BBAI Stock In Freefall: 17.87% Drop After Disappointing Earnings

Table of Contents

Disappointing Earnings Report: Key Metrics That Triggered the Fall

BBAI's recent earnings report significantly missed analyst expectations, triggering the sharp decline in BBAI stock. Several key metrics fell drastically short, contributing to the overall negative sentiment. Analyzing these BBAI financial results reveals the core issues impacting investor confidence.

-

Revenue significantly below analyst projections: BBAI's reported revenue was considerably lower than the consensus forecast among analysts, indicating a potential slowdown in sales growth and market penetration. This shortfall in BBAI revenue directly impacted investor confidence in the company's short-term prospects.

-

EPS miss compared to consensus estimates: Earnings per share (EPS) significantly missed expectations, further exacerbating the negative reaction to the BBAI earnings report. This metric reflects the company's profitability on a per-share basis, and the significant miss signaled weaker-than-anticipated performance. The BBAI EPS shortfall significantly impacted investor sentiment and fueled selling pressure.

-

Negative or significantly lowered future guidance: Perhaps the most damaging aspect of the report was the negative or significantly lowered future guidance provided by BBAI. This lack of confidence in future performance sent a clear message to investors that the challenges facing the company are likely to persist. The lowered BBAI revenue projections for the coming quarters added further pressure on the stock price.

Market Reaction and Investor Sentiment

The immediate market response to the disappointing BBAI earnings was swift and brutal. The BBAI stock price plummeted, experiencing a significant increase in trading volume as investors rushed to sell their shares. This surge in selling pressure amplified the initial drop, accelerating the decline in the BBAI stock price.

-

Increased selling pressure: The significant miss on BBAI earnings triggered a wave of selling, as investors reacted to the negative news by exiting their positions.

-

Decline in investor confidence: The disappointing results and lowered guidance severely eroded investor confidence in BBAI's ability to deliver on its promises and achieve its long-term goals.

-

Negative analyst ratings and price target reductions: Following the release of the earnings report, several analysts downgraded their ratings on BBAI stock and reduced their price targets, reflecting their diminished outlook for the company. This further fueled the negative sentiment surrounding BBAI and contributed to the downward pressure on the stock price. The changes in BBAI investor sentiment were clearly reflected in the dramatic drop in the stock's value.

Impact on BBAI's Long-Term Strategy

The disappointing BBAI earnings results will undoubtedly necessitate a reassessment of the company's long-term strategy. The significant underperformance raises questions about the effectiveness of current initiatives and the need for potential adjustments. The BBAI future outlook appears uncertain, requiring a strategic review.

-

Potential adjustments in strategy or operations: BBAI may need to explore cost-cutting measures, revise its product development roadmap, or even consider strategic partnerships or acquisitions to address the underlying issues that contributed to the disappointing results. The company's BBAI long-term growth plans might need significant recalibration.

-

Impact on Research and Development: The shortfall in BBAI revenue might lead to cuts in research and development, potentially hindering future innovation and growth.

Potential Factors Contributing to the Decline Beyond Earnings

While the disappointing earnings report was the primary driver of the BBAI stock's decline, other factors likely exacerbated the drop. Understanding these contributing factors provides a more complete picture of the situation.

-

Overall market downturn: A broader market downturn could have amplified the negative impact of the BBAI earnings report, creating a less favorable environment for all stocks, including BBAI.

-

Sector-specific headwinds: Headwinds specific to BBAI's industry might have further contributed to the stock's decline, creating a double whammy effect alongside the disappointing earnings.

-

Geopolitical events: Unforeseen geopolitical events could also have negatively impacted investor sentiment towards BBAI, adding to the overall pressure on the stock price. These external factors influenced BBAI stock performance in conjunction with the internal challenges.

Conclusion

The 17.87% decline in BBAI stock is primarily attributable to a severely disappointing earnings report that fell significantly short of analyst expectations. Factors such as missed revenue projections, a disappointing EPS, and lowered future guidance all contributed to a dramatic drop in BBAI stock price. Furthermore, broader market conditions, sector-specific headwinds, and potential geopolitical factors exacerbated this decline. While the recent BBAI stock drop is significant, investors should carefully consider the long-term prospects of the company before making any rash decisions. Conduct thorough research and analysis of BBAI's financial performance, future outlook, and market position before investing in or divesting from BBAI stock. Stay informed about future BBAI earnings announcements and market updates to make informed decisions regarding your BBAI stock holdings.

Featured Posts

-

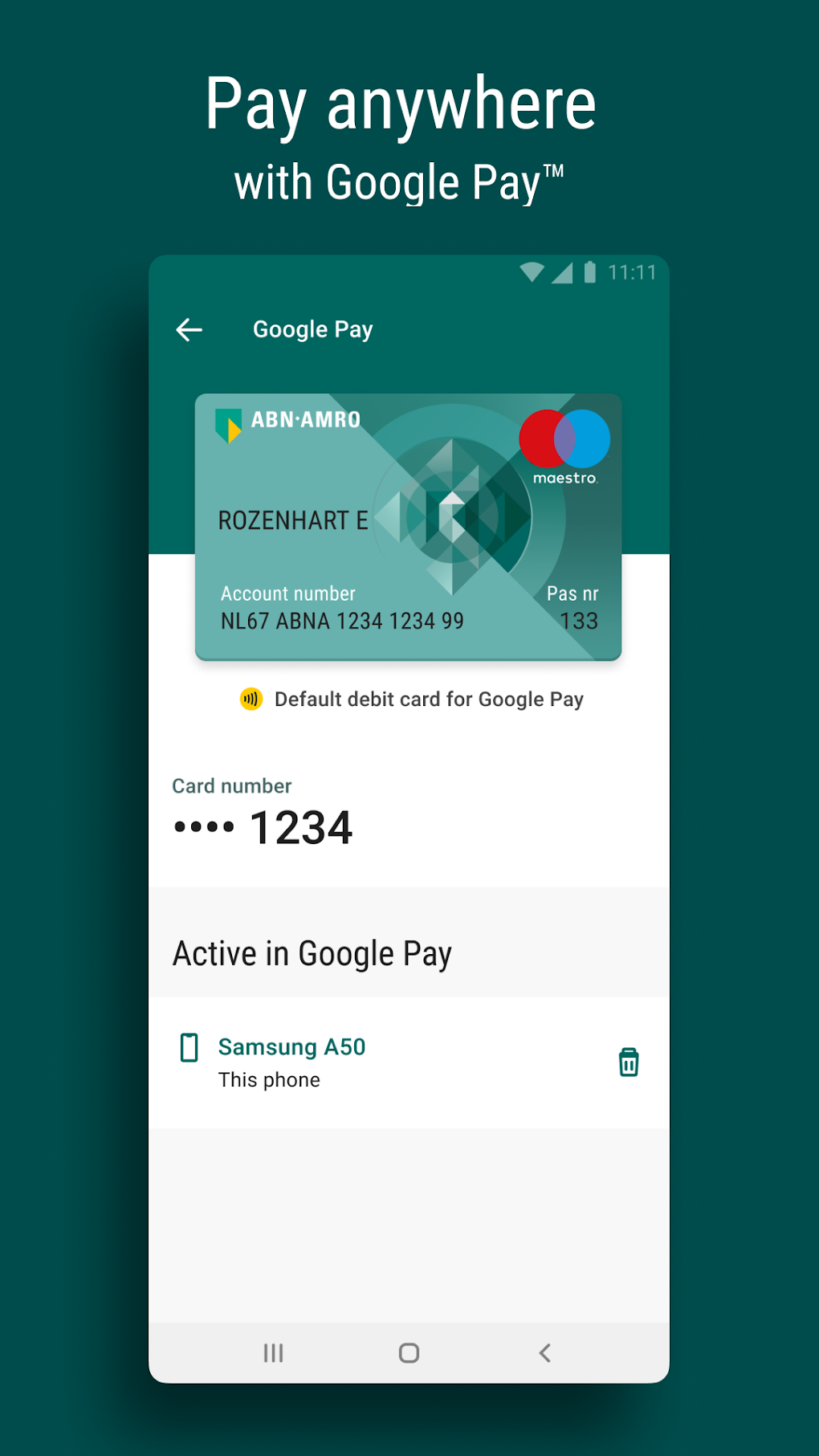

Kamerbrief Certificaten Abn Amro Programma Details En Verkoopmogelijkheden

May 21, 2025

Kamerbrief Certificaten Abn Amro Programma Details En Verkoopmogelijkheden

May 21, 2025 -

3 1

May 21, 2025

3 1

May 21, 2025 -

Trans Australia Run The Race To Break The Record

May 21, 2025

Trans Australia Run The Race To Break The Record

May 21, 2025 -

The Klopp Effect Transforming Hout Bay Fcs Game

May 21, 2025

The Klopp Effect Transforming Hout Bay Fcs Game

May 21, 2025 -

Parcourir La Loire A Velo 5 Itineraires A Decouvrir

May 21, 2025

Parcourir La Loire A Velo 5 Itineraires A Decouvrir

May 21, 2025

Latest Posts

-

Saskatchewan Political Panel Examining Western Separation

May 22, 2025

Saskatchewan Political Panel Examining Western Separation

May 22, 2025 -

Federal Leaders Saskatchewan Visit Controversial Comments And Political Fallout

May 22, 2025

Federal Leaders Saskatchewan Visit Controversial Comments And Political Fallout

May 22, 2025 -

Bps Future Ceos Strategy For Valuation Growth And Uk Listing Commitment

May 22, 2025

Bps Future Ceos Strategy For Valuation Growth And Uk Listing Commitment

May 22, 2025 -

Saskatchewan Political Panel Analysis Of Recent Federal Leaders Visit And Public Reaction

May 22, 2025

Saskatchewan Political Panel Analysis Of Recent Federal Leaders Visit And Public Reaction

May 22, 2025 -

Exploring The Goldbergs Themes Episodes And More

May 22, 2025

Exploring The Goldbergs Themes Episodes And More

May 22, 2025