Is HMRC Owed You Money? Check Your Payslip Today

Table of Contents

Understanding Your Payslip: Key Areas to Examine

Understanding your payslip is crucial for managing your finances and ensuring you're not paying more tax than necessary. Familiarising yourself with the terminology and key sections will empower you to identify potential errors or unclaimed benefits. Learning how to check your payslip for a tax refund is a valuable skill.

Deciphering Tax Codes

Your tax code is a vital piece of information on your payslip. It determines how much Income Tax is deducted from your earnings. An incorrect tax code can lead to significant overpayment over time.

- Common Tax Code Issues: Incorrect codes can result from changes in circumstances (marriage, job change, etc.) or administrative errors. For example, an incorrect code might deduct tax at a higher rate than you should be paying.

- Impact of Incorrect Tax Codes: Overpayments can accumulate over months or even years, leading to substantial sums owed back to you by HMRC.

- Correcting an Incorrect Tax Code: If you suspect an error, contact HMRC immediately to provide the necessary information for correction. They can adjust your tax code and process a refund for any overpayments.

Identifying Tax Deductions

Your payslip clearly shows your gross pay (your earnings before deductions) and net pay (your earnings after deductions). Pay close attention to the following deductions:

- Income Tax: This is the tax levied on your earnings.

- National Insurance Contributions (NICs): This is a social insurance contribution.

[Insert image here: Sample payslip with Income Tax, NICs, and Net Pay clearly highlighted]

Spotting inconsistencies, unusually high deductions, or deductions for items you're unsure about are crucial indicators that warrant further investigation.

Checking for Tax Reliefs and Allowances

Numerous tax reliefs and allowances can reduce your tax bill. It's essential to verify that these are correctly applied on your payslip.

- Marriage Allowance: If you're married or in a civil partnership, you might be eligible to transfer a portion of your personal allowance to your spouse.

- Childcare Vouchers: If you utilize childcare vouchers, ensure the correct deductions and reliefs are reflected.

- Other Allowances: Other allowances could include those for working from home expenses or gifts to charity. Always check the specifics for your situation.

Common Reasons for HMRC Owing You Money

Several factors could result in HMRC owing you money. Let's explore some common reasons:

Incorrect Tax Code

As discussed earlier, an incorrect tax code is a primary reason for overpayment. Even a seemingly small error can lead to substantial overpayments over time.

- Real-life Examples: Many taxpayers have received thousands of pounds back from HMRC due to an incorrect tax code.

- HMRC Resources: For further information and to verify your tax code, visit the official HMRC website.

Unclaimed Tax Reliefs

Many eligible taxpayers overlook valuable tax reliefs. These can significantly reduce your tax liability and result in a considerable refund.

- Common Tax Reliefs: Marriage allowance, working from home expenses, gift aid, and others.

- Eligibility Criteria: Each relief has specific eligibility criteria. Check the HMRC website for details on each allowance.

Overpayment of Tax

Several scenarios can lead to tax overpayment:

- Change in Employment Status: Moving from full-time to part-time employment, or self-employment, can cause overpayment if not handled correctly.

- Incorrect Tax Return: Errors in your self-assessment tax return can result in overpayment.

- Accurate Record Keeping: Maintaining accurate records of your income and expenses is vital to prevent overpayment.

How to Claim a Tax Refund from HMRC

Claiming your refund is a straightforward process. Follow these steps:

Gathering Necessary Documents

You will need these documents to support your claim:

- Payslips: These show your earnings and tax deductions.

- P60: This is your end-of-year tax statement.

- P45: This form is issued when you leave a job.

These documents are usually accessible through your employer or online accounts.

Submitting Your Claim

You can usually submit your claim online through the HMRC website or via post.

- Online Claim: The HMRC website provides a user-friendly interface for online claims.

- Postal Claim: If you prefer, you can submit a claim via post, using the relevant forms available from the HMRC website.

- Processing Times: HMRC outlines the typical processing times on their website.

Tracking Your Claim

After submitting your claim, you can check its status online. HMRC's website provides tools to track your claim's progress.

Is HMRC Owed You Money? Take Action Today!

Regularly checking your payslip is crucial to ensure you are receiving all the tax relief you're entitled to and avoid overpaying tax. Understanding your payslip, identifying potential overpayments, and knowing how to claim a refund are essential skills. Don't wait! Check your payslip today and see if HMRC owes you money. Start your claim now! Visit the official HMRC website for more information and to begin your claim: [Insert HMRC website link here].

Featured Posts

-

Analyzing Emerging Business Hubs A Nationwide Perspective

May 20, 2025

Analyzing Emerging Business Hubs A Nationwide Perspective

May 20, 2025 -

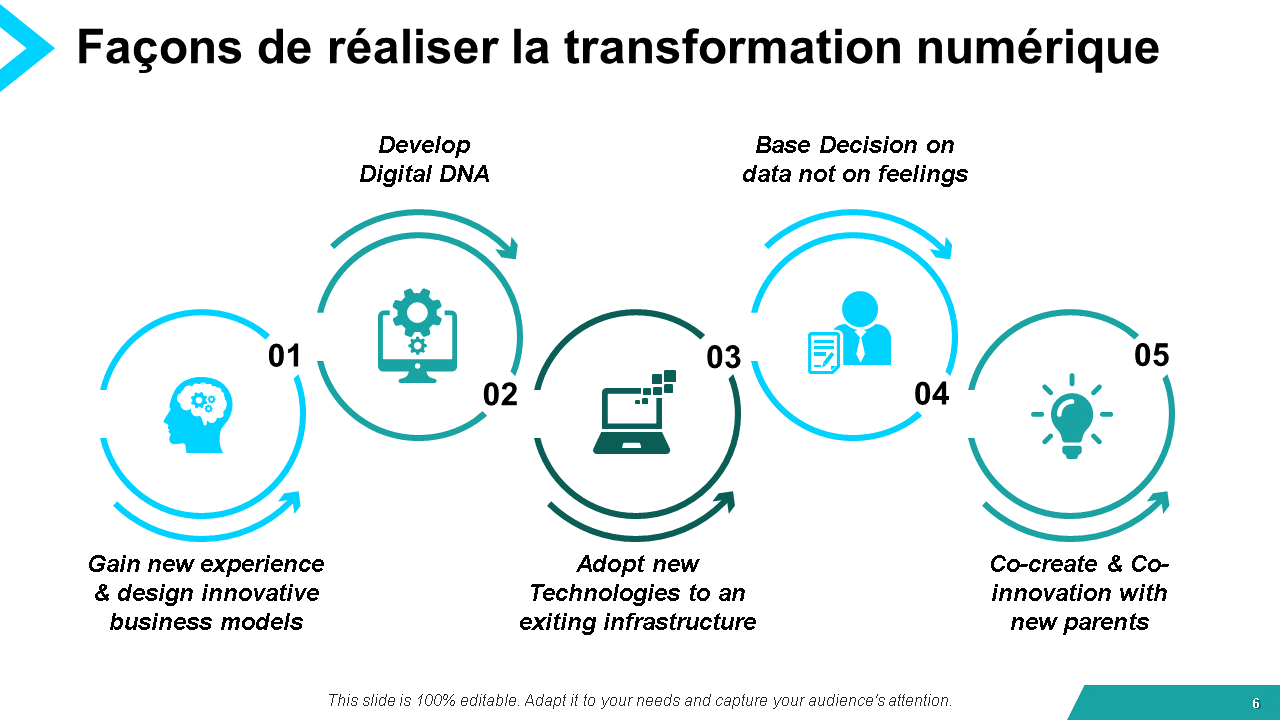

Ivoire Tech Forum 2025 La Transformation Numerique En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 La Transformation Numerique En Cote D Ivoire

May 20, 2025 -

Ivoire Tech Forum 2025 Les Innovations Technologiques Au C Ur De La Transformation Numerique

May 20, 2025

Ivoire Tech Forum 2025 Les Innovations Technologiques Au C Ur De La Transformation Numerique

May 20, 2025 -

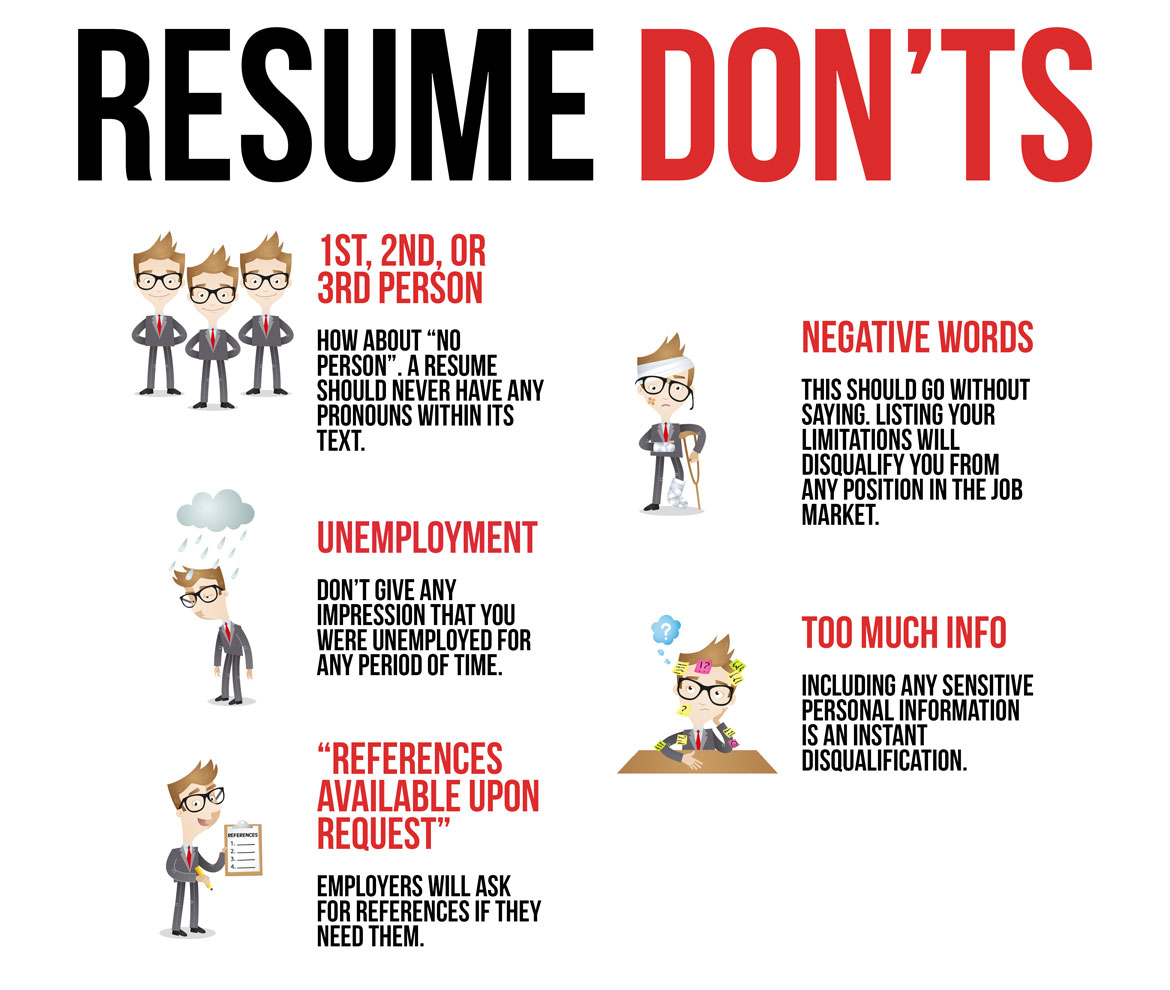

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

May 20, 2025

Crack The Code 5 Dos And Don Ts To Secure A Private Credit Role

May 20, 2025 -

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025

Latest Posts

-

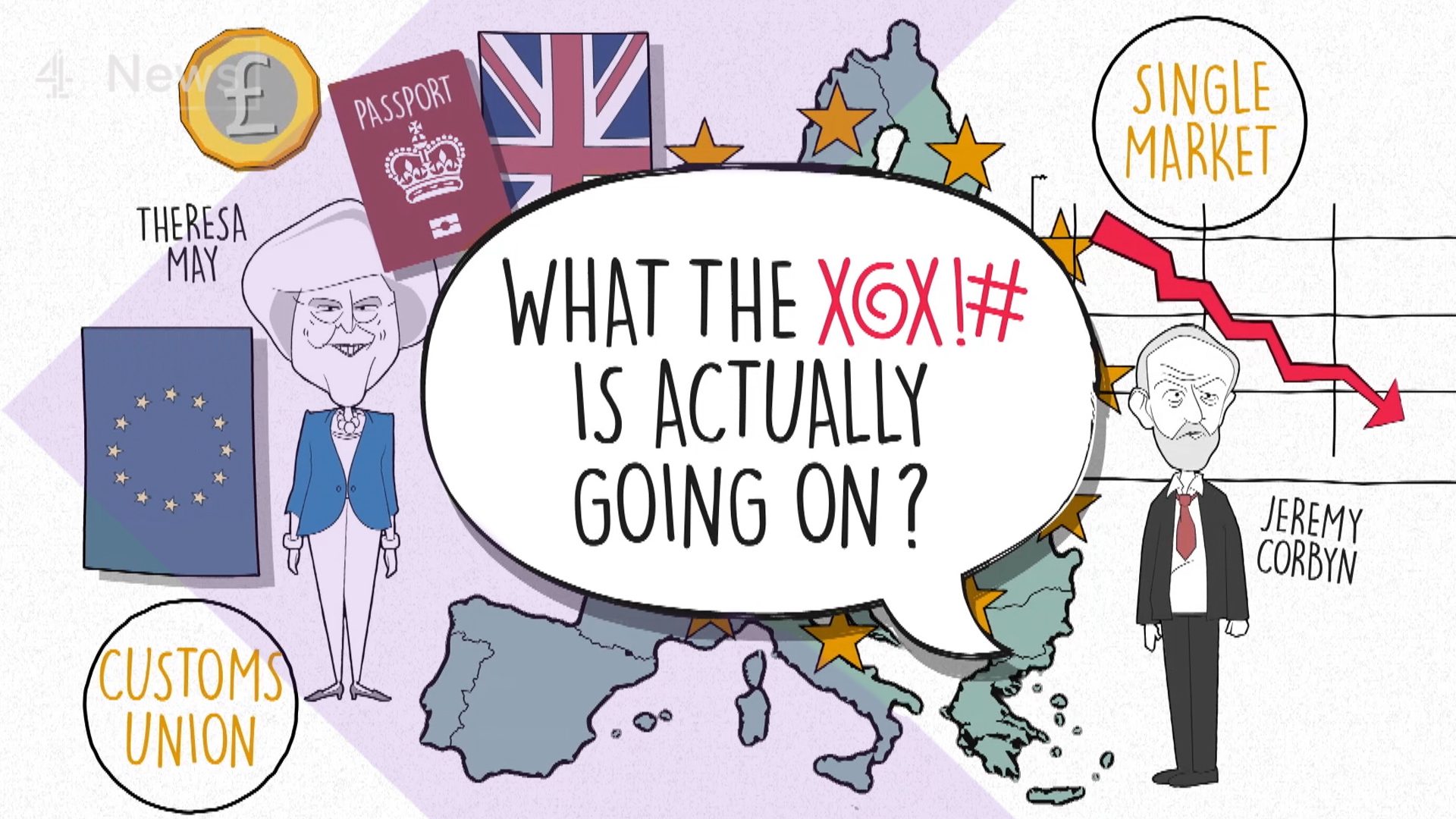

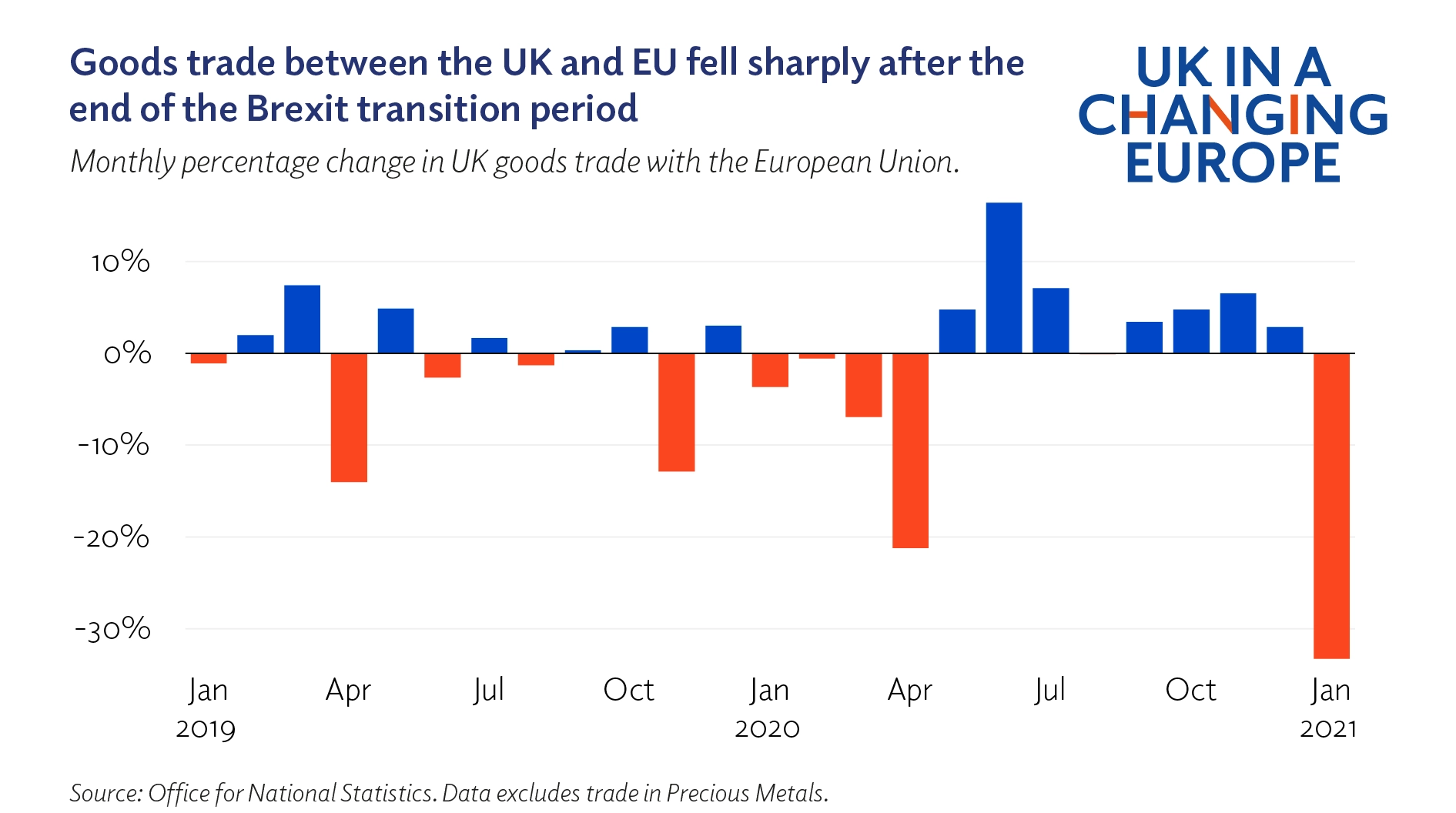

Uk Luxury Industry Brexits Negative Effect On Eu Trade

May 20, 2025

Uk Luxury Industry Brexits Negative Effect On Eu Trade

May 20, 2025 -

The Impact Of Brexit On Uk Luxury Exports To The European Union

May 20, 2025

The Impact Of Brexit On Uk Luxury Exports To The European Union

May 20, 2025 -

Brexit And The Uk Luxury Goods Sector An Export Analysis

May 20, 2025

Brexit And The Uk Luxury Goods Sector An Export Analysis

May 20, 2025 -

Bof As Analysis Why Current Stock Market Valuations Shouldnt Deter Investors

May 20, 2025

Bof As Analysis Why Current Stock Market Valuations Shouldnt Deter Investors

May 20, 2025 -

Stock Market Valuation Concerns Bof As Analysis And Investor Guidance

May 20, 2025

Stock Market Valuation Concerns Bof As Analysis And Investor Guidance

May 20, 2025