Leveraging Ind AS 117 For Growth In India's Insurance Market

Table of Contents

Understanding the Core Principles of Ind AS 117

Ind AS 117, Insurance Contracts, is a crucial accounting standard that dictates how insurance companies recognize, measure, and present insurance contracts in their financial statements. Understanding its core principles is fundamental for successful implementation. Key concepts include:

-

Definition of an insurance contract: Ind AS 117 defines an insurance contract as an agreement where one party (the insurer) accepts significant insurance risk from another party (the policyholder) in exchange for consideration (premiums). This definition is crucial for identifying which contracts fall under the scope of the standard. The precise definition impacts which contracts need to be accounted for under Ind AS 117 versus other accounting standards.

-

Recognition of insurance contract liabilities: Insurance contract liabilities are recognized when the insurer becomes obligated to provide insurance services under a contract. This involves estimating the future cash flows associated with the contract, considering factors like mortality rates, lapse rates, and investment returns. Accurate liability recognition is critical for presenting a true and fair view of the insurer's financial position.

-

Measurement of insurance contract liabilities: The measurement of insurance contract liabilities is a complex process requiring sophisticated actuarial models. These models consider various factors, including the time value of money, risk adjustments, and the probability of future claims. The standard requires the use of current market information for accurate valuation.

-

Presentation of insurance contract information in financial statements: Ind AS 117 specifies how information relating to insurance contracts should be presented in the financial statements, including the disclosure of significant judgments and assumptions used in the accounting process. This transparency fosters accountability and allows stakeholders to understand the underlying risks and uncertainties associated with the insurer’s business model.

Bullet Points:

- The convergence of Ind AS 117 with IFRS 17 has brought significant changes to the landscape of insurance accounting in India, requiring insurers to adopt new methodologies and enhance their actuarial capabilities.

- Accurate risk assessment is paramount in applying Ind AS 117. Failing to adequately assess and quantify risks can lead to material misstatements in financial reports.

- Applying Ind AS 117 to complex insurance products, such as those with embedded options or guarantees, presents significant challenges requiring specialized expertise.

Enhancing Financial Reporting and Transparency with Ind AS 117

Ind AS 117 significantly improves the quality and reliability of financial reporting within the Indian insurance sector by introducing greater transparency and comparability.

-

Improved comparability of financial statements: By establishing a consistent framework for accounting for insurance contracts, Ind AS 117 allows for better comparability of financial statements across different insurers. This makes it easier for investors and analysts to assess the relative performance and financial health of various companies.

-

Greater transparency in the recognition and measurement of insurance liabilities: The standard demands greater detail in disclosing the assumptions and methodologies used in estimating and measuring insurance liabilities. This increased transparency helps stakeholders to better understand the uncertainties and risks associated with these liabilities.

-

Reduced ambiguity in accounting practices: Prior to Ind AS 117, there was considerable variation in accounting practices amongst Indian insurers. The standard clarifies accounting procedures, leading to reduced ambiguity and improved consistency in financial reporting.

-

Better understanding of the insurer's financial position and performance: The improved transparency and comparability afforded by Ind AS 117 provide a more accurate and comprehensive picture of an insurer's financial position, allowing stakeholders to make informed decisions.

Strategic Decision-Making and Risk Management under Ind AS 117

Ind AS 117 is not merely a compliance requirement; it's a powerful tool for strategic planning and risk management.

-

Improved pricing strategies: Accurate measurement of liabilities under Ind AS 117 provides a more robust basis for pricing insurance products. Insurers can better assess the risks associated with each policy and price accordingly, ensuring profitability and sustainability.

-

Enhanced risk assessment and management: The standard necessitates a thorough assessment of the risks associated with insurance contracts, prompting insurers to develop more sophisticated risk management strategies.

-

More effective capital allocation and investment decisions: A clearer understanding of the insurer's financial position, facilitated by Ind AS 117, enables more informed decisions regarding capital allocation and investment strategies.

-

Facilitated regulatory compliance: Compliance with Ind AS 117 demonstrates adherence to regulatory requirements, minimizing the risk of penalties and maintaining a positive reputation within the regulatory landscape.

Ind AS 117 and Competitive Advantage in the Indian Insurance Market

Companies that effectively implement and leverage Ind AS 117 gain a significant competitive advantage in the dynamic Indian insurance market.

-

Attracting investors: Transparent and reliable financial reporting, facilitated by Ind AS 117, attracts investors who value accuracy and clarity. This access to capital fuels growth and expansion.

-

Gaining trust from policyholders and stakeholders: Demonstrating a commitment to robust accounting practices fosters trust among policyholders and other stakeholders.

-

Meeting stricter regulatory requirements: Adherence to Ind AS 117 ensures compliance with regulatory expectations, minimizing legal and operational risks.

-

Access to better financial instruments and lower borrowing costs: A strong financial reporting profile, strengthened by proper Ind AS 117 application, can lead to access to better financial instruments and potentially lower borrowing costs.

Case Studies: Successful Implementation of Ind AS 117 in India

(This section would ideally include specific examples of Indian insurance companies and their successful implementations of Ind AS 117, highlighting the quantifiable benefits achieved. Further research is needed to populate this section with real-world case studies.)

Conclusion

Effectively leveraging Ind AS 117 is no longer optional but a necessity for growth and sustainability in India's dynamic insurance market. Accurate application of the standard enhances financial reporting, informs strategic decision-making, and significantly improves competitiveness. By embracing the principles and best practices of Ind AS 117, insurance companies can build a stronger foundation for future success. Don't let accounting complexities hinder your growth. Master Ind AS 117 and unlock the full potential of your insurance business. Contact us today to learn more about how we can help your company effectively implement and leverage Ind AS 117 for sustainable growth in the Indian insurance market.

Featured Posts

-

Stefanos Stefanu Kibris Ta Baris Icin Bir Girisim Cagrisi

May 15, 2025

Stefanos Stefanu Kibris Ta Baris Icin Bir Girisim Cagrisi

May 15, 2025 -

The Surveillance State And Ai Therapy Ethical Concerns And Risks

May 15, 2025

The Surveillance State And Ai Therapy Ethical Concerns And Risks

May 15, 2025 -

San Jose Earthquakes Opposition Scouting Report A Comprehensive Analysis

May 15, 2025

San Jose Earthquakes Opposition Scouting Report A Comprehensive Analysis

May 15, 2025 -

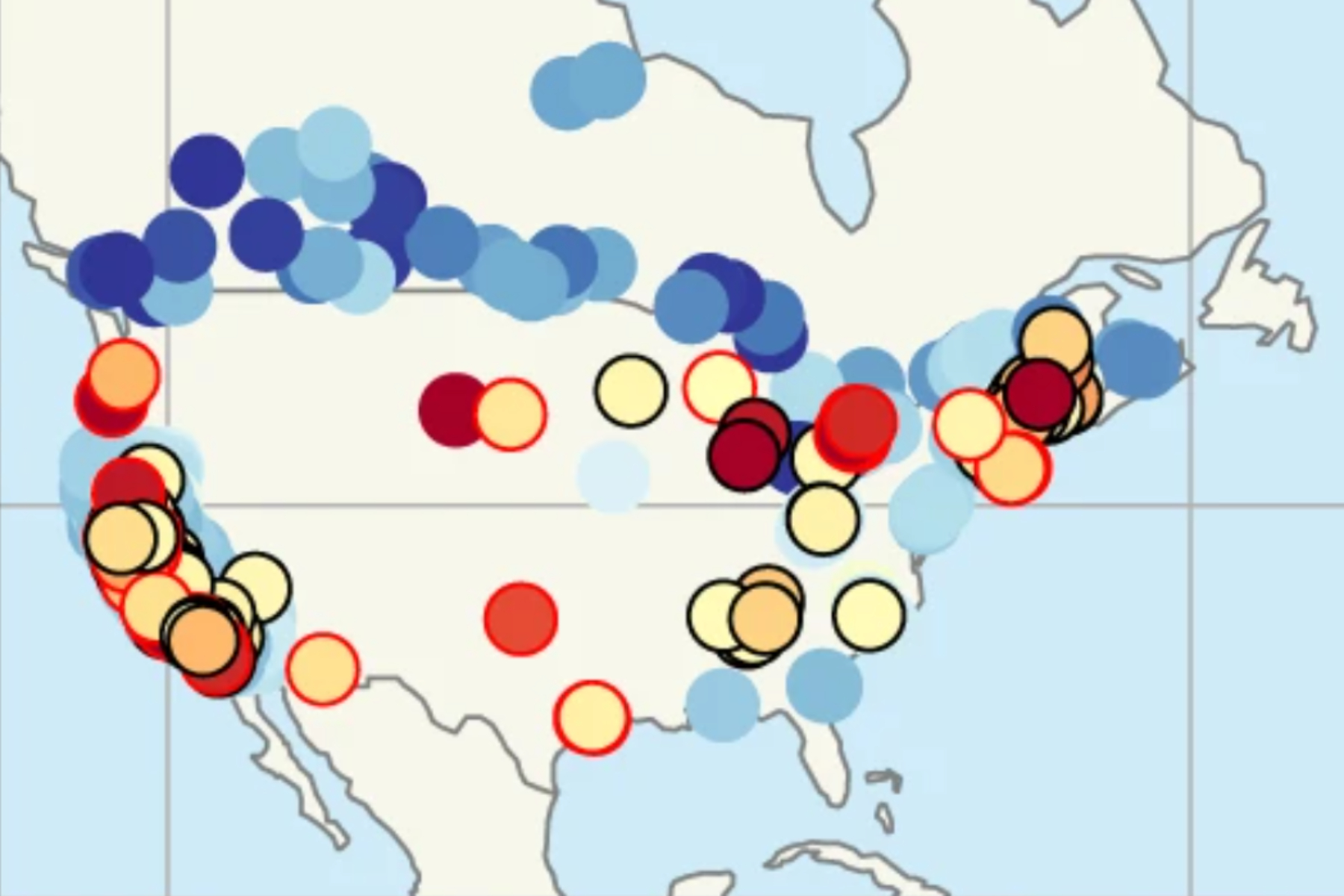

Millions Exposed Shocking Study Reveals Widespread Pfas Contamination In Us Tap Water

May 15, 2025

Millions Exposed Shocking Study Reveals Widespread Pfas Contamination In Us Tap Water

May 15, 2025 -

Vavel United States Your Source For Athletic Club De Bilbao News And Analysis

May 15, 2025

Vavel United States Your Source For Athletic Club De Bilbao News And Analysis

May 15, 2025