Jim Cramer And CoreWeave (CRWV): Analyzing The OpenAI Partnership

Table of Contents

Jim Cramer's Take on CoreWeave (CRWV) and its OpenAI Connection

Cramer's Public Statements on CoreWeave:

Analyzing Jim Cramer's public statements about CoreWeave provides valuable insight into market sentiment. While specific quotes and dates require real-time data collection (and may change rapidly), we can generally assess his overall sentiment. Has he been consistently bullish, expressing strong confidence in CoreWeave's future based on the OpenAI partnership? Or has he expressed any reservations or concerns? Tracking his comments over time, coupled with sentiment analysis, can help us gauge the potential influence of his opinions on investor behavior.

- Example (Hypothetical): On [Date], Cramer stated on "Mad Money," "[Quote about CoreWeave's potential]." This statement, made in the context of [Context of statement], suggests a [Bullish/Bearish] sentiment.

- Example (Hypothetical): A later appearance on [Date] saw Cramer [mentioning a specific aspect of the CoreWeave/OpenAI partnership] and its implications for [mentioning potential benefits or risks].

Understanding Cramer's Investment Philosophy:

Jim Cramer's investment philosophy is characterized by [explain key aspects, e.g., a focus on short-term gains, a preference for certain industry sectors, etc.]. Understanding these elements is crucial for assessing whether his support of CoreWeave aligns with his typical investment strategies. Does his emphasis on [specific aspect of his philosophy] complement CoreWeave’s business model and risk profile? Or are there potential inconsistencies?

- Key aspects of Cramer's approach: [List key aspects, for example, growth potential, market trends, risk tolerance].

- Alignment with CoreWeave: [Analyze how well Cramer's investment approach aligns with CoreWeave’s long-term goals and strategies].

The Weight of Cramer's Opinion:

Jim Cramer's influence on market sentiment is undeniable. His commentary can significantly impact the stock prices of companies he discusses. It's important to remember, however, that his opinions are not a guaranteed predictor of future performance. While his pronouncements can drive short-term volatility, long-term investment decisions should be based on a more comprehensive analysis.

- Examples of past influence: [Provide examples of times when Cramer's commentary significantly affected stock prices – referencing credible sources].

- Potential for bias: It's essential to acknowledge the possibility of bias in Cramer's opinions and avoid blindly following his recommendations without independent research.

CoreWeave (CRWV) and OpenAI: A Deep Dive into the Partnership

The Nature of the Partnership:

The CoreWeave-OpenAI partnership centers around CoreWeave providing crucial AI infrastructure, likely including high-performance computing resources, to support OpenAI's ambitious projects. The details of the agreement – the exact services provided, the contract duration, and exclusivity clauses – are vital to understanding the long-term implications for both companies.

- Key features of the agreement: [List key features, if available; otherwise, describe the likely nature of the services provided].

- Potential duration and exclusivity: [Discuss the expected duration of the agreement and whether it's exclusive or CoreWeave may serve other AI clients].

Strategic Implications for CoreWeave:

This partnership offers substantial strategic benefits for CoreWeave. The association with OpenAI instantly elevates CoreWeave's profile, potentially leading to increased revenue streams, stronger market positioning, and access to cutting-edge AI technologies.

- Market share gains: [Analyze potential gains in the AI infrastructure market].

- Brand recognition and access to OpenAI's technology: [Discuss the enhanced brand reputation and potential technological advancements this partnership brings].

- Potential for future collaborations: [Explore the possibility of future collaborations beyond the initial agreement].

Risks and Challenges for CoreWeave:

While the partnership presents significant opportunities, it also introduces potential risks. Over-reliance on OpenAI, competition from established cloud providers like Google Cloud, AWS, and Azure, and the rapid pace of technological change all present challenges.

- Competition analysis: [Analyze the competitive landscape and CoreWeave's position within it].

- Technological obsolescence: [Discuss the risk of CoreWeave's technology becoming outdated].

- Financial risks: [Assess the financial risks associated with the partnership].

Analyzing CoreWeave's (CRWV) Stock Performance in Light of the Partnership

Stock Price Volatility and the OpenAI Factor:

A thorough analysis of CoreWeave's stock price fluctuations since the announcement of the OpenAI partnership is crucial. Tracking price movements, comparing them to market benchmarks, and identifying key catalysts for volatility will reveal the market's response to the partnership.

- Specific dates of price changes: [Provide specific dates and percentage changes in stock prices].

- Comparison to market benchmarks: [Compare CoreWeave's performance to relevant market indices].

Investor Sentiment and Future Projections:

Analyzing investor sentiment (through news articles, financial reports, and analyst ratings) helps predict future price movements. Understanding analyst price targets and growth projections provides a framework for assessing the long-term potential of CoreWeave stock.

- Analyst ratings and price targets: [Summarize analyst ratings and price targets for CRWV].

- Predicted growth rates: [Discuss predicted growth rates based on market analysis and company projections].

Conclusion: Investing in CoreWeave (CRWV) – A Calculated Risk?

The CoreWeave (CRWV) and OpenAI partnership presents a compelling investment opportunity, but it's not without risk. Jim Cramer's commentary adds another layer of complexity, influencing market sentiment but not necessarily dictating future performance. The potential for significant growth in the AI infrastructure sector is undeniable, but careful due diligence is crucial before committing capital. Investors should consider the strategic advantages of the OpenAI collaboration alongside the inherent risks of relying on a single major partner and navigating a highly competitive market. Conduct thorough research on CoreWeave (CRWV) and its OpenAI partnership, considering factors like financial performance, competitive landscape, and technological advancements, before making any investment decisions. Explore further resources on CRWV stock analysis, OpenAI related stocks, and AI investment opportunities to make informed choices. Remember, responsible investing in the dynamic AI sector requires a comprehensive understanding of the market and individual company risks and opportunities.

Featured Posts

-

Adam Ramey Of Dropout Kings Dead At 32 A Tragic Loss

May 22, 2025

Adam Ramey Of Dropout Kings Dead At 32 A Tragic Loss

May 22, 2025 -

Thousands Of Zebra Mussels Discovered On Boat Lift In Casper

May 22, 2025

Thousands Of Zebra Mussels Discovered On Boat Lift In Casper

May 22, 2025 -

New York City Welcomes Vybz Kartel For A Historic Musical Performance

May 22, 2025

New York City Welcomes Vybz Kartel For A Historic Musical Performance

May 22, 2025 -

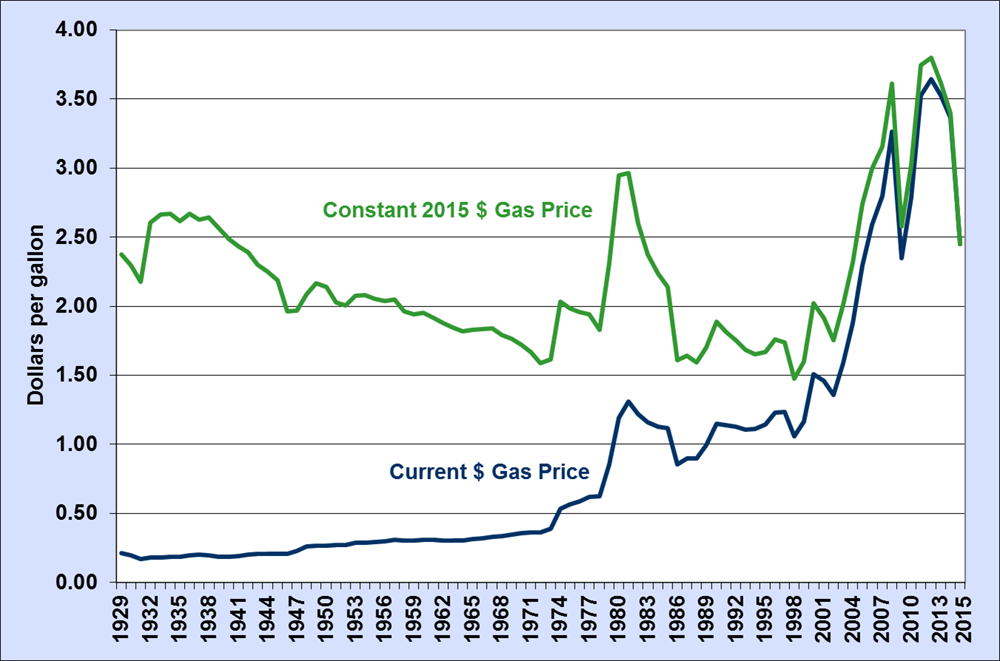

Fuel Costs Soar 20 Cent Increase In Average Gas Price

May 22, 2025

Fuel Costs Soar 20 Cent Increase In Average Gas Price

May 22, 2025 -

Mysterious Red Lights Flash Over France What Was It

May 22, 2025

Mysterious Red Lights Flash Over France What Was It

May 22, 2025

Latest Posts

-

Metallicas 2026 Dublin Shows Aviva Stadium Double Header

May 23, 2025

Metallicas 2026 Dublin Shows Aviva Stadium Double Header

May 23, 2025 -

Fitore E Madhe Ngritja E Kosoves Ne Ligen B Fale Uefa S

May 23, 2025

Fitore E Madhe Ngritja E Kosoves Ne Ligen B Fale Uefa S

May 23, 2025 -

Aviva Stadium To Host Metallica For Two Nights In June 2026

May 23, 2025

Aviva Stadium To Host Metallica For Two Nights In June 2026

May 23, 2025 -

Kosova Ne Ligen B Rendesia E Bashkepunimit Me Uefa

May 23, 2025

Kosova Ne Ligen B Rendesia E Bashkepunimit Me Uefa

May 23, 2025 -

Big Rig Rock Report 3 12 Your Source For Trucking Information 99 7 The Fox

May 23, 2025

Big Rig Rock Report 3 12 Your Source For Trucking Information 99 7 The Fox

May 23, 2025