Japan's Steep Yield Curve: A Growing Concern For Investors And The Economy

Table of Contents

Understanding Japan's Yield Curve and its Current State

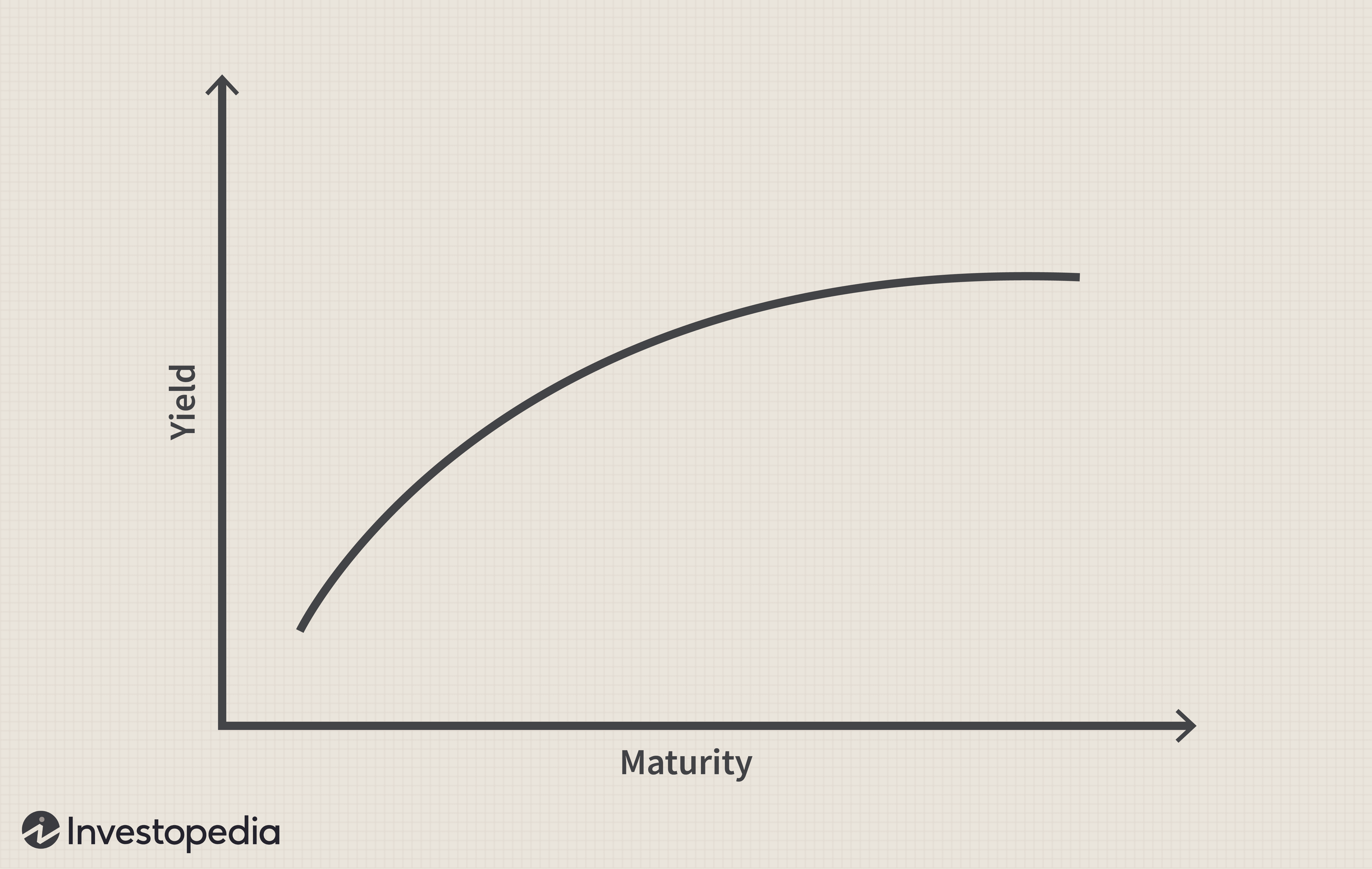

A yield curve graphically represents the relationship between the interest rates (yields) of government bonds with different maturities. A normal yield curve slopes upward, indicating that longer-term bonds offer higher yields to compensate investors for the increased risk associated with longer holding periods. However, Japan's yield curve has recently taken on a steeper-than-usual shape, a development that warrants close attention.

The current steepness of Japan's yield curve reflects a significant divergence between short-term and long-term JGB yields. While the Bank of Japan (BOJ) maintains its ultra-low short-term interest rate policy, long-term yields have been steadily climbing.

- Current JGB yields across different maturities: As of [insert date], 10-year JGB yields are at [insert current yield]%, while 2-year yields remain near [insert current yield]%. This significant difference represents the steepening curve.

- Historical context: Compared to the relatively flat yield curve seen in previous years, this steepening represents a notable shift. [Insert data/chart comparing current yield curve to historical data].

- Impact of the Bank of Japan's monetary policy on the yield curve: The BOJ's Yield Curve Control (YCC) policy, aimed at keeping long-term interest rates low, has been challenged by recent market forces, leading to the observed steepening.

Causes of the Steepening Yield Curve in Japan

Several factors contribute to the widening spread between short-term and long-term JGB yields:

- Inflationary pressures and expectations: While still relatively subdued compared to other developed nations, rising inflation in Japan, coupled with expectations of further increases, is pushing long-term yields higher. Investors demand higher returns to compensate for the erosion of purchasing power caused by inflation.

- Changes in investor sentiment and risk appetite: Global economic uncertainty and shifts in investor risk appetite are impacting demand for JGBs. Some investors may be reducing their holdings, driving up yields.

- Potential shift in the Bank of Japan's monetary policy stance: Speculation about a potential shift away from the BOJ's ultra-loose monetary policy is also contributing to the steepening curve. Anticipation of future interest rate hikes increases long-term yields.

- Global economic factors influencing JGB yields: Global factors, such as rising US interest rates and strong US dollar, can impact demand for JGBs, affecting their yields.

The Role of the Bank of Japan's Policy

The BOJ's Yield Curve Control (YCC) policy aims to manage long-term interest rates by setting a target for 10-year JGB yields. However, the effectiveness of YCC is being questioned in the face of the current steepening curve.

- Explanation of Yield Curve Control (YCC): YCC involves setting a target range for 10-year JGB yields and intervening in the market to maintain that range.

- Challenges faced by the BOJ in managing the yield curve: The BOJ faces the challenge of balancing its commitment to low interest rates with the need to manage inflation expectations and market stability. The current steepening suggests that maintaining YCC at its current settings may be proving increasingly difficult.

- Potential future adjustments to BOJ policy and their implications: Market participants are closely watching for potential adjustments to YCC, which could significantly impact the yield curve and the Japanese economy. A change in policy could lead to further yield curve fluctuations.

Implications for Investors

Japan's steep yield curve presents both risks and opportunities for various types of investors:

- Risks and opportunities for bond investors: While the steep curve offers higher yields on longer-term JGBs, it also increases the risk of capital losses if interest rates rise further.

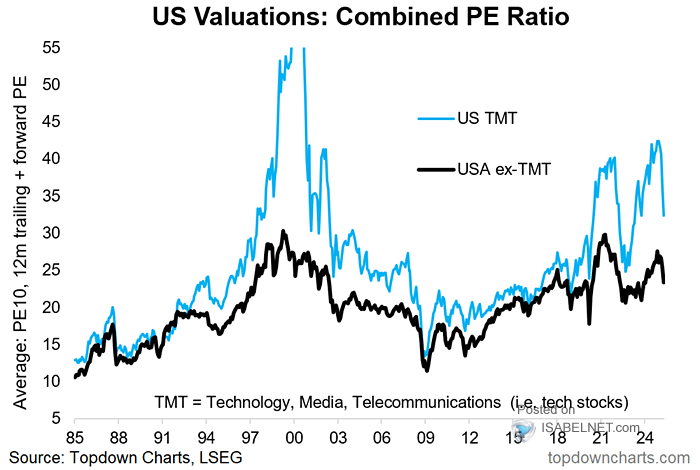

- Impact on equity markets: The rising interest rates can impact corporate profitability and potentially lead to lower valuations in the equity markets.

- Implications for foreign investors in Japanese assets: Foreign investors holding Japanese assets are exposed to currency risk and fluctuations in JGB yields.

- Potential hedging strategies for investors: Investors can employ various hedging strategies to mitigate the risks associated with a steep yield curve, such as using derivatives.

Economic Consequences of a Steep Yield Curve in Japan

A persistent steep yield curve could have significant economic consequences for Japan:

- Impact on borrowing costs for businesses and consumers: Higher long-term interest rates increase borrowing costs for businesses and consumers, potentially dampening investment and consumption.

- Effect on economic growth: Increased borrowing costs could hinder economic growth, potentially slowing down expansion.

- Potential for increased inflation: While initially driven by factors beyond the yield curve, a steep curve can further fuel inflationary pressures through higher borrowing costs affecting business prices.

- Risk of financial instability: A sharp increase in interest rates could increase the risk of financial instability, particularly for highly leveraged businesses.

Conclusion

Japan's steepening yield curve is a significant development with far-reaching implications for investors and the Japanese economy. The interplay between the BOJ's monetary policy, inflationary pressures, and global economic factors creates a complex and uncertain environment. The potential for further shifts in the yield curve and the BOJ's response introduces considerable risk. Understanding Japan's steep yield curve is crucial for making informed investment decisions. Stay updated on market trends and consult with a financial advisor to develop a strategy that aligns with your risk tolerance.

Featured Posts

-

Microsoft Surface Simplification Another Device Cut

May 17, 2025

Microsoft Surface Simplification Another Device Cut

May 17, 2025 -

Why Current Stock Market Valuations Shouldnt Deter Investors Insights From Bof A

May 17, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Insights From Bof A

May 17, 2025 -

Is Josh Hart The Knicks Draymond Green Analyzing His Contributions

May 17, 2025

Is Josh Hart The Knicks Draymond Green Analyzing His Contributions

May 17, 2025 -

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025 -

Rethinking Middle Management Their Essential Contribution To Companies And Employees

May 17, 2025

Rethinking Middle Management Their Essential Contribution To Companies And Employees

May 17, 2025

Latest Posts

-

Breaking Moto News Gncc Mx Sx Flat Track And Enduro Action

May 17, 2025

Breaking Moto News Gncc Mx Sx Flat Track And Enduro Action

May 17, 2025 -

The Josh Cavallo Effect Increased Lgbtq Inclusion In Sport

May 17, 2025

The Josh Cavallo Effect Increased Lgbtq Inclusion In Sport

May 17, 2025 -

Controversial Non Call Crew Chiefs Admission In Pistons Loss To Knicks

May 17, 2025

Controversial Non Call Crew Chiefs Admission In Pistons Loss To Knicks

May 17, 2025 -

Your Daily Dose Of Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Your Daily Dose Of Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Nba Analyst Perkins Advises Knicks Brunson On Podcast

May 17, 2025

Nba Analyst Perkins Advises Knicks Brunson On Podcast

May 17, 2025