageable for lower earners initially.

- Cons: Significantly higher total interest paid over the life of the loan. Longer repayment period.

-

Graduated Repayment Plan: Payments start low and gradually increase over time, aligning with the expectation of rising income.

- Pros: Easier to manage initially, particularly for new graduates.

- Cons: Payments become progressively higher, potentially creating financial strain later.

-

Income-Driven Repayment (IDR) Plans: These plans base monthly payments on a borrower's discretionary income and family size. They offer more flexibility and potential for loan forgiveness. We will discuss these in more detail below.

- Pros: Lower monthly payments, potentially leading to loan forgiveness.

- Cons: Longer repayment periods, potential tax implications on forgiven amounts.

Income-Driven Repayment (IDR) Plans: A Deep Dive

Income-Driven Repayment (IDR) plans offer a lifeline to borrowers struggling with high student loan debt. These plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Understanding the nuances of each is critical for effective student loan repayment planning.

-

IBR, PAYE, REPAYE, and ICR: Each plan has slightly different eligibility requirements, income calculation methods, and payment formulas. Financial planners must carefully assess each client's individual circumstances to determine the most suitable IDR plan.

-

Eligibility and Income Verification: Eligibility typically involves demonstrating financial need based on income and family size. Income verification processes can vary, requiring submission of tax returns or pay stubs.

-

Loan Forgiveness and Tax Implications: IDR plans often lead to loan forgiveness after a specific number of years (typically 20-25), but this forgiven amount may be considered taxable income. Financial planners should discuss these potential tax implications with their clients.

-

Choosing the Right IDR Plan: The best IDR plan depends on the borrower's specific financial situation, including income, family size, and loan amount. Careful analysis is needed to optimize student loan repayment and maximize potential benefits.

Strategies for Efficient Student Loan Repayment

Effective student loan repayment requires proactive planning and strategic decision-making. Financial planners can guide clients towards achieving faster repayment and minimizing overall interest costs.

-

Budgeting and Realistic Repayment Plans: Creating a realistic budget that incorporates student loan payments is crucial. This involves tracking income and expenses and allocating funds towards loan repayment.

-

Accelerated Repayment: Making extra payments, even small amounts, can significantly reduce the loan's lifespan and save money on interest. This is a key strategy for efficient student loan repayment.

-

Student Loan Refinancing: Refinancing can consolidate multiple loans into one with a lower interest rate, potentially saving borrowers considerable money. However, carefully consider the potential risks, including the loss of federal loan benefits.

- Interest Rates: Shop around for the best rates and terms.

- Credit Score Impact: A good credit score is vital for securing favorable refinancing terms.

- Loan Consolidation: Refinancing can simplify repayment by consolidating multiple loans into a single payment.

-

Credit Score and Repayment Options: A higher credit score unlocks better interest rates and more favorable loan terms. Financial planners can guide clients on improving their credit scores to optimize their student loan repayment options.

Addressing Special Circumstances and Potential Challenges

Not all borrowers face the same circumstances. Understanding and addressing special situations is vital for successful student loan repayment.

-

Deferment and Forbearance: These options temporarily postpone or reduce payments, but interest may still accrue. Financial planners should counsel clients on the long-term implications of using these options.

-

Student Loan Default: Defaulting on student loans has severe consequences, including damage to credit scores, wage garnishment, and tax refund offset. Financial planners should stress the importance of avoiding default.

-

Disability and Other Extenuating Circumstances: Borrowers with disabilities or other significant challenges may be eligible for loan forgiveness or other assistance programs. Financial planners should help clients explore these options.

-

Federal vs. Private Student Loans: Federal and private student loans have different repayment options, forgiveness programs, and default consequences. Understanding these differences is crucial for effective student loan repayment planning.

Conclusion

Successfully guiding clients through student loan repayment requires a comprehensive understanding of the available options and strategies. By mastering the information presented in this guide, financial planners can equip their clients with the knowledge and tools needed to navigate the complexities of student loan debt and achieve long-term financial well-being. Remember to stay updated on changes in student loan programs and regulations to provide the most accurate and effective advice to your clients regarding their student loan repayment. Start helping your clients achieve their financial goals with a personalized student loan repayment strategy today!

Featured Posts

-

Trumps Multiple Affairs And Sexual Misconduct Accusations How He Won The Presidency

May 17, 2025

Trumps Multiple Affairs And Sexual Misconduct Accusations How He Won The Presidency

May 17, 2025 -

Josh Cavallo Inspiring Change In Football And Beyond

May 17, 2025

Josh Cavallo Inspiring Change In Football And Beyond

May 17, 2025 -

Get More For Less Practical Tips For Finding Cheap Stuff That Doesnt Suck

May 17, 2025

Get More For Less Practical Tips For Finding Cheap Stuff That Doesnt Suck

May 17, 2025 -

Chat Gpt Creator Open Ai Investigated By The Ftc

May 17, 2025

Chat Gpt Creator Open Ai Investigated By The Ftc

May 17, 2025 -

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 17, 2025

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir This Fall

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025