Is Palantir Stock A Buy Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Financial Performance and Analyst Ratings

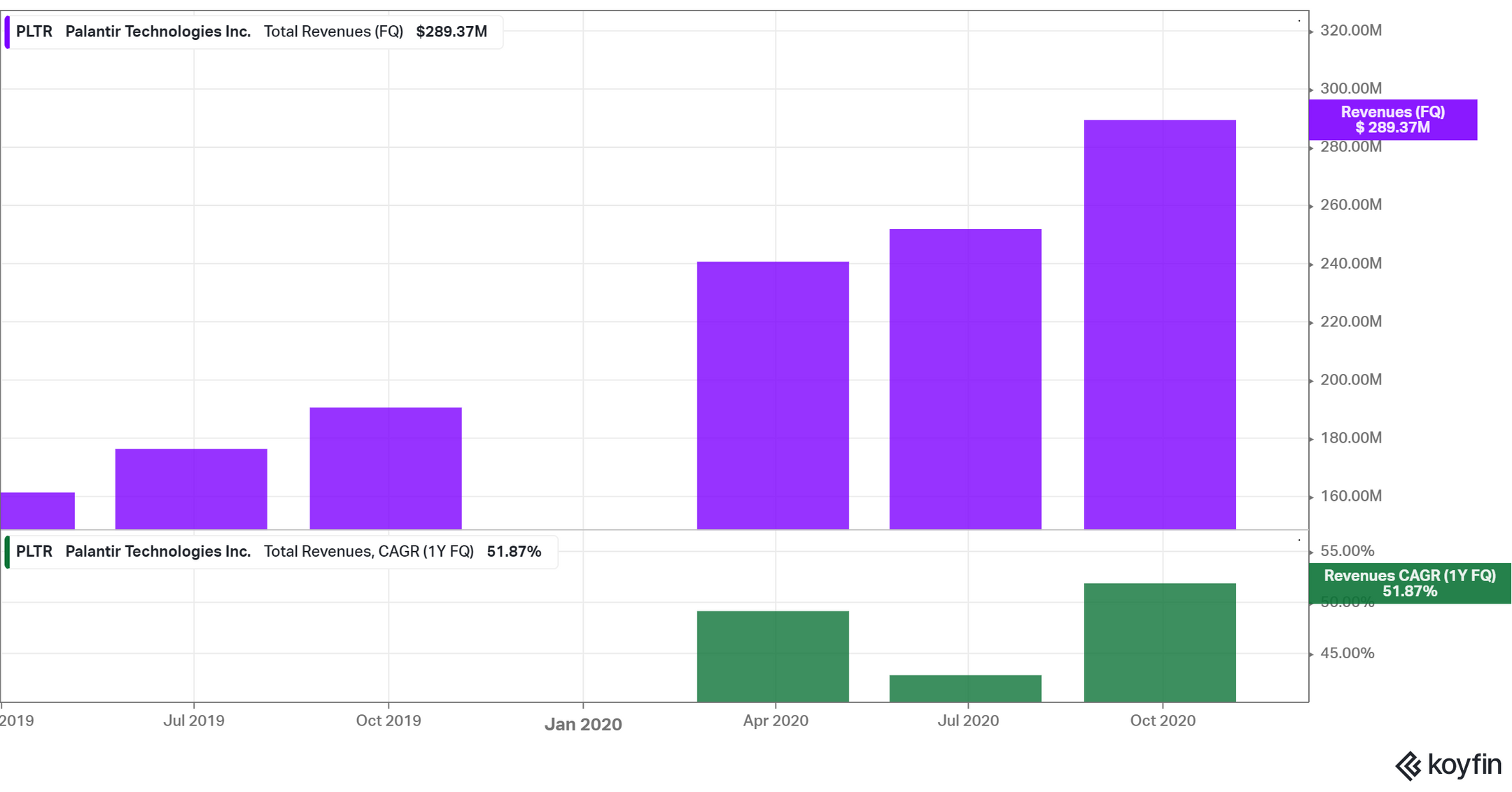

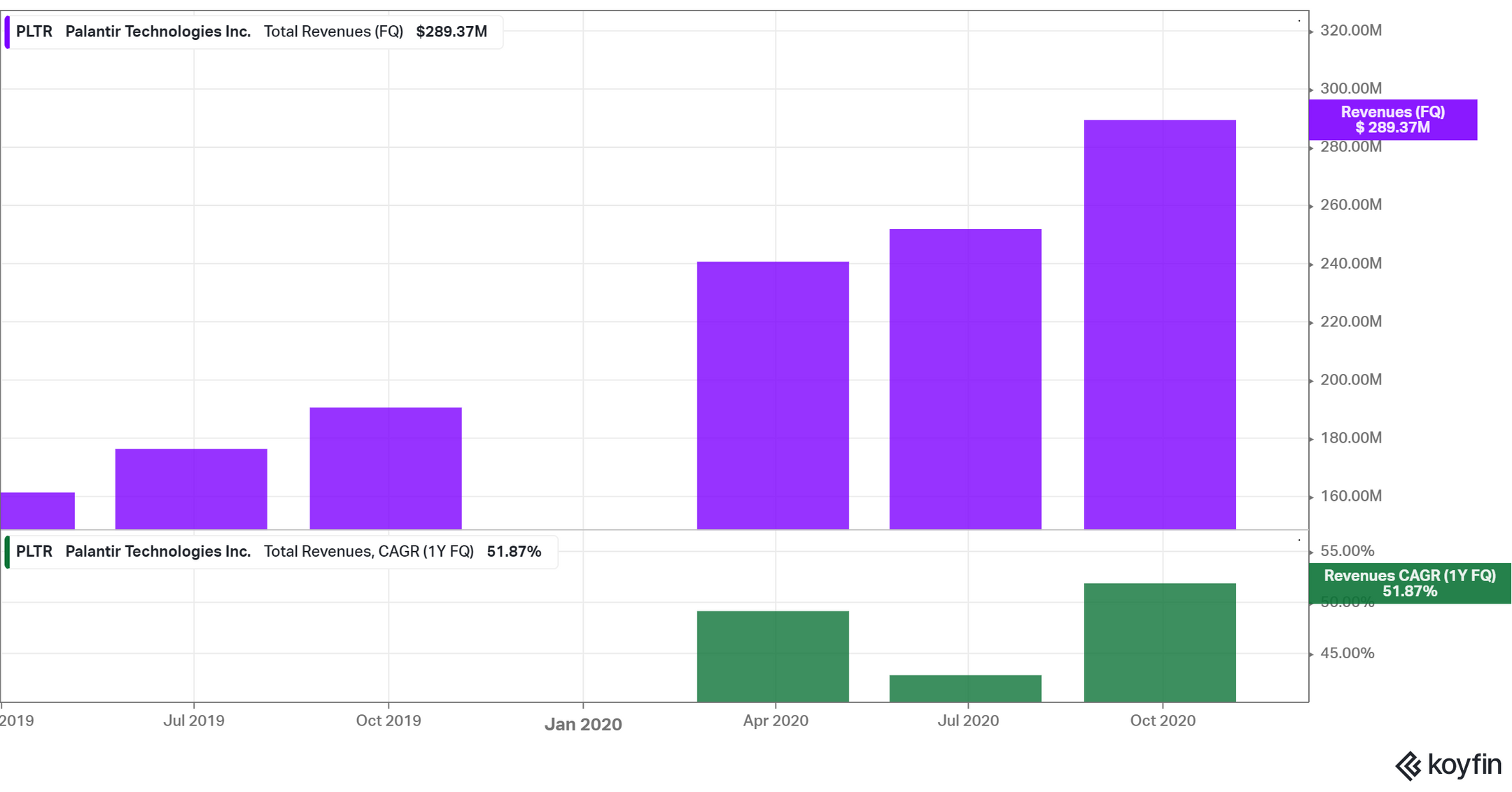

Q4 2022 Earnings and Revenue Growth:

Palantir's Q4 2022 earnings report offered a mixed bag. While the company exceeded revenue expectations, profitability remained a challenge. Let's delve into the specifics:

- Revenue Growth: Palantir reported a year-over-year revenue increase of X%, exceeding analyst predictions of Y%. This growth was primarily driven by increased demand for its government and commercial platforms. [Link to Palantir Q4 2022 Earnings Report]

- Operating Income: Operating income was Z%, indicating continued investment in research and development and sales expansion. This needs to be viewed within the context of the company's long-term growth strategy.

- Free Cash Flow: Free cash flow was positive at $A million, a crucial indicator of the company's financial health and its ability to reinvest in its business or return capital to shareholders.

While the revenue growth is encouraging, the ongoing investment in future growth means that short-term profitability might not meet every investor’s expectations. This is a key factor to consider when evaluating Palantir stock.

Current Analyst Ratings and Price Targets:

Wall Street analysts hold diverse opinions on Palantir stock. The consensus remains somewhat cautious, reflecting the company's high-growth, high-risk profile:

- Buy Ratings: Several prominent investment banks, including [Investment Bank A] and [Investment Bank B], maintain a "buy" rating on PLTR stock, citing its long-term growth potential.

- Hold Ratings: Others, like [Investment Bank C], have issued "hold" ratings, suggesting a wait-and-see approach until further evidence of profitability emerges.

- Average Price Target: The average price target among analysts is currently $X, with a range from $Y to $Z. This reflects the uncertainty surrounding Palantir's future performance.

Recent changes in analyst sentiment have been relatively minor, indicating a degree of stability in the market's view of Palantir. However, any significant shifts in the macroeconomic environment could trigger dramatic changes in these ratings and price targets.

Growth Potential and Future Market Opportunities

Government Contracts and Commercial Expansion:

Palantir's revenue streams are currently diversified between government and commercial contracts. While government contracts represent a significant portion of its current revenue, the company is aggressively pursuing growth in the commercial sector:

- Government Sector Growth: The ongoing demand for advanced data analytics and AI solutions by government agencies worldwide presents significant growth opportunities for Palantir. This is particularly true in areas like national security and intelligence.

- Commercial Sector Expansion: Palantir is actively expanding its partnerships with commercial clients across various industries. Success in this area will be critical for long-term sustainability and reduced reliance on the government sector.

- Competitive Landscape: The competition in both government and commercial sectors is fierce, with established players and nimble startups vying for market share. Palantir needs to continually innovate to maintain its competitive edge.

Technological Innovation and AI Integration:

Palantir's strategic investments in artificial intelligence (AI) are positioning the company for significant future growth. AI is seen as a core driver of its next phase of expansion:

- AI-powered Platform: Palantir is incorporating AI capabilities into its core platform, enhancing its data analysis and decision-making tools. This is a crucial step in making its platform more valuable to its clients and boosting overall efficiency.

- New Product Launches: The company has been actively launching new AI-driven products and services tailored to specific market needs. This dynamic approach allows them to adapt to evolving client demands.

- Strategic Partnerships: Collaboration with other technology companies in the AI space could further accelerate Palantir's growth and innovation.

The successful integration of AI into its platform and the development of new AI-powered applications will be key drivers of Palantir's future financial performance.

Risks and Potential Downsides of Investing in Palantir Stock

Valuation and Stock Price Volatility:

Palantir's stock price has historically been highly volatile, reflecting the inherent risks associated with investing in a high-growth, high-risk company:

- Price-to-Sales Ratio: Palantir's price-to-sales ratio is currently relatively high compared to industry peers, indicating a premium valuation based on future growth expectations. This high valuation makes the stock susceptible to downward pressure if growth doesn't meet expectations.

- Stock Price Volatility: The company's stock price has exhibited significant swings, reflecting the market's changing sentiment and uncertainty regarding its long-term profitability. Investors should be prepared for substantial fluctuations in the stock's price.

Geopolitical and Economic Uncertainty:

Global events and economic conditions present significant risks to Palantir's business:

- Geopolitical Risks: Palantir's reliance on government contracts exposes it to geopolitical risks, including changes in government policy and international conflicts. A reduction in government spending could negatively impact its revenues.

- Economic Downturn: A global economic downturn could reduce demand for Palantir's services from both government and commercial clients, potentially affecting its revenue growth.

These external factors could significantly impact the company's financial performance and the valuation of its stock.

Conclusion

Analyzing Palantir's financial performance, growth prospects, and inherent risks reveals a complex investment picture. While revenue growth is encouraging and the company's AI initiatives show promise, concerns remain about profitability and the volatility of its stock price. The looming May 5th date adds another layer of uncertainty. Whether Palantir stock is a buy before May 5th depends heavily on your individual risk tolerance and investment horizon. This analysis offers a perspective, but it’s crucial to conduct thorough research, weigh the risks and rewards, and consider consulting a financial advisor before making any investment decisions. Is Palantir stock right for your portfolio? Should you buy Palantir stock before May 5th? Only you can answer that question. Remember, this information is for educational purposes only and does not constitute financial advice.

Featured Posts

-

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 09, 2025

Njwm Krt Alqdm Waltbgh Drast Fy Altnaqdat

May 09, 2025 -

Stricter Uk Visa Requirements New Rules For Nigerian And Pakistani Nationals

May 09, 2025

Stricter Uk Visa Requirements New Rules For Nigerian And Pakistani Nationals

May 09, 2025 -

New Deals Team At Deutsche Bank A Focus On Defense Finance

May 09, 2025

New Deals Team At Deutsche Bank A Focus On Defense Finance

May 09, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

From 3 000 Babysitter To 3 600 Daycare A Fathers Financial Nightmare

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Fathers Financial Nightmare

May 09, 2025

Latest Posts

-

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 10, 2025

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 10, 2025 -

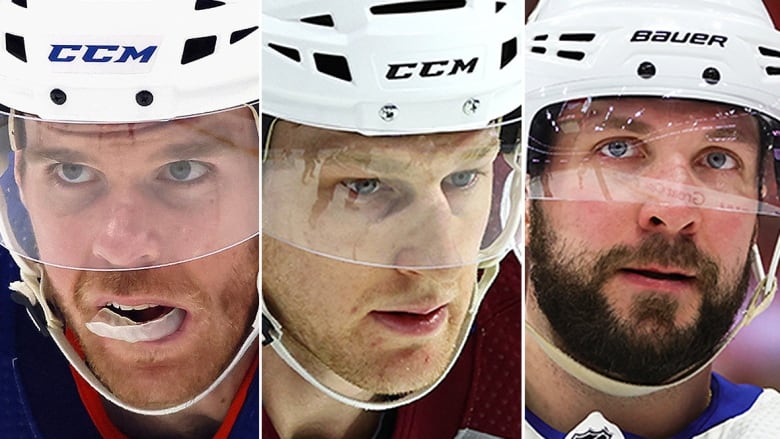

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025

Draisaitl Hellebuyck And Kucherov A Look At The Hart Trophy Finalists

May 10, 2025 -

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

Oilers Beat Kings In Overtime Series Tied 1 1

May 10, 2025

Oilers Beat Kings In Overtime Series Tied 1 1

May 10, 2025 -

Edmonton Oilers Leon Draisaitl Hart Trophy Finalist And Banner Season Highlights

May 10, 2025

Edmonton Oilers Leon Draisaitl Hart Trophy Finalist And Banner Season Highlights

May 10, 2025