$900 Million Tariff Bite: Apple Stock Takes A Hit

Table of Contents

The $900 Million Tariff Impact on Apple's Bottom Line

The newly implemented tariffs directly affect several key Apple products, significantly impacting the company's revenue and profit margins. This section analyzes the financial implications of these tariffs on Apple's bottom line.

-

Specific Products Affected: The tariffs primarily target iPhones, iPads, and other Apple products manufactured in China. This encompasses a large portion of Apple's product line, increasing the severity of the financial impact.

-

Quantifying the Financial Loss: Estimates suggest a direct loss of around $900 million due to these tariffs. However, the indirect costs, including potential supply chain disruptions and decreased consumer demand, could push the total financial impact even higher.

-

Impact on Profit Margins: The increased production costs due to tariffs directly compress Apple's profit margins. This reduction in profitability could force Apple to reconsider its pricing strategies or explore alternative manufacturing locations.

-

Mitigating the Losses: Apple is likely to employ several strategies to offset these losses. This could include increasing product prices to absorb the added tariff costs, diversifying its manufacturing base to reduce reliance on China, or exploring cost-cutting measures elsewhere in the supply chain. Analysis of Apple's most recent financial report reveals early attempts at these mitigation strategies.

-

Analysis of Apple's Financial Report: Post-tariff announcement, Apple's financial reports will be closely scrutinized by investors and analysts to gauge the true extent of the financial damage and the effectiveness of the company's response strategies. Early indications suggest a more cautious approach to future projections.

How the Tariffs Affected Apple Stock Prices

The announcement of the new tariffs triggered an immediate and negative reaction in the stock market, directly impacting Apple's share price.

-

Immediate Stock Price Drop: Following the tariff announcement, Apple's stock price experienced a noticeable drop, reflecting investor concern and uncertainty about the future.

-

Long-Term Effects on Stock Performance: The long-term effects are still unfolding. Continued trade tensions and potential escalation could lead to further volatility and sustained pressure on Apple's stock price.

-

Investor Sentiment and Market Reaction: The market reacted negatively, signaling a decline in investor confidence in Apple's short-term prospects. Concerns about the impact on future earnings and the potential for further tariffs contributed to the negative sentiment.

-

Volatility in Apple's Stock Price: Apple's stock price has demonstrated increased volatility since the tariff announcement, indicating uncertainty among investors. This volatility highlights the heightened risk associated with investing in Apple stock during this period of trade uncertainty.

-

Comparison to Competitors: It is crucial to compare Apple's stock performance to that of its competitors in the tech industry to gauge the sector-wide impact of these tariffs and determine whether Apple’s response is comparatively effective.

Investor Concerns and Future Outlook

The current situation presents several concerns for investors, raising questions about the long-term implications for Apple and the overall market.

-

Investment Risk: The ongoing trade war introduces significant investment risk for those holding Apple stock. Further tariff increases or escalation of trade tensions could negatively impact Apple's future earnings.

-

Long-Term Implications: The long-term implications of these tariffs extend beyond immediate financial losses. They could force Apple to restructure its supply chain, potentially impacting innovation and product development.

-

Market Analysis and Predictions: Market analysts are closely monitoring the situation and providing varying predictions regarding Apple's future stock performance. These predictions depend heavily on the resolution of the trade dispute and Apple's ability to mitigate the tariff's impact effectively.

-

Potential Future Tariff Increases: The potential for further tariff increases adds another layer of uncertainty and risk. Investors need to factor this possibility into their investment strategies.

-

Navigating the Uncertainty: Investors should diversify their portfolios, conduct thorough research, and closely monitor developments in the trade war to navigate this period of economic uncertainty.

Broader Implications of the Trade War on the Tech Industry

The impact of these tariffs extends far beyond Apple, affecting the entire tech industry and global supply chains.

-

Broader Implications: The trade war creates uncertainty and instability for the entire tech sector, hindering innovation and potentially shifting manufacturing landscapes.

-

Impact on Global Supply Chains: The reliance on complex global supply chains makes the tech industry particularly vulnerable to trade disputes. Tariffs disrupt these intricate networks, increasing costs and potentially slowing down production.

-

Potential for Further Escalation: The risk of further escalation in trade tensions remains high. This uncertainty continues to weigh heavily on the tech industry's outlook.

-

Impact on International Relations: The trade war negatively impacts international relations and economic cooperation, potentially creating long-term damage to global economic stability.

-

Adaptation of Other Tech Companies: Other tech companies are actively adapting to the changing trade landscape by diversifying their supply chains, exploring new manufacturing locations, and lobbying for policy changes.

Conclusion

The $900 million tariff bite has dealt a significant blow to Apple, impacting its bottom line and causing a considerable drop in its stock price. This situation underscores the serious consequences of the ongoing trade war and its profound influence on global corporations. The long-term implications for Apple and the tech industry remain uncertain.

Call to Action: Stay informed about the evolving trade landscape and its impact on Apple stock. Monitor market trends, follow Apple's financial reports, and consider the potential risks and rewards before making any investment decisions regarding Apple stock or other tech companies affected by the ongoing trade disputes. Understand the intricacies of the Apple stock and tariff effects for informed investment decisions.

Featured Posts

-

Young Hawaiian Artists Shine Sew A Lei Poster Contest For Memorial Day

May 25, 2025

Young Hawaiian Artists Shine Sew A Lei Poster Contest For Memorial Day

May 25, 2025 -

George Russells Future At Mercedes A Contract Conundrum

May 25, 2025

George Russells Future At Mercedes A Contract Conundrum

May 25, 2025 -

Market Update Frankfurt Dax Closes Near 24 000 Points

May 25, 2025

Market Update Frankfurt Dax Closes Near 24 000 Points

May 25, 2025 -

Record Global Forest Loss Driven By Devastating Wildfires

May 25, 2025

Record Global Forest Loss Driven By Devastating Wildfires

May 25, 2025 -

Monaco Corruption Scandal A Look At The Princes Finances And His Managers Role

May 25, 2025

Monaco Corruption Scandal A Look At The Princes Finances And His Managers Role

May 25, 2025

Latest Posts

-

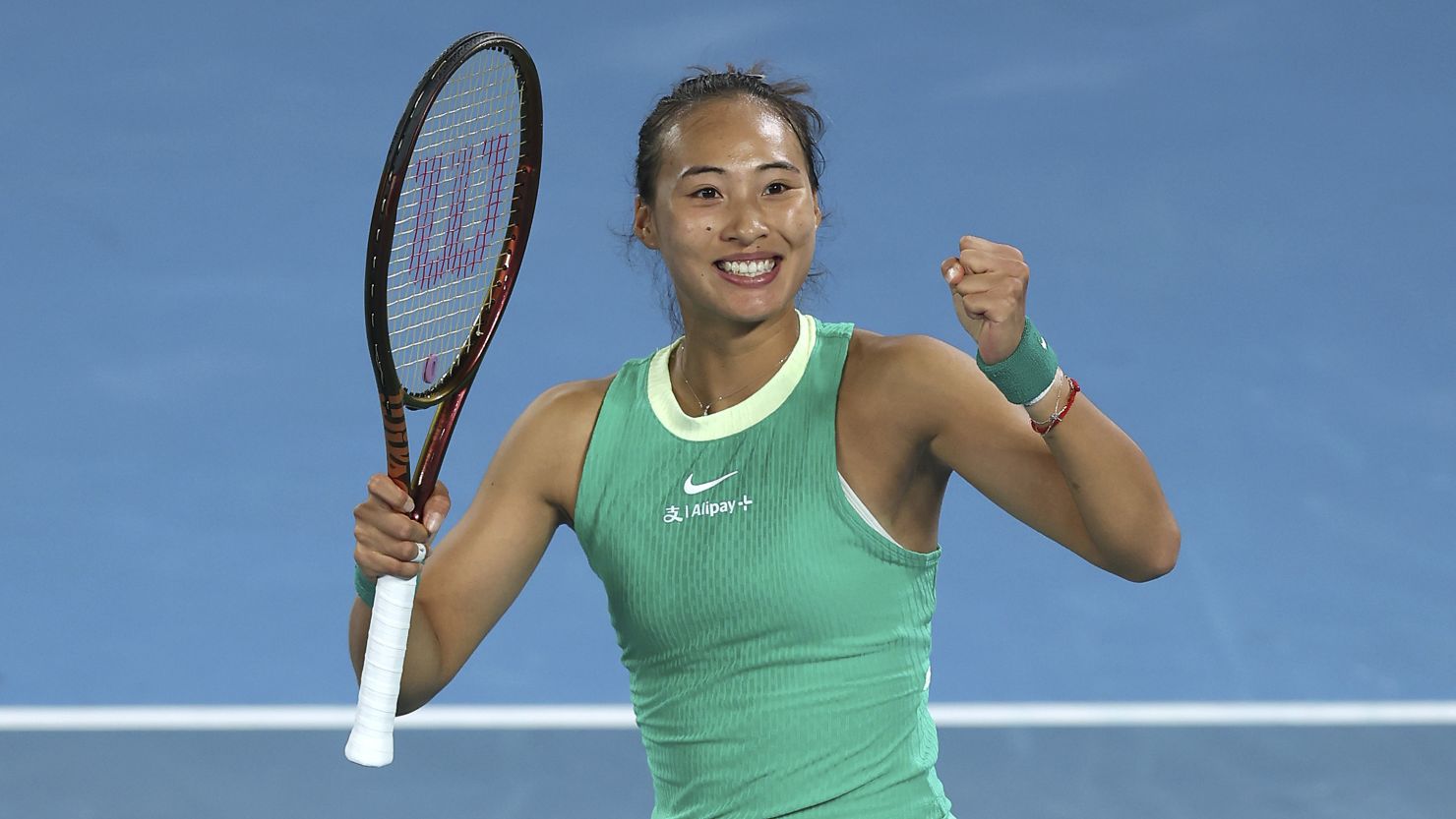

Zheng Qinwens Impressive Italian Open Semifinal Showing

May 25, 2025

Zheng Qinwens Impressive Italian Open Semifinal Showing

May 25, 2025 -

Italian Open 2024 Zheng Qinwens Semifinal Journey

May 25, 2025

Italian Open 2024 Zheng Qinwens Semifinal Journey

May 25, 2025 -

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 25, 2025

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 25, 2025 -

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal

May 25, 2025

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal

May 25, 2025 -

F1 I Mercedes Afinei Ton Verstappen

May 25, 2025

F1 I Mercedes Afinei Ton Verstappen

May 25, 2025