Top Performing India Fund DSP Issues Stock Market Caution, Raises Cash Position

Table of Contents

DSP's Rationale for Increasing Cash Position

DSP's decision to raise its cash position is a significant indicator of their cautious outlook on the near-term future of the Indian stock market. Their investment rationale centers around mitigating risks associated with several key factors impacting the India Economic Outlook. This defensive strategy reflects a prudent approach to portfolio management in the face of uncertainty.

- Overvaluation in Certain Sectors: DSP likely identified specific sectors within the Indian stock market exhibiting signs of overvaluation. This could be due to rapid price appreciation exceeding fundamental value, leaving them vulnerable to corrections.

- Increased Volatility Due to Global Uncertainty: Global economic headwinds, including persistent inflation and aggressive interest rate hikes by major central banks, contribute to increased market volatility. These uncertainties directly impact the Indian economy and its stock market.

- Geopolitical Risks: Geopolitical tensions and conflicts around the world can create uncertainty in global markets, impacting investor sentiment and leading to capital outflows from emerging markets like India.

- Domestic Political Factors: Upcoming elections or other significant political events within India can also introduce uncertainty and volatility into the stock market. This makes risk mitigation a key priority for fund managers like DSP.

DSP's official statements (if available) should be referenced for further clarity on their specific concerns. Analyzing their shifts in investment strategy provides invaluable insight for individual investors navigating the complexities of the Indian stock market.

Impact on Investors and Investment Strategies

DSP's move has significant implications for investors in India and worldwide. The question on many investors' minds is: Should I follow suit and reduce my equity exposure?

- Following DSP's Lead: While it's not necessarily advisable to blindly mimic the actions of a single fund manager, DSP's cautionary stance highlights the importance of reassessing risk tolerance and portfolio allocation.

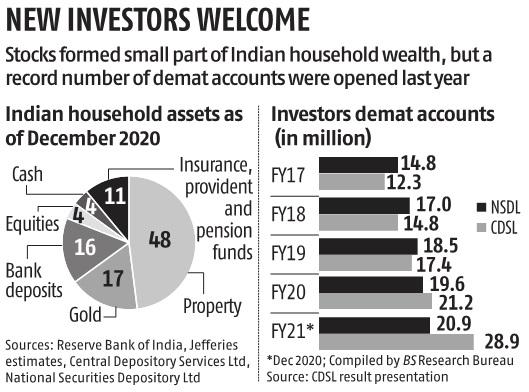

- Alternative Investment Options: During periods of market uncertainty, exploring alternative investment options—such as bonds, gold, or real estate—can help diversify portfolios and mitigate risks.

- Assessing Risk Tolerance: Investors should carefully evaluate their own risk tolerance. DSP's move underscores the need for a personalized investment strategy that aligns with individual financial goals and risk appetite.

- Portfolio Diversification: The importance of a well-diversified portfolio cannot be overstated. Spreading investments across various asset classes reduces reliance on any single market and minimizes potential losses.

It is crucial to remember that this advice is for informational purposes only. Seeking professional financial advice tailored to your individual circumstances is highly recommended before making any significant investment decisions.

Analysis of the Indian Stock Market's Current State

Understanding the current state of the Indian stock market is vital for informed decision-making. Several key factors need to be considered:

- Key Economic Indicators: Analyzing economic indicators India, such as GDP growth, inflation rates, and unemployment figures, provides a comprehensive view of the country's economic health.

- Sectoral Analysis: The performance of individual sectors, such as IT, banking, and manufacturing, varies significantly. Understanding these differences allows for a more nuanced assessment of market conditions.

- Foreign Investment Flows: Tracking foreign investment flows into India provides insight into global investor sentiment towards the Indian economy.

- Overall Market Sentiment: Gauging overall market sentiment – whether bullish or bearish – is crucial. This can be assessed through various metrics and news analysis.

Reliable data and charts from reputable sources are crucial for a thorough analysis of the Indian Economy and its impact on the stock market performance India.

Comparison with Other Fund Managers' Strategies

To gain a broader perspective, it’s crucial to compare DSP’s strategy with those of other fund managers investing in the Indian market. This comparative analysis, using investment benchmarks, can reveal whether their cautious approach is an isolated incident or a wider trend reflecting a more general shift in market sentiment among experienced fund manager strategies. This broader context provides valuable insight into the prevailing investment climate.

Conclusion

DSP's decision to increase its cash position reflects a cautious outlook on the short-term prospects of the Indian stock market. Various economic and geopolitical factors contribute to this cautious sentiment. Investors should carefully review their own portfolios, assess their risk tolerance, and consider adjusting their strategies accordingly. Informed decision-making, based on individual circumstances and professional financial advice, is paramount. Stay informed about the evolving situation in the Indian stock market and consider adjusting your investment strategy accordingly. Learn more about [link to relevant resource] and seek professional advice on managing your portfolio in the face of uncertainty. Don't hesitate to consult with a financial advisor regarding your investment strategy in the context of the current DSP India Fund and broader Indian stock market situation.

Featured Posts

-

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 29, 2025

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 29, 2025 -

Attorney Generals Transgender Athlete Ban Implications For Minnesota Schools

Apr 29, 2025

Attorney Generals Transgender Athlete Ban Implications For Minnesota Schools

Apr 29, 2025 -

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025 -

State Of Emergency In Kentucky Preparing For Catastrophic Flooding

Apr 29, 2025

State Of Emergency In Kentucky Preparing For Catastrophic Flooding

Apr 29, 2025 -

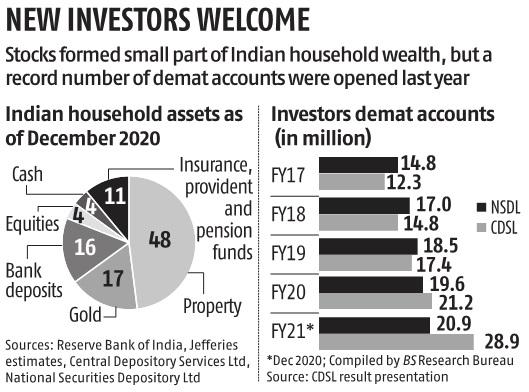

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Fueling Energy Growth

Apr 29, 2025

Latest Posts

-

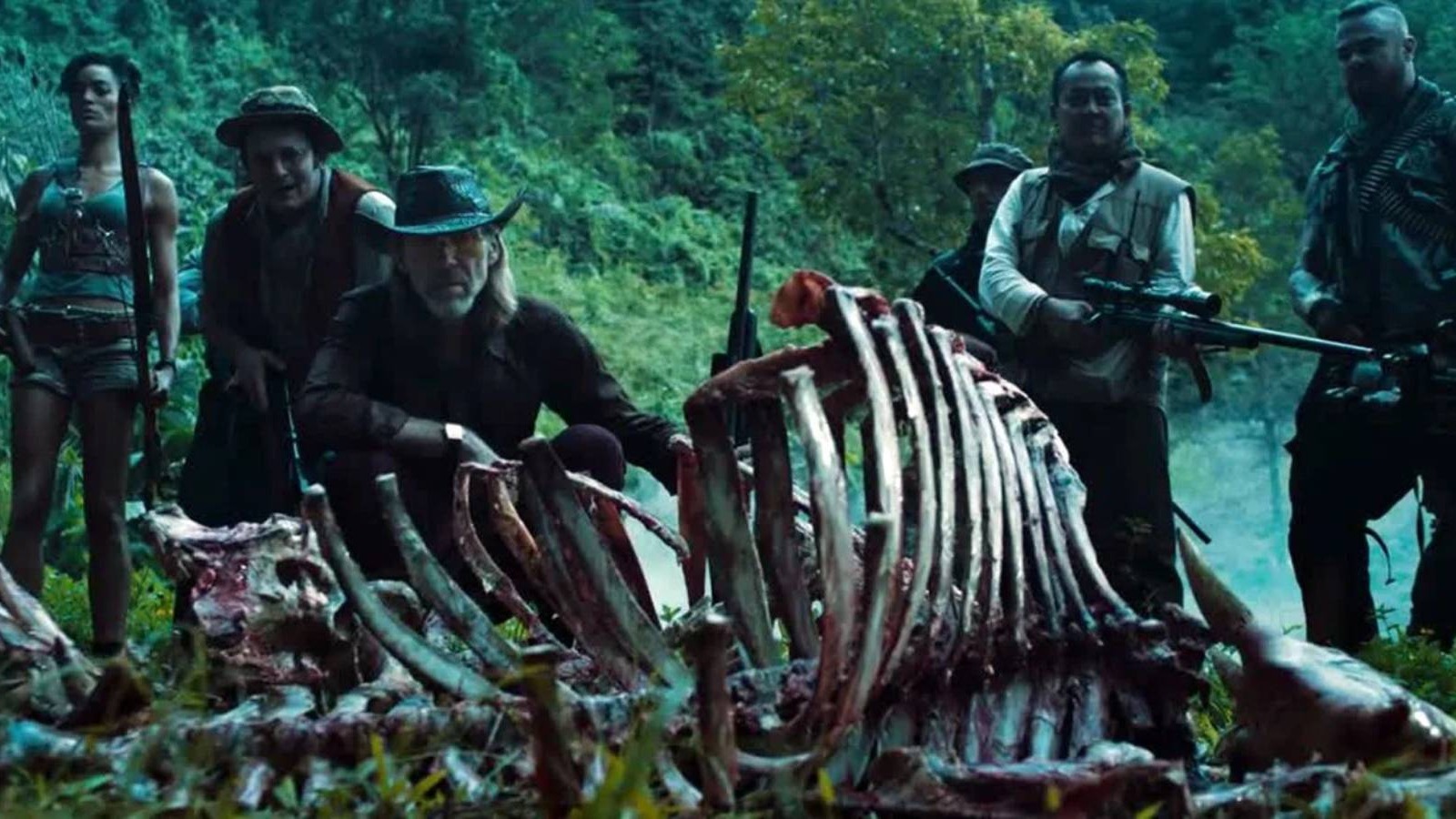

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025 -

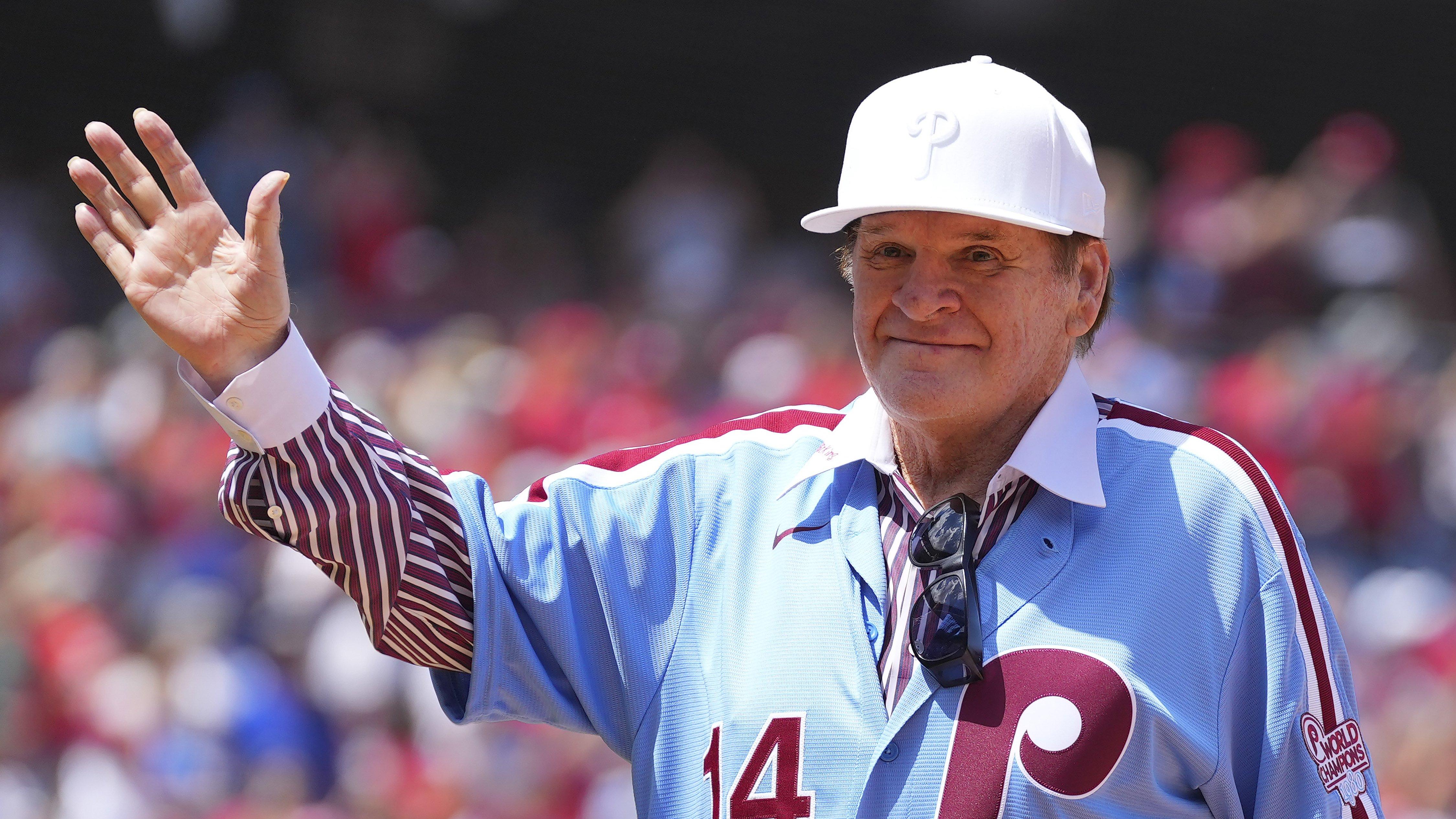

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025 -

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025