Gold Fields And Gold Road Merger: A$3.7 Billion Deal Details

Table of Contents

Deal Structure and Valuation

The merger between Gold Fields and Gold Road Resources is structured as an acquisition where Gold Fields will acquire all outstanding shares of Gold Road. The deal's total valuation is A$3.7 billion, representing a significant investment in the Australian gold mining sector. The specifics of the acquisition method include a combination of cash and shares offered to Gold Road shareholders. A detailed breakdown of the consideration remains to be fully disclosed but is expected to include a premium over Gold Road's prevailing share price. This premium aims to incentivize Gold Road shareholders to accept the offer.

- Total deal valuation: A$3.7 billion

- Price per share offered to Gold Road shareholders: [Insert Price per share once available - This is crucial information and should be added once released.]

- Breakdown of cash and share consideration: [Insert breakdown once available]

- Expected completion date: [Insert date once available]

The acquisition price, share exchange ratio, and overall merger consideration reflect Gold Fields' strategic assessment of Gold Road's assets and future potential. The transaction value underscores the significance of this acquisition within the broader context of global gold mining mergers and acquisitions.

Synergies and Benefits for Gold Fields

The strategic rationale behind Gold Fields' acquisition of Gold Road is multifaceted and centers around achieving significant synergies and expanding its operational footprint. This acquisition offers several key benefits for Gold Fields:

- Increased gold production and reserves: The merger will significantly boost Gold Fields' gold production capacity by adding Gold Road's substantial gold reserves and resources to its existing portfolio. This increase will strengthen Gold Fields' position as a major gold producer.

- Diversification of geographic portfolio: Gold Road's assets are primarily located in Western Australia, adding geographical diversification to Gold Fields' existing operations. This diversification reduces operational risks associated with concentrating production in a single region.

- Cost synergies and operational efficiencies: By integrating Gold Road's operations, Gold Fields anticipates realizing considerable cost savings through streamlined processes, optimized resource allocation, and economies of scale. These operational efficiencies will improve profit margins.

- Access to Gold Road's advanced exploration projects: The acquisition grants Gold Fields access to Gold Road's promising exploration projects in Western Australian gold fields. These projects hold potential for discovering new reserves and extending the lifespan of existing mines.

These synergies and benefits position Gold Fields for robust growth and increased profitability in the long term.

Impact on Gold Road Shareholders

The merger presents significant implications for Gold Road shareholders. The primary impact is the premium offered on their shares, providing a substantial return on their investment compared to Gold Road's previous share price. Shareholders will be presented with the option of accepting the offer and receiving the agreed-upon consideration in cash and shares, or selling their shares independently on the market.

- Premium offered compared to Gold Road's share price: [Insert premium percentage once available]

- Options available to shareholders: Accepting the offer, selling shares on the open market.

- Potential long-term benefits from being part of Gold Fields: Access to a larger, more diversified company with enhanced long-term growth potential.

The shareholder value proposition is a central aspect of this transaction, aiming to provide a fair and attractive deal for Gold Road's investors. The success of the deal will also depend on securing shareholder approval.

Regulatory Approvals and Antitrust Concerns

The successful completion of the Gold Fields and Gold Road merger is contingent upon obtaining necessary regulatory approvals. This process involves navigating potential antitrust concerns and securing clearance from relevant competition authorities in Australia and potentially other jurisdictions.

- Required approvals from competition authorities: Australian Competition and Consumer Commission (ACCC) approval is anticipated to be a key hurdle.

- Potential impact on competition in the gold mining sector: The merger's impact on competition within the Australian gold mining sector will be a key consideration for regulators.

- Timeline for regulatory approvals: The timeframe for obtaining all necessary approvals is uncertain, although the companies will likely provide updates as the process unfolds.

The regulatory review will determine whether the merger complies with competition laws and doesn't negatively impact the market.

Future Outlook and Market Implications

The Gold Fields and Gold Road merger is likely to have a significant impact on the Australian gold market and the broader global gold mining industry.

- Effect on gold production and supply: The combined entity will be a major player in Australian gold production, potentially influencing gold supply dynamics.

- Potential changes in gold pricing: While it’s difficult to predict the precise impact, the merger may subtly influence gold pricing depending on overall market dynamics.

- Impact on other gold mining companies: The merger could trigger further consolidation within the gold mining sector, as other companies may seek strategic partnerships or acquisitions to enhance competitiveness.

Industry consolidation is expected to continue in the gold mining sector, with this merger potentially setting a precedent for future deals.

Conclusion

The Gold Fields and Gold Road merger represents a significant consolidation within the Australian gold mining sector. This A$3.7 billion deal promises significant benefits for Gold Fields, including increased production, enhanced operational efficiency, and expanded exploration opportunities. While regulatory approvals are pending, the transaction's completion holds substantial implications for shareholders and the wider gold market. The long-term success will depend on successfully navigating regulatory hurdles and realizing the anticipated synergies.

Call to Action: Stay informed about the progress of this landmark Gold Fields and Gold Road merger. Further updates on this transformative gold mining acquisition will be provided as the deal progresses. Follow our website for ongoing coverage of the Gold Fields and Gold Road merger and other important developments in the Australian mining sector.

Featured Posts

-

Are We In A Recession Stock Market Performance Suggests Otherwise

May 06, 2025

Are We In A Recession Stock Market Performance Suggests Otherwise

May 06, 2025 -

Surprisingly Good Cheap Stuff Hidden Gems Revealed

May 06, 2025

Surprisingly Good Cheap Stuff Hidden Gems Revealed

May 06, 2025 -

Eksport Trotylu Z Polski Skala I Znaczenie Zamowienia

May 06, 2025

Eksport Trotylu Z Polski Skala I Znaczenie Zamowienia

May 06, 2025 -

Us Tariffs Halt Sheins Planned London Ipo

May 06, 2025

Us Tariffs Halt Sheins Planned London Ipo

May 06, 2025 -

Chris Pratt Weighs In On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Chris Pratt Weighs In On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Latest Posts

-

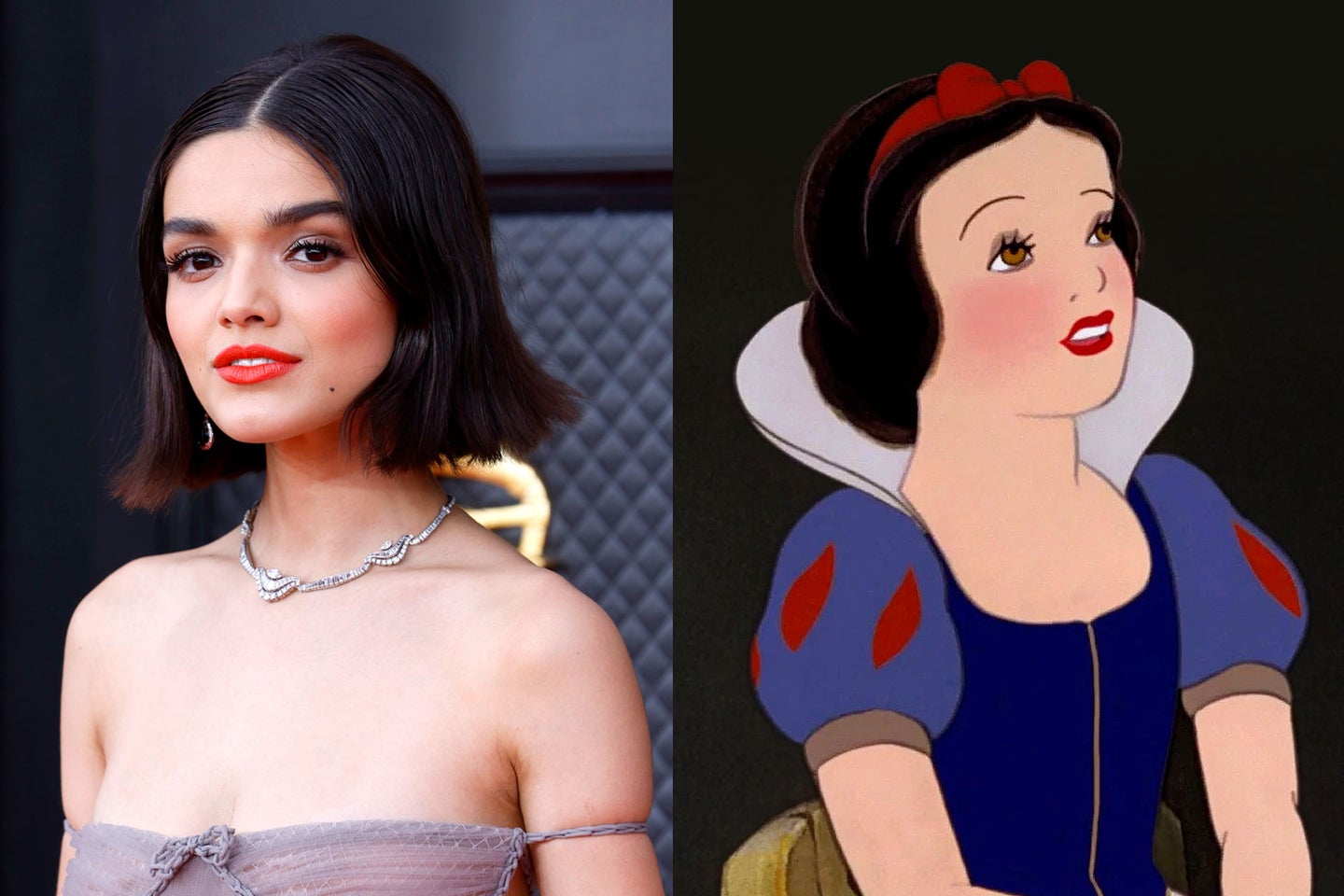

Snow White Controversy Doesnt Stop Rachel Zegler From Gracing The Met Gala Red Carpet

May 06, 2025

Snow White Controversy Doesnt Stop Rachel Zegler From Gracing The Met Gala Red Carpet

May 06, 2025 -

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025

From Walmart Deli To Track Star Dylan Beards Story

May 06, 2025 -

Celebrating Black Women A Nashville Mural Initiative

May 06, 2025

Celebrating Black Women A Nashville Mural Initiative

May 06, 2025 -

Nikes New Fitness Venture With Kim Kardashian The Skims Collaboration

May 06, 2025

Nikes New Fitness Venture With Kim Kardashian The Skims Collaboration

May 06, 2025 -

Met Gala 2024 Rachel Zegler Attends Despite Snow White Controversy

May 06, 2025

Met Gala 2024 Rachel Zegler Attends Despite Snow White Controversy

May 06, 2025