6% Kering Share Slump After First Quarter Earnings Miss

Table of Contents

Analyzing the Q1 Earnings Miss: Key Factors Behind the Kering Stock Decline

The Kering share slump wasn't a sudden event; it was the culmination of several interconnected factors impacting the company's financial performance.

Underperformance of Key Brands

Gucci, traditionally Kering's flagship brand and a major driver of revenue, experienced a slowdown in sales growth during the first quarter. This underperformance, coupled with weaker-than-expected results from other key brands, significantly impacted overall earnings.

- Gucci Sales Slowdown: Reports indicate a [insert specific percentage]% decrease in Gucci's sales compared to the same period last year, falling short of analyst projections by [insert specific percentage]%. This can be attributed to several factors, including:

- Changing Consumer Preferences: A shift in consumer tastes away from Gucci's signature styles.

- Increased Competition: Intensified competition from other luxury brands.

- Supply Chain Disruptions: Lingering effects of global supply chain issues impacting production and distribution.

- Other Brand Underperformance: [Insert names of other underperforming brands] also reported weaker-than-expected sales, contributing to the overall decline in Kering's Q1 performance. Specific data points, including sales figures and percentage changes, should be included here (if available from publicly released data).

Impact of Global Economic Uncertainty

The current global economic climate, characterized by high inflation, rising interest rates, and concerns about a potential recession, significantly impacted consumer spending on luxury goods. This macroeconomic headwind undeniably contributed to the Kering share slump.

- Reduced Consumer Confidence: Uncertainty about the future led to decreased consumer confidence and a reduction in discretionary spending, including purchases of luxury items.

- Geopolitical Instability: Ongoing geopolitical tensions and conflicts further dampened consumer sentiment and impacted global market stability.

- Luxury Market Slowdown: Reports suggest a general slowdown in the luxury goods market, indicating that Kering's challenges are not entirely unique but reflect broader industry trends.

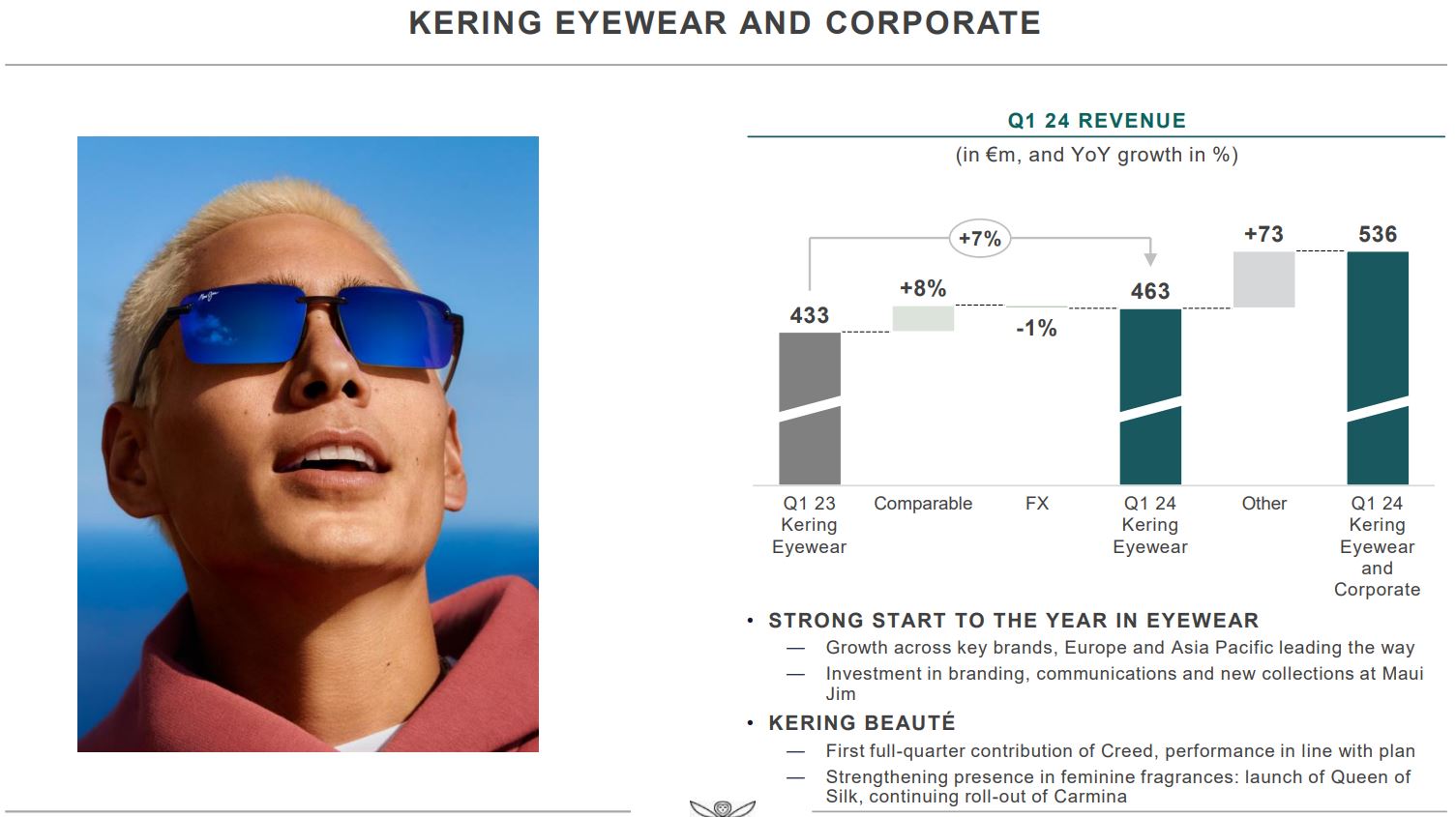

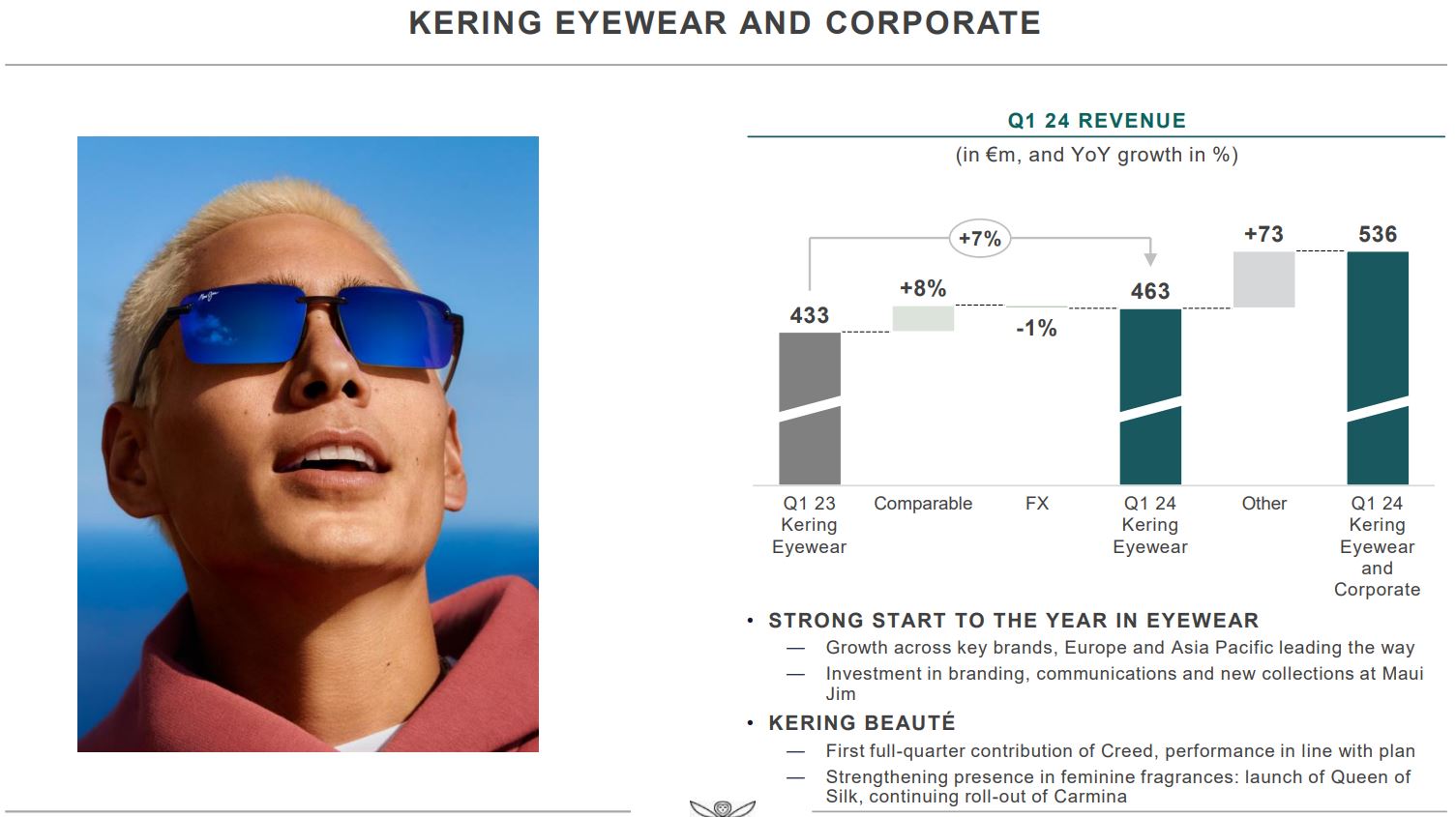

Currency Fluctuations and Their Effect on Kering's Financials

Fluctuations in currency exchange rates also played a role in impacting Kering's reported earnings. The strength or weakness of the Euro against other major currencies like the US dollar directly affects the company's financial statements.

- Euro Strength/Weakness: [Insert details on the Euro's performance against relevant currencies during Q1 and its impact on Kering's revenue and profits]. For example: A stronger Euro might have negatively impacted sales reported in other currencies.

- Hedging Strategies: Kering likely employs various hedging strategies to mitigate currency risks. However, the effectiveness of these strategies can vary depending on market conditions. The level of success or failure of these strategies should be assessed if information is publicly available.

Investor Reaction and Market Sentiment Following the Kering Share Price Drop

The Kering share price drop triggered a swift and significant reaction from investors.

Immediate Market Response

Following the earnings announcement, investors reacted swiftly, leading to a sell-off in Kering shares.

- Sharp Decline: The 6% drop represented a significant immediate market response to the disappointing results.

- Increased Trading Volume: Trading volume likely increased substantially as investors adjusted their positions in Kering stock.

- Analyst Comments: Analysts responded with cautious commentary, expressing concerns about the company's near-term outlook. Include quotes from relevant analysts if available.

Long-Term Implications for Kering's Stock Price

The long-term implications of the Q1 earnings miss remain uncertain. Several factors will determine whether the Kering share price recovers or continues its downward trend.

- Recovery Strategies: The success of Kering's planned strategies to address the underlying issues will be crucial for a share price recovery.

- Market Conditions: The overall performance of the luxury goods market and the broader global economic environment will heavily influence future share price movements.

- Investor Confidence: Rebuilding investor confidence will be essential for attracting new investment and driving share price appreciation.

Looking Ahead: Kering's Strategies to Recover and Future Outlook

Kering's management has outlined strategies to address the challenges and improve future performance.

Management's Response and Future Plans

Kering's management has likely responded to the disappointing Q1 results with a plan to improve. This might involve changes in product strategy, marketing campaigns, or cost-cutting measures. Specific details of these plans should be included here if available through press releases or company statements.

- Strategic Initiatives: [Detail any specific initiatives like product launches, new marketing campaigns, or restructuring plans].

- Cost-Cutting Measures: [Discuss any planned cost-cutting measures to improve profitability].

- Focus on Key Brands: [Mention plans to improve performance at underperforming brands].

Analyst Predictions and Future Price Targets for Kering Shares

Analyst predictions for Kering's future share price vary widely. Some might predict a recovery while others remain more cautious.

- Range of Predictions: [Include a summary of various analyst predictions, mentioning the range of price targets and the reasoning behind them].

- Consensus Estimates: [Mention if there's a consensus estimate for future share price movements].

- Underlying Assumptions: [Highlight the key assumptions underlying various analyst predictions].

Conclusion: The Kering Share Slump - What's Next for Investors?

The 6% Kering share slump reflects a confluence of factors including underperforming key brands, particularly Gucci, the impact of global economic uncertainty, and the influence of currency fluctuations. While Kering's management has outlined strategies for recovery, the success of these plans and the overall health of the luxury goods market will significantly influence future share price movements. Stay tuned for further analysis on the Kering share price and how this slump might impact the luxury goods market. Monitor the Kering share price closely to make informed investment decisions.

Featured Posts

-

Ai Stuwt Relx Groei Door Economische Onzekerheid Heen

May 24, 2025

Ai Stuwt Relx Groei Door Economische Onzekerheid Heen

May 24, 2025 -

Us To Eliminate Penny Circulation By Early 2026 What You Need To Know

May 24, 2025

Us To Eliminate Penny Circulation By Early 2026 What You Need To Know

May 24, 2025 -

Bbc Radio 1 Big Weekend Confirmed Acts Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1 Big Weekend Confirmed Acts Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph While Texting

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph While Texting

May 24, 2025 -

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025

Dazi Ue Borse In Caduta Minacce Di Reazioni Senza Limiti

May 24, 2025

Latest Posts

-

Analyzing Ramaphosas White House Encounter Could He Have Handled It Differently

May 24, 2025

Analyzing Ramaphosas White House Encounter Could He Have Handled It Differently

May 24, 2025 -

Newark Airports Flight Disruptions A Legacy Of A Flawed Air Traffic Control Strategy

May 24, 2025

Newark Airports Flight Disruptions A Legacy Of A Flawed Air Traffic Control Strategy

May 24, 2025 -

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 24, 2025

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 24, 2025 -

Trumps Private Warning Putin Unready To End War Say European Officials

May 24, 2025

Trumps Private Warning Putin Unready To End War Say European Officials

May 24, 2025 -

Stock Market Reaction Analyzing Todays Bond Sell Off Dow Movement And Bitcoin Surge

May 24, 2025

Stock Market Reaction Analyzing Todays Bond Sell Off Dow Movement And Bitcoin Surge

May 24, 2025