XRP ETF Approval: Predicting Initial Investment Flows Of $800 Million

Table of Contents

Factors Influencing the Predicted $800 Million Investment

Several key factors contribute to the prediction of an $800 million initial investment flow into an XRP ETF upon its approval. These factors encompass both institutional and retail investor behavior, as well as XRP's unique position in the cryptocurrency landscape.

Institutional Investor Interest

Increased regulatory clarity surrounding crypto assets is a major catalyst. Hedge funds and pension funds, traditionally hesitant due to regulatory uncertainty and operational complexities, may finally see XRP as a viable asset class. ETFs offer a regulated and accessible entry point, simplifying investment processes and mitigating risks associated with direct cryptocurrency purchases.

- Examples of large institutional investors: Several large asset management firms have already expressed interest in cryptocurrencies, and the launch of an XRP ETF could be the trigger for substantial allocations. BlackRock's involvement in other crypto ETF applications shows a growing institutional appetite.

- Existing interest in other crypto ETFs: The success of Bitcoin and Ethereum ETFs demonstrates the strong demand for regulated crypto exposure from institutional investors. This precedent suggests a high likelihood of similar interest in an XRP ETF.

Retail Investor Demand

ETFs dramatically lower the barrier to entry for retail investors. Individuals who may have been intimidated by the technicalities of direct crypto trading can now participate easily and with perceived reduced risk. The simplicity and perceived security of ETFs are powerful attractors.

- Statistics on retail investor interest in crypto ETFs: Data shows a significant increase in retail investor participation in other crypto ETFs, reflecting a broader trend of increased retail interest in the cryptocurrency market.

- Comparison with other successful crypto ETFs: The successful launches of other crypto ETFs have demonstrated the substantial retail demand that can follow regulatory approval. An XRP ETF could replicate and surpass this success given XRP's unique features.

XRP's Unique Position in the Market

XRP's use case as a payment solution and its potential for widespread adoption are key factors. Its speed, low transaction fees, and scalability differentiate it from many other cryptocurrencies. Its established relationship with Ripple, a leading financial technology company, adds further credibility.

- Key features of XRP: Speed, low cost, scalability, and energy efficiency are significant advantages that attract investors.

- Comparison to other cryptocurrencies: Compared to Bitcoin or Ethereum, XRP's focus on payments and its established network provide a distinct appeal to investors seeking utility and potential real-world applications.

- Potential partnerships: Future partnerships with financial institutions could drive increased adoption and investment in XRP.

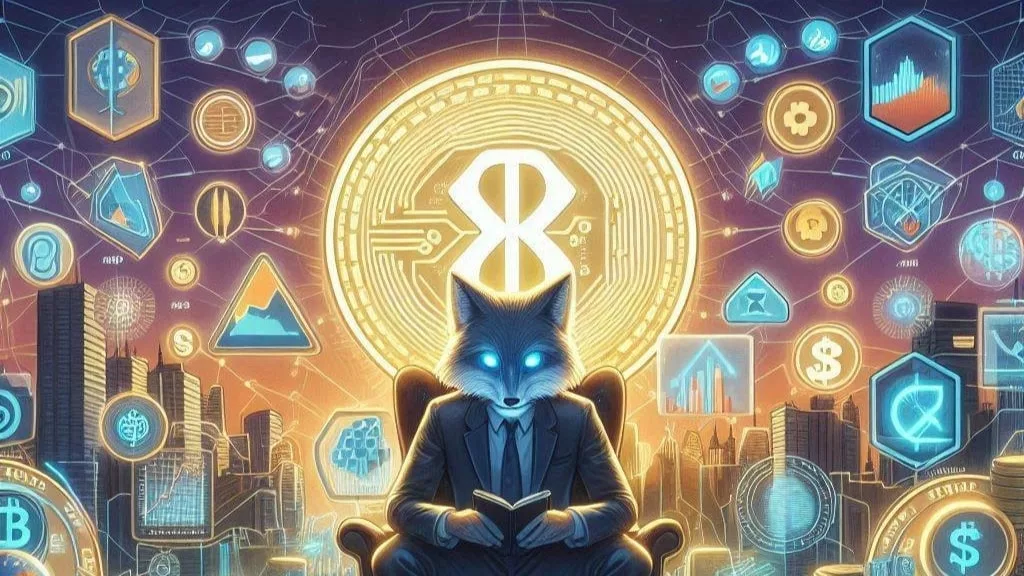

Methodology Behind the $800 Million Prediction

The $800 million figure is not arbitrary; it's based on a careful analysis of various market factors and trends.

Market Analysis and Forecasting Techniques

Several quantitative and qualitative methods contributed to this prediction. These included:

-

Market cap analysis: Analyzing XRP's current market cap and projected growth based on ETF adoption.

-

Trading volume analysis: Assessing historical trading volume and projecting increases based on ETF accessibility.

-

Investor sentiment analysis: Gauging the overall market sentiment towards XRP and its potential growth.

-

Specific models and techniques employed: Sophisticated financial models, such as discounted cash flow analysis and comparable company analysis were used alongside trend analysis of investor flows into other crypto ETFs.

-

Acknowledgment of limitations and potential variations: It's crucial to acknowledge the inherent volatility of the cryptocurrency market and that the $800 million figure is an estimate, subject to market fluctuations and unforeseen events.

Comparison with Other Successful ETF Launches

To provide a benchmark, we analyzed initial investment flows of successfully launched crypto ETFs. Factors contributing to their success, such as regulatory clarity and market timing, were compared to the potential XRP ETF scenario.

- Examples of successful crypto ETFs: Examining the initial investment flows and market performance of similar ETFs provides valuable data points for projection.

- Key performance indicators (KPIs) for comparison: Metrics like AUM (Assets Under Management) growth, trading volume, and price appreciation in the initial period post-launch were key indicators used for comparison.

Potential Impact of $800 Million Investment on XRP's Price and Market

The predicted $800 million investment would have significant short-term and long-term consequences.

Short-Term Price Volatility

The approval and subsequent investment surge could lead to significant price volatility.

- Potential price increase scenarios: A substantial influx of capital could drive a rapid increase in XRP's price. The magnitude of this increase depends on various factors, including the rate of investment flow and overall market conditions.

- Risk factors to consider: Short-term volatility is inherent; market sentiment, supply and demand dynamics, and potential regulatory changes could cause price fluctuations.

Long-Term Market Implications

Increased investment could reshape XRP's market position significantly.

- Long-term price predictions: Sustained institutional and retail interest could lead to a long-term increase in XRP's price and market capitalization.

- Potential for wider cryptocurrency adoption: The success of an XRP ETF could legitimize cryptocurrencies in the eyes of mainstream investors, potentially accelerating the wider adoption of crypto assets.

Conclusion

The potential approval of an XRP ETF presents a significant opportunity for both institutional and retail investors, with predictions indicating an initial investment flow potentially reaching $800 million. This substantial influx of capital is driven by several factors, including increasing institutional interest, the accessibility of ETFs, and XRP's unique characteristics within the cryptocurrency market. While the $800 million figure is a prediction and subject to market dynamics, it highlights the significant potential for growth and underscores the importance of monitoring the situation closely. Stay informed on the latest developments concerning XRP ETF approval and consider exploring investment opportunities strategically. Don't miss out on the potential of XRP ETF investments!

Featured Posts

-

Beyond Saving Private Ryan A Historians Guide To Authentic Wwii Cinema

May 08, 2025

Beyond Saving Private Ryan A Historians Guide To Authentic Wwii Cinema

May 08, 2025 -

Dogecoin Shiba Inu And Sui Exploring The Factors Behind Their Growth

May 08, 2025

Dogecoin Shiba Inu And Sui Exploring The Factors Behind Their Growth

May 08, 2025 -

Four Inter Milan Players Out Of Contract In 2026 Analysis And Implications

May 08, 2025

Four Inter Milan Players Out Of Contract In 2026 Analysis And Implications

May 08, 2025 -

Neymar En La Lista Preliminar De Brasil Un Regreso Contra Argentina

May 08, 2025

Neymar En La Lista Preliminar De Brasil Un Regreso Contra Argentina

May 08, 2025 -

Gha Voices Concerns Over Proposed Jhl Privatisation

May 08, 2025

Gha Voices Concerns Over Proposed Jhl Privatisation

May 08, 2025