Is $2,000 The Next Stop For Ethereum's Price? Resistance Now Broken.

Table of Contents

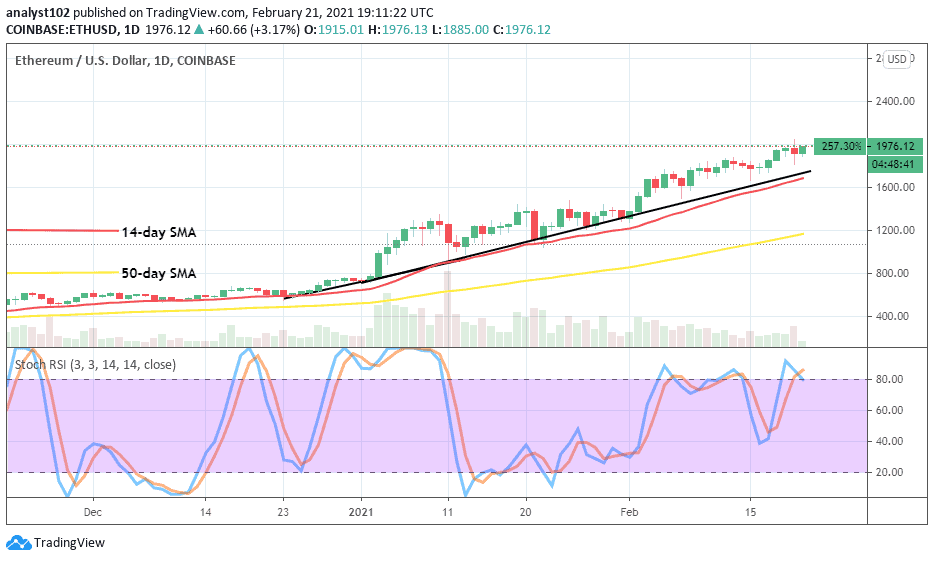

Technical Analysis: Signs Pointing Towards $2,000

Breaking Key Resistance Levels

Ethereum's recent price action has been nothing short of remarkable. The cryptocurrency has decisively broken through several key resistance levels, suggesting a strong bullish momentum. This breakthrough isn't just a minor price increase; it's a significant shift in the market's perception of Ethereum's value.

- Resistance Levels Broken: The recent surge saw Ethereum break through the psychological $1,700 barrier, followed by a further push past the $1,800 level. These were significant resistance points that had previously capped price increases.

- Chart Patterns: The price action displayed a classic "cup and handle" pattern on several timeframes, a bullish signal indicating a potential breakout. The volume accompanying these breakouts further confirms the strength of the move.

- [Insert relevant chart/graph showing price action and resistance levels here]

Positive RSI and MACD Indicators

Technical indicators are also painting a bullish picture. The Relative Strength Index (RSI) has moved above the 70 level, indicating overbought conditions but also suggesting sustained buying pressure. The Moving Average Convergence Divergence (MACD) is showing a clear bullish crossover, further reinforcing the upward trend.

- RSI Readings: RSI consistently above 70 for several days points to strong bullish momentum.

- MACD Signal: A clear bullish MACD crossover signals a potential shift from bearish to bullish sentiment.

- Correlation with Price: The positive readings in both RSI and MACD align perfectly with the recent price surge, strengthening the bullish outlook.

Support Levels and Potential Pullbacks

While the momentum is undeniably bullish, it's crucial to consider potential pullbacks. Identifying support levels is key to assessing the sustainability of the uptrend and the likelihood of reaching $2,000.

- Key Support Levels: The $1,700 and $1,600 levels represent potential support areas. A dip to these levels could provide a buying opportunity for investors.

- Pullback Scenarios: A minor pullback to retest these support levels is not uncommon during a bull run. Such a correction could be healthy for the market, consolidating gains before another leg upward.

- Impact on $2000 Target: A healthy pullback to a support level would likely be followed by another upward push, increasing the probability of reaching the $2,000 target.

Fundamental Factors Fueling Ethereum's Growth

Increased DeFi Activity and Adoption

The explosive growth of decentralized finance (DeFi) is a major driver of Ethereum's value. Ethereum remains the dominant platform for DeFi applications, attracting billions of dollars in Total Value Locked (TVL).

- TVL Statistics: The total value locked in DeFi protocols on Ethereum continues to hit record highs, demonstrating the platform's utility and attractiveness to users.

- Growth of DeFi Platforms: Leading DeFi platforms like Uniswap, Aave, and Compound continue to experience significant growth, driving demand for ETH.

- New DeFi Projects: The constant emergence of innovative DeFi projects further fuels the ecosystem's growth, attracting new investors and developers to the Ethereum network.

Ethereum 2.0 Development and Upgrades

The ongoing development of Ethereum 2.0 is a significant catalyst for long-term growth. The transition to a proof-of-stake consensus mechanism will improve scalability, security, and energy efficiency.

- Key Milestones Achieved: The successful implementation of key phases in the Ethereum 2.0 roadmap demonstrates the network's progress.

- Anticipated Improvements: Ethereum 2.0 promises significantly increased transaction speeds and reduced transaction fees, making the network more accessible and user-friendly.

- Impact on Price: The anticipated upgrades contribute to the long-term bullish outlook for Ethereum, making it an attractive investment for both short-term and long-term investors.

Institutional Investment and Adoption

Increasing interest from institutional investors is another positive factor influencing Ethereum's price. Larger firms are recognizing the potential of Ethereum and are starting to allocate significant capital to the cryptocurrency.

- Examples of Institutional Investments: Several prominent investment firms and hedge funds have publicly declared their holdings in Ethereum.

- Impact of Institutional Adoption: Institutional investment brings greater stability and liquidity to the market, potentially mitigating the effects of market volatility.

- Price Stability and Growth: Increased institutional involvement contributes to long-term price stability and potentially more sustainable growth.

Market Sentiment and External Factors

Overall Crypto Market Sentiment

The overall sentiment in the cryptocurrency market plays a significant role in Ethereum's price. A positive overall sentiment, often driven by Bitcoin's price action, can fuel further gains in Ethereum.

- Bitcoin's Price Action: A bullish trend in Bitcoin often creates a positive ripple effect across the entire cryptocurrency market, boosting Ethereum's price as well.

- General Investor Confidence: Overall investor confidence in the cryptocurrency market is crucial for sustained growth in Ethereum.

- Impact of Regulatory News: Positive regulatory developments or announcements can significantly impact the overall sentiment and the price of cryptocurrencies.

Potential Risks and Challenges

While the outlook for Ethereum is generally positive, several factors could hinder its price movement. It's essential to acknowledge these potential challenges.

- Regulatory Uncertainty: Regulatory uncertainty around cryptocurrencies in various jurisdictions remains a significant risk factor.

- Competition from Other Blockchain Platforms: Competition from other blockchain platforms vying for market share could present a challenge to Ethereum's dominance.

- Potential Market Corrections: Like any asset class, cryptocurrencies are susceptible to market corrections and periods of volatility.

Analyst Predictions and Forecasts

Many cryptocurrency analysts have issued bullish predictions for Ethereum's price, with some suggesting that $2,000 is a realistic target in the near future.

- Specific Price Targets: Numerous analysts have put forward price targets ranging from $1,900 to $2,200 for Ethereum in the coming months.

- Timeframes: Timeframes for reaching these targets vary depending on the analyst and their methodology.

- Reasoning behind Predictions: The reasoning behind these predictions is largely based on the technical analysis, fundamental factors, and market sentiment discussed above.

Conclusion

Reaching $2,000 for Ethereum is not guaranteed, but the confluence of factors discussed—strong technical indicators, fundamental growth drivers, and positive market sentiment—suggests a strong potential. While potential risks exist, the bullish momentum and long-term prospects for Ethereum appear promising.

Call to Action: While reaching $2,000 for Ethereum is not guaranteed, the confluence of factors discussed suggests a strong potential. Continue monitoring the Ethereum price, stay informed about relevant news, and make your own informed decisions regarding investment in Ethereum. Is $2,000 the next stop for Ethereum's price? Only time will tell, but the signs are certainly promising. Stay updated on the latest developments in the Ethereum market to capitalize on potential opportunities.

Featured Posts

-

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025 -

Xrp Etf Approval Predicting Initial Investment Flows Of 800 Million

May 08, 2025

Xrp Etf Approval Predicting Initial Investment Flows Of 800 Million

May 08, 2025 -

Liga De Quito Vs Flamengo Analisis Del Partido De La Libertadores Grupo C Fecha 3

May 08, 2025

Liga De Quito Vs Flamengo Analisis Del Partido De La Libertadores Grupo C Fecha 3

May 08, 2025 -

Xrp Price Prediction Analyzing The Impact Of Grayscales Etf Bid

May 08, 2025

Xrp Price Prediction Analyzing The Impact Of Grayscales Etf Bid

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career A 98 Txt Retrospective

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career A 98 Txt Retrospective

May 08, 2025