Is Palantir Stock A Buy After Its Recent 30% Fall?

Table of Contents

Palantir's Recent Performance and the Reasons Behind the 30% Drop

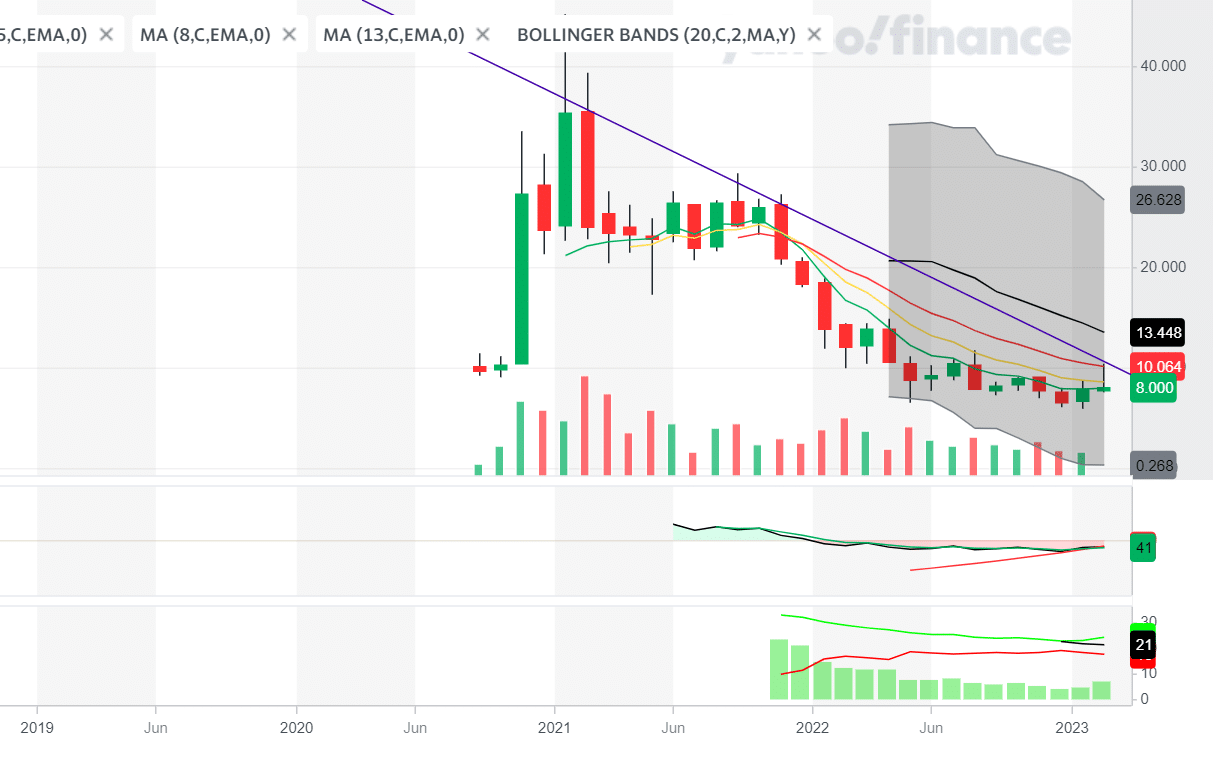

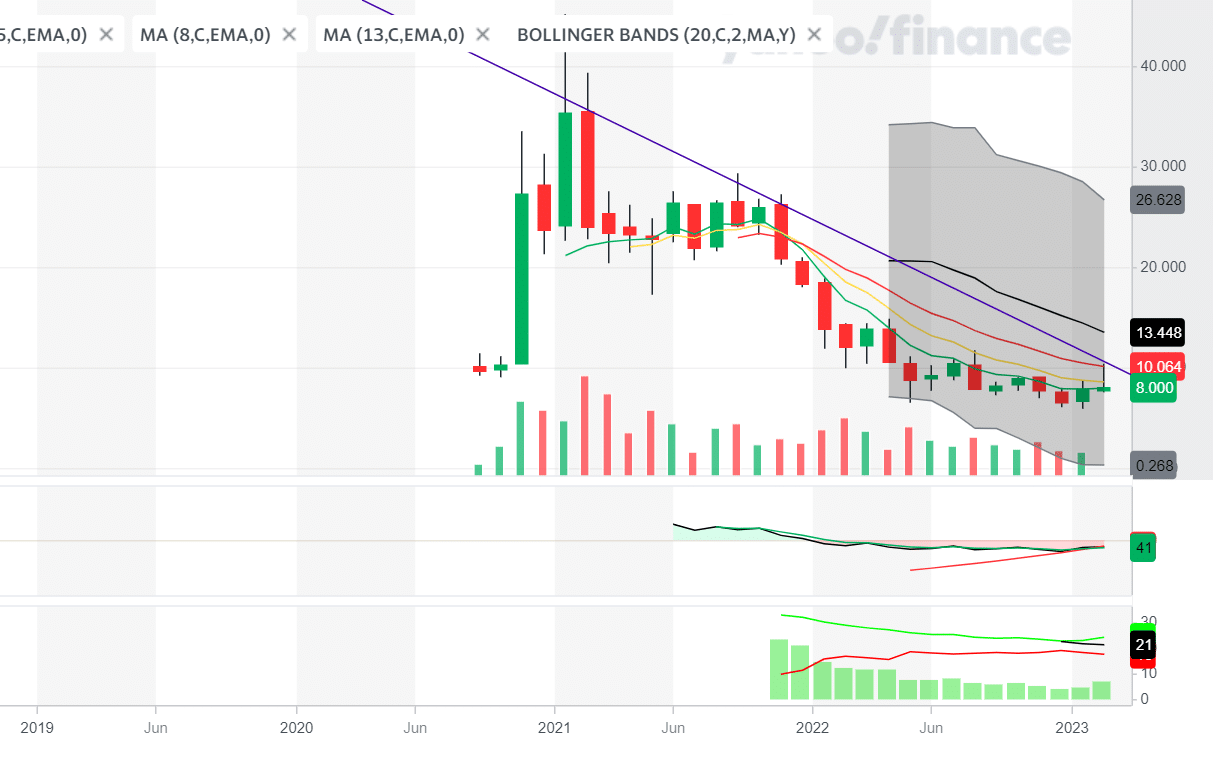

Palantir Technologies, a leading provider of big data analytics platforms for government and commercial clients, has seen its stock price significantly decline in recent months. The 30% fall represents a substantial loss for investors, prompting a thorough examination of the contributing factors. Analyzing the Palantir stock chart reveals a period of consistent decline leading up to this sharp drop.

Several factors likely contributed to this downturn:

- Negative Market Sentiment: The broader tech sector has experienced a period of volatility, impacting even strong performers like Palantir. Concerns about rising interest rates and inflation have weighed heavily on growth stocks.

- Growth Concerns: While Palantir has demonstrated significant revenue growth, some investors may be concerned about the sustainability of this pace. Any revenue misses or slower-than-expected growth could trigger sell-offs.

- Earnings Reports and Announcements: Specific news, such as less-than-stellar earnings reports or announcements regarding contract wins or losses, can significantly impact investor sentiment and contribute to price fluctuations in Palantir stock price. Careful analysis of these announcements is crucial.

- Macroeconomic Factors: Broader macroeconomic conditions, such as geopolitical instability and inflation, can influence investor risk appetite and lead to corrections in even fundamentally sound companies like Palantir.

[Insert a chart or graph visually representing Palantir's stock performance over the relevant period. Clearly label the axes and highlight the 30% drop.]

Evaluating Palantir's Fundamental Strengths and Weaknesses

To determine if the current Palantir stock price presents a buying opportunity, a comprehensive assessment of its fundamental strengths and weaknesses is necessary.

Strengths:

- Strong Government Contracts: Palantir enjoys substantial government contracts, providing a stable revenue stream and access to sensitive data.

- Unique Technology: Its proprietary data analytics platform offers distinct capabilities and competitive advantages in the market.

- Growing Commercial Client Base: Palantir is successfully expanding its commercial client base, diversifying its revenue sources beyond government contracts.

Weaknesses:

- High Valuation: Palantir's valuation remains high relative to its profitability, making it susceptible to market corrections.

- Dependence on Government Contracts: Over-reliance on government contracts exposes Palantir to potential political and budgetary risks.

- Intense Competition: The big data analytics market is highly competitive, with established players and emerging startups vying for market share.

Analyzing Palantir financials, including Palantir revenue, profitability (or lack thereof), debt levels, and cash flow is essential to understanding its financial health and long-term sustainability. This deep dive into Palantir financials will provide a clearer picture of the company's stability.

Assessing the Risk-Reward Ratio of Investing in Palantir Stock Now

Investing in Palantir stock at its current price involves assessing the risk-reward ratio carefully.

Potential Risks:

- Stock Price Volatility: Palantir stock has historically been volatile, meaning further price declines are possible.

- Uncertainty about Future Growth: The sustainability of Palantir's revenue growth remains a key concern for investors.

- Potential for Further Price Declines: Negative news or broader market downturns could lead to additional price drops.

Potential Rewards:

- Significant Upside Potential: If Palantir meets or exceeds expectations, its stock price could rebound significantly.

- Discounted Price: The recent price drop presents a potential opportunity to buy Palantir stock at a discounted price.

- Long-Term Growth Prospects: The big data analytics market offers significant long-term growth potential.

The current risk-reward profile for Palantir stock depends on an investor's risk tolerance and investment horizon. The potential for significant returns must be weighed against the risks of further price declines and volatility.

Comparing Palantir to its Competitors

A comparison with key competitors in the big data analytics market, such as [insert competitor names], provides valuable context. Analyzing Palantir market share, revenue growth, and profitability in relation to these competitors offers a comprehensive view of its competitive positioning and future growth potential. Factors such as Palantir vs [competitor name] in terms of technology, client base, and market penetration should be carefully considered.

Conclusion: Should You Buy Palantir Stock After its Recent Fall?

The decision of whether to buy Palantir stock after its recent 30% fall is complex and depends on individual circumstances and risk tolerance. While the price drop presents a potential buying opportunity at a seemingly discounted price, significant risks remain, including stock price volatility and uncertainty about future growth. The company's strong technology and government contracts offer resilience, but its high valuation and competition in the big data analytics market are key considerations.

Our analysis suggests that investors with a high-risk tolerance and a long-term investment horizon might find the current price attractive. However, thorough due diligence and a careful assessment of Palantir's financials and competitive landscape are crucial before making any investment decisions regarding Palantir stock. Before investing in Palantir stock, conduct your own thorough research and consider consulting with a financial advisor.

Featured Posts

-

Newark Mayor Ras Baraka Arrested Protest At Ice Detention Center

May 10, 2025

Newark Mayor Ras Baraka Arrested Protest At Ice Detention Center

May 10, 2025 -

Tesla Stock Slump Drives Elon Musks Net Worth Below 300 Billion

May 10, 2025

Tesla Stock Slump Drives Elon Musks Net Worth Below 300 Billion

May 10, 2025 -

Kormanyepuelet Noi Mosdo Letartoztatas Transznemu No Floridaban

May 10, 2025

Kormanyepuelet Noi Mosdo Letartoztatas Transznemu No Floridaban

May 10, 2025 -

The Epstein Client List Pam Bondis Claims And Their Implications

May 10, 2025

The Epstein Client List Pam Bondis Claims And Their Implications

May 10, 2025 -

Politiko Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025

Politiko Ne Vse Soyuzniki Ukrainy Posetyat Kiev 9 Maya

May 10, 2025