LDC Graduation For CAs: A Roadmap To Accelerated Progress

Table of Contents

Understanding the LDC Landscape and its Value for CAs

The significance of LDC markets for CAs cannot be overstated. These markets represent a substantial portion of global finance, offering lucrative opportunities for professionals with specialized knowledge. LDC expertise translates to a competitive edge in the job market, opening doors to specialized roles and higher earning potential.

The intricacies of LDC instruments, including bonds, notes, and other debt securities, require a deep understanding of financial modeling, valuation techniques, and risk assessment. This expertise is highly sought after by investment banks, fund management firms, and corporate finance departments.

- Increased earning potential: CAs with LDC expertise often command significantly higher salaries compared to those in general CA roles.

- Access to specialized roles: LDC graduation opens doors to specialized roles like Debt Capital Markets Analyst, Portfolio Manager (Fixed Income), and Credit Analyst.

- Enhanced understanding of debt markets: This expertise is crucial in today's interconnected global economy, providing a broad perspective on financial markets.

- Development of advanced skills: You'll develop advanced financial modeling and valuation skills, highly transferable across various financial sectors.

Essential Skills and Knowledge for LDC Graduation

To achieve LDC graduation, CAs need a blend of technical and soft skills. Technical skills form the foundation of your LDC expertise, while soft skills enhance your ability to collaborate and communicate effectively within a professional setting.

Technical skills encompass:

- Mastery of financial modeling software: Proficiency in Excel, Bloomberg Terminal, and other financial modeling tools is essential for analyzing LDC instruments.

- Deep understanding of debt instruments: This includes a comprehensive knowledge of various bond types, loan structures, and their associated risks.

- Proficiency in credit analysis and risk assessment: Accurately assessing the creditworthiness of issuers and understanding various risk factors is crucial for success.

In addition to technical expertise, soft skills are equally critical:

- Strong communication and presentation skills: Clearly articulating complex financial concepts to clients and colleagues is vital.

- Ability to work effectively in teams: LDC projects often involve collaborative efforts, requiring effective teamwork and communication.

- Project management skills: Managing multiple projects simultaneously, prioritizing tasks, and meeting deadlines efficiently are essential.

Strategic Steps Towards LDC Graduation: A Practical Guide

A structured approach is crucial for accelerating your progress towards LDC graduation. This involves a combination of formal education, professional development, networking, and practical experience.

- Pursuing relevant certifications: Consider certifications like the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) to enhance your credibility and expertise.

- Participating in industry conferences and workshops: Attending industry events provides valuable networking opportunities and exposure to the latest trends and insights in the LDC market.

- Networking with professionals: Build relationships with experienced professionals in the LDC field through industry events, online communities, and mentorship programs.

- Seeking mentorship: Find a mentor who can provide guidance and support throughout your LDC career journey.

- Gaining practical experience: Seek internships or projects in LDC-related roles to gain hands-on experience and apply your knowledge.

Leveraging Technology and Resources for LDC Learning

In today's digital age, leveraging technology and available resources is paramount for efficient LDC learning.

- Online learning platforms: Utilize online learning platforms like Coursera, edX, and Udemy for structured courses on LDC-related topics.

- Financial databases: Access reputable financial databases such as Bloomberg Terminal and Refinitiv Eikon for real-time market data and analytics.

- Industry publications and blogs: Stay updated on the latest trends and insights by following leading industry publications and blogs specializing in LDC markets.

- Online forums and communities: Engage in online forums and communities to network with other professionals, share knowledge, and stay informed about industry developments.

Conclusion

Achieving LDC graduation as a CA opens doors to a rewarding and high-growth career path. By strategically acquiring the necessary skills, knowledge, and experience, you can accelerate your progress and unlock significant career advantages within the dynamic world of listed debt capital. This roadmap provides a practical framework for your journey, emphasizing the importance of continuous learning, effective networking, and leveraging available resources. Take the next step towards your successful LDC graduation today! Start planning your path towards becoming an expert in LDC Graduation for CAs and unlock your full potential in the exciting field of listed debt capital markets.

Featured Posts

-

View The Lotto And Lotto Plus Results Saturday April 12 2025

May 07, 2025

View The Lotto And Lotto Plus Results Saturday April 12 2025

May 07, 2025 -

Did Ke Huy Quan Appear In The White Lotus Season 3 A Deep Dive

May 07, 2025

Did Ke Huy Quan Appear In The White Lotus Season 3 A Deep Dive

May 07, 2025 -

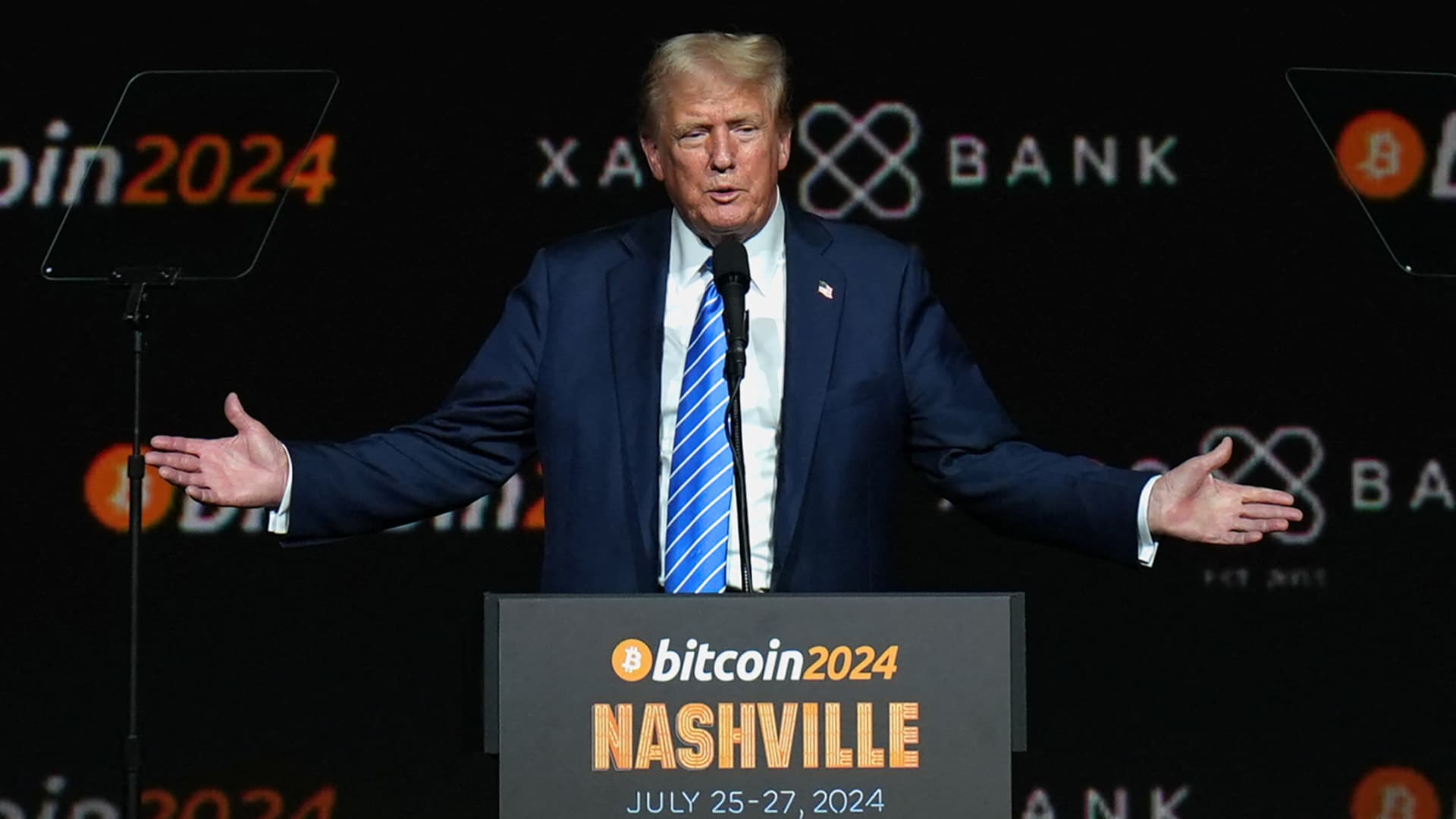

The Trump Presidency And The Rise Of His Crypto Holdings

May 07, 2025

The Trump Presidency And The Rise Of His Crypto Holdings

May 07, 2025 -

Exclusive Report Trump Administrations Plan For Columbia University Federal Oversight

May 07, 2025

Exclusive Report Trump Administrations Plan For Columbia University Federal Oversight

May 07, 2025 -

Apo Group Press Release Minister Tavios Upcoming Visit To Zambia And Ldc Forum

May 07, 2025

Apo Group Press Release Minister Tavios Upcoming Visit To Zambia And Ldc Forum

May 07, 2025

Latest Posts

-

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025 -

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025 -

Investment Insights Examining The Performance Of Dogecoin Shiba Inu And Sui

May 08, 2025

Investment Insights Examining The Performance Of Dogecoin Shiba Inu And Sui

May 08, 2025 -

Bitcoin De Son Gelismeler Fiyat Analizi Ve Uzman Goeruesleri

May 08, 2025

Bitcoin De Son Gelismeler Fiyat Analizi Ve Uzman Goeruesleri

May 08, 2025 -

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025