Iran Sanctions: How US Crackdown Affects Chinese Plastics Industry

Table of Contents

Disruption of Petrochemical Imports

The sanctions have significantly limited Iran's ability to export petrochemicals, including crucial raw materials like polypropylene and polyethylene, heavily relied upon by Chinese plastics manufacturers. This has led to considerable disruption within the Chinese plastics industry.

Reduced Supply of Key Raw Materials

The reduced availability of Iranian petrochemicals has created a number of challenges:

- Reduced availability leads to price increases: The decreased supply has driven up prices for polypropylene and polyethylene, increasing the cost of production for Chinese plastics manufacturers.

- Increased reliance on alternative, often more expensive, suppliers: Chinese companies have been forced to seek alternative sources, often at higher costs and with longer lead times. This includes sourcing from countries like Saudi Arabia, Russia, and the Middle East.

- Potential for production slowdowns and shortages: Some Chinese plastics manufacturers have experienced production slowdowns or even shortages due to the limited availability of key raw materials. This has had a knock-on effect on the availability of finished plastic products.

Increased Costs and Price Volatility

The decreased supply of Iranian petrochemicals has created a volatile market, leading to unpredictable price fluctuations:

- Higher input costs translate to higher final product prices: The increased cost of raw materials has been passed on to consumers, leading to higher prices for plastic products in China and globally.

- Difficulties in accurate cost forecasting: The price volatility makes it extremely difficult for Chinese plastics companies to accurately forecast their costs and profitability. This uncertainty makes long-term planning challenging.

- Increased risk of contract renegotiations with clients: The unpredictable market conditions have increased the risk of contract renegotiations and potential disputes with clients due to price fluctuations and supply chain disruptions.

Adaptation Strategies of Chinese Plastics Companies

Faced with these challenges, Chinese plastics companies have adopted several strategies to mitigate the impact of the Iran sanctions:

Diversification of Suppliers

Chinese companies are actively seeking alternative sources for petrochemicals to reduce reliance on any single supplier:

- Increased logistical complexity and transportation costs: Sourcing from alternative suppliers often involves increased logistical complexity and higher transportation costs, adding to the overall expense.

- Negotiating new contracts with different suppliers and quality standards: Establishing relationships with new suppliers requires significant effort in negotiating contracts and ensuring consistent quality standards.

- Potential for longer lead times: Sourcing from geographically distant suppliers can result in longer lead times, potentially affecting production schedules and delivery commitments.

Investment in Domestic Production

To reduce dependence on imports, there’s a growing focus on boosting domestic petrochemical production:

- Significant capital investment required for new plants and infrastructure: Building new petrochemical plants requires substantial capital investment and long lead times.

- Potential for increased competition within the domestic market: Increased domestic production may lead to heightened competition among Chinese producers.

- Government support and policies crucial for success: Government support and favorable policies are essential to encourage investment and stimulate growth in domestic petrochemical production.

Technological Innovation

Chinese plastics companies are investing in R&D to improve efficiency and explore alternative materials:

- Development of recycled plastic usage solutions: There is an increased focus on developing and implementing solutions for using recycled plastics to reduce reliance on virgin materials.

- Exploration of bio-based plastics and alternatives: Research into bio-based plastics and other sustainable alternatives is gaining momentum as companies seek to diversify their material sources.

- Investment in automation and process optimization: Companies are investing in automation and process optimization to improve efficiency and reduce costs.

Broader Economic Implications

The sanctions and the subsequent adaptations within the Chinese plastics industry have far-reaching implications:

Impact on Global Plastics Markets

The changes in the Chinese plastics industry have created ripple effects throughout the global market:

- Increased pressure on global petrochemical prices: The increased demand from alternative suppliers has put upward pressure on global petrochemical prices.

- Shifting dynamics in international plastics trade: The sanctions have altered established trade patterns and created new opportunities for other petrochemical exporters.

- Opportunities for other petrochemical exporters: Countries like Saudi Arabia and Russia have seen increased demand for their petrochemicals, benefiting from the disruption in Iranian exports.

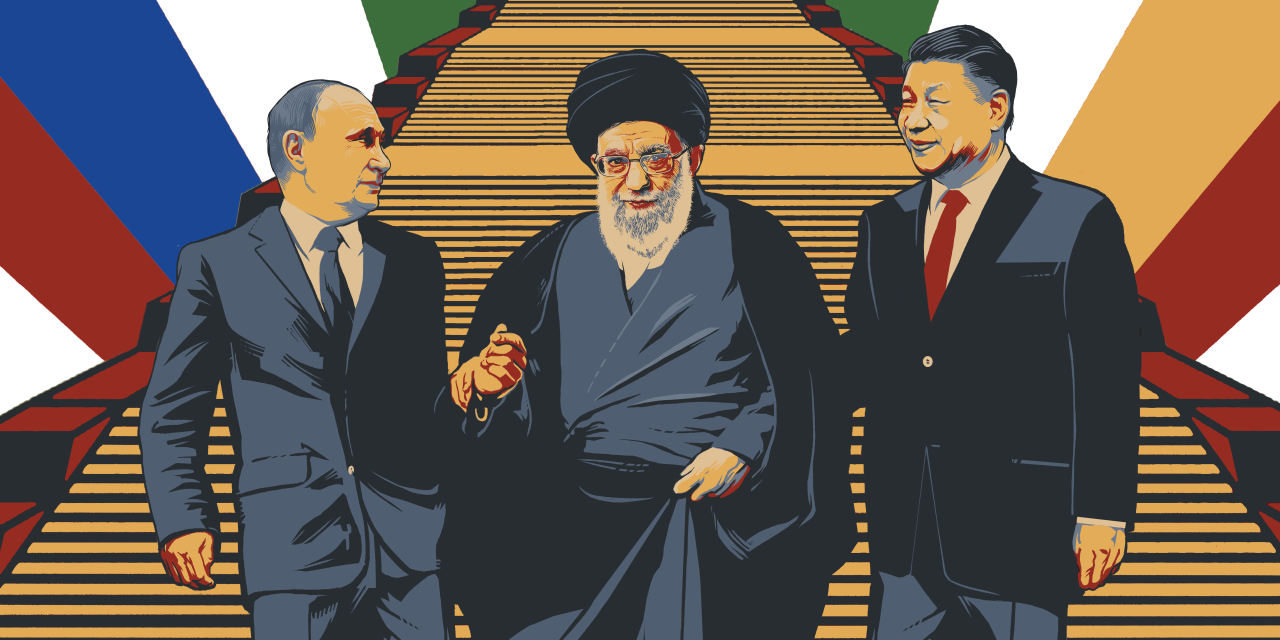

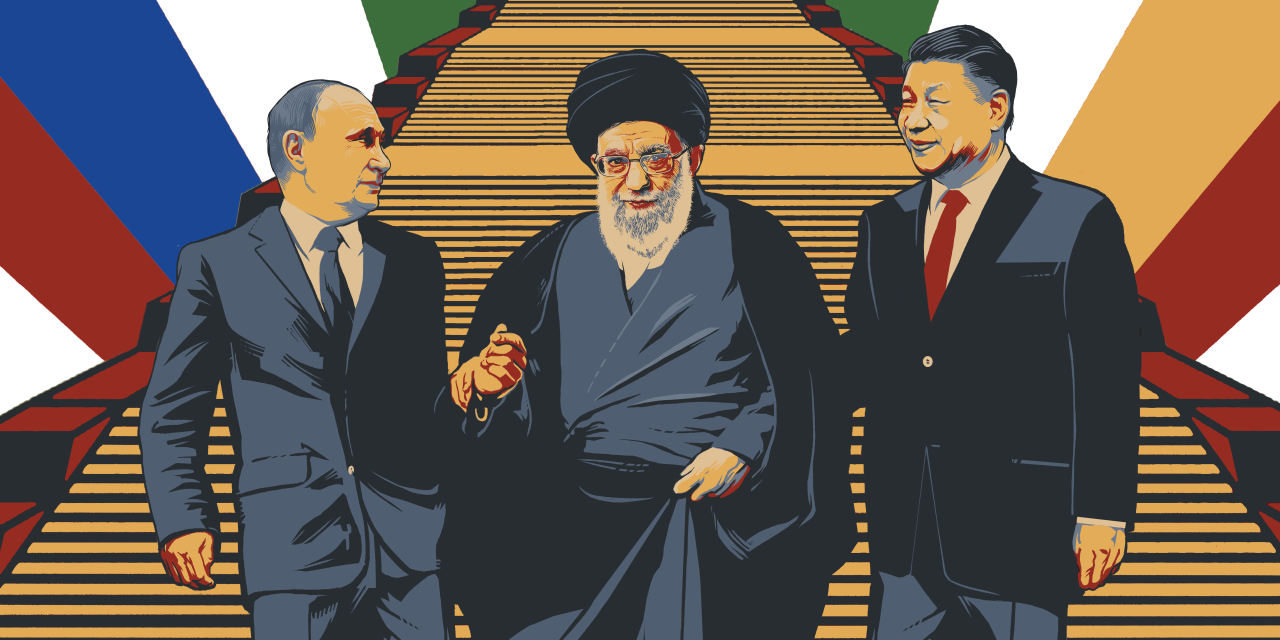

Geopolitical Ramifications

The sanctions highlight the interconnectedness of the global economy and the risks associated with geopolitical instability:

- Increased scrutiny of international trade partnerships: The situation has intensified scrutiny of international trade partnerships and the importance of diversification.

- Potential for future trade disputes and protectionist measures: The sanctions have raised concerns about the potential for future trade disputes and protectionist measures.

- Calls for greater diversification and resilience in global supply chains: The events have underscored the need for greater diversification and resilience in global supply chains to reduce vulnerability to geopolitical risks.

Conclusion

The US sanctions on Iran have undeniably impacted the Chinese plastics industry, forcing companies to adapt through diversification, domestic production increases, and technological innovation. Understanding the complexities of these Iran sanctions and their effects on the global Chinese plastics industry is crucial for businesses to navigate the evolving landscape. Companies need to proactively assess their supply chain vulnerabilities and develop strategies to mitigate risks. Staying informed about developments concerning US sanctions and their effects on petrochemical imports is essential for long-term success in this dynamic market. Learn more about how Iran sanctions affect your business and plan accordingly.

Featured Posts

-

Simone Biles To Address Washington University Class Of 2025

May 07, 2025

Simone Biles To Address Washington University Class Of 2025

May 07, 2025 -

Alkshf En Hqayq Mdhsht En Jaky Shan

May 07, 2025

Alkshf En Hqayq Mdhsht En Jaky Shan

May 07, 2025 -

Lion Electrics Financial Troubles Liquidation A Real Possibility

May 07, 2025

Lion Electrics Financial Troubles Liquidation A Real Possibility

May 07, 2025 -

Why Jenna Ortega Is Poised To Become Horrors Next Scream Queen

May 07, 2025

Why Jenna Ortega Is Poised To Become Horrors Next Scream Queen

May 07, 2025 -

Sbi Holdings Rewards Shareholders With Xrp Ripple Xrp News

May 07, 2025

Sbi Holdings Rewards Shareholders With Xrp Ripple Xrp News

May 07, 2025

Latest Posts

-

Xrp Price Prediction Breaking Resistance To Reach 3 40

May 08, 2025

Xrp Price Prediction Breaking Resistance To Reach 3 40

May 08, 2025 -

Analyzing Xrp Ripple A Path To Financial Independence

May 08, 2025

Analyzing Xrp Ripple A Path To Financial Independence

May 08, 2025 -

Ripple Xrp Price Surge Will It Hit 3 40

May 08, 2025

Ripple Xrp Price Surge Will It Hit 3 40

May 08, 2025 -

Xrp Ripple Investment Potential For Life Changing Returns

May 08, 2025

Xrp Ripple Investment Potential For Life Changing Returns

May 08, 2025 -

Xrp Up 400 In 3 Months A Detailed Investment Analysis

May 08, 2025

Xrp Up 400 In 3 Months A Detailed Investment Analysis

May 08, 2025