Is Gambling On Natural Disasters The New Normal? The Case Of The Los Angeles Wildfires

Table of Contents

The Mechanics of Disaster-Related Gambling

The seemingly straightforward act of buying home insurance is, in a way, a form of gambling. You're betting that a disaster won't strike, while the insurance company bets the opposite. This risk assessment forms the foundation of a complex financial ecosystem built around natural disasters.

Insurance and Reinsurance Markets

Traditional insurance functions as a form of risk transfer. Insurers pool premiums from numerous policyholders to compensate those who experience losses. Reinsurance companies, in turn, insure the insurers, protecting them against catastrophic events that could bankrupt them. This creates a layered system of financial risk management.

- Examples of Wildfire Insurance Products: Homeowners insurance, commercial property insurance, agricultural insurance.

- Risk Assessment and Premium Setting: Insurers use historical data, predictive modeling, and location-specific risk assessments to determine premiums. Areas with a higher risk of wildfires generally command higher premiums.

- Limitations of Traditional Insurance: Traditional insurance struggles to handle truly catastrophic events like widespread wildfires, which can overwhelm even the largest insurance pools. This is where the speculative aspect becomes more pronounced.

Predictive Modeling and Data Analysis

Sophisticated data analysis and predictive modeling are becoming increasingly crucial in assessing wildfire risk. These models incorporate various data sources to forecast the likelihood and severity of wildfires.

- Data Sources: Weather patterns (temperature, humidity, wind speed), historical wildfire data, vegetation maps, fuel load assessments, proximity to populated areas.

- Limitations of Predictive Models: These models are not perfect. Unforeseen weather patterns, human intervention, and the inherent complexity of wildfires can lead to inaccurate predictions.

- Technology's Role: Technology, while improving risk assessment, can also exacerbate the problem. Climate change models predict more frequent and severe wildfires, influencing investment strategies and potentially increasing the stakes of this "disaster gamble."

Speculative Investment in Disaster Relief

Beyond traditional insurance, some investment strategies directly profit from disaster relief efforts. This raises significant ethical concerns.

- Examples of Investments: Investments in disaster relief companies (e.g., construction, cleanup), infrastructure projects funded by disaster relief aid, and even catastrophe bonds that pay out based on the severity of a disaster.

- Ethical Implications: Profiting from human suffering is ethically problematic, sparking debates about responsible investing and corporate social responsibility.

- Potential Regulatory Responses: Governments are grappling with how to regulate such investments, potentially by introducing stricter ethical guidelines and transparency requirements.

The Los Angeles Wildfires as a Case Study

The economic impact of the Los Angeles wildfires offers a clear case study of disaster-related gambling.

Economic Impact of Wildfires

The financial toll of wildfires in Los Angeles is staggering. Billions of dollars are lost annually in property damage, business interruption, and lost productivity.

- Statistics on Losses: Detailed statistics on property damage, business interruption, and insurance payouts vary depending on the specific wildfire event, but the figures consistently reach into the billions.

- Impact on Local Economy and Employment: Wildfires cause job losses in affected sectors (tourism, construction), increasing economic hardship.

- Role of Climate Change: The increasing frequency and severity of wildfires are linked to climate change, further exacerbating the economic consequences and fueling investment in disaster preparedness (and, conversely, in profit-seeking activities related to disaster recovery).

Insurance Claims and Market Responses

The escalating wildfire risk in Los Angeles has prompted significant changes in the insurance market.

- Changes in Premiums and Policy Availability: Insurers are raising premiums and in some cases, limiting or refusing to offer policies in high-risk areas.

- Impact on Insurance Industry Profitability: The increased claims payouts associated with the wildfires put pressure on insurers' profitability, potentially leading to higher premiums or reduced coverage.

- Regulatory Changes and Industry Responses: State and federal regulators are reviewing insurance practices, and the industry is investing in risk mitigation strategies and technological solutions.

Public Perception and Social Implications

Public perception of disaster-related gambling is mixed. While many understand the need for insurance, the idea of profiting directly from disaster relief is deeply controversial.

- Ethical Dilemmas: The ethical dilemma centers on the tension between risk management and the potential for exploitation.

- Public Discourse and Policy Debates: Public discourse is increasingly focused on the need for responsible investment practices, ethical considerations, and governmental regulations.

- Potential for Social Unrest or Inequality: The disproportionate impact of wildfires on vulnerable populations highlights the potential for increased social inequality, further complicating the issue.

Conclusion

The increasing frequency and severity of natural disasters, exemplified by the Los Angeles wildfires, have highlighted a troubling trend: the normalization of "gambling on natural disasters." This involves a complex interplay of insurance markets, predictive modeling, and speculative investment, raising significant ethical and societal concerns. The economic impact of these disasters is vast, influencing insurance premiums, industry responses, and even public policy. The potential for profit from human suffering demands careful consideration and responsible action.

We must move beyond simply reacting to disasters and proactively address the underlying causes, including climate change. By researching responsible investment options, supporting organizations focused on climate change mitigation and wildfire prevention, and advocating for ethical regulations in disaster-related finance, we can work towards a future where disaster risk assessment is guided by a commitment to societal well-being, not profit maximization. The future of disaster-related finance hinges on our collective commitment to prevent the normalization of "gambling on natural disasters" and instead prioritize human safety and sustainable practices.

Featured Posts

-

All Star Weekend Herros 3 Pointer Triumph And Cavs Skills Challenge Domination

Apr 24, 2025

All Star Weekend Herros 3 Pointer Triumph And Cavs Skills Challenge Domination

Apr 24, 2025 -

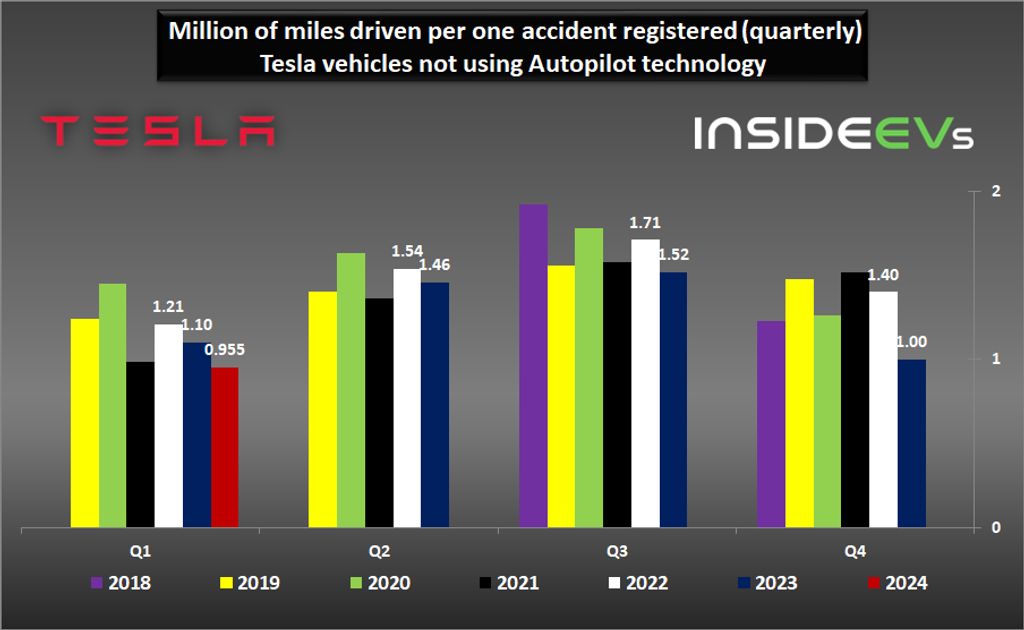

Tesla Q1 2024 Lower Profits And The Musk Administration Connection

Apr 24, 2025

Tesla Q1 2024 Lower Profits And The Musk Administration Connection

Apr 24, 2025 -

High Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025

High Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse Spoilers And Survival Chances

Apr 24, 2025

The Bold And The Beautiful Liams Collapse Spoilers And Survival Chances

Apr 24, 2025 -

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025

Teslas Reduced Q1 Profitability Analysis Of The Musk Factor

Apr 24, 2025