Investing In Palantir Before May 5th: What Do Analysts Say?

Table of Contents

Palantir's Recent Performance and Future Projections

Palantir's recent financial reports offer a mixed bag for potential investors. While Q4 2022 earnings showed continued revenue growth, the pace of growth and profitability margins remain key factors influencing analyst sentiment. Analyzing key performance indicators (KPIs) is critical for understanding Palantir's trajectory.

- Revenue growth rate: Compared to previous quarters, Palantir's revenue growth has shown some fluctuation. Comparing this to competitor performance in the data analytics market is crucial for assessing its market position and competitive advantage.

- Profitability margins: While Palantir is showing progress towards profitability, its margins are still under scrutiny by analysts. Future projections for profitability will significantly impact investor confidence.

- Customer acquisition and retention rates: The success of Palantir's business model hinges on acquiring and retaining high-value clients. High customer churn could signal underlying challenges.

- Impact of government contracts: A significant portion of Palantir's revenue stems from government contracts. The stability and future outlook of these contracts are vital factors in long-term revenue forecasting. This influence on overall Palantir revenue growth and the PLTR stock forecast is substantial. Analyzing the Palantir financial performance in the context of these contracts is essential. The Palantir stock price often reflects the success in securing and maintaining these contracts.

Analyst Ratings and Price Targets for Palantir

Analyst ratings for Palantir vary significantly. While some analysts issue "buy" recommendations with ambitious Palantir price targets, others maintain "hold" or even "sell" ratings. Understanding the rationale behind these differing opinions is key.

- Specific analyst ratings and associated price targets: A range of price targets exists, reflecting the wide spectrum of expectations regarding Palantir's future performance. The average price target, while useful, shouldn't be the sole determinant of investment decisions.

- Key arguments supporting bullish and bearish views: Bullish analysts often highlight Palantir's innovative technology and large addressable market. Bearish analysts might point to concerns about profitability, competition, or the company's dependence on government contracts.

- Comparison of analyst predictions with historical accuracy: It's vital to assess the historical accuracy of these analysts' predictions. Past performance, however, is not necessarily indicative of future results. Understanding this limitation when reviewing Palantir analyst ratings is crucial. The PLTR stock rating is dynamic and changes frequently based on market sentiment and financial performance. This necessitates ongoing monitoring of Palantir buy/sell recommendations.

Key Factors Influencing Analyst Opinions on Palantir

Several macro and micro factors significantly influence analyst opinions on Palantir. Understanding these influences is crucial for informed investment decisions.

- Impact of macroeconomic conditions: Inflation, interest rate hikes, and overall economic uncertainty affect the valuation of growth stocks like Palantir. These Palantir macroeconomic factors significantly influence investor sentiment.

- Competitive landscape analysis: Palantir faces competition from established players and emerging startups in the data analytics market. Analyzing the competitive landscape helps determine Palantir's market share and its ability to maintain its competitive edge.

- Success and challenges of new product launches: The success of new products like AIP (Artificial Intelligence Platform) and Foundry is vital for future growth. The challenges associated with market adoption and integration are important considerations.

- Long-term growth potential of the data analytics market: The overall growth potential of the data analytics market is a significant factor in assessing Palantir's long-term prospects. This relates directly to Palantir growth prospects and the sustainability of its business model. Understanding Palantir competition within this context is essential to a holistic Palantir market analysis.

Risks Associated with Investing in Palantir Before May 5th

Investing in Palantir involves significant risks. Before making any investment decision, it is crucial to consider these potential downsides.

- Potential for lower-than-expected earnings: Palantir's future earnings are subject to significant uncertainty. Lower-than-expected earnings could negatively impact the Palantir stock price.

- Risk of increased competition: The competitive landscape in the data analytics sector is dynamic. Increased competition could erode Palantir's market share and profitability.

- Impact of negative news or regulatory changes: Negative news or regulatory changes could trigger significant price volatility. PLTR stock volatility is a key risk factor to consider. Understanding the Palantir risk factors is essential for mitigating potential losses.

Conclusion

Analyst opinions on Palantir before May 5th are diverse, highlighting the need for thorough due diligence before making any investment decision. While some analysts are bullish on Palantir's future, citing strong technology and a large market, others express concerns about profitability and competition. The Palantir investment decision should be based on a comprehensive understanding of the company's financial performance, competitive landscape, and inherent risks.

While analyst opinions offer valuable insights, investing in Palantir before May 5th requires careful consideration of your own risk tolerance and investment goals. Conduct further research and make an informed decision based on your individual financial situation. Before making any investment in Palantir, remember to carefully assess the risks and opportunities involved. Learn more about Palantir and other investment opportunities! Remember to consider all aspects of Palantir investing and analyze PLTR stock analysis thoroughly before committing your capital. Understanding Palantir before May 5th requires a multifaceted approach.

Featured Posts

-

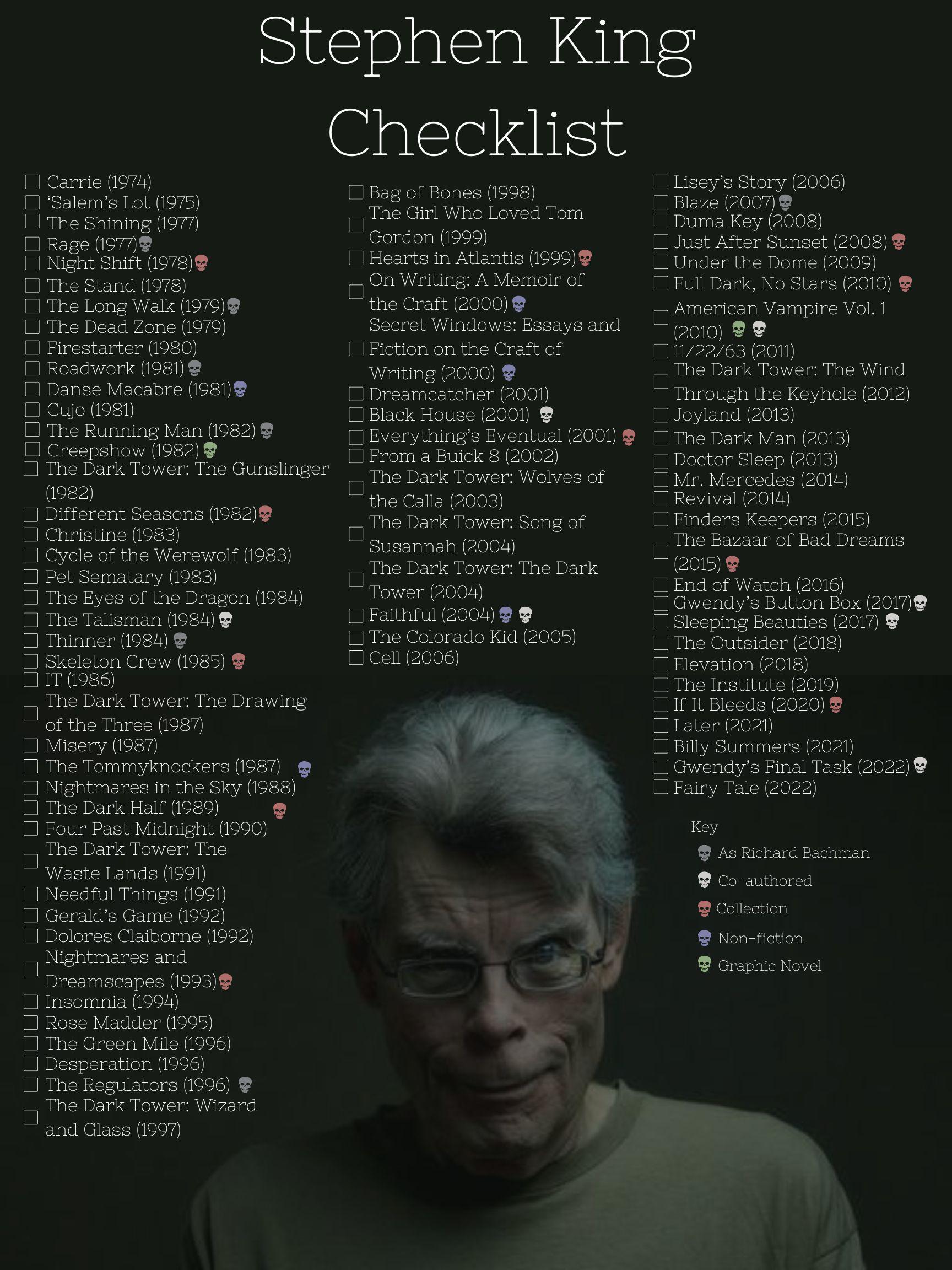

The Ultimate Stephen King Reading List 5 Books You Cant Miss

May 09, 2025

The Ultimate Stephen King Reading List 5 Books You Cant Miss

May 09, 2025 -

Fox News Hosts Clash Over Trumps Tariffs A Heated Exchange

May 09, 2025

Fox News Hosts Clash Over Trumps Tariffs A Heated Exchange

May 09, 2025 -

Is The Us Attorney Generals Daily Fox News Strategy Effective A Critical Analysis

May 09, 2025

Is The Us Attorney Generals Daily Fox News Strategy Effective A Critical Analysis

May 09, 2025 -

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025 -

Elon Musks 300 Billion Net Worth Milestone Broken Examining Teslas Recent Struggles

May 09, 2025

Elon Musks 300 Billion Net Worth Milestone Broken Examining Teslas Recent Struggles

May 09, 2025