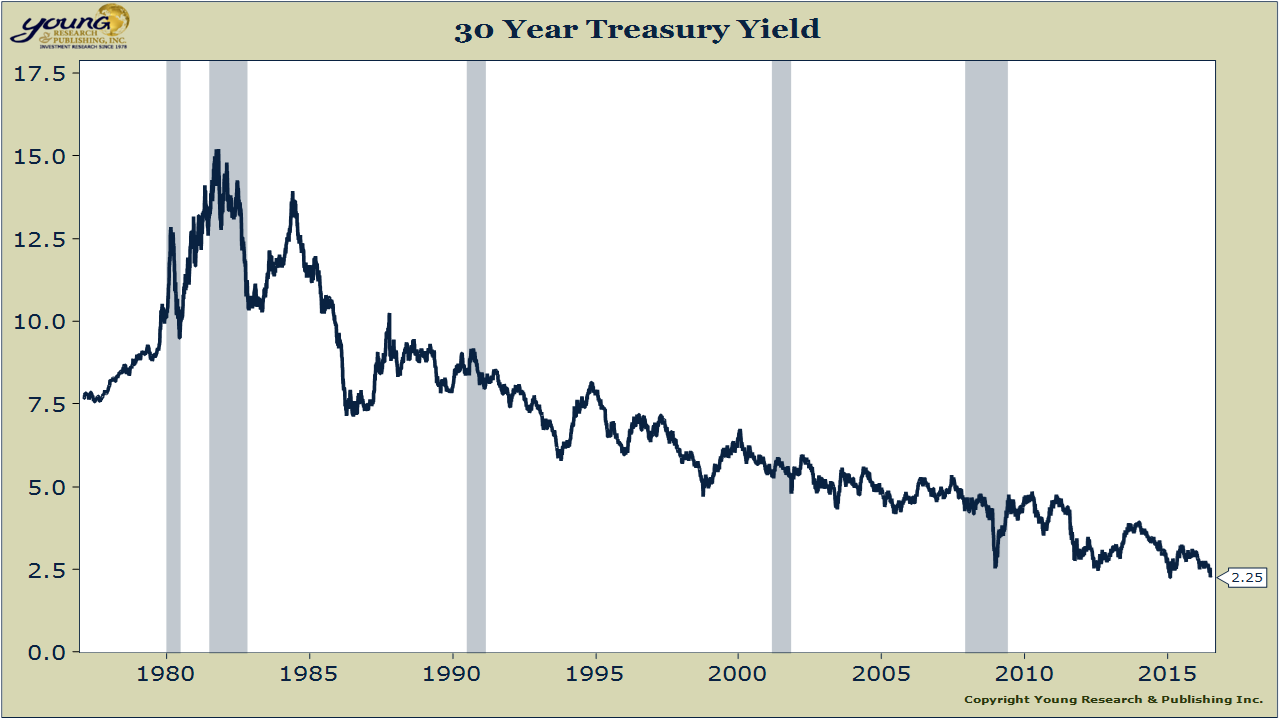

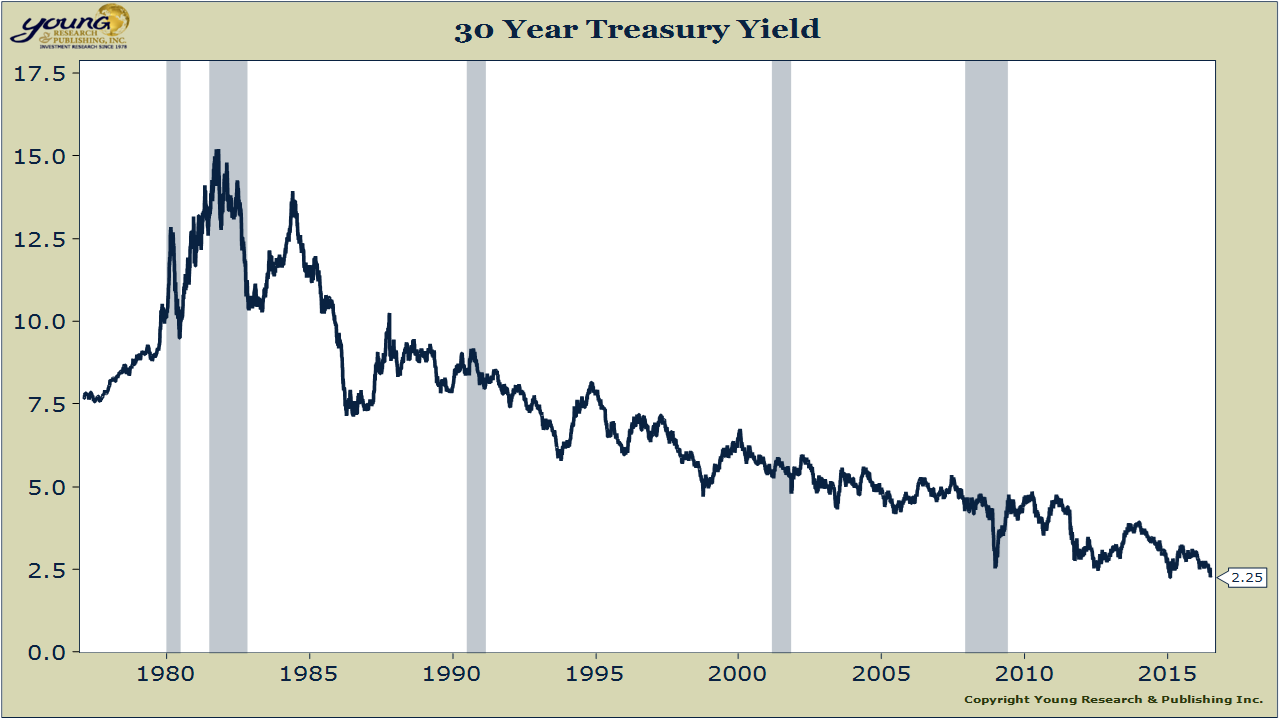

Is The 'Sell America' Trade Resurfacing As 30-Year Treasury Yields Hit 5%?

Table of Contents

The Significance of the 5% 30-Year Treasury Yield

A 5% yield on 30-year Treasuries is a significant event. Historically, such high yields have been associated with periods of economic uncertainty and rising inflation. This level of return, comparatively high against many other global bond markets currently offering lower yields, makes US debt exceptionally attractive to foreign investors seeking higher returns. This increased attractiveness could potentially draw significant capital inflows, strengthening the dollar. However, paradoxically, high yields can also signal underlying economic weaknesses that might spur a "Sell America" reaction.

- Impact on bond markets: Higher yields can lead to increased demand for US Treasury bonds, potentially impacting other fixed-income securities and pushing down prices.

- Attraction for foreign investors: International investors seeking higher returns might shift their portfolios towards US Treasuries, boosting demand and the US dollar.

- Potential consequences for the US dollar: The impact on the dollar is complex. High yields could attract capital, strengthening it, but a simultaneous "Sell America" trend might weaken it.

Evidence of Capital Flight from the US

While the 5% yield is attracting some foreign capital, several economic indicators raise concerns about a potential "Sell America" trend. Persistently high inflation, aggressive interest rate hikes by the Federal Reserve, and ongoing political uncertainty contribute to a climate of risk aversion, potentially driving capital outwards.

- Data on foreign investment flows: A careful analysis of recent data on foreign direct investment (FDI) and portfolio investment flows into and out of the US is crucial to identifying any significant shifts. A sustained outflow would be a strong indicator.

- Analysis of the US dollar's performance: A weakening US dollar against other major currencies could be interpreted as a sign of decreased confidence in the US economy and a potential "Sell America" scenario.

- Examples of capital flight: Tracking the investment decisions of multinational corporations and large institutional investors could reveal whether significant capital is being moved out of the US.

Counterarguments and Alternative Perspectives

It's crucial to consider counterarguments. Attributing capital flows solely to a "Sell America" narrative overlooks other influential factors. The US economy possesses strengths that continue to attract investment, such as a large and innovative domestic market and a relatively stable political system compared to some other regions.

- Strong US economic fundamentals: Despite current challenges, the US economy retains significant advantages, including a robust innovation ecosystem and a large consumer market, which can offset some negative factors.

- Geopolitical factors: Global instability, particularly the war in Ukraine and the ongoing energy crisis, might be influencing investment decisions more significantly than the US economy alone. Investors may be shifting assets based on broader geopolitical risk assessments, not just US-specific factors.

- Central bank policies: The actions of the Federal Reserve and other central banks globally are significant players, and their policies on interest rates and monetary supply can influence capital flows dramatically.

The Role of Global Economic Uncertainty

Global economic uncertainty plays a major role. The war in Ukraine, the energy crisis, and supply chain disruptions create a volatile environment, pushing investors to seek safer haven assets. This could lead to capital moving away from perceived riskier markets, including the US, even if the underlying fundamentals remain relatively strong.

- Geopolitical events and US attractiveness: The impact of global events on investor perception of US assets needs to be carefully considered. Uncertainty can lead to capital flight irrespective of domestic conditions.

- Safe haven assets: Investors often flock to safe haven assets, such as gold or government bonds from highly stable economies, during times of heightened global uncertainty. This competition for "safe" investments could impact the flow of capital to the US.

- Investor sentiment and risk aversion: A prevailing climate of risk aversion can heavily influence investment decisions, leading to capital moving to less volatile markets, regardless of yield differentials.

Conclusion: Is the "Sell America" Trade Really Back?

The evidence regarding the resurgence of the "Sell America" trade is mixed. While the 5% 30-year Treasury yield is attractive to some foreign investors, other indicators, like potentially weakening dollar strength and heightened global uncertainty, suggest a more complex picture. A definitive conclusion requires continuous monitoring of economic data and geopolitical developments. While a full-blown "Sell America" scenario isn't definitively confirmed, the potential for significant capital flight due to a combination of factors cannot be dismissed.

Stay updated on the evolving situation regarding the "Sell America" trade and its impact on the global economy. Subscribe to our newsletter for regular analysis and insights on 30-year Treasury yields and related market trends.

Featured Posts

-

Bbai Stock In Freefall 17 87 Drop After Disappointing Earnings

May 21, 2025

Bbai Stock In Freefall 17 87 Drop After Disappointing Earnings

May 21, 2025 -

Espace Julien Les Novelistes En Prelude Au Hellfest

May 21, 2025

Espace Julien Les Novelistes En Prelude Au Hellfest

May 21, 2025 -

Vanja Mijatovic Zvanicno Promenila Ime

May 21, 2025

Vanja Mijatovic Zvanicno Promenila Ime

May 21, 2025 -

Solve The Nyt Mini Crossword March 16 2025 Hints And Solutions

May 21, 2025

Solve The Nyt Mini Crossword March 16 2025 Hints And Solutions

May 21, 2025 -

Abn Amro Huizenmarktverwachting 2024 Stijgende Prijzen Ondanks Rente

May 21, 2025

Abn Amro Huizenmarktverwachting 2024 Stijgende Prijzen Ondanks Rente

May 21, 2025

Latest Posts

-

Blockbusters A Bgt Special Event Review

May 21, 2025

Blockbusters A Bgt Special Event Review

May 21, 2025 -

Fing A Look At David Walliams New Fantasy Film Greenlit By Stan

May 21, 2025

Fing A Look At David Walliams New Fantasy Film Greenlit By Stan

May 21, 2025 -

Stan Approves David Walliams New Fantasy Project Fing

May 21, 2025

Stan Approves David Walliams New Fantasy Project Fing

May 21, 2025 -

David Walliams Fing Stans Greenlight And What To Expect

May 21, 2025

David Walliams Fing Stans Greenlight And What To Expect

May 21, 2025 -

Mia Wasikowska And Taika Waititi Team Up For Family Movie

May 21, 2025

Mia Wasikowska And Taika Waititi Team Up For Family Movie

May 21, 2025