Billions In Crypto Options Expiring: What To Expect For Bitcoin And Ethereum

Table of Contents

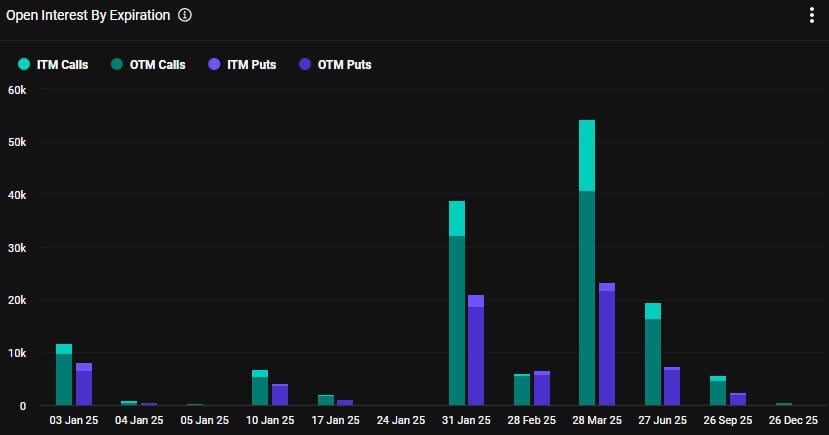

Understanding the Crypto Options Expiration Event

Crypto options, like their traditional counterparts, represent a derivative contract offering leveraged exposure to the underlying asset's price movements. Understanding how these options work is crucial to grasping the potential market impact of this upcoming expiration. "Open interest," a key metric, represents the total number of outstanding options contracts that haven't been settled. High open interest indicates significant market activity and can foreshadow increased price volatility around the expiration date. Options expiration itself marks the final date on which the option contract can be exercised. The settling of these contracts, often involving the buying or selling of the underlying cryptocurrency, can inject significant buying or selling pressure into the market, leading to price swings.

- Call Options: Grant the buyer the right to buy the cryptocurrency at the strike price.

- Put Options: Grant the buyer the right to sell the cryptocurrency at the strike price.

- Options Contract Settlement: Typically involves the buyer either exercising their right to buy or sell the cryptocurrency or letting the option expire worthless.

- Market Makers and Liquidity Providers: Play a crucial role in ensuring smooth trading and sufficient liquidity during periods of high volatility, such as options expirations.

Analyzing Bitcoin's Price Outlook During the Expiration

Bitcoin, the leading cryptocurrency, is highly sensitive to market sentiment and regulatory changes. Currently, Bitcoin's price is [insert current Bitcoin price and brief market trend analysis here]. Analyzing the open interest in Bitcoin options contracts nearing expiration is key to predicting potential price movements. A high open interest with a significant concentration of bullish (call) options suggests potential upward pressure as traders seek to exercise their options. Conversely, a high concentration of bearish (put) options could lead to downward pressure. However, a balance between call and put options might result in sideways price movement.

Relevant on-chain metrics, such as the Bitcoin network's transaction volume and miner behavior, can offer additional insights into market sentiment and potential price changes.

- Key Resistance Levels: [Insert key resistance levels for Bitcoin]

- Key Support Levels: [Insert key support levels for Bitcoin]

- Macroeconomic Factors: Inflation, interest rate hikes by central banks, and global economic uncertainty can significantly influence Bitcoin's price during this period.

- Regulatory News: Any significant regulatory announcements concerning Bitcoin can trigger substantial market reactions.

Ethereum's Price Predictions During the Options Expiration

Ethereum, the second-largest cryptocurrency, also faces the impact of this upcoming options expiration. The current Ethereum price is [insert current Ethereum price and brief market trend analysis here]. Similar to Bitcoin, the open interest in Ethereum options contracts will be a critical factor. The upcoming Ethereum upgrades, such as [mention specific upgrades and their potential impact on price], will likely play a significant role in shaping the price trajectory. Increased DeFi activity and NFT market trends will also influence Ethereum's price movement.

- Key Resistance Levels for Ethereum: [Insert key resistance levels for Ethereum]

- Key Support Levels for Ethereum: [Insert key support levels for Ethereum]

- Impact of DeFi Activity: The growth or decline of Decentralized Finance (DeFi) applications on the Ethereum network can impact its price.

- Influence of NFT Market Trends: The popularity and trading volume of Non-Fungible Tokens (NFTs) on the Ethereum blockchain can affect its price.

Managing Risk During High Volatility Periods

The period surrounding a large crypto options expiration is inherently volatile. Employing effective risk management strategies is crucial for protecting your investments. Diversification, spreading your investments across various cryptocurrencies and asset classes, is a cornerstone of sound portfolio management. Knowing your risk tolerance—your ability to withstand potential losses—is paramount.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Hedging Strategies: Using financial instruments to offset potential losses.

- Setting Stop-Loss Orders: Automatically selling your assets when the price reaches a predetermined level to limit potential losses.

Billions in Crypto Options Expiring – Key Takeaways and Next Steps

The expiration of billions of dollars in crypto options presents a period of heightened volatility for Bitcoin and Ethereum. Open interest, market sentiment, and macroeconomic factors will significantly influence price movements. Informed decision-making and robust risk management are crucial during this time. Understanding crypto options and employing strategies like diversification and stop-loss orders can help mitigate potential risks.

Stay informed about this significant event and continue learning about crypto options to make well-informed decisions. Follow our blog for further updates on the expiring billions in crypto options and their impact on Bitcoin and Ethereum. Consider consulting financial professionals for personalized advice before making any investment decisions.

Featured Posts

-

Penny Pritzker The Billionaire Hotel Heiress And The Harvard Admissions Battle

May 08, 2025

Penny Pritzker The Billionaire Hotel Heiress And The Harvard Admissions Battle

May 08, 2025 -

Finding A Ps 5 Before The Price Goes Up Your Guide To Retailers

May 08, 2025

Finding A Ps 5 Before The Price Goes Up Your Guide To Retailers

May 08, 2025 -

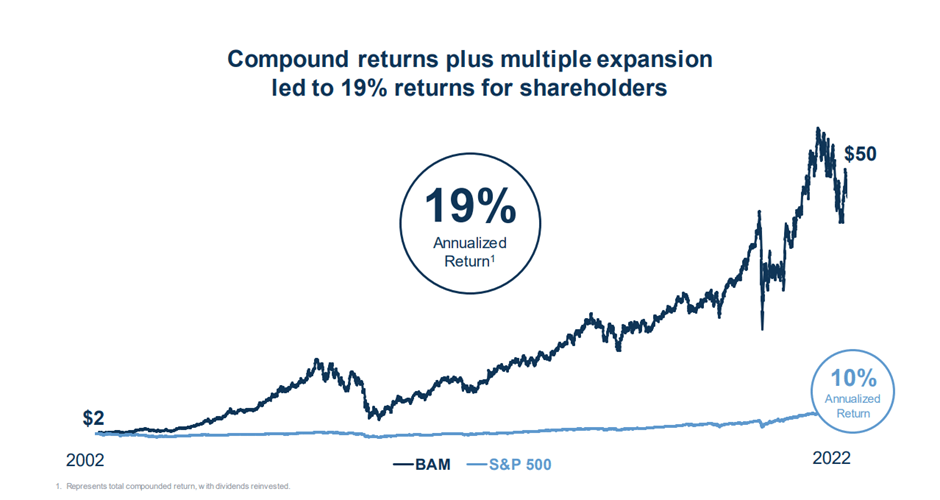

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

May 08, 2025

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

May 08, 2025 -

Arsenal Ps Zh Barselona Inter Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025 -

Jayson Tatum And Ella Mai Commercial Hints At New Baby

May 08, 2025

Jayson Tatum And Ella Mai Commercial Hints At New Baby

May 08, 2025