'Liberation Day' Tariffs: A Deep Dive Into Their Effects On Various Stock Sectors

Table of Contents

Impact on the Technology Sector

The technology sector, a cornerstone of the global economy, is significantly impacted by Liberation Day Tariffs, experiencing both challenges and opportunities.

Semiconductor Industry

The semiconductor industry, a vital component of countless technological devices, faces headwinds due to the tariffs.

- Increased production costs: Tariffs on imported materials and components directly increase production costs, squeezing profit margins.

- Supply chain disruptions: Reliance on global supply chains makes the semiconductor industry vulnerable to disruptions caused by trade restrictions. This can lead to shortages and delays, impacting manufacturing schedules and product launches.

- Shifting investment strategies: Companies are increasingly exploring strategies to diversify their supply chains and increase domestic production to mitigate the impact of Liberation Day Tariffs. This includes reshoring manufacturing and investing in domestic semiconductor production facilities.

Software and Cloud Computing

While less directly affected by tariffs on physical goods, the software and cloud computing sectors experience indirect consequences.

- Increased costs for hardware components: Software companies rely on hardware infrastructure, and increased costs for imported hardware components translate into higher operational expenses.

- Impact on international collaborations: Tariffs can create barriers to international collaborations and data transfers, potentially hindering innovation and market expansion.

- Opportunities for data localization: The tariffs create opportunities for companies specializing in data localization and security solutions, as businesses prioritize data security and compliance within their own regions.

Effects on the Energy Sector

The energy sector, a vital driver of economic growth, is deeply intertwined with global trade, making it susceptible to the effects of Liberation Day Tariffs.

Oil and Gas

The oil and gas industry faces considerable volatility due to the fluctuating global energy prices, heavily influenced by trade policies and tariffs.

- Price volatility: Liberation Day Tariffs contribute to price volatility, making it challenging for energy companies to accurately forecast revenue and manage their investments. This uncertainty directly impacts stock valuations.

- Increased investment in renewables: The tariffs might incentivize investment in renewable energy sources as a means to reduce dependence on imported fossil fuels.

- Geopolitical implications: The tariffs have geopolitical implications, potentially leading to shifts in global energy markets and alliances.

Renewable Energy

The renewable energy sector presents a mixed bag, experiencing both challenges and opportunities as a result of the Liberation Day Tariffs.

- Tariffs on imported components: Tariffs on imported components for solar panels, wind turbines, and other renewable energy technologies increase project costs.

- Government support: Governments may increase support and investment in domestic renewable energy projects to reduce reliance on imports and promote energy independence.

- Long-term growth potential: Despite short-term challenges, the long-term growth potential of renewable energy remains strong, driven by the global transition towards cleaner energy sources.

The Automotive Industry and Liberation Day Tariffs

The automotive industry, a significant contributor to global manufacturing, is particularly vulnerable to the effects of Liberation Day Tariffs due to its complex global supply chains.

Automobile Manufacturers

Automobile manufacturers face substantial challenges as a result of increased tariffs on imported parts and vehicles.

- Increased production costs: Higher tariffs lead to increased production costs, reducing competitiveness and profitability.

- Potential for job losses: Increased costs might lead to production cuts and job losses within the automotive industry.

- Shifting production strategies: Automakers are exploring strategies to mitigate the impact of tariffs, including shifting production to regions with lower tariffs or sourcing more parts domestically.

Auto Parts Suppliers

Auto parts suppliers face similar challenges as automakers, dealing with increased input costs and potentially reduced demand.

- Negotiating new contracts: Suppliers are engaged in intense negotiations with automakers to adjust contracts in light of increased costs.

- Potential for consolidation: The sector might experience consolidation as smaller suppliers struggle to remain competitive.

- Exploring emerging markets: Suppliers might explore new opportunities in emerging markets less affected by the tariffs.

Analyzing the Consumer Goods Sector

The consumer goods sector, encompassing a wide array of products, is significantly impacted by Liberation Day Tariffs, leading to price increases and influencing consumer behavior.

Retail and E-commerce

Retailers and e-commerce businesses face increased costs for imported goods, impacting their profit margins and potentially consumer spending.

- Strategies for absorbing cost increases: Retailers are implementing strategies to mitigate price increases, including absorbing some costs themselves or seeking alternative sourcing.

- Focus on domestic products: There's an increased focus on sourcing products domestically to minimize the impact of tariffs.

- Shifting consumer preferences: Consumer preferences might shift towards products less affected by the tariffs.

Food and Beverage

The food and beverage industry's sensitivity to tariffs depends heavily on its reliance on imported ingredients and products.

- Increased prices: Tariffs on imported food and beverages lead to higher prices for consumers.

- Opportunities for domestic producers: Domestic food and beverage producers may experience increased demand as consumers opt for locally sourced products.

- Shifting consumption habits: Consumer consumption habits might change in the long term, with a greater emphasis on locally produced goods.

Conclusion

The "Liberation Day" tariffs represent a significant economic event with widespread and complex implications for various stock sectors. Understanding the sector-specific impacts – from the challenges faced by the technology and automotive industries to the potential opportunities within renewable energy and domestic food production – is crucial for informed investment decisions. Investors should carefully analyze their portfolios, considering the potential risks and rewards associated with these tariffs. Staying informed about the ongoing developments surrounding Liberation Day Tariffs and their evolving impact is vital for navigating the complexities of this new economic landscape. Conduct thorough research and consult with financial advisors to create a robust investment strategy that accounts for the multifaceted effects of these significant tariffs.

Featured Posts

-

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025 -

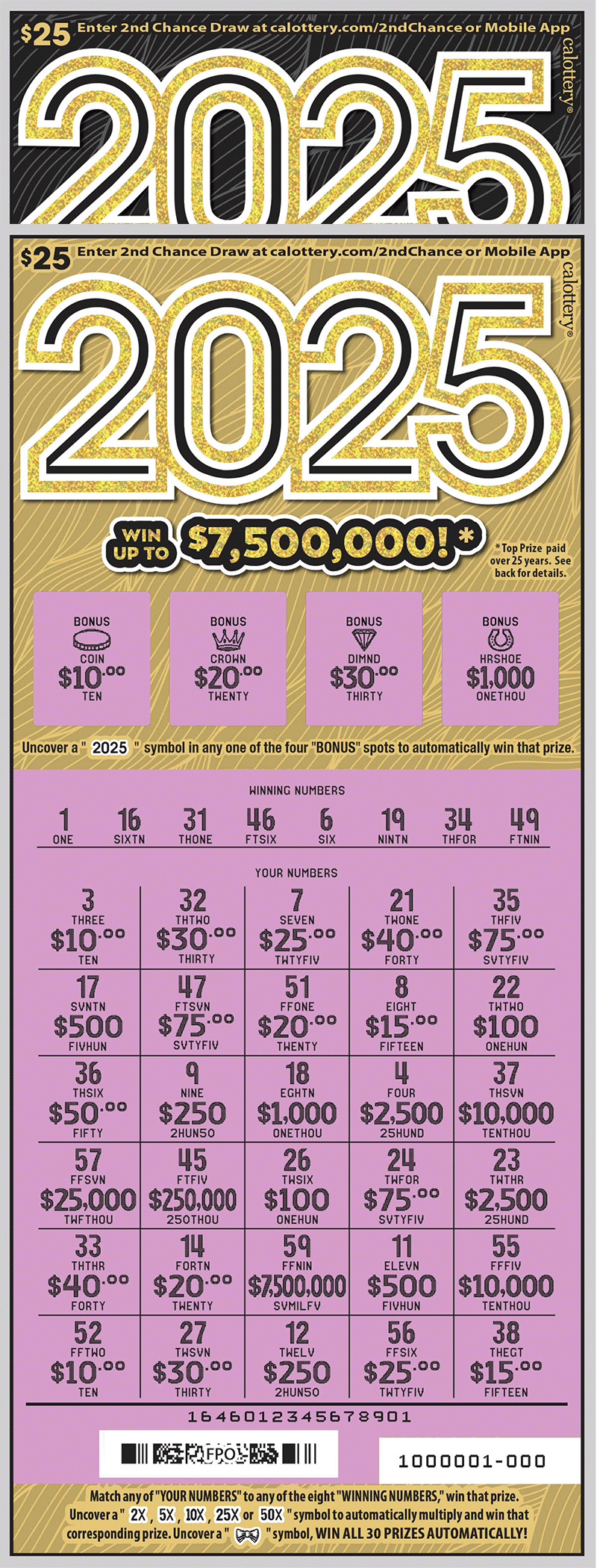

April 16 2025 Lottery Results

May 08, 2025

April 16 2025 Lottery Results

May 08, 2025 -

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025

Tatums Candid Remarks On Larry Birds Impact On The Boston Celtics

May 08, 2025 -

Thunder Vs Rockets Live Stream Game Preview And Odds

May 08, 2025

Thunder Vs Rockets Live Stream Game Preview And Odds

May 08, 2025 -

Lahwr Ky Nsf Ahtsab Edaltyn Khtm Ayk Tshwysh Nak Swrthal

May 08, 2025

Lahwr Ky Nsf Ahtsab Edaltyn Khtm Ayk Tshwysh Nak Swrthal

May 08, 2025