Why Current Stock Market Valuations Shouldn't Deter Investors: Insights From BofA

Table of Contents

BofA's Bullish Outlook Despite High Valuations

Despite the perceived high valuations, BofA maintains a bullish outlook on the stock market. Their reasoning centers on several key factors, suggesting that current market prices are justifiable considering long-term growth potential and the broader economic environment.

- BofA's supporting evidence: Recent BofA reports cite robust corporate earnings projections and ongoing economic growth as key drivers for their positive outlook. Specific analyst statements emphasize the resilience of the market in the face of inflationary pressures and interest rate adjustments.

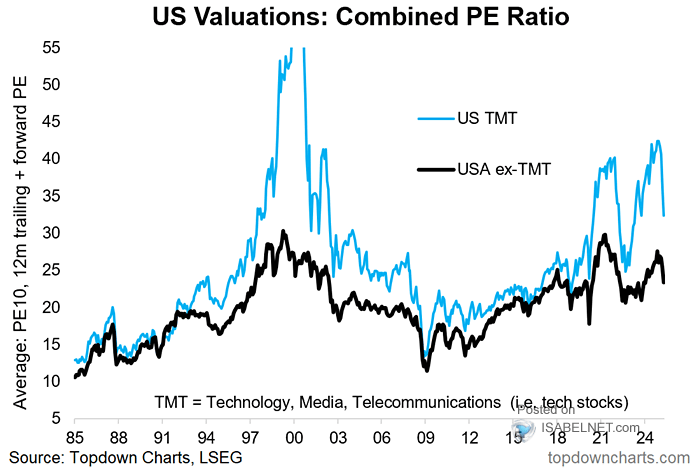

- Key metrics: BofA's analysis considers P/E ratios within a historical context, demonstrating that while current ratios may seem elevated, they are not unprecedented. Furthermore, projected earnings growth rates are factored into the valuation assessment, tempering concerns about overvaluation. They also consider other valuation metrics, such as Price-to-Sales and Price-to-Book ratios, to present a complete picture.

- Sector recommendations: BofA's recommendations often highlight sectors poised for significant growth, such as technology, healthcare, and renewable energy. These sectors are expected to benefit from long-term trends like technological advancements and increasing demand for sustainable solutions.

The Role of Interest Rates in Shaping Market Valuations

Interest rates play a crucial role in influencing stock market valuations. The relationship is often inverse: lower interest rates generally support higher valuations, while higher rates tend to exert downward pressure.

- Lower rates and higher valuations: Lower interest rates make borrowing cheaper for companies, fueling investment and potentially leading to higher earnings. This, in turn, can justify higher stock prices. Conversely, lower rates also make bonds less attractive, pushing investors towards equities.

- Current interest rate environment: The current interest rate environment, while fluctuating, remains relatively low in a historical context, offering a degree of support for higher valuations.

- Potential rate hikes and their impact: While potential interest rate hikes could impact stock valuations negatively, BofA's analysis seems to factor in these possibilities. Their bullish outlook suggests they believe the potential negative impact will be manageable and outweighed by positive growth factors.

Long-Term Growth Potential Outweighs Short-Term Concerns

Focusing solely on short-term market fluctuations can be misleading. The long-term growth potential of many sectors and the market as a whole offers a compelling reason to remain invested.

- Technological advancements: Breakthroughs in artificial intelligence, biotechnology, and renewable energy are expected to drive significant economic growth and create new investment opportunities. These advancements translate into increased corporate profitability and higher stock valuations over time.

- Increased corporate earnings: Sustained economic growth and technological advancements contribute to increased corporate earnings. These stronger earnings provide a fundamental basis for higher stock prices.

- Emerging market trends: Growth in emerging markets presents another significant avenue for long-term growth. These markets offer exciting opportunities for investors willing to take on slightly more risk.

Diversification and Risk Management Strategies

To mitigate the inherent risks associated with stock market investments, diversification and effective risk management are essential.

- Diversification strategies: A well-diversified portfolio that includes various asset classes (stocks, bonds, real estate), sectors, and geographies can help to reduce overall portfolio volatility.

- Long-term investment: A long-term investment approach allows investors to ride out short-term market fluctuations, focusing on the overall long-term growth potential.

- Risk management techniques: Investors should utilize risk management techniques such as dollar-cost averaging, stop-loss orders, and regular portfolio rebalancing to minimize potential losses.

Conclusion: Why Current Stock Market Valuations Shouldn't Deter Your Investment Strategy

BofA's bullish outlook, supported by considerations of interest rates, long-term growth potential, and sound risk management strategies, suggests that current stock market valuations, while seemingly high, shouldn't deter long-term investors. Remember, a well-diversified portfolio, a long-term perspective, and thorough research are crucial elements of successful investing. Don't let high stock market valuations deter you from pursuing your financial goals. Invest wisely despite current valuations, and consult with a financial advisor to create a strategy that aligns with your individual risk tolerance and investment objectives. Learn more about BofA's analysis of current stock market valuations to inform your investment decisions.

Featured Posts

-

Office365 Security Breach Nets Hacker Millions According To Federal Authorities

May 17, 2025

Office365 Security Breach Nets Hacker Millions According To Federal Authorities

May 17, 2025 -

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025 -

Investigation Reveals Crucial Details In Bayesian Superyacht Loss

May 17, 2025

Investigation Reveals Crucial Details In Bayesian Superyacht Loss

May 17, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 17, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

May 17, 2025 -

Singapore Airlines Staff To Receive 7 Months Bonus Straits Times Report

May 17, 2025

Singapore Airlines Staff To Receive 7 Months Bonus Straits Times Report

May 17, 2025

Latest Posts

-

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025 -

Josh Harts Status Will He Play Against The Celtics On February 23rd

May 17, 2025

Josh Harts Status Will He Play Against The Celtics On February 23rd

May 17, 2025 -

Reta Nba Situacija Teisejas Pripazino Klaida Pakeitusia Pistons Ir Knicks Rungtyniu Rezultata

May 17, 2025

Reta Nba Situacija Teisejas Pripazino Klaida Pakeitusia Pistons Ir Knicks Rungtyniu Rezultata

May 17, 2025 -

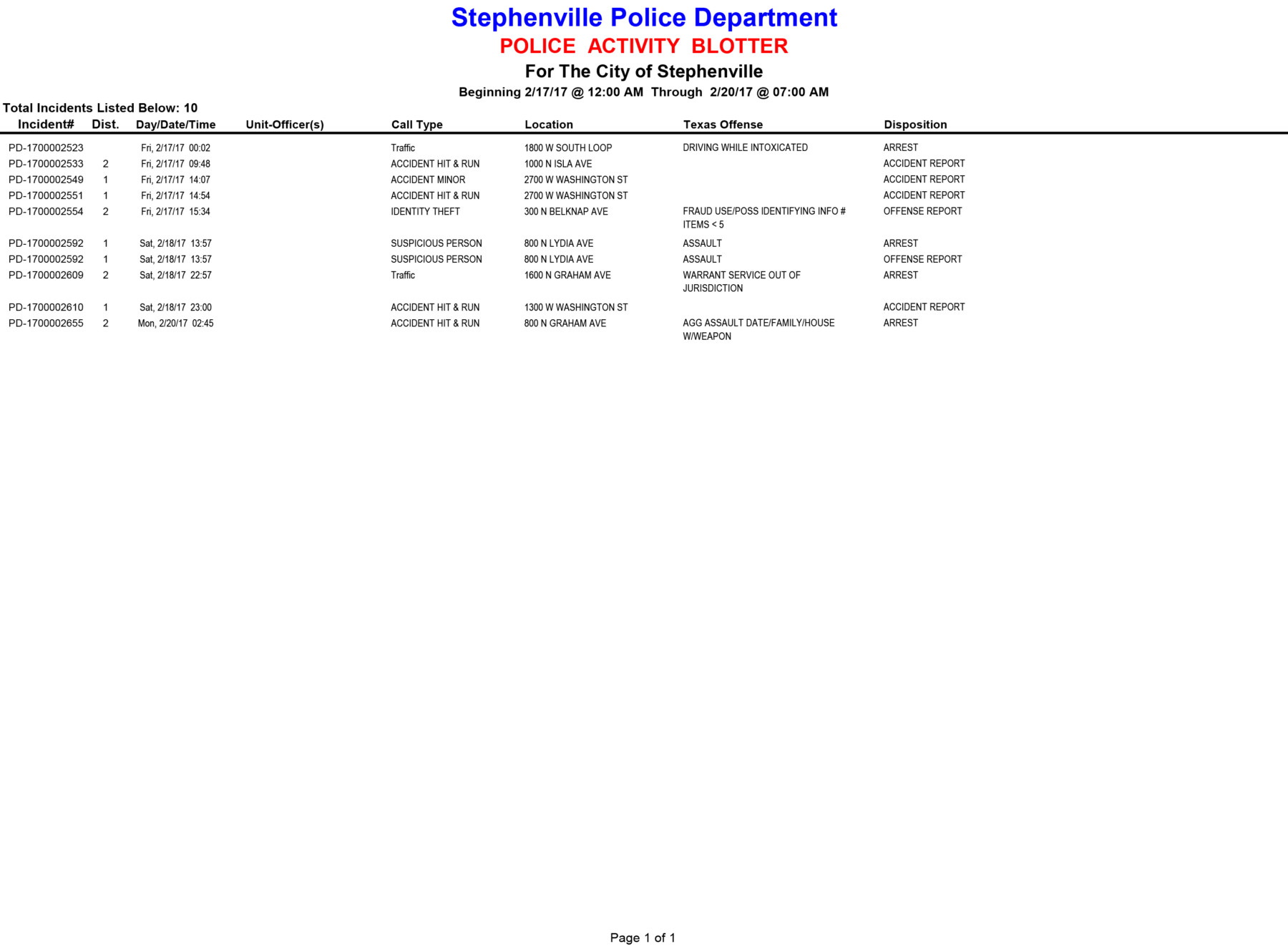

Police Activity Recent Blotter Reports From Austintown And Boardman

May 17, 2025

Police Activity Recent Blotter Reports From Austintown And Boardman

May 17, 2025 -

Teisejo Klaida Nba Rungtynese Tarp Pistons Ir Knicks Retas Atvejis

May 17, 2025

Teisejo Klaida Nba Rungtynese Tarp Pistons Ir Knicks Retas Atvejis

May 17, 2025