Investment In Uber: Weighing The Risks And Rewards Of The Robotaxi Plan

Table of Contents

Uber's ambitious robotaxi plan is poised to disrupt the transportation industry, presenting a compelling investment opportunity with potentially high rewards but also substantial risks. The significant capital investment required for developing and deploying autonomous vehicles necessitates a thorough risk assessment before committing funds. This article aims to analyze the potential rewards and risks associated with investing in Uber, focusing on its autonomous vehicle strategy and its impact on the company's future. We'll explore key factors influencing the return on investment (ROI) for Uber investment in this transformative technology.

<h2>The Potential Rewards of Uber's Robotaxi Investment</h2>

Uber's investment in robotaxis holds the promise of significant long-term gains, potentially reshaping the company's financial landscape and establishing it as a leader in autonomous vehicle technology.

<h3>Reduced Operational Costs</h3>

The automation of ride-hailing services offers considerable potential for cost reduction. Eliminating the need for human drivers represents a major expense saving.

- Lower driver salaries: A substantial portion of Uber's current operational costs stems from driver compensation. Robotaxis would eliminate this expense.

- Reduced insurance premiums: Insurance costs for autonomous vehicles could be significantly lower than for human-driven vehicles, as accident rates are theoretically reduced due to improved safety features and algorithms.

- Increased vehicle utilization: Autonomous vehicles can operate 24/7, maximizing vehicle utilization and increasing revenue generation compared to human drivers who require breaks and downtime.

<h3>Increased Market Share and Revenue</h3>

Robotaxis could dramatically expand Uber's market reach and service offerings.

- Capturing new customer segments: Autonomous vehicles could attract customers currently underserved by traditional ride-sharing services, such as elderly individuals or those with disabilities.

- Offering new service tiers: Uber could introduce premium autonomous ride options, catering to customers willing to pay more for a higher level of comfort and convenience.

- Expanding into underserved areas: Robotaxis can operate in areas with limited public transportation or where it is difficult to recruit human drivers, opening new revenue streams.

<h3>Technological Leadership and Innovation</h3>

Successful deployment of robotaxis would position Uber as a technology leader in the autonomous vehicle sector.

- Patent development: Uber's investment in autonomous driving technology translates into valuable intellectual property, generating potential licensing revenue and providing a competitive advantage.

- Data collection and AI advancements: Operating a large fleet of robotaxis generates massive amounts of data, which can be used to further refine AI algorithms and improve autonomous driving capabilities.

- First-mover advantage: Establishing a significant presence in the robotaxi market early on can create a substantial first-mover advantage, hindering competition and ensuring market dominance.

<h2>The Significant Risks Associated with Uber's Robotaxi Plan</h2>

Despite the potential rewards, Uber's robotaxi plan faces considerable challenges and risks.

<h3>Technological Challenges</h3>

Developing and deploying safe and reliable autonomous vehicles presents significant technological hurdles.

- Unforeseen technical failures: Software glitches, sensor limitations, and unexpected environmental factors (e.g., extreme weather) can lead to accidents or system malfunctions.

- Regulatory hurdles: Navigating the complex regulatory landscape surrounding autonomous vehicles requires significant time and resources.

- High development costs: Research, development, and testing of autonomous vehicle technology are extremely expensive endeavors.

- Lengthy testing periods: Thorough testing and validation are crucial before widespread deployment, potentially delaying the realization of projected returns.

<h3>Regulatory and Legal Hurdles</h3>

The legal and regulatory environment surrounding autonomous vehicles is still evolving and presents considerable uncertainty.

- Varying regulations across jurisdictions: Differing regulations across different states and countries add to the complexity of deploying robotaxis on a large scale.

- Legal challenges related to accidents: Determining liability in the event of an accident involving an autonomous vehicle remains a significant legal and ethical challenge.

- Public perception and acceptance: Public trust and acceptance of self-driving technology are crucial for the success of robotaxi services.

<h3>Competition and Market Saturation</h3>

The autonomous vehicle market is intensely competitive, with established automakers and tech giants vying for dominance.

- Competition from Waymo, Tesla, and other players: Uber faces stiff competition from well-funded and established players in the autonomous vehicle market.

- Potential for price wars: Intense competition could lead to price wars, reducing profitability for all participants.

- Market saturation affecting profitability: If the market becomes saturated with autonomous vehicles, it could lead to reduced prices and lower profit margins.

<h3>Ethical and Safety Concerns</h3>

Ethical considerations and public safety concerns surround the development and deployment of autonomous vehicles.

- Algorithm biases: AI algorithms used in autonomous vehicles could exhibit biases, potentially leading to unfair or discriminatory outcomes.

- Handling of unexpected situations: Autonomous vehicles need to be able to handle unexpected and complex situations safely and reliably.

- Public trust and acceptance of self-driving technology: Gaining and maintaining public trust in the safety and reliability of self-driving technology is crucial for widespread adoption.

<h2>Analyzing the Investment Landscape: Uber Stock and Future Projections</h2>

Before making any investment decisions, carefully consider Uber's current market position and future projections.

<h3>Current Market Valuation and Stock Performance</h3>

Uber's current stock price, market capitalization, and recent performance trends should be thoroughly analyzed. This includes considering the overall market conditions and their impact on the company's valuation.

<h3>Analyst Predictions and Future Growth Estimates</h3>

Consult financial analysts' reports and predictions regarding Uber's future growth prospects, specifically factoring in the impact of the robotaxi initiative. These projections provide valuable insights into the potential return on investment.

<h3>Diversification of Investment Portfolio</h3>

Remember that diversification is key to mitigating risk. Investing in Uber, or any high-growth tech company, should be part of a broader, diversified portfolio to lessen potential losses.

<h2>Conclusion: Investing Wisely in Uber's Robotaxi Future</h2>

Investing in Uber's robotaxi plan presents a high-risk, high-reward proposition. The potential for reduced operational costs, increased market share, and technological leadership is significant. However, substantial technological, regulatory, and competitive challenges need careful consideration. Before investing in Uber stock based on its autonomous vehicle strategy, conduct thorough research, analyze the competitive landscape, and understand the potential downsides. Seek professional financial advice to make informed investment decisions about Uber robotaxi investment strategy and autonomous vehicle investment opportunities. Weighing the risks and rewards carefully is crucial for making sound, informed investment decisions.

Featured Posts

-

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025 -

Offseason Trade Analysis Thunder Vs Bulls The Untold Story

May 08, 2025

Offseason Trade Analysis Thunder Vs Bulls The Untold Story

May 08, 2025 -

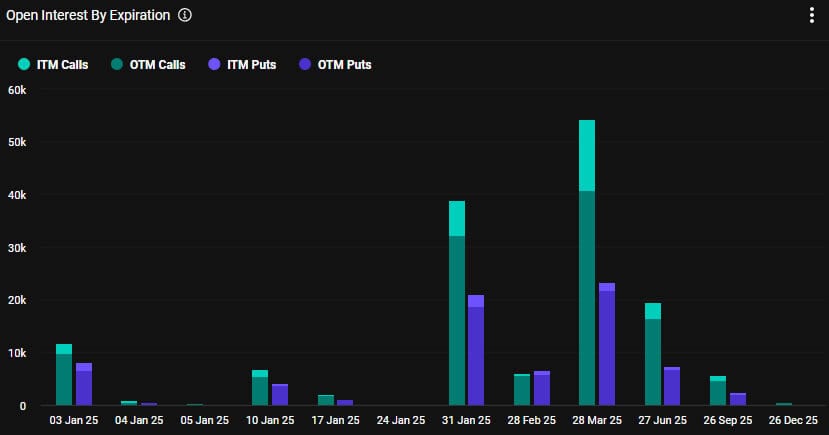

Billions In Crypto Options Expiring What To Expect For Bitcoin And Ethereum

May 08, 2025

Billions In Crypto Options Expiring What To Expect For Bitcoin And Ethereum

May 08, 2025 -

Is 100 000 Bitcoin Realistic Assessing The Impact Of Trumps Economic Agenda

May 08, 2025

Is 100 000 Bitcoin Realistic Assessing The Impact Of Trumps Economic Agenda

May 08, 2025 -

Chinas Growing Presence In Greenland A Threat To Us Interests

May 08, 2025

Chinas Growing Presence In Greenland A Threat To Us Interests

May 08, 2025