Is XRP's 400% Price Jump A Buy Signal? Analysis And Predictions.

Table of Contents

Understanding the 400% Price Surge

Analyzing the Catalysts

Several factors likely contributed to XRP's dramatic price increase. Identifying these catalysts is crucial for understanding the sustainability of this surge.

-

Positive Ripple Court News: Developments in the ongoing Ripple vs. SEC lawsuit significantly impact XRP's price. Positive rulings or settlements could fuel further price increases, while negative news could trigger a sharp decline. Following "Ripple lawsuit update" news closely is paramount for XRP investors.

-

Increased Trading Volume: A surge in XRP trading volume often precedes and accompanies price increases. High trading volume indicates strong market interest and potential for continued growth. Monitoring "XRP trading volume" is key to gauging market sentiment.

-

Broader Market Trends: The overall cryptocurrency market often influences individual cryptocurrencies. A bullish market trend can lift all boats, including XRP. Understanding the wider "cryptocurrency market analysis" is vital to interpreting XRP's price action.

-

Regulatory Developments: Positive regulatory developments, either in the US or globally, can significantly impact XRP's price. Clarity around regulations could boost investor confidence and fuel further price growth. Staying updated on "XRP regulatory developments" is essential.

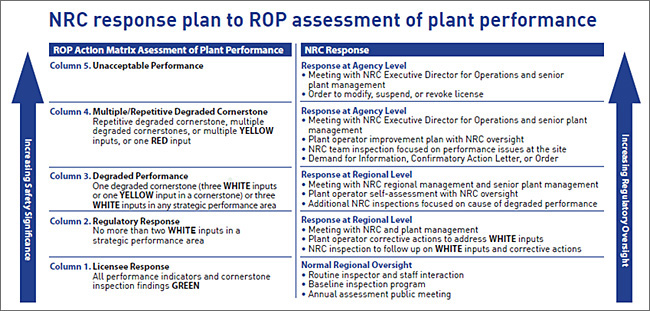

[Insert chart/graph illustrating XRP price movements during the surge period.]

Assessing Market Sentiment

Analyzing market sentiment is crucial for understanding the reasons behind the price surge.

-

Social Media Trends: A positive shift in social media sentiment towards XRP, indicated by increased positive mentions and discussions on platforms like Twitter and Reddit, can contribute to price increases. Monitoring "XRP sentiment analysis" on social media offers valuable insights.

-

Fear of Missing Out (FOMO): Rapid price increases often trigger FOMO, leading more investors to buy, fueling further price increases. This can create a self-reinforcing cycle, but also makes the market more vulnerable to corrections. Understanding the role of "FOMO" in driving XRP's price is essential.

-

Fundamental vs. Technical Analysis: While the 400% jump is a clear technical signal, understanding the underlying fundamentals (Ripple's technology, adoption rate, etc.) is crucial for assessing long-term potential. A combination of "fundamental analysis" and "technical analysis" provides a more comprehensive picture.

[Include a section discussing XRP market capitalization and its implications.]

Risk Assessment and Potential Downsides

Ripple Lawsuit Uncertainty

The ongoing legal battle between Ripple and the SEC remains a significant risk factor for XRP.

-

Potential Outcomes: A favorable ruling for Ripple could lead to substantial price increases, while an unfavorable outcome could trigger a significant price drop. "SEC vs Ripple" is a headline to follow diligently.

-

Regulatory Uncertainty: The lawsuit's uncertainty creates regulatory risk. Until the legal battle concludes, uncertainty about XRP's regulatory status will likely persist, impacting investor confidence. Understanding "regulatory uncertainty" surrounding XRP is crucial for risk assessment.

-

Impact on Investment: Investors need to carefully weigh the potential risks and rewards before investing in XRP. The "Ripple lawsuit update" will heavily influence future price movements.

Market Volatility and Correction Risks

The cryptocurrency market is inherently volatile, and XRP is no exception.

-

Price Corrections: Sharp price increases are often followed by corrections. Understanding the possibility of an "XRP price correction" is crucial for risk management.

-

Market Downturns: Broader cryptocurrency market downturns can significantly impact XRP's price, regardless of positive news related to Ripple. Staying abreast of "cryptocurrency volatility" and "market correction" trends is vital.

-

Risk Mitigation Strategies: Investors should employ strategies to mitigate risk, such as diversifying their portfolios and only investing what they can afford to lose. This is key to "risk management" in the volatile crypto market.

Long-Term Predictions and Investment Strategy

Factors Influencing Future XRP Price

Several factors could influence XRP's long-term price:

-

Technological Advancements: Ripple's ongoing development and adoption of new technologies could positively impact XRP's value. Staying informed about "Ripple technology" advancements is important.

-

Adoption Rates: Increased adoption of XRP by financial institutions and businesses will play a crucial role in its long-term price. Tracking "XRP adoption" rates is key to assessing future potential.

-

Partnerships: Strategic partnerships and collaborations could significantly boost XRP's value. Understanding the implications of future "Ripple partnerships" is essential.

[Offer realistic, yet cautious, "XRP long-term price prediction" scenarios.]

Smart Investment Strategies

Investing in XRP requires a cautious and well-informed approach.

-

Diversification: Diversifying investments across different asset classes is crucial to mitigate risk. "Cryptocurrency portfolio diversification" is a must.

-

Due Diligence: Conduct thorough research and understand the risks involved before investing in XRP. "Responsible investing" requires careful consideration.

-

Risk Management: Only invest what you can afford to lose and develop a risk management strategy to protect your investments. Effective "risk mitigation" is vital in the crypto market.

Conclusion

XRP's recent 400% price surge is a complex event driven by a combination of factors, including positive court news, increased trading volume, and broader market trends. However, the ongoing Ripple lawsuit and inherent market volatility introduce significant risks. While the potential for future growth exists, investors must approach XRP with caution and conduct thorough due diligence. Is XRP's 400% price jump a buy signal for you? Only you can decide after carefully considering the information presented. Remember, this analysis does not constitute financial advice.

Featured Posts

-

Ripple Settlement Talks Sec May Classify Xrp As A Commodity

May 01, 2025

Ripple Settlement Talks Sec May Classify Xrp As A Commodity

May 01, 2025 -

Kampen Eist Stroomnetaansluiting Kort Geding Tegen Enexis

May 01, 2025

Kampen Eist Stroomnetaansluiting Kort Geding Tegen Enexis

May 01, 2025 -

Mercedes Mones Tbs Championship Plea To Momo Watanabe

May 01, 2025

Mercedes Mones Tbs Championship Plea To Momo Watanabe

May 01, 2025 -

Assams Nrc Chief Minister To Take Action Against Non Listed Aadhaar Holders

May 01, 2025

Assams Nrc Chief Minister To Take Action Against Non Listed Aadhaar Holders

May 01, 2025 -

Nikki Burdines Seven Year Run At Wkrn Nashville Ends

May 01, 2025

Nikki Burdines Seven Year Run At Wkrn Nashville Ends

May 01, 2025

Latest Posts

-

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025 -

The Death Of A Dallas And 80s Soap Star

May 01, 2025

The Death Of A Dallas And 80s Soap Star

May 01, 2025 -

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025