Judge Rejects Paramount-Skydance Merger Block, Speeds Shareholder Suit

Table of Contents

The Judge's Decision and its Impact

The judge's reasoning for rejecting the motion to block the Paramount-Skydance merger centered on the lack of sufficient evidence demonstrating irreparable harm to the plaintiffs should the merger proceed. The court found the arguments presented by those seeking to halt the merger unconvincing, deeming them insufficient to justify an injunction.

- Key arguments presented by the opposing parties: The opposing parties argued the merger would harm competition and undervalue Skydance's assets. They cited concerns about potential conflicts of interest and a lack of transparency in the valuation process.

- Specific legal precedents cited by the judge: The judge referenced several precedents establishing a high bar for granting injunctions in merger cases, emphasizing the need for clear and convincing evidence of irreparable harm. Cases involving similar media mergers were referenced to support the decision.

- The immediate consequences of the ruling for Paramount and Skydance: The ruling allows the Paramount-Skydance merger to move forward, although the shadow of the shareholder lawsuit remains. Both companies can now focus on integrating their operations, albeit under the added pressure of ongoing litigation.

- Analysis of the judge's speed in making the decision: The swiftness of the judge's decision suggests a strong belief in the merits of the merger and/or a clear lack of merit in the arguments to block it. This expedited process reduces uncertainty and allows the companies to proceed with their integration plans more efficiently.

This decision will undoubtedly influence future media mergers and acquisitions. The precedent set regarding the burden of proof for securing injunctions against mergers could embolden future merger attempts, while simultaneously increasing the pressure on proponents to ensure robust due diligence and transparency. Similar cases involving Warner Bros. Discovery and other media conglomerates will be closely scrutinized in light of this ruling.

The Accelerating Shareholder Lawsuit

The shareholder lawsuit alleges that the proposed Paramount-Skydance merger undervalues Skydance Media and thus harms existing shareholders. The plaintiffs claim the proposed deal doesn't reflect the true market value of Skydance's assets and intellectual property.

- Claims made by the shareholders: The shareholders' claims primarily revolve around allegations of inadequate valuation, breaches of fiduciary duty, and a lack of transparency in the negotiation process leading to the proposed merger agreement.

- Potential financial ramifications for the companies: If the shareholders prevail, Paramount and Skydance could face significant financial penalties, including potential revisions to the merger agreement or even the unraveling of the deal altogether. This could involve substantial legal fees and reputational damage.

- The timeline for the lawsuit's progression now that the merger block is rejected: With the merger block removed, the shareholder lawsuit will likely proceed more rapidly. Discovery, depositions, and potential settlement negotiations will now unfold without the added delay caused by the injunction request.

- Discussion of potential legal strategies for both sides: Paramount and Skydance will likely focus on demonstrating the fairness of the merger valuation and the due diligence processes undertaken. The shareholders, meanwhile, will need to present strong evidence to support their claims of undervaluation and potential breaches of fiduciary duty.

The judge's ruling significantly impacts the shareholder suit's speed and efficiency by eliminating a major procedural hurdle. The case can now progress to its merits without the unnecessary delay of a drawn-out battle over the injunction.

Analysis of the Paramount-Skydance Merger Itself

The proposed merger aims to unite Paramount's established distribution network and production capabilities with Skydance's successful film and television production track record. The strategic goal is to create a more vertically integrated entertainment powerhouse capable of competing more effectively in the rapidly evolving media landscape.

- Synergies expected between Paramount and Skydance: The merger anticipates synergies in production, distribution, marketing, and potentially talent acquisition. Combining resources and expertise could lead to cost savings and increased efficiency.

- Potential benefits and drawbacks of the merger for consumers: Potential benefits include a potentially broader and more diverse range of content. Potential drawbacks could include reduced competition and higher prices, if the merged entity enjoys increased market power.

- Market analysis of the competitive landscape post-merger: The merger is expected to shift the competitive balance within the entertainment industry, potentially strengthening Paramount's position against competitors like Disney and Netflix.

- Financial projections and valuation of the combined entity: The financial projections underlying the merger will be crucial for determining the ultimate success or failure of the integration process. The valuation of the combined entity needs to be justified to avoid further legal challenges.

The Paramount-Skydance merger takes place within a broader context of industry consolidation and the ongoing streaming wars. The deal is a strategic move to enhance competitiveness in a market increasingly dominated by large, vertically integrated media companies.

Expert Opinions and Market Reaction

Industry analysts have offered mixed reactions to the judge's decision. Some see it as a positive step towards consolidating the entertainment industry, while others express concern about the potential for reduced competition and increased market concentration.

- Stock market reactions following the ruling: The stock market reaction to the ruling was relatively muted, suggesting investors were already anticipating this outcome or viewing the shareholder lawsuit as a manageable risk.

- Predictions for the future of the Paramount-Skydance merger: The ultimate success of the merger will depend on the outcome of the shareholder lawsuit and the ability of Paramount and Skydance to effectively integrate their operations and realize the anticipated synergies.

- Potential impact on other potential mergers and acquisitions in the sector: This decision could set a precedent for future mergers and acquisitions in the entertainment industry, influencing how companies approach deal structuring and valuation.

Overall market sentiment is cautious but hopeful. The removal of the immediate threat of a merger block allows investors to focus on the long-term potential of the combined entity. However, the lingering shareholder lawsuit adds an element of uncertainty.

Conclusion

The judge's rejection of the Paramount-Skydance merger block significantly accelerates the timeline for both the merger itself and the ensuing shareholder lawsuit. This decision sets a precedent and provides valuable insights into the legal complexities surrounding major media mergers. The outcome will undoubtedly influence future M&A activity in the entertainment industry. The Paramount-Skydance merger remains a significant event, shaping the future landscape of entertainment.

Call to Action: Stay updated on the latest developments regarding the Paramount-Skydance merger and its legal ramifications by regularly checking back for updates on this crucial case impacting the future of the entertainment industry. For further insights into the Paramount-Skydance merger and other major media deals, continue to follow our coverage.

Featured Posts

-

Viral Confusion Brazilian Fans Think Kai Cenat Is Playboi Carti

May 27, 2025

Viral Confusion Brazilian Fans Think Kai Cenat Is Playboi Carti

May 27, 2025 -

Emergency Landing In Seattle Tokyo Flight Diverted After Passenger Incident

May 27, 2025

Emergency Landing In Seattle Tokyo Flight Diverted After Passenger Incident

May 27, 2025 -

Elon Musks Leadership Style And Teslas Success

May 27, 2025

Elon Musks Leadership Style And Teslas Success

May 27, 2025 -

The Alien Invasion Earths Struggle For Survival

May 27, 2025

The Alien Invasion Earths Struggle For Survival

May 27, 2025 -

Ramshtayn Germaniya Obyavlyaet O Krupnoy Postavke Vooruzheniy Ukraine V Bryussele

May 27, 2025

Ramshtayn Germaniya Obyavlyaet O Krupnoy Postavke Vooruzheniy Ukraine V Bryussele

May 27, 2025

Latest Posts

-

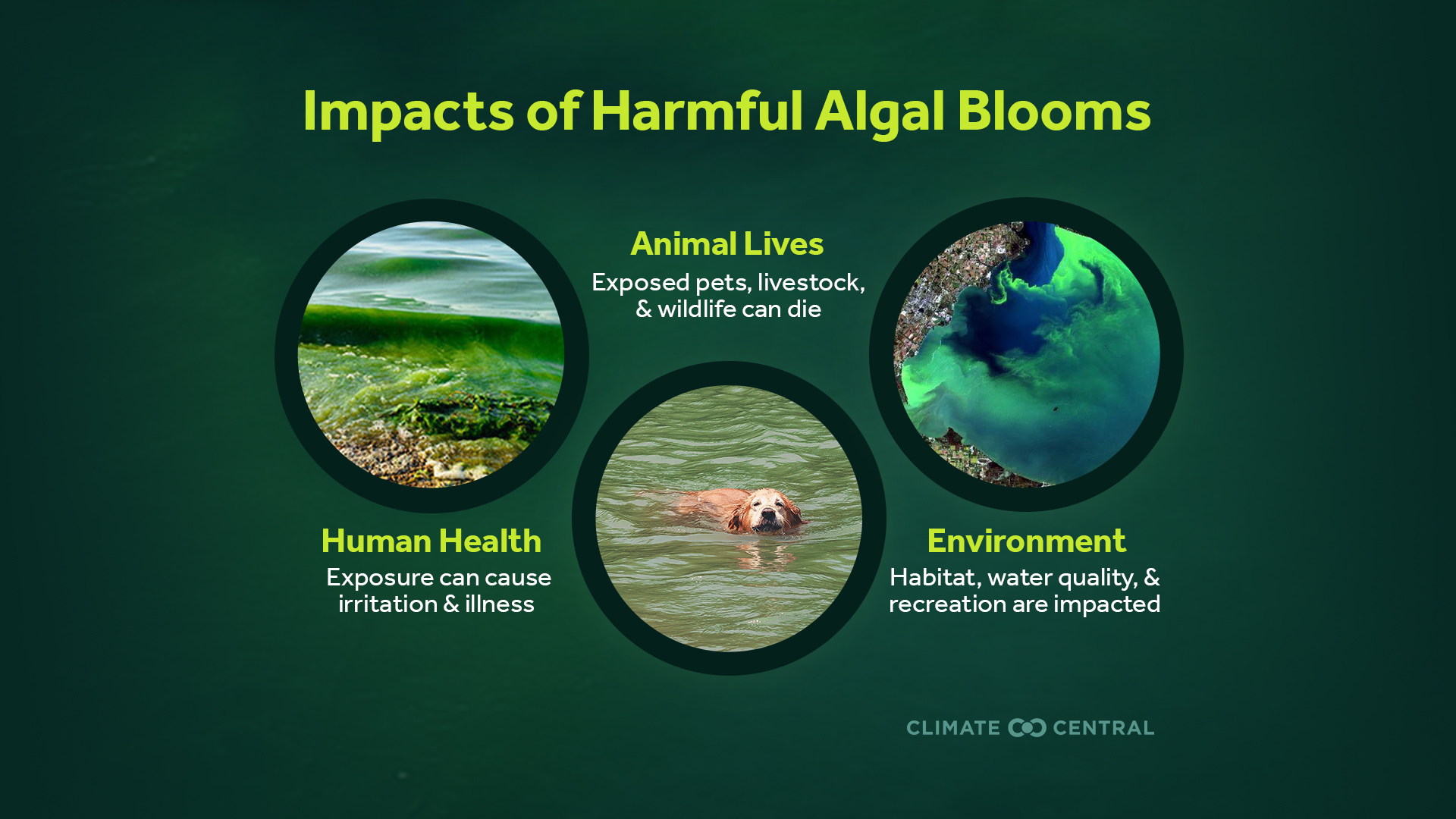

California Coast Under Siege Toxic Algae Bloom And Its Consequences

May 30, 2025

California Coast Under Siege Toxic Algae Bloom And Its Consequences

May 30, 2025 -

Killer Seaweed The Extermination Of Marine Life In Australia

May 30, 2025

Killer Seaweed The Extermination Of Marine Life In Australia

May 30, 2025 -

Toxic Algae Bloom A Growing Threat To Californias Coastal Ecosystem

May 30, 2025

Toxic Algae Bloom A Growing Threat To Californias Coastal Ecosystem

May 30, 2025 -

Australias Marine Fauna Under Siege The Invasive Seaweed Crisis

May 30, 2025

Australias Marine Fauna Under Siege The Invasive Seaweed Crisis

May 30, 2025 -

Southern California Bioluminescence When And Where To Find It

May 30, 2025

Southern California Bioluminescence When And Where To Find It

May 30, 2025