Key Developments In The Treasury Market: April 8th

Table of Contents

Yield Curve Shifts and Their Implications

Changes in benchmark yields (2-year, 10-year, 30-year)

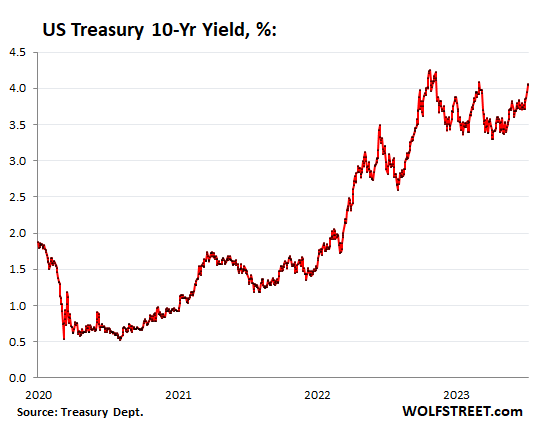

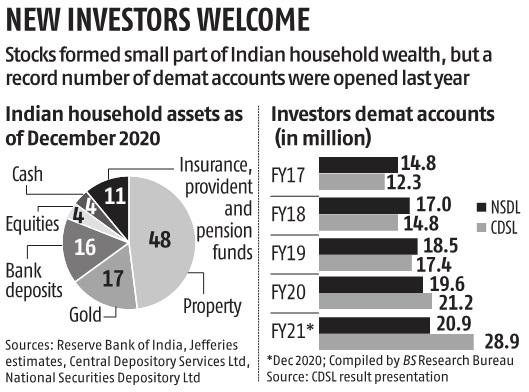

April 8th saw notable shifts across the Treasury yield curve. Specifically:

- 2-year Treasury yield: Increased by 5 basis points to 4.75%, reflecting growing expectations of further Federal Reserve interest rate hikes.

- 10-year Treasury yield: Rose by 7 basis points to 3.80%, indicating increased investor concerns about inflation and future economic growth.

- 30-year Treasury yield: Increased by 6 basis points to 4.05%, suggesting long-term inflation expectations remain elevated.

These changes were primarily driven by a combination of factors: stronger-than-expected inflation data released earlier in the week, renewed concerns about persistent inflation, and ongoing speculation regarding the future trajectory of Federal Reserve monetary policy. These shifts directly impact borrowing costs for corporations and the government, influencing investment strategies across various asset classes.

Impact on the yield curve shape (steepening, flattening, inversion)

The yield curve on April 8th exhibited a steepening trend. The spread between the 2-year and 10-year Treasury yields widened, reflecting a growing belief in a future economic slowdown, despite current elevated short-term rates. Understanding yield curve shapes is critical for gauging economic health.

- Normal Yield Curve: A positively sloped curve (short-term yields lower than long-term yields) typically signals economic expansion.

- Inverted Yield Curve: When long-term yields are lower than short-term yields, it’s often considered a recessionary indicator.

- Flat Yield Curve: A small difference between short and long-term yields suggests economic uncertainty.

The observed steepening on April 8th, while not inverted, signals a divergence in market expectations regarding short-term and long-term economic growth. The widening yield spread between the 2-year and 10-year notes might reflect investor concerns about the potential for future rate cuts if economic growth slows down.

Treasury Auction Results and Market Response

Analysis of specific auction results (e.g., 10-year note, 30-year bond)

The Treasury Department conducted auctions for both 10-year notes and 30-year bonds on April 8th. Results included:

- 10-year Note Auction: The bid-to-cover ratio was slightly lower than expected at 2.25, suggesting slightly weaker-than-anticipated demand. The high yield was 3.82%, marginally higher than the when-issued forecast.

- 30-year Bond Auction: The bid-to-cover ratio was stronger at 2.40, indicating relatively robust demand for long-term securities. The high yield was 4.07%.

Market reaction to the auction results

The market reaction to the auctions was mixed. While the stronger-than-expected 30-year bond auction initially supported prices, the slightly weaker demand for the 10-year notes contributed to a slight dip in yields later in the trading session. This highlights the interplay between investor sentiment, macroeconomic data, and specific auction results in shaping Treasury market dynamics. The secondary market trading volumes were above average following the auctions, indicating active trading and adjustments to portfolio positions based on auction outcomes.

Impact of Macroeconomic Data and Geopolitical Events

Influence of key economic indicators (e.g., inflation data, employment reports)

Recent economic data releases played a significant role in shaping Treasury market sentiment on April 8th. Stronger-than-expected inflation figures fueled concerns about the Federal Reserve’s commitment to controlling inflation, driving up yields. This anticipation of continued rate hikes influenced investor behavior and trading strategies, with many seeking higher returns to counter inflation.

Role of geopolitical events (e.g., international conflicts, trade disputes)

Geopolitical uncertainties, while not the dominant factor on April 8th, continue to provide a backdrop of risk aversion. Ongoing international tensions can lead to safe-haven flows into Treasury securities, as investors seek the relative safety and stability of U.S. government debt. However, on this particular day, the impact of geopolitical events was secondary to the effects of domestic economic data.

Conclusion

April 8th witnessed notable shifts in the Treasury market, driven by a confluence of factors. Changes in benchmark yields reflected growing inflation concerns and expectations of further interest rate hikes. Auction results revealed a mixed picture of investor demand, while macroeconomic data and the lingering influence of geopolitical events added to the overall market volatility. Understanding these interacting forces is crucial for navigating the complexities of the Treasury market.

Understanding the dynamics of the Treasury market is crucial for informed investment decisions. Stay updated on key developments in the Treasury market by following reputable financial news sources and consulting with financial professionals. Regularly reviewing Treasury yield curves and auction results provides critical insight into market sentiment and overall economic health.

Featured Posts

-

Dismissing Stock Market Valuation Concerns A Bof A Perspective

Apr 29, 2025

Dismissing Stock Market Valuation Concerns A Bof A Perspective

Apr 29, 2025 -

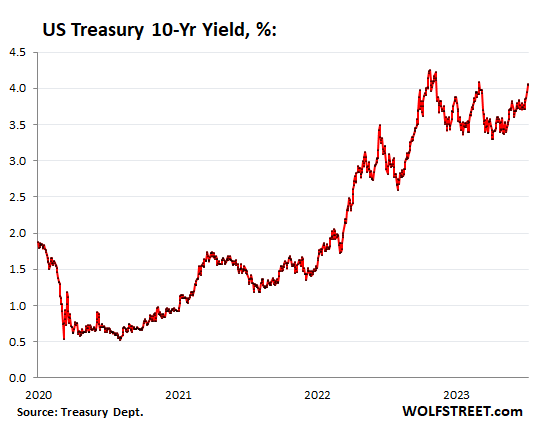

Top Performing India Fund Dsp Issues Stock Market Caution Raises Cash Position

Apr 29, 2025

Top Performing India Fund Dsp Issues Stock Market Caution Raises Cash Position

Apr 29, 2025 -

Tragedy Strikes North Carolina University Fatal Shooting Incident

Apr 29, 2025

Tragedy Strikes North Carolina University Fatal Shooting Incident

Apr 29, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 29, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 29, 2025 -

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025

Latest Posts

-

Report On Black Hawk Helicopter And American Airlines Crash Fatal Mistakes Revealed

Apr 29, 2025

Report On Black Hawk Helicopter And American Airlines Crash Fatal Mistakes Revealed

Apr 29, 2025 -

Investigation Uncovers Disturbing Truths About The D C Blackhawk Plane Crash

Apr 29, 2025

Investigation Uncovers Disturbing Truths About The D C Blackhawk Plane Crash

Apr 29, 2025 -

D C Blackhawk Jet Crash A Devastating New Report

Apr 29, 2025

D C Blackhawk Jet Crash A Devastating New Report

Apr 29, 2025 -

Black Hawk American Airlines Collision Pilot Error Investigation

Apr 29, 2025

Black Hawk American Airlines Collision Pilot Error Investigation

Apr 29, 2025 -

New Report Details The Horrors Of The D C Blackhawk Passenger Jet Crash

Apr 29, 2025

New Report Details The Horrors Of The D C Blackhawk Passenger Jet Crash

Apr 29, 2025