Investor Concerns About Stock Market Valuations: BofA's Take

Table of Contents

BofA's Key Concerns Regarding Current Stock Market Valuations

BofA's overall assessment suggests a cautious outlook on current stock market valuations. While not outright declaring a bubble, their analysis highlights several key areas of concern that indicate potential overvaluation in specific sectors. They emphasize the need for careful consideration and a strategic approach to investment.

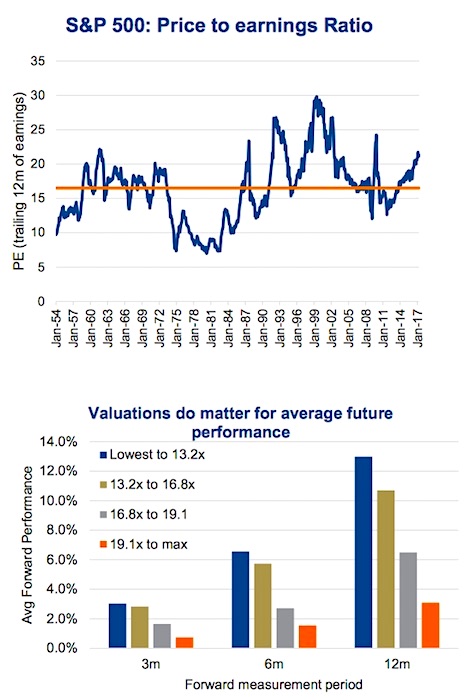

Elevated Price-to-Earnings Ratios (P/E): A Cause for Concern?

The Price-to-Earnings ratio (P/E ratio) is a crucial metric used to evaluate the relative value of a company's stock. It represents the price an investor pays for each dollar of a company's earnings. High P/E ratios generally suggest that a stock is overvalued, while low P/E ratios may signal undervaluation. BofA's analysis reveals elevated P/E ratios across several key sectors, raising concerns about potential overvaluation.

- Specific sectors identified by BofA as potentially overvalued based on P/E analysis:

- Technology sector: High P/E ratios compared to historical averages, reflecting sustained investor enthusiasm despite potential growth deceleration.

- Energy sector: Recent price increases have driven up P/E ratios, prompting concerns about potential future price corrections.

- Consumer discretionary sector: Inflationary pressures are impacting consumer spending, creating valuation risks for companies in this sector.

Impact of Rising Interest Rates on Stock Market Valuations

There's an inverse relationship between interest rates and stock market valuations. As interest rates rise, the attractiveness of bonds (considered less risky) increases, drawing investors away from equities. This reduced demand can lead to lower stock prices. BofA anticipates further interest rate hikes, projecting their impact on valuations negatively.

- Potential consequences of rising interest rates:

- Reduced corporate earnings due to higher borrowing costs, impacting profitability.

- Decreased investor appetite for riskier assets, leading to capital flight from equities.

- Potential for market corrections or declines, causing significant volatility.

Inflation's Role in Shaping Stock Market Valuations

Persistent inflation erodes purchasing power and impacts corporate profitability. Rising input costs squeeze profit margins, while slowing consumer spending reduces revenues. BofA's analysis reflects a concern about the current inflationary environment and its potential longevity.

- Illustrative impacts of inflation on stock market valuations:

- Increased input costs for businesses lead to squeezed profit margins, impacting earnings.

- Potential for consumer spending slowdown, affecting company revenues and growth prospects.

- Pressure on central banks to further increase interest rates to combat inflation, exacerbating the negative impact.

Recessionary Risks and Their Influence on Valuations

BofA acknowledges the increased likelihood of a recession in the near future. Recessionary fears significantly impact investor sentiment, triggering a flight to safety and potentially leading to significant market downturns.

- Potential impacts of recessionary risks on stock valuations:

- Increased market volatility as investors react to economic uncertainty.

- Flight to safety among investors, shifting capital from equities to safer havens like government bonds.

- Potential for significant market downturns as investor confidence erodes.

BofA's Recommendations for Investors Navigating Uncertain Valuations

Given their concerns, BofA suggests several strategies for investors to navigate the current uncertain market environment.

Diversification Strategies

BofA recommends a diversified portfolio to mitigate risk. This includes investing across different asset classes (stocks, bonds, real estate) and sectors, reducing reliance on any single investment's performance. A geographically diversified portfolio is also advised.

Defensive Investing Approaches

Focusing on value stocks – companies trading at lower valuations relative to their fundamentals – and sectors less vulnerable to economic downturns (such as utilities or consumer staples) is a prudent approach, according to BofA's recommendations.

Long-Term Perspective

Maintaining a long-term investment horizon is crucial, especially during periods of market uncertainty. Short-term market fluctuations should not dictate long-term investment strategies.

Conclusion

BofA's analysis highlights significant concerns about current stock market valuations, emphasizing the intertwined challenges of rising interest rates, persistent inflation, and recessionary risks. Their recommendations advocate for diversification, defensive investing strategies, and a long-term perspective. Understanding current stock market valuations is crucial for informed investment decisions. Stay updated on BofA's analysis and other expert opinions to navigate the market effectively.

Featured Posts

-

Surprisingly Good Cheap Stuff Hidden Gems Revealed

May 06, 2025

Surprisingly Good Cheap Stuff Hidden Gems Revealed

May 06, 2025 -

Meet Greg Abel Warren Buffetts Chosen Successor And Future Of Berkshire Hathaway

May 06, 2025

Meet Greg Abel Warren Buffetts Chosen Successor And Future Of Berkshire Hathaway

May 06, 2025 -

Recession Indicators What Social Media Trends Reveal

May 06, 2025

Recession Indicators What Social Media Trends Reveal

May 06, 2025 -

Gold Fields And Gold Road Merger A 3 7 Billion Deal Details

May 06, 2025

Gold Fields And Gold Road Merger A 3 7 Billion Deal Details

May 06, 2025 -

Joseph Baena Arnold Schwarzenegger Bueszke Fianak Utja A Sikerhez

May 06, 2025

Joseph Baena Arnold Schwarzenegger Bueszke Fianak Utja A Sikerhez

May 06, 2025

Latest Posts

-

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025 -

Mindy Kalings Transformation Slim Figure Stuns Fans

May 06, 2025

Mindy Kalings Transformation Slim Figure Stuns Fans

May 06, 2025 -

Mindy Kalings Weight Loss Journey Before And After Photos From The Series Premiere

May 06, 2025

Mindy Kalings Weight Loss Journey Before And After Photos From The Series Premiere

May 06, 2025 -

The Office Mindy Kaling Revela Detalhes Sobre Relacionamento Complicado Com Ex Colega

May 06, 2025

The Office Mindy Kaling Revela Detalhes Sobre Relacionamento Complicado Com Ex Colega

May 06, 2025 -

Apos Anos De Silencio Mindy Kaling Fala Sobre Relacionamento Com Ex De The Office

May 06, 2025

Apos Anos De Silencio Mindy Kaling Fala Sobre Relacionamento Com Ex De The Office

May 06, 2025