High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Arguments for Maintaining a Calm Stance

BofA's optimistic stance on high stock market valuations isn't based on blind faith. Their analysis rests on several key pillars, which we will examine below.

Strong Corporate Earnings and Profitability

One of BofA's core arguments centers around the strength of current corporate earnings and profitability. They point to robust financial performance across various sectors, suggesting that current market valuations, while high, are underpinned by solid fundamentals.

- Examples of strong performing sectors: Technology, healthcare, and consumer staples have demonstrated remarkable resilience and growth, contributing significantly to overall market performance.

- Projected future earnings: BofA's analysts project continued earnings growth in many sectors, indicating a sustained trajectory of profitability that justifies, at least partially, the current high stock valuation ratios.

- Comparison to previous economic cycles: While acknowledging the elevated levels, BofA's analysis suggests that current stock market valuations, when compared to similar points in previous economic cycles, are not unprecedentedly high, indicating potential for further growth. This perspective relies on examining historical data and comparing current market multiples to past market peaks.

These strong corporate earnings contribute significantly to mitigating concerns surrounding high stock market valuations.

Low Interest Rates and Monetary Policy

Low interest rates play a crucial role in BofA's optimistic outlook. The current monetary policy environment, characterized by historically low interest rates and quantitative easing measures, has stimulated investment and fueled higher valuations.

- Impact of monetary policy: Easy monetary policy makes borrowing cheaper for companies, encouraging investment and expansion, leading to stronger earnings and higher stock prices. This effect is a key component of BofA's analysis of current high stock market valuations.

- Potential future interest rate changes: While interest rates are expected to rise gradually, BofA anticipates that the increase will be managed carefully to avoid jeopardizing economic growth and triggering a market downturn.

- Influence on investment decisions: The low-interest-rate environment continues to influence investment decisions, encouraging investors to seek higher returns in the stock market, thereby supporting higher valuations despite concerns about overvaluation. This pushes investors toward riskier assets like equities.

Therefore, the current monetary policy landscape is an important factor in how BofA views the current market valuations.

Technological Innovation and Long-Term Growth Potential

BofA highlights the significant impact of technological innovation on long-term growth prospects. This dynamic, they argue, justifies higher valuations compared to previous economic cycles.

- Examples of innovative sectors driving growth: The rapid advancement in artificial intelligence, biotechnology, and renewable energy are cited as significant drivers of future economic growth, contributing to higher market valuations.

- Discussion of potential future disruptions and their effects on valuations: BofA acknowledges the disruptive potential of new technologies, but argues that this disruption primarily leads to creative destruction, replacing less efficient players, and ultimately stimulating long-term growth.

- Future growth potential: The continuous innovation and the immense potential for growth in these sectors contribute to the long-term outlook for positive market performance despite current high stock market valuations.

This long-term perspective helps contextualize the current high valuations within a broader narrative of technological advancement and sustained economic growth.

Addressing Concerns about Overvaluation

BofA acknowledges the concerns about overvaluation, addressing them using a range of valuation metrics. They don't dismiss the high valuations but offer counterarguments.

- Discussion of valuation metrics used by BofA (e.g., P/E ratio, Shiller P/E): BofA uses multiple valuation metrics, including the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller P/E), to assess market valuation. They examine these metrics in relation to both current and historical data.

- Comparison to historical data: BofA's analysts compare current valuation multiples to historical data, demonstrating that while high, they are not necessarily unprecedented or indicative of an imminent crash. This historical perspective is a key component of their analysis.

- Justification for current levels: They justify the current levels by referencing the factors discussed above: robust earnings, low interest rates, and the potential for continued growth fueled by technological innovation.

By acknowledging and then addressing common concerns about overvaluation, BofA presents a balanced and well-reasoned perspective.

Conclusion: Navigating High Stock Market Valuations with Confidence

In summary, BofA's relatively calm stance on high stock market valuations is supported by several key factors: strong corporate earnings and profitability, the influence of low interest rates and accommodative monetary policy, and the transformative potential of technological innovation driving long-term growth. While acknowledging the inherent risks and uncertainties in any market, particularly one with high stock market valuations, BofA’s analysis suggests that these factors mitigate some of the concerns surrounding overvaluation. However, it’s crucial to remember that the market is always subject to fluctuations, and unforeseen events can impact valuations.

While navigating these high stock market valuations, consider BofA's analysis as a valuable perspective. Remember to conduct your own research and develop a well-informed investment strategy that aligns with your risk tolerance. Understanding the different factors impacting stock market valuations, including the nuances of evaluating high valuations, is critical for informed decision-making.

Featured Posts

-

Market Reaction To Trumps Statement On Keeping Powell As Fed Chair

Apr 24, 2025

Market Reaction To Trumps Statement On Keeping Powell As Fed Chair

Apr 24, 2025 -

Understanding The Liberal Party Platform A Voters Guide

Apr 24, 2025

Understanding The Liberal Party Platform A Voters Guide

Apr 24, 2025 -

Chinas Energy Strategy Middle Eastern Lpg As A Us Tariff Alternative

Apr 24, 2025

Chinas Energy Strategy Middle Eastern Lpg As A Us Tariff Alternative

Apr 24, 2025 -

Bitcoin Climbs Amidst Trumps Trade And Fed Policy Moves

Apr 24, 2025

Bitcoin Climbs Amidst Trumps Trade And Fed Policy Moves

Apr 24, 2025 -

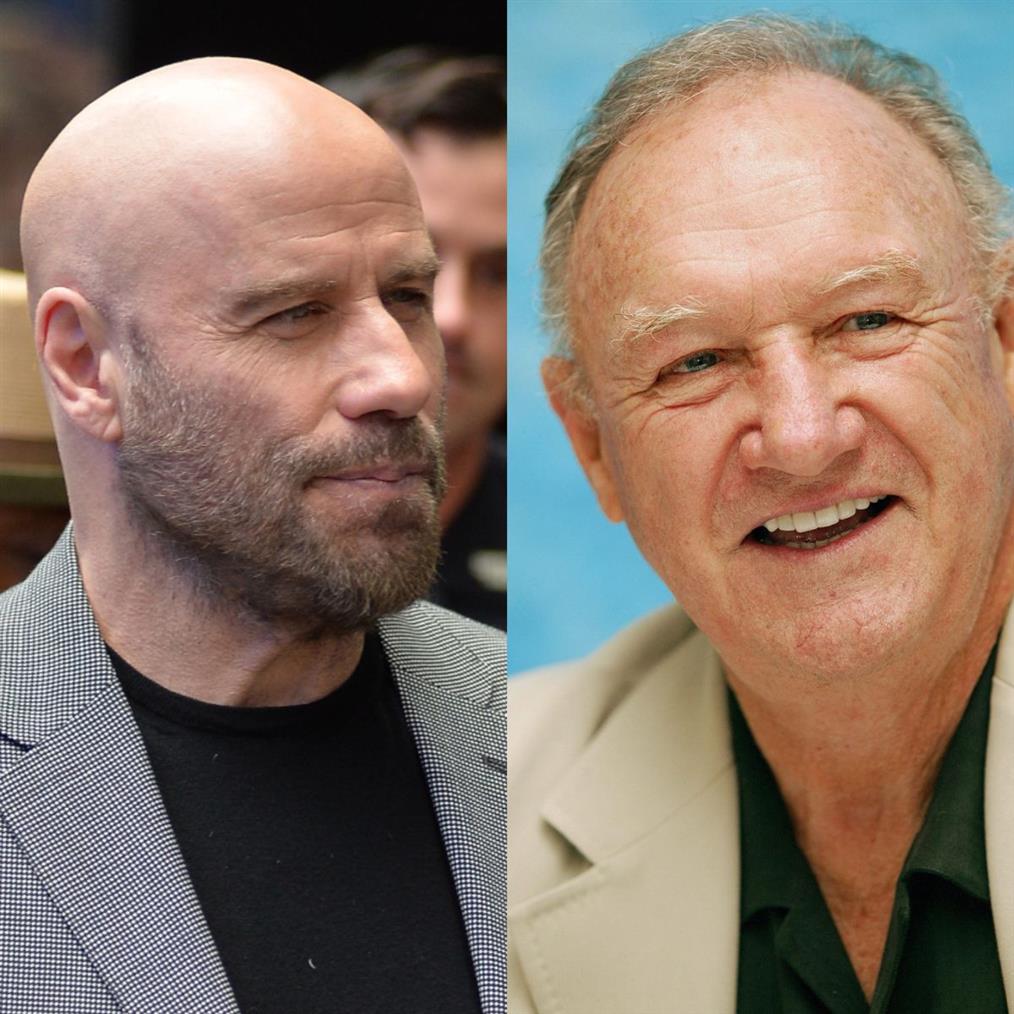

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025