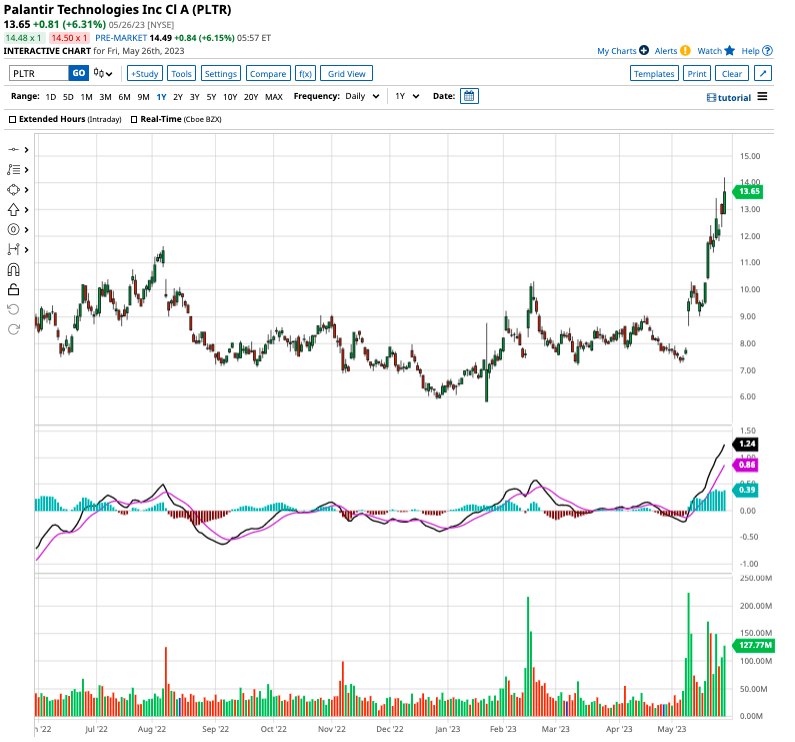

Investing In Palantir In 2024: Potential For 40% Growth By 2025?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham and Foundry. Gotham caters to government agencies, providing data integration and analysis for national security and intelligence purposes. Foundry, on the other hand, serves commercial clients across various sectors, including healthcare, finance, and manufacturing.

Palantir's revenue generation is primarily through subscription and licensing models. Gotham's revenue is largely driven by long-term contracts with government entities, while Foundry's revenue depends on client adoption and expansion within the commercial market.

- Gotham's Dependence: Gotham's reliance on government contracts presents both opportunities and risks. While these contracts often guarantee substantial revenue streams, they can also be subject to budget cuts, delays, and shifts in government priorities.

- Foundry's Commercial Growth: Foundry's growth potential is significant, as its data analytics platform is applicable to a vast range of commercial applications. Success in this area hinges on attracting and retaining a diverse customer base and demonstrating strong return on investment (ROI) for its clients.

- Diversification Strategy: Palantir's dual-platform strategy is crucial for revenue stability. Diversification reduces reliance on any single sector, mitigating the impact of potential setbacks in either the government or commercial markets.

Financial Performance and Growth Projections

Palantir's recent financial reports show a steady growth trajectory, albeit with fluctuating profit margins. Analyzing key performance indicators (KPIs) such as revenue growth, operating income, and earnings per share (EPS) is crucial to assess the feasibility of the 40% growth target.

- Key Performance Indicators (KPIs): Tracking KPIs like customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate provides insights into the health and sustainability of Palantir's business. Comparing these metrics to competitors like Snowflake and Databricks is also important.

- Growth Drivers and Headwinds: Factors driving Palantir's growth include increasing demand for data analytics solutions, advancements in artificial intelligence (AI), and expansion into new markets. Conversely, potential headwinds include economic downturns, intensifying competition, and geopolitical uncertainty.

- Analyst Predictions: While analyst predictions vary, many see potential for significant growth in Palantir's future. However, realizing a 40% growth rate by 2025 depends heavily on successful execution of its strategic plans and favorable market conditions. It's important to consider a range of forecasts and understand the underlying assumptions.

Risks and Challenges Facing Palantir

Investing in Palantir involves certain risks. Understanding these challenges is crucial for informed decision-making.

- Government Contract Risks: The nature of government contracts poses risks, including budget constraints, regulatory hurdles, and potential contract cancellations or delays. These risks can significantly impact Palantir's short-term revenue projections.

- Competition: Palantir faces intense competition from both established players and emerging startups in the big data and analytics space. Maintaining a competitive edge requires continuous innovation and adaptation.

- Scaling Challenges: Scaling operations to meet ambitious growth targets requires significant investment and effective management. Failure to scale efficiently can hinder profitability and hinder stock price growth.

Long-Term Growth Potential and Investment Strategy

Palantir's long-term growth potential rests on its ability to leverage technological advancements, particularly in AI, and expand into new markets.

- Expansion Opportunities: Palantir's technology is applicable across various sectors, offering substantial opportunities for expansion and diversification. Exploring new markets and strategic partnerships is key to long-term growth.

- Strategic Acquisitions: Acquiring complementary companies can accelerate growth and enhance Palantir's technological capabilities. This approach requires careful due diligence and integration capabilities.

- Investment Strategies: For long-term investors, a buy-and-hold strategy might be suitable, while short-term investors might prefer a more tactical approach, capitalizing on market fluctuations. Diversifying investments across other sectors is crucial for mitigating risks.

Conclusion: Should You Invest in Palantir in 2024?

Palantir presents both exciting opportunities and significant risks. While the potential for 40% growth by 2025 is not impossible, it hinges on several factors, including successful execution of its strategic plans and favorable market conditions. The company's dependence on large contracts and the competitive landscape demand careful consideration. Before investing in Palantir stock, conduct thorough due diligence, understand your risk tolerance, and consider diversifying your investment portfolio. Consult with a financial advisor to explore whether Palantir investments align with your individual financial goals. Remember to research further using reputable financial news sources and analyst reports before making any investment decisions.

Featured Posts

-

Brian Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025

Brian Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025 -

Examining The Attorney Generals Media Strategy Beyond Epsteins Shadow

May 10, 2025

Examining The Attorney Generals Media Strategy Beyond Epsteins Shadow

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

Fyraty Fy Alerby Alqtry Thlyl Ladayh Bed Antqalh Mn Alahly Almsry

May 10, 2025

Fyraty Fy Alerby Alqtry Thlyl Ladayh Bed Antqalh Mn Alahly Almsry

May 10, 2025 -

Ai Driven Podcast Creation Analyzing And Transforming Repetitive Scatological Documents

May 10, 2025

Ai Driven Podcast Creation Analyzing And Transforming Repetitive Scatological Documents

May 10, 2025