Is News Corp An Undervalued Asset? A Deeper Look At Its Business Units

Table of Contents

News Corp, the media and information services company led by Rupert Murdoch, has a long and complex history. While its stock price may not always reflect its intrinsic worth, a closer examination of its diverse business units reveals potential for significant undervaluation. This article delves into News Corp's key divisions to assess whether it represents a compelling undervalued investment opportunity.

News Corp's Key Business Segments: A Breakdown

News Corp operates across several key sectors, each contributing differently to its overall financial performance and valuation. Understanding the strengths and weaknesses of each segment is crucial to evaluating the company's overall worth.

News & Information Services: A Legacy Reimagined

This segment comprises News Corp's newspapers and digital publishing arms, including prestigious titles like The Wall Street Journal, The Times, and The Sun. While print advertising revenue continues to decline, the company is actively pursuing digital subscription growth and cost-cutting measures to maintain profitability.

- Market share analysis: News Corp maintains significant market share in specific niche markets, particularly with The Wall Street Journal's dominance in financial news.

- Digital subscription growth: The company is investing heavily in digital subscriptions, a key strategy to offset declining print advertising revenue. Success in this area is crucial for long-term financial health.

- Impact of declining print advertising: This is a significant challenge, but the shift towards digital subscriptions is mitigating the impact.

- Potential for cost-cutting and efficiency gains: Consolidation and streamlining of operations could improve margins significantly.

- Competitive landscape: The news industry is fiercely competitive, with online giants like Google and Facebook posing major challenges. News Corp's competitive advantage lies in its brand reputation and high-quality journalism. Keyword optimization: News Corp newspapers, digital publishing, print advertising decline, subscription revenue, market share, competitive advantage

Book Publishing: HarperCollins' Strength

HarperCollins Publishers, a significant player in the global book publishing industry, contributes substantially to News Corp's revenue.

- Best-selling authors: HarperCollins boasts a strong roster of best-selling authors, contributing to consistent revenue streams.

- Impact of e-books and audiobooks: Adapting to the growth of e-books and audiobooks has been vital, requiring strategic investment in technology and distribution.

- Growth strategies: Expanding into new markets and genres, and embracing digital formats, are key growth strategies for HarperCollins.

- Profitability margins compared to competitors: Maintaining competitive margins in the face of intense competition requires efficient operations and strong author relationships.

- Intellectual property value: The vast catalog of intellectual property owned by HarperCollins presents a significant long-term asset. Keyword optimization: HarperCollins, book publishing, e-books, audiobooks, publishing industry trends, royalty rates

Digital Real Estate Services: realtor.com's Potential

realtor.com, a major player in the online real estate market, represents a significant growth area for News Corp.

- Market share in the online real estate market: realtor.com holds a substantial share of the market, competing directly with giants like Zillow.

- Revenue growth: Consistent revenue growth in this sector is vital for News Corp's overall financial health.

- Profitability: Maintaining profitability in a highly competitive market requires strategic pricing and efficient marketing.

- Competitive advantages over Zillow and other competitors: Focusing on specific niches or offering unique services could provide a competitive edge.

- Future growth potential: The online real estate market is expected to continue growing, offering substantial future potential for realtor.com. Keyword optimization: realtor.com, online real estate, digital real estate, market share, revenue growth, Zillow competitor

Financial Performance and Valuation: A Closer Look

Analyzing News Corp's financial performance and valuation is crucial to determine if it's truly an undervalued asset.

Revenue Streams and Profitability: Deciphering the Numbers

Examining News Corp's financial statements reveals key insights into its revenue drivers and profitability.

- Revenue growth year-over-year: Consistent revenue growth is a positive indicator of the company's financial health.

- Operating income: Analyzing operating income helps assess the efficiency of its operations.

- Net income: Net income reflects the company's overall profitability after all expenses are considered.

- Debt levels: High debt levels can pose a risk, while low debt levels indicate financial stability.

- Free cash flow: Free cash flow indicates the company's ability to generate cash after covering its operating expenses and capital expenditures.

- Dividend payout ratio: The dividend payout ratio reveals how much of its earnings the company distributes as dividends to shareholders. Keyword optimization: News Corp financials, revenue growth, profit margin, debt-to-equity ratio, free cash flow, dividend yield

Valuation Metrics: Assessing Intrinsic Value

Several valuation metrics can be used to assess whether News Corp's current stock price accurately reflects its intrinsic value.

- Price-to-earnings ratio (P/E): A low P/E ratio may suggest undervaluation, but context is crucial.

- Price-to-book ratio (P/B): The P/B ratio compares the market value of a company to its book value.

- Discounted cash flow (DCF) analysis: DCF analysis projects future cash flows to estimate the present value of the company.

- Comparable company analysis: Comparing News Corp's valuation to similar companies in the industry can provide valuable insights. Keyword optimization: News Corp valuation, P/E ratio, P/B ratio, DCF analysis, comparable company analysis, intrinsic value

Risks and Challenges Facing News Corp: Navigating Headwinds

Despite its potential, News Corp faces several risks and challenges.

Competition and Disruption: The Evolving Media Landscape

The media landscape is constantly evolving, presenting significant challenges for News Corp.

- Competition from other media outlets: Intense competition from other news organizations and digital platforms is a constant pressure.

- The rise of social media: Social media platforms have disrupted the traditional news distribution model.

- Challenges in adapting to changing consumer preferences: Understanding and adapting to evolving consumer preferences is crucial for survival.

- Technological disruption: News Corp needs to continuously invest in technology to maintain its competitiveness. Keyword optimization: media competition, social media disruption, technological disruption, changing consumer behavior

Regulatory and Legal Risks: Navigating the Legal Minefield

News Corp operates in a heavily regulated industry and faces potential legal risks.

- Antitrust concerns: Mergers and acquisitions can trigger antitrust scrutiny.

- Media regulation: Changes in media regulations can significantly impact News Corp's operations.

- Defamation lawsuits: News organizations are often subject to defamation lawsuits.

- International political risks: Operating in multiple countries exposes News Corp to international political risks. Keyword optimization: media regulation, antitrust law, defamation lawsuits, political risk

Conclusion: Is News Corp Undervalued for You?

News Corp's diverse portfolio presents both significant opportunities and considerable challenges. While the company faces headwinds from competition and technological disruption, a detailed analysis of its business units suggests that its current market valuation might not fully reflect its potential long-term value. Investors must carefully weigh the inherent risks, including those associated with its debt levels and the competitive media landscape, against the potential undervaluation of its assets and the growth prospects within its digital and book publishing sectors. Conduct thorough due diligence and a careful assessment of its financial performance before making any investment decisions. Is News Corp an undervalued asset for your portfolio? The answer requires your own comprehensive research and analysis.

Featured Posts

-

Dazi Trump Al 20 Analisi Dell Impatto Su Nike Lululemon E Altri Brand

May 24, 2025

Dazi Trump Al 20 Analisi Dell Impatto Su Nike Lululemon E Altri Brand

May 24, 2025 -

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025 -

Finding Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

Finding Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

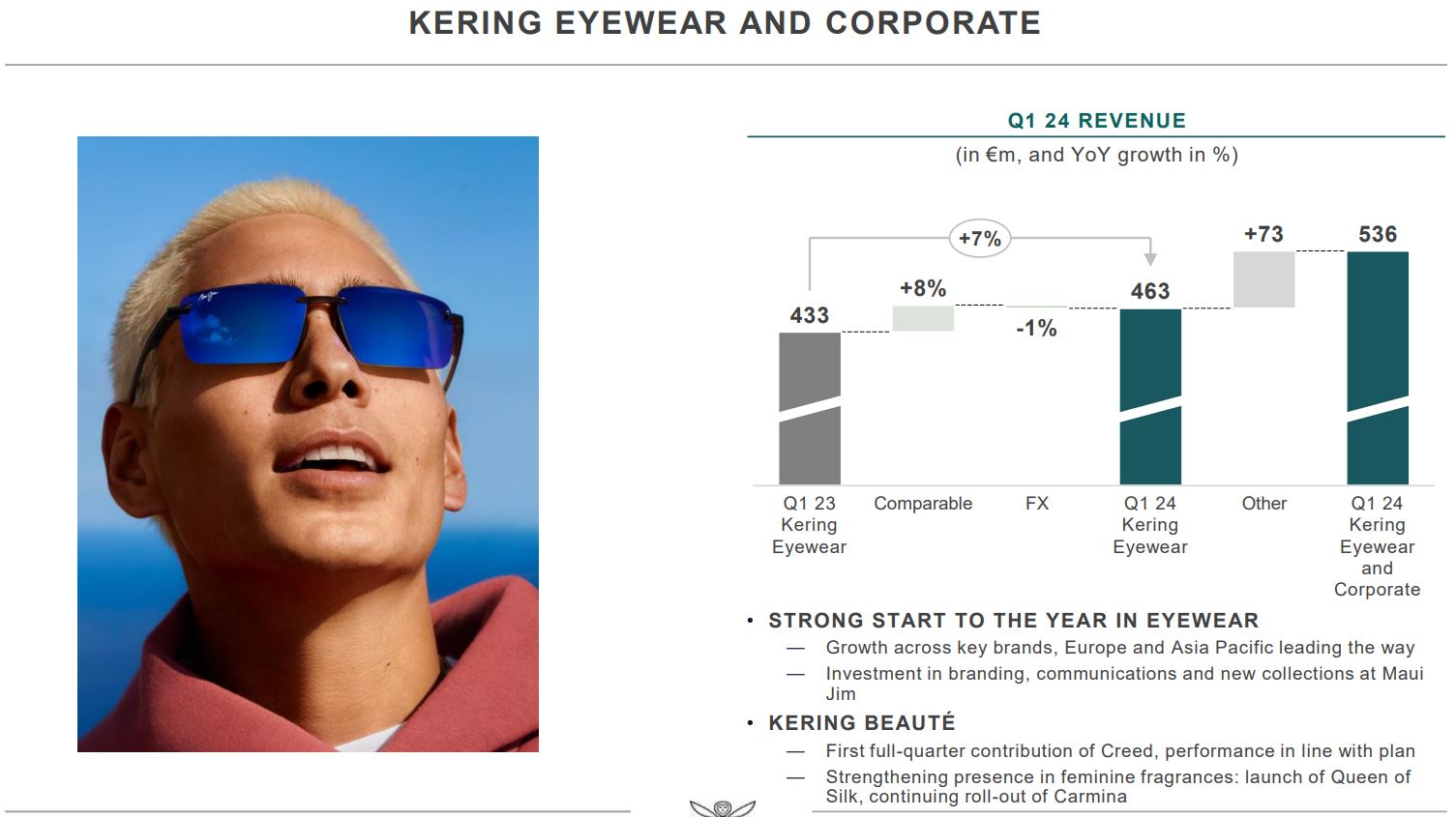

6 Kering Share Slump After First Quarter Earnings Miss

May 24, 2025

6 Kering Share Slump After First Quarter Earnings Miss

May 24, 2025 -

Bbc Radio 1 Big Weekend 2024 Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Latest Posts

-

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025

Philips Annual General Meeting Of Shareholders Key Highlights

May 24, 2025 -

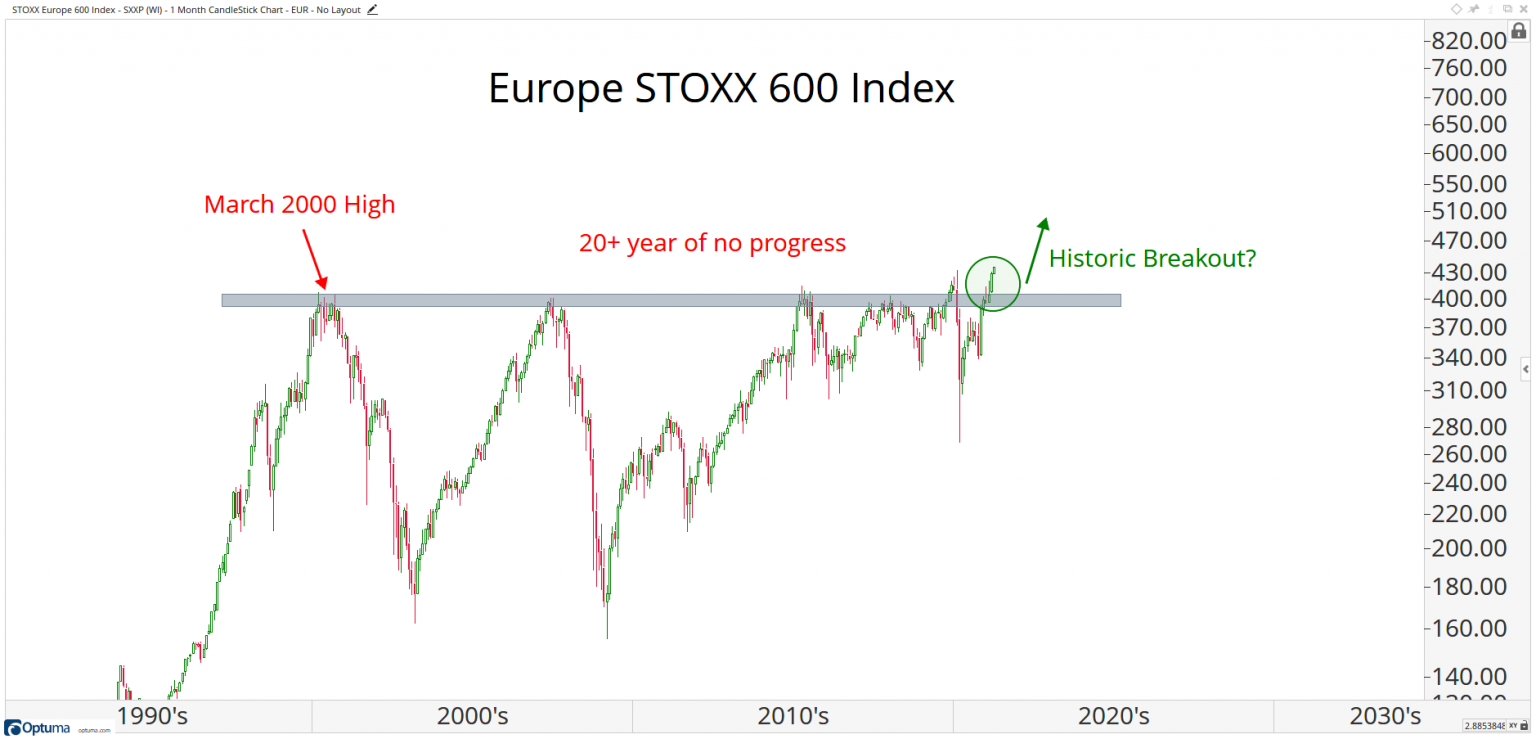

Voorspelling Zal De Snelle Markt Draai Bij Europese Aandelen Aanhouden

May 24, 2025

Voorspelling Zal De Snelle Markt Draai Bij Europese Aandelen Aanhouden

May 24, 2025 -

Analyse Snelle Markt Draai Europese Aandelen Toekomstige Richting

May 24, 2025

Analyse Snelle Markt Draai Europese Aandelen Toekomstige Richting

May 24, 2025 -

Vervolg Snelle Marktbeweging Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025

Vervolg Snelle Marktbeweging Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Snelle Markt Draai

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Snelle Markt Draai

May 24, 2025