Is A Live Nation Breakup Inevitable? The Pressure Builds

Table of Contents

1. Background:

Live Nation Entertainment is a global leader in the live entertainment industry. Its business model integrates ticketing (primarily through Ticketmaster), venue ownership and operation, and artist management services. This vertical integration, while providing synergies, has also attracted intense criticism and regulatory scrutiny. The possibility of a Live Nation breakup is a topic of intense debate, given the implications for artists, consumers, and the industry at large.

2. Main Points:

H2: Antitrust Concerns and Regulatory Scrutiny

H3: Monopoly Power in Ticketing

Live Nation's dominance in the ticketing market, largely through its subsidiary Ticketmaster, is a major source of concern. Ticketmaster controls a significant portion of ticket sales for major concerts and events, giving Live Nation immense leverage over artists and consumers. This monopoly power has resulted in numerous controversies regarding exorbitant fees, opaque pricing structures, and allegations of anti-competitive practices. Lawsuits and ongoing investigations by regulatory bodies like the Department of Justice highlight the gravity of these concerns.

- The impact on artists includes limited bargaining power regarding ticket pricing and distribution.

- Consumers face inflated prices, hidden fees, and a lack of transparency in the ticketing process.

- Ongoing investigations could lead to significant fines and potentially a mandated breakup of Live Nation.

Keyword Integration: "Live Nation monopoly," "Ticketmaster antitrust," "Live Nation regulatory scrutiny"

H2: Financial Performance and Investor Sentiment

H3: Profitability and Debt

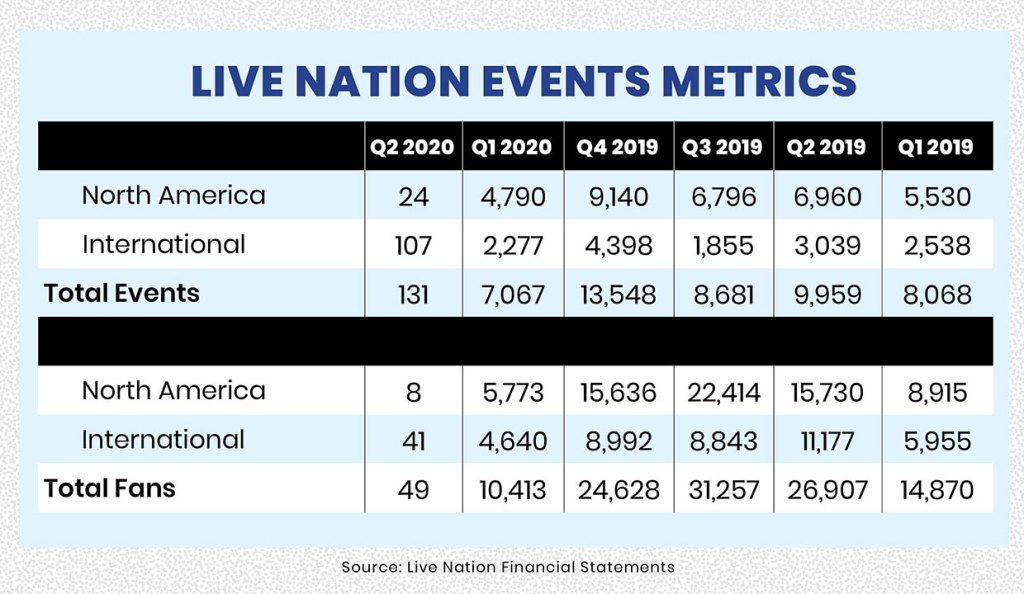

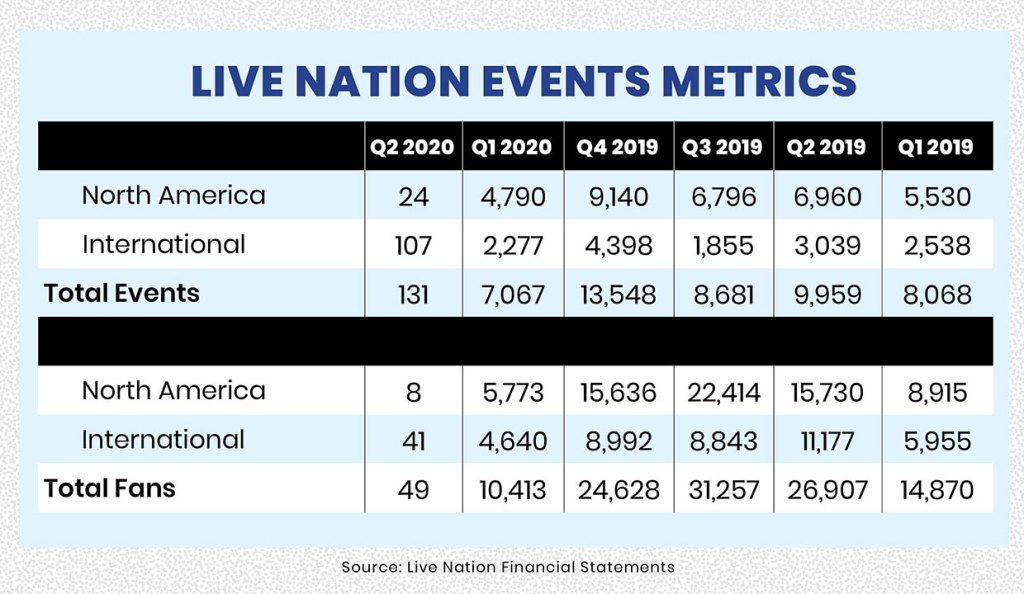

While Live Nation generally reports strong revenue, its financial health is a complex picture. High debt levels, coupled with economic downturns and industry-specific challenges (like the pandemic’s impact), can impact profitability and investor confidence. Fluctuations in Live Nation stock price reflect the market's apprehension regarding the company's long-term sustainability and the potential for regulatory intervention.

- High debt levels increase financial vulnerability and limit strategic flexibility.

- Economic downturns can significantly affect concert attendance and revenue streams.

- Negative investor sentiment could lead to a decline in Live Nation's stock value and increased pressure for change.

Keyword Integration: "Live Nation stock," "Live Nation financial performance," "Live Nation debt"

H2: Artist and Consumer Backlash

H3: Growing Criticism and Public Opinion

The growing discontent among artists and consumers is a significant factor in the debate surrounding a potential Live Nation breakup. Artists complain about unfavorable contract terms, limited control over ticket pricing, and a lack of transparency. Consumers express frustration with high ticket prices, excessive fees, and the overall concert-going experience. Negative social media campaigns and boycotts further amplify this backlash.

- High-profile artist complaints and boycotts garner significant media attention and public support.

- Negative public opinion and social media sentiment erode Live Nation's brand reputation.

- Consumer advocacy groups are actively pushing for regulatory reform and greater transparency.

Keyword Integration: "Live Nation boycott," "Live Nation artist relations," "Live Nation consumer complaints"

H2: Potential Scenarios for a Live Nation Breakup

H3: Regulatory-Driven Split: Antitrust lawsuits or regulatory intervention could force a divestiture of Ticketmaster or other divisions, effectively breaking up Live Nation.

H3: Strategic Divestment: Live Nation might proactively divest certain business units to address antitrust concerns and improve its public image, avoiding a more forceful breakup.

H3: Acquisition or Merger: A competitor might acquire Live Nation or a significant portion of its assets, leading to a restructuring of the live music industry.

Each scenario carries significant consequences for the live music industry, impacting artists, consumers, and the competitive landscape.

3. Conclusion:

The pressures facing Live Nation are undeniable. Antitrust concerns, financial vulnerabilities, and significant artist and consumer backlash all contribute to the possibility of a Live Nation breakup. While a forced breakup through regulatory action remains a significant threat, a strategic divestment or even acquisition are also plausible outcomes. Whether a Live Nation breakup occurs remains uncertain, but the current trajectory suggests that significant change is likely. Share your thoughts: Do you think a Live Nation breakup is likely? Let us know your predictions in the comments below! #LiveNationBreakup #TicketmasterMonopoly #LiveMusicIndustry

Featured Posts

-

Louisiana Horror Film Sinners Coming Soon To Theaters

May 29, 2025

Louisiana Horror Film Sinners Coming Soon To Theaters

May 29, 2025 -

Six Year Old Girl South African Mothers Kidnapping And Sale Conviction

May 29, 2025

Six Year Old Girl South African Mothers Kidnapping And Sale Conviction

May 29, 2025 -

Realtors Home And Garden Show Returns To State Fair Park

May 29, 2025

Realtors Home And Garden Show Returns To State Fair Park

May 29, 2025 -

Finding The Perfect Fit Nike Air Max 95 Og Big Bubble Hm 8755 001 Sizing Guide

May 29, 2025

Finding The Perfect Fit Nike Air Max 95 Og Big Bubble Hm 8755 001 Sizing Guide

May 29, 2025 -

Oslo Brann Nyhetsvarsel For Fire Odelagte Bater

May 29, 2025

Oslo Brann Nyhetsvarsel For Fire Odelagte Bater

May 29, 2025

Latest Posts

-

Attend The Virtual Investor Conference May 15 2025 International Company Presentations

May 30, 2025

Attend The Virtual Investor Conference May 15 2025 International Company Presentations

May 30, 2025 -

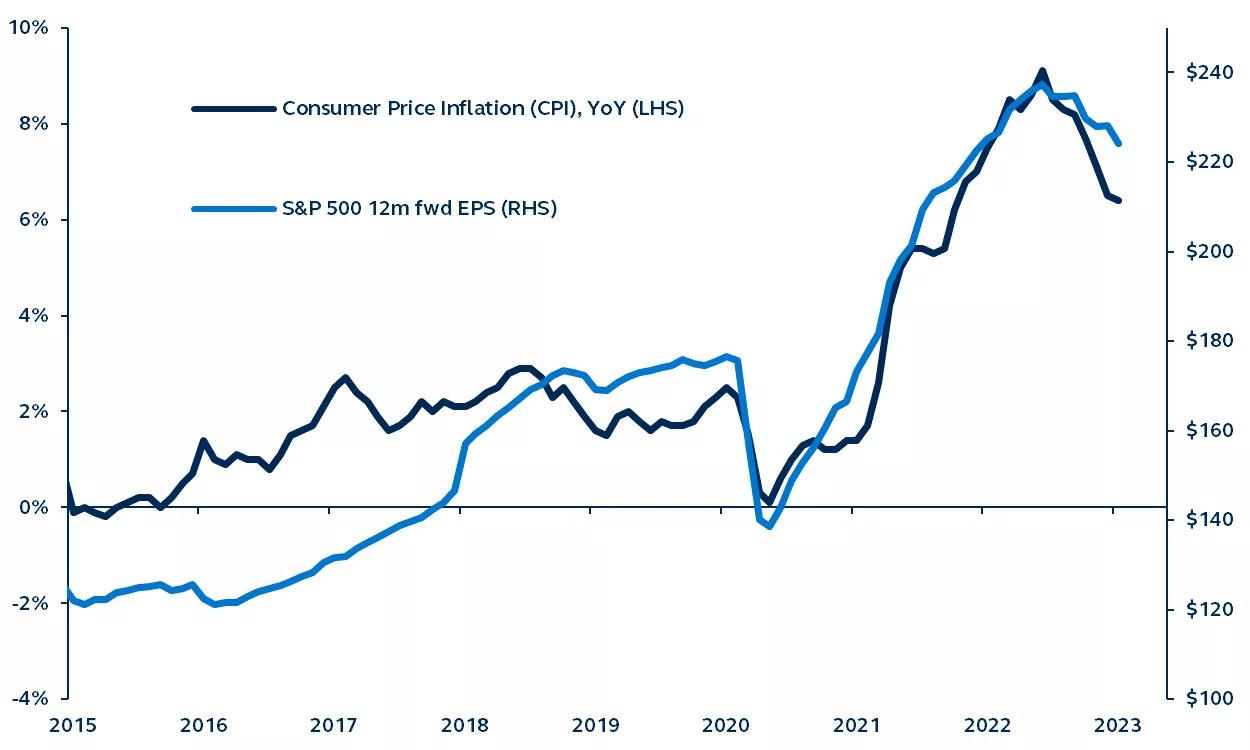

Corporate Earnings Strong Now But Will The Trend Continue

May 30, 2025

Corporate Earnings Strong Now But Will The Trend Continue

May 30, 2025 -

Live Webcast Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025

Live Webcast Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025 -

Deutsche Bank Executives Meet With Finance Minister To Discuss Economic Issues

May 30, 2025

Deutsche Bank Executives Meet With Finance Minister To Discuss Economic Issues

May 30, 2025 -

Virtual Investor Conference Key International Companies Participating May 15 2025

May 30, 2025

Virtual Investor Conference Key International Companies Participating May 15 2025

May 30, 2025