Corporate Earnings: Strong Now, But Will The Trend Continue?

Table of Contents

H2: Current State of Corporate Earnings

Recent quarters have witnessed exceptionally strong corporate earnings performance. Many companies have reported significant increases in profits, exceeding even the most optimistic predictions. This robust growth is a positive sign for the overall economy, but understanding its underlying drivers is crucial to assess its sustainability.

H3: Key Sectors Driving Growth

Several key sectors have been instrumental in driving this surge in corporate earnings.

- Technology: The technology sector continues to lead the charge, with companies like Apple and Microsoft reporting record revenues fueled by strong demand for software, cloud services, and hardware. This growth is driven by ongoing digital transformation across industries and the increasing reliance on technology solutions.

- Apple's Q2 earnings exceeded expectations, driven by strong iPhone sales and growth in services.

- Microsoft's cloud computing division, Azure, experienced significant growth, contributing substantially to overall earnings.

- Energy: The energy sector has seen a dramatic resurgence, boosted by elevated oil and gas prices. Companies focused on renewable energy are also experiencing growth as the world transitions towards cleaner energy sources.

- ExxonMobil and Chevron have reported significant increases in profits due to higher energy prices.

- Growth in renewable energy is driven by increasing government investment and consumer demand for sustainable energy solutions.

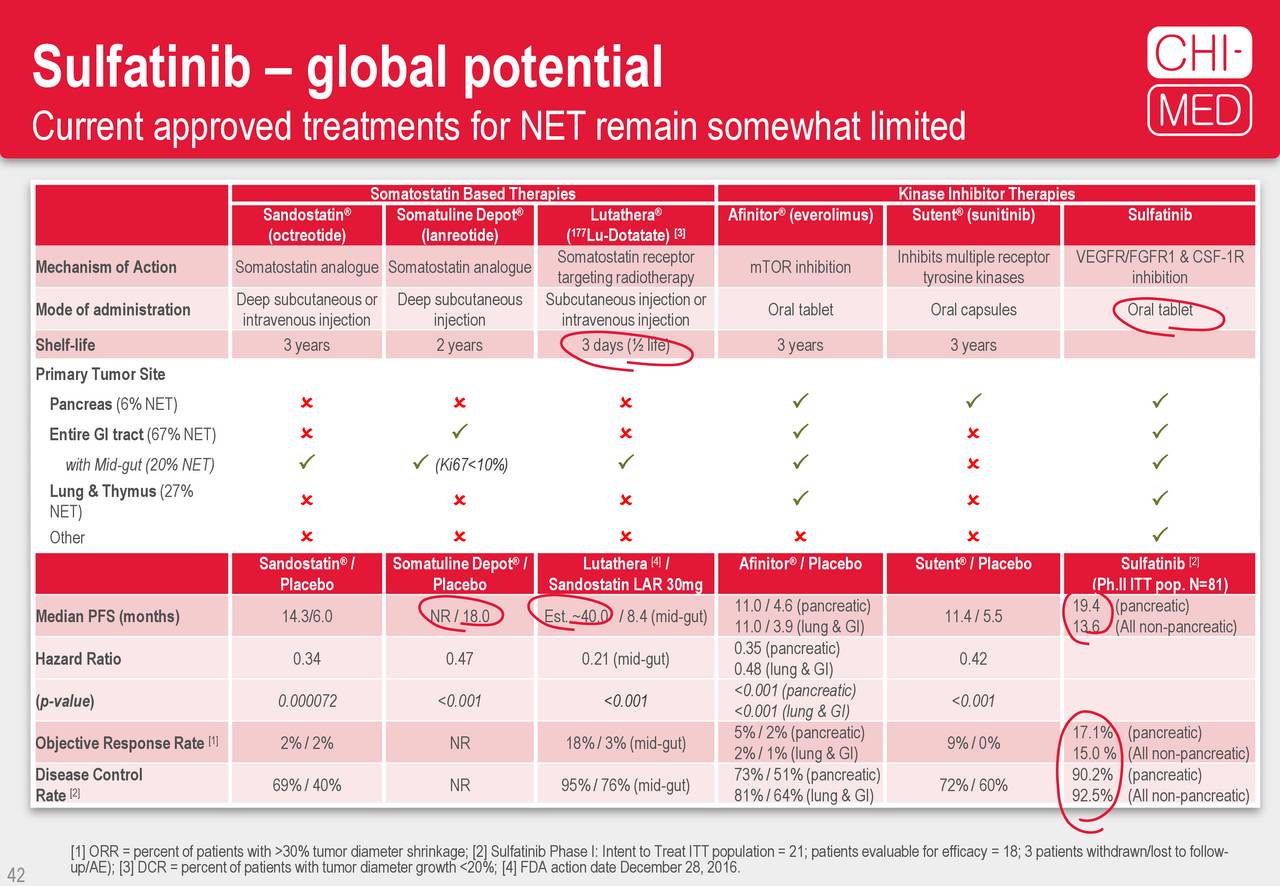

- Healthcare: The healthcare sector has consistently shown resilience, with strong earnings driven by increasing demand for healthcare services and innovative pharmaceutical products.

- Pharmaceutical companies have benefited from the launch of new drugs and therapies.

- Medical device companies have seen strong sales due to increasing healthcare spending.

H3: Factors Contributing to Strong Earnings

Several factors have contributed to this impressive performance in corporate earnings:

- Low Unemployment and Strong Consumer Spending: A robust labor market with low unemployment has led to higher consumer spending, driving demand for goods and services.

- Supply Chain Improvements: Easing supply chain disruptions have reduced production costs and allowed companies to meet increasing demand more effectively.

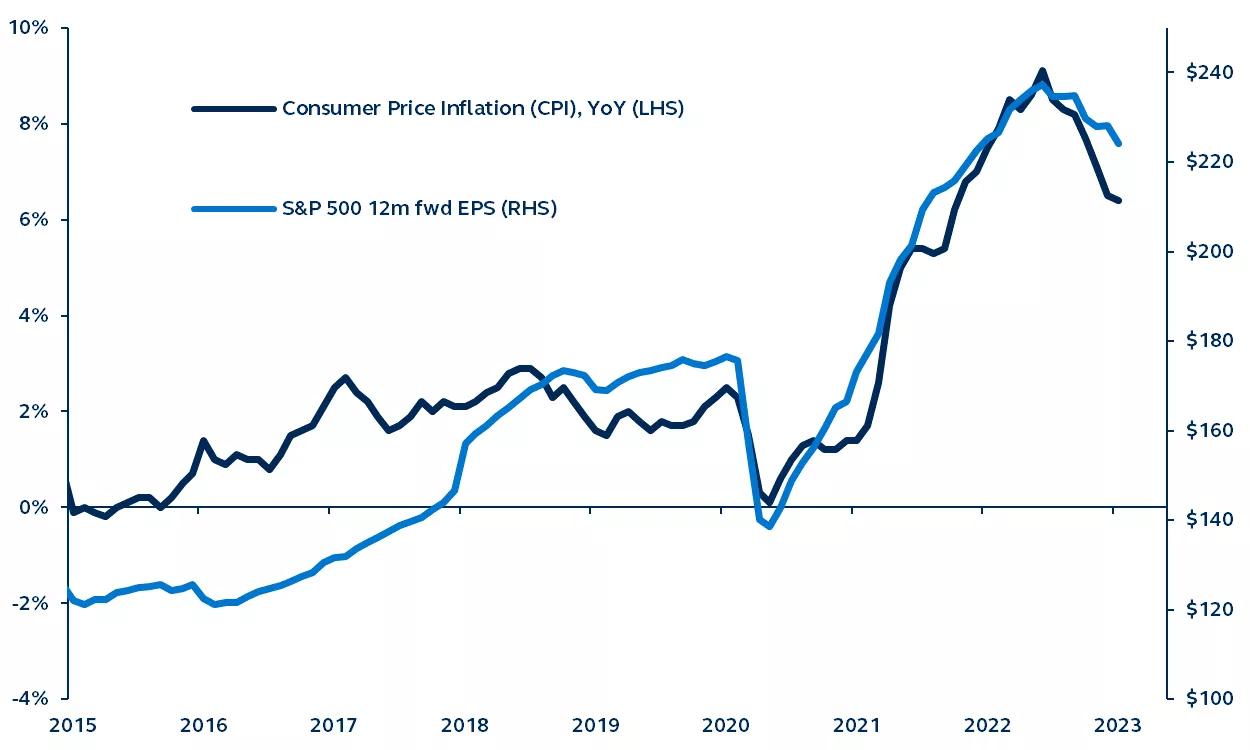

- Reduced Inflation (relatively): While inflation remains a concern, it has shown signs of easing in some areas, relieving pressure on corporate profit margins.

- Efficient Cost Management and Increased Productivity: Many companies have implemented cost-cutting measures and increased productivity, boosting profitability.

H2: Potential Headwinds and Risks

Despite the current strength, several potential headwinds could significantly impact future corporate earnings growth.

H3: Economic Slowdown

The possibility of a recession or significant economic slowdown looms large. Rising interest rates, persistent inflation, and geopolitical instability are all contributing to this risk.

- Rising interest rates increase borrowing costs for businesses, potentially hindering investment and expansion.

- High inflation erodes consumer purchasing power, dampening demand for goods and services.

- Geopolitical uncertainty can disrupt supply chains and negatively impact business confidence.

H3: Geopolitical Uncertainty

Global conflicts and political instability pose significant risks to corporate earnings. These events can lead to supply chain disruptions, increased costs, and reduced consumer confidence.

- The ongoing war in Ukraine has already caused significant disruptions to global energy markets and supply chains.

- Trade tensions between major economies could further impact corporate profitability.

H3: Inflationary Pressures

Persistent inflationary pressures remain a significant threat to corporate earnings. Even with some easing, rising prices can squeeze profit margins and impact consumer spending.

- Rising wages can increase labor costs, reducing profitability.

- Higher energy and raw material prices can also increase production costs.

H2: Long-Term Outlook for Corporate Earnings

Predicting the future of corporate earnings is inherently challenging, but several factors suggest a mixed outlook.

H3: Analyst Predictions and Forecasts

Financial analysts offer diverse predictions regarding future corporate earnings growth. Some forecast continued, albeit moderated, growth, while others anticipate a more significant slowdown or even a decline. A range of scenarios must be considered.

- Many analysts predict a moderation of earnings growth in the coming quarters.

- Some forecast a potential decline in earnings due to economic slowdown and geopolitical risks.

H3: Strategies for Navigating Uncertainty

Companies need to implement strategies to mitigate the risks and maintain profitability in an uncertain environment:

- Diversification: Expanding into new markets and product lines can reduce reliance on any single market or product.

- Cost-Cutting Measures: Streamlining operations and reducing unnecessary expenses can improve profitability.

- Technological Innovation: Investing in technology can improve efficiency and create new revenue streams.

3. Conclusion

While Q2 2024 showcased remarkably strong corporate earnings, the long-term outlook remains uncertain. The current strength is fueled by several positive factors, but potential headwinds like economic slowdown, geopolitical risks, and persistent inflationary pressures pose significant challenges. Understanding these complexities is crucial for investors and business leaders alike. Stay informed on the latest developments and continue your research on the future of corporate earnings to make well-informed decisions about investment strategies and business planning. Analyzing corporate earnings reports and market trends is vital for navigating the evolving economic landscape. Keep a close eye on key indicators related to corporate profits and earnings growth to make sound financial and business decisions.

Featured Posts

-

Rising Temperatures Rising Deaths 311 Fatalities In Englands Heatwave

May 30, 2025

Rising Temperatures Rising Deaths 311 Fatalities In Englands Heatwave

May 30, 2025 -

May 15 2025 Deutsche Bank Depositary Receipts Virtual Investor Conference Webcast Schedule

May 30, 2025

May 15 2025 Deutsche Bank Depositary Receipts Virtual Investor Conference Webcast Schedule

May 30, 2025 -

Proces Rn En Appel Decision Attendue En 2026 Reaction De Laurent Jacobelli

May 30, 2025

Proces Rn En Appel Decision Attendue En 2026 Reaction De Laurent Jacobelli

May 30, 2025 -

Transferbombe Dolberg Pa Vej Til London

May 30, 2025

Transferbombe Dolberg Pa Vej Til London

May 30, 2025 -

Understanding San Diego Airport Flight Delays Causes And Solutions

May 30, 2025

Understanding San Diego Airport Flight Delays Causes And Solutions

May 30, 2025