Elon Musk's $300 Billion Net Worth Milestone Broken: Examining Tesla's Recent Struggles

Table of Contents

The Fall from Grace: Deconstructing Elon Musk's Net Worth Decline

Elon Musk's net worth, once a seemingly insurmountable peak, has plummeted considerably. This dramatic decrease is primarily attributed to the significant downturn in Tesla's stock price and the financial burden of his ambitious Twitter acquisition.

Tesla Stock Performance and Market Volatility:

The correlation between Tesla's stock performance and Elon Musk's net worth is undeniable. Tesla's stock price has experienced substantial volatility in recent times, leading to a considerable reduction in Musk's personal wealth.

- Factors contributing to the stock decline:

- Increased competition from established automakers and new EV startups.

- Global economic slowdown and concerns about reduced consumer spending.

- Production challenges and delays in meeting delivery targets.

- Elon Musk's controversial actions and statements impacting investor confidence.

- Data points: Between [Start Date] and [End Date], Tesla's stock price fell by [Percentage]%, resulting in a [Dollar Amount] decrease in market capitalization. This directly impacted Musk's net worth, reducing it by an estimated [Dollar Amount].

The Impact of Musk's Twitter Acquisition:

The acquisition of Twitter, now X, has placed a significant financial strain on Elon Musk. The massive debt incurred to finance the purchase, coupled with operational losses at the social media platform, has significantly impacted his personal wealth and negatively influenced investor sentiment toward Tesla.

- Financial burden and conflicts of interest: The acquisition cost [Dollar Amount], placing a significant burden on Musk's personal finances. Concerns about potential conflicts of interest between his roles at Tesla and X have also contributed to investor anxieties.

- Data points: Musk reportedly pledged Tesla shares as collateral for loans related to the Twitter acquisition, further exacerbating the link between his personal finances and Tesla's stock performance. The debt incurred is estimated at [Dollar Amount], impacting his overall net worth.

Examining Tesla's Operational Challenges

Beyond the impact of Elon Musk's personal ventures, Tesla itself is grappling with a number of operational challenges that contribute to its stock price volatility and, consequently, Musk's net worth.

Production Bottlenecks and Supply Chain Issues:

Tesla's ambitious production targets have been hampered by persistent supply chain disruptions and logistical hurdles. These challenges have resulted in production bottlenecks, impacting delivery times and overall profitability.

- Specific examples of production delays: Shortages of key components like battery cells and semiconductors have repeatedly caused delays in Tesla's production lines.

- Data points: Tesla's production numbers in [Year] fell short of projected targets by [Percentage]%, impacting revenue and profit margins.

Increasing Competition in the EV Market:

Tesla once enjoyed a near monopoly in the electric vehicle market, but the landscape has drastically changed. Established automakers and new EV startups are aggressively entering the market, posing a serious threat to Tesla's dominance.

- Key competitors and their market strategies: Companies like [Competitor 1], [Competitor 2], and [Competitor 3] are launching competitive EVs with advanced features and aggressive pricing strategies.

- Data points: Tesla's market share has decreased from [Percentage]% to [Percentage]% in the last [Time Period], highlighting the intensifying competition.

Negative Publicity and Brand Perception:

Negative publicity surrounding Elon Musk and his actions has undoubtedly affected Tesla's brand image and consumer confidence. Controversies and unpredictable pronouncements have created uncertainty and impacted sales.

- Examples of controversies and their impact: Various controversies surrounding Elon Musk have negatively influenced public perception of both him and Tesla.

- Data points: Brand perception surveys show a decline in positive sentiment towards Tesla following certain controversial events. Social media analytics reveal a shift in public opinion.

Conclusion:

The dramatic decline in Elon Musk's net worth is intricately linked to the multifaceted challenges facing Tesla. Factors such as decreased Tesla stock prices, the financial burden of the Twitter acquisition, production bottlenecks, intensifying competition, and negative publicity all play significant roles. The interconnectedness between Musk's personal wealth and Tesla's performance remains a crucial factor in understanding this financial rollercoaster.

Call to Action: Follow the ongoing saga of Elon Musk's net worth and its correlation with Tesla’s performance. Stay updated on Tesla's strategies to overcome its challenges and learn more about the future of the electric vehicle market by visiting [Link to Tesla Investor Relations] and following reputable financial news sources. Understanding the dynamic interplay between Elon Musk's net worth and Tesla's success is crucial for navigating the ever-evolving landscape of the electric vehicle industry.

Featured Posts

-

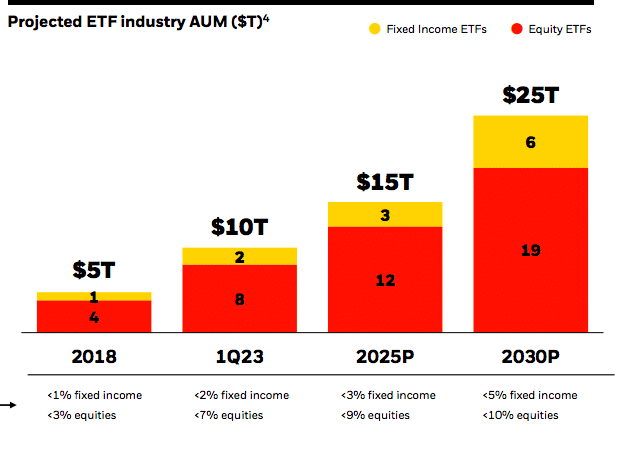

110 Potential Gains Analyzing The Black Rock Etf Billionaires Are Investing In

May 09, 2025

110 Potential Gains Analyzing The Black Rock Etf Billionaires Are Investing In

May 09, 2025 -

10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights Bantuan Dan Sokongan Dihulurkan

May 09, 2025

10 Adn Pas Selangor Bantu Mangsa Tragedi Putra Heights Bantuan Dan Sokongan Dihulurkan

May 09, 2025 -

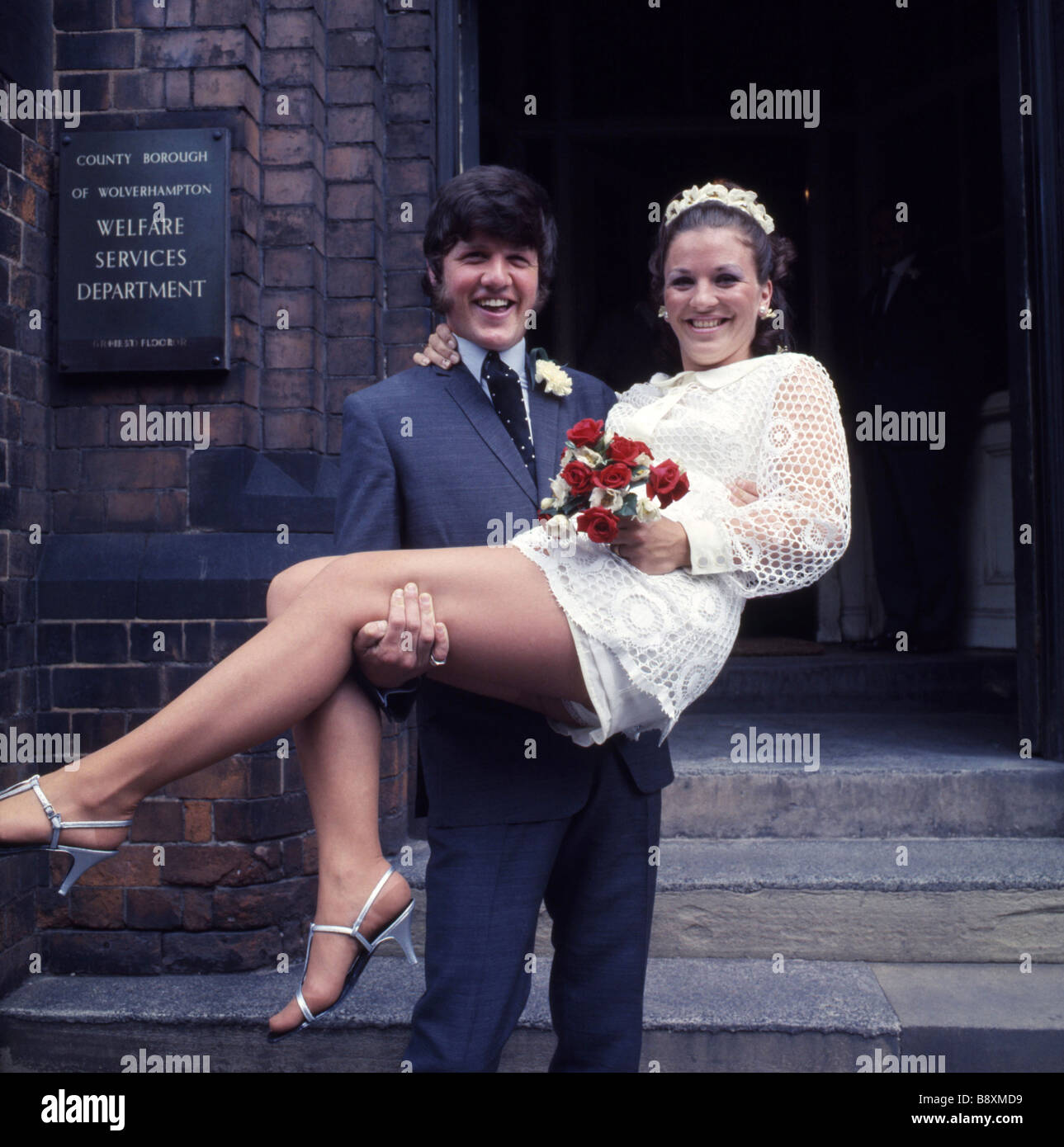

His Rise To The Top A Footballers Journey After Wolves

May 09, 2025

His Rise To The Top A Footballers Journey After Wolves

May 09, 2025 -

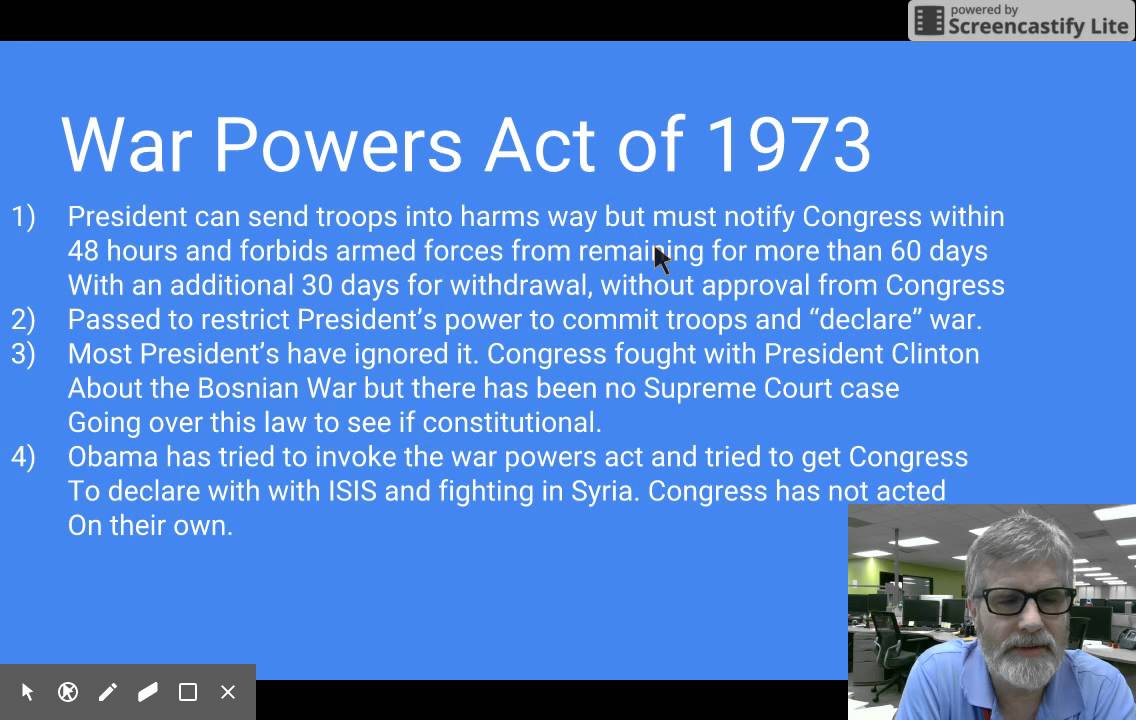

Examining The Context Of Pam Bondis Statements On Killing American Citizens

May 09, 2025

Examining The Context Of Pam Bondis Statements On Killing American Citizens

May 09, 2025 -

Analyzing Abcs March 2025 Schedule Focus On High Potential Reruns

May 09, 2025

Analyzing Abcs March 2025 Schedule Focus On High Potential Reruns

May 09, 2025