Investing In Apple (AAPL): Identifying Crucial Price Levels

Table of Contents

Understanding Apple's Stock Performance History

Analyzing Apple's past performance is crucial for predicting future price movements and identifying potential turning points in investing in Apple (AAPL). Examining historical price trends reveals patterns that can indicate future support and resistance levels. Major highs and lows often correspond with significant market events.

- Significant price increases: The launch of the iPhone X in 2017, for instance, triggered a substantial surge in AAPL's stock price, reflecting strong consumer demand and positive market sentiment. This event highlights the importance of monitoring product release cycles when considering AAPL investing strategies.

- Price drops correlated with global economic slowdowns: During periods of global economic uncertainty, such as the initial stages of the COVID-19 pandemic, Apple's stock price, like many tech stocks, experienced a downturn. This emphasizes the influence of macroeconomic factors on investing in Apple (AAPL).

- Impact of supply chain disruptions: Supply chain issues, as witnessed in recent years, can significantly impact Apple's production and consequently its stock price. Understanding these potential risks is vital for any investor considering Apple stock investment.

Identifying Key Support and Resistance Levels

In the context of investing in Apple (AAPL), support and resistance levels represent price ranges where buying and selling pressure tends to be strongest. Support levels are prices where the stock is likely to find buyers and bounce back, while resistance levels are prices where selling pressure is strong, potentially causing price declines.

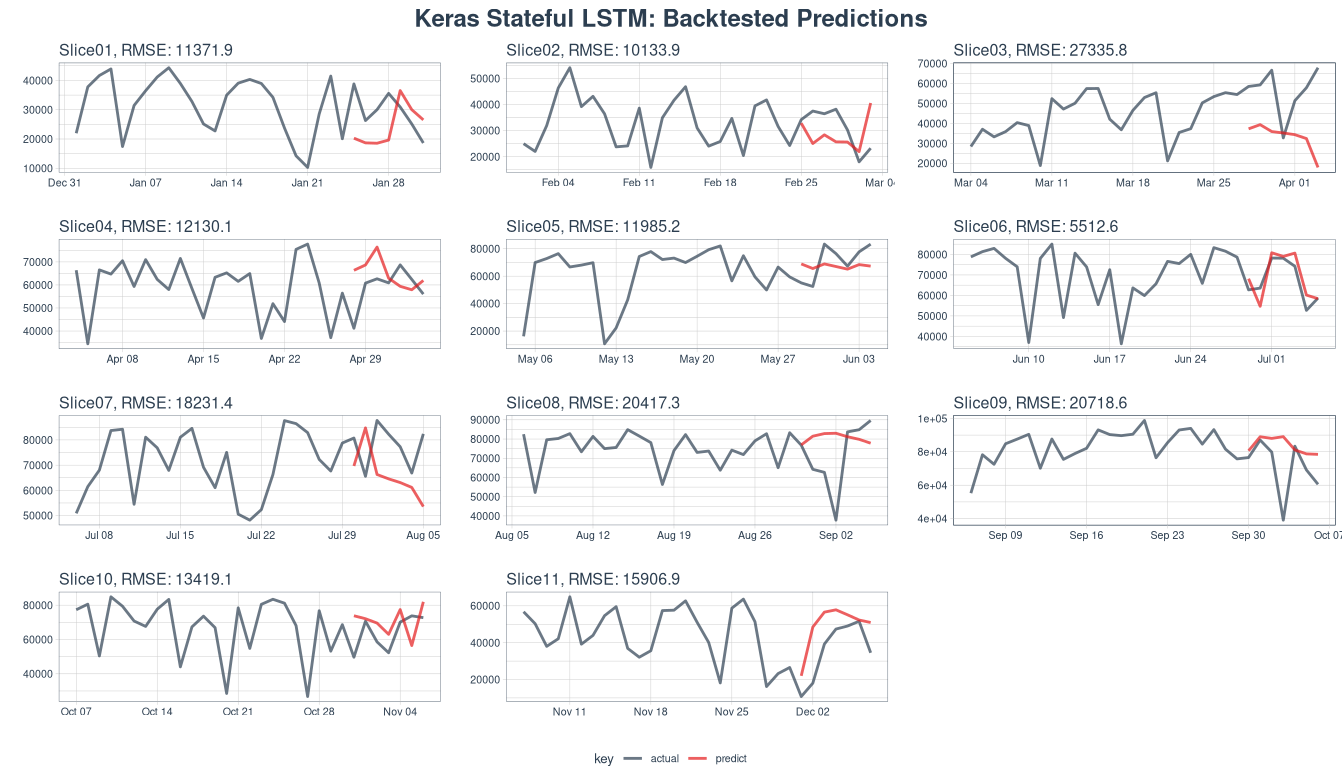

A chart illustrating Apple's historical price action clearly shows these levels. Identifying these levels involves analyzing past price data. Technical indicators can significantly enhance this analysis:

- Identifying a strong support level: A strong support level is often identified by observing multiple instances where the price has bounced back from a specific price point.

- Using moving averages: Moving averages, like the 50-day and 200-day moving averages, can act as dynamic support and resistance levels, providing confirmation of price trends.

- Interpreting Fibonacci retracement levels: Fibonacci retracement levels provide potential support and resistance levels based on mathematical ratios, offering another tool for analysis in investing in Apple (AAPL).

The Role of Fundamental Analysis in AAPL Investing

While technical analysis, such as identifying support and resistance in investing in Apple (AAPL), focuses on price charts, fundamental analysis delves into the company's financial health. This involves analyzing key financial metrics:

- Analyzing Apple's revenue streams: Understanding the contribution of various product lines (iPhone, Mac, Services, etc.) to Apple's overall revenue is essential. Shifting revenue streams can significantly impact future price movements.

- Interpreting Apple's earnings reports: Quarterly earnings reports provide insights into Apple's profitability and future growth prospects, directly influencing its stock price.

- The significance of Apple's cash reserves and debt levels: A strong balance sheet with substantial cash reserves and manageable debt indicates financial stability, a positive factor for long-term AAPL stock investment. The P/E ratio and EPS growth also play a crucial role.

Risk Management Strategies for AAPL Investments

Effective risk management is paramount in investing in Apple (AAPL) or any stock. Several strategies can help mitigate potential losses:

- Using stop-loss orders: Stop-loss orders automatically sell your shares when the price drops to a predetermined level, limiting potential losses.

- Diversifying your portfolio: Don't put all your eggs in one basket. Diversify your investments across different asset classes to reduce the impact of any single stock's underperformance.

- Long-term investment strategy: A long-term investment horizon can help you weather short-term market fluctuations and benefit from Apple's long-term growth potential. This is a key aspect of successful Apple stock investing.

Conclusion: Making Informed Decisions about Investing in Apple (AAPL)

Successfully investing in Apple (AAPL) involves a multifaceted approach. Understanding Apple's historical stock performance, identifying crucial price levels (support and resistance), conducting thorough fundamental analysis, and implementing effective risk management strategies are all critical components. By utilizing the information provided in this guide, you can make more informed decisions regarding your Apple investments. Remember to conduct further research, consult financial professionals, and stay updated on market trends to refine your approach to investing in Apple (AAPL) and identifying crucial price levels for optimal results.

Featured Posts

-

Planning Your Memorial Day Trip 2025 Flight Demand Predictions

May 25, 2025

Planning Your Memorial Day Trip 2025 Flight Demand Predictions

May 25, 2025 -

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 25, 2025

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 25, 2025 -

French Cac 40 Index Negative Close On Friday Stable Weekly Performance

May 25, 2025

French Cac 40 Index Negative Close On Friday Stable Weekly Performance

May 25, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekenen De Bewegingen Voor Beleggers

May 25, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekenen De Bewegingen Voor Beleggers

May 25, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 25, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 25, 2025

Latest Posts

-

F1 Wolffs Response To Russells Underrated Comment Sparks Debate

May 25, 2025

F1 Wolffs Response To Russells Underrated Comment Sparks Debate

May 25, 2025 -

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025 -

Southern Vacation Destination Addresses Safety Concerns Following Shooting Incident

May 25, 2025

Southern Vacation Destination Addresses Safety Concerns Following Shooting Incident

May 25, 2025 -

Toto Wolff Responds To George Russells Underrated Claims

May 25, 2025

Toto Wolff Responds To George Russells Underrated Claims

May 25, 2025 -

Formula 1 Mertsedes So Kazni Pred Trkata Vo Bakhrein

May 25, 2025

Formula 1 Mertsedes So Kazni Pred Trkata Vo Bakhrein

May 25, 2025