Interpreting The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the NAV and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

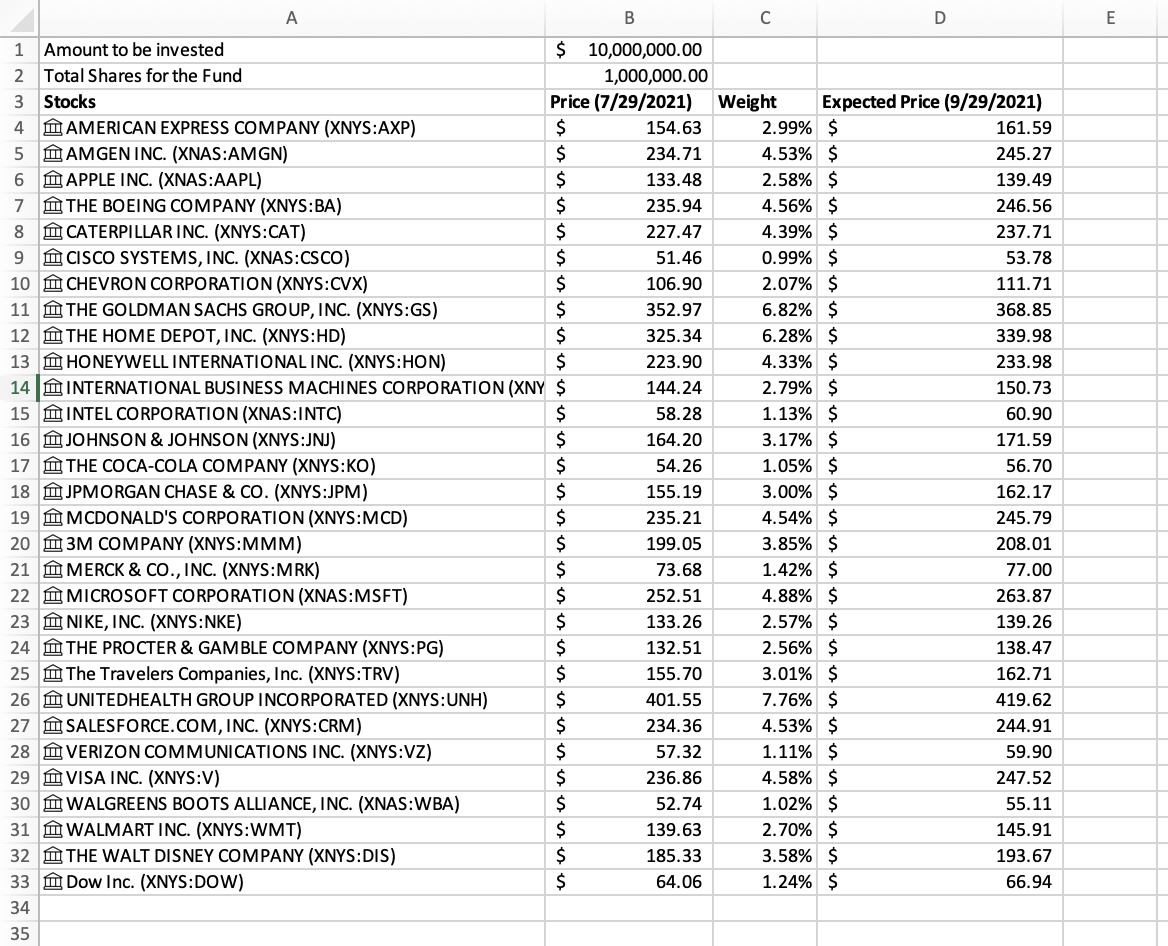

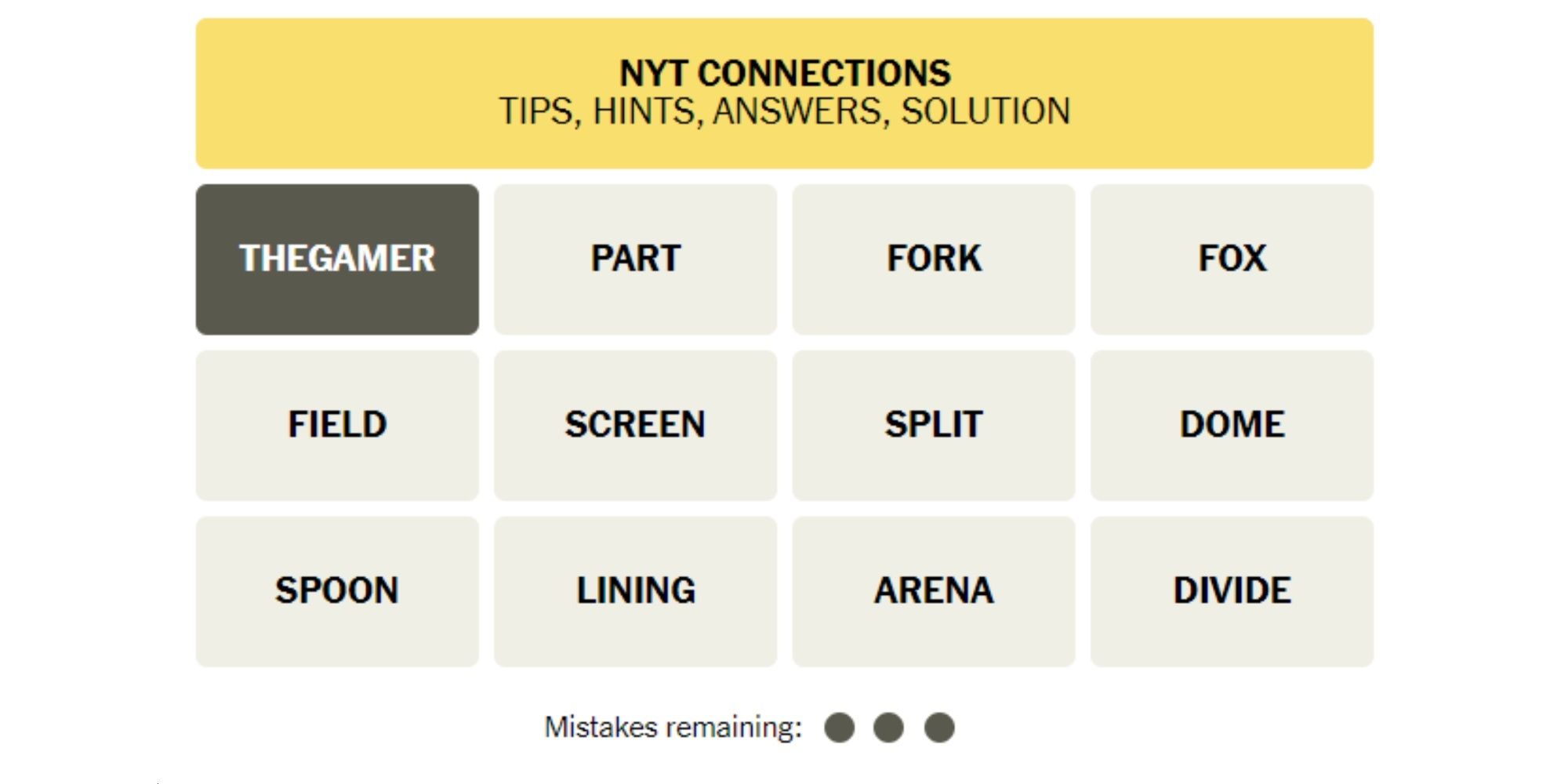

The Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this calculation reflects the collective value of its holdings. The basic formula is:

NAV = Total Assets - Total Liabilities

Let's break down the components:

Total Assets: This primarily includes the ETF's holdings in the 30 constituent companies of the Dow Jones Industrial Average. The value of these holdings fluctuates daily based on the market price of each company's stock. Additionally, total assets include any cash reserves the ETF holds.

Total Liabilities: This encompasses the ETF's expenses, including management fees and other operational costs. These are deducted from the total assets to arrive at the net asset value.

The NAV is calculated daily, typically at the close of the market, and is then published by Amundi and various financial data providers. Several key factors influence NAV fluctuations:

- Changes in the underlying Dow Jones Industrial Average index: The ETF's performance is directly tied to the index's movement. An increase in the index generally results in a higher NAV, and vice versa.

- Currency fluctuations: If the ETF holds assets denominated in currencies other than the ETF's base currency, exchange rate changes can impact the NAV.

- Dividend payments received by the ETF: When the underlying companies pay dividends, the ETF receives these payments, increasing its assets and potentially its NAV.

- Management fees: These fees are deducted from the ETF's assets, reducing the NAV. They represent a recurring cost of owning the ETF.

Keywords: NAV calculation, Amundi Dow Jones Industrial Average UCITS ETF assets, ETF liabilities, Dow Jones Industrial Average components

Interpreting NAV Changes: What do fluctuations mean for investors?

Understanding NAV changes is key to assessing the Amundi Dow Jones Industrial Average UCITS ETF's performance. A positive NAV change indicates an increase in the value of the ETF's underlying assets, reflecting positive market performance. Conversely, a negative change signifies a decrease in value.

The NAV is closely related to the ETF's share price, although a small tracking error might exist. This difference arises from trading costs and other market inefficiencies. However, the NAV provides a reliable indicator of the ETF’s intrinsic value.

Let's look at different NAV scenarios:

- Significant increase in NAV: This usually suggests strong performance of the Dow Jones Industrial Average and the companies within it.

- Slight decrease in NAV: This could reflect a minor correction in the market or temporary weakness in the Dow Jones Industrial Average.

- No change in NAV: This indicates that the value of the ETF's holdings remained relatively stable during the period.

It’s important to compare the current NAV to previous days' NAVs and to the Dow Jones Industrial Average's performance to gauge the ETF's tracking efficiency.

Keywords: NAV interpretation, ETF price, market performance, tracking error, Dow Jones Industrial Average performance

Using NAV to Make Informed Investment Decisions

Investors can use NAV data to assess the ETF's performance relative to the Dow Jones Industrial Average. Consistent monitoring allows investors to evaluate the ETF's tracking ability and identify any significant deviations. While NAV is crucial, it's essential to consider it alongside other performance indicators, such as expense ratios and historical performance, for a comprehensive analysis. Long-term NAV trends often provide a more accurate reflection of the ETF's performance than short-term fluctuations. Focusing on long-term growth is often a more effective strategy.

Keywords: Investment decisions, ETF performance, long-term investment, Dow Jones Industrial Average tracking

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is readily available from several sources:

- Amundi's website: The fund manager's official website is the primary source for accurate and up-to-date NAV information.

- Financial news websites: Reputable financial news sources often provide real-time or delayed NAV data for major ETFs.

- Brokerage platforms: If you hold the ETF through a brokerage account, the NAV will typically be displayed on your account statement or portfolio overview.

Always ensure you use reliable sources to avoid inaccurate information.

Keywords: NAV data, Amundi website, financial news, brokerage platforms, data providers

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi Dow Jones Industrial Average UCITS ETF Investments

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for informed investment decisions. We've covered how the NAV is calculated, how to interpret its fluctuations, and where to find reliable NAV data. By regularly monitoring the NAV and considering its implications alongside other market indicators, you can optimize your portfolio and make well-informed choices regarding your Amundi Dow Jones Industrial Average UCITS ETF investments. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF investment by regularly checking its NAV. Understanding its fluctuations is key to successful long-term investing. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, NAV, Net Asset Value, portfolio optimization, informed investment

Featured Posts

-

Tisice Prepustenych Analyza Krizy Na Nemeckom Pracovnom Trhu

May 25, 2025

Tisice Prepustenych Analyza Krizy Na Nemeckom Pracovnom Trhu

May 25, 2025 -

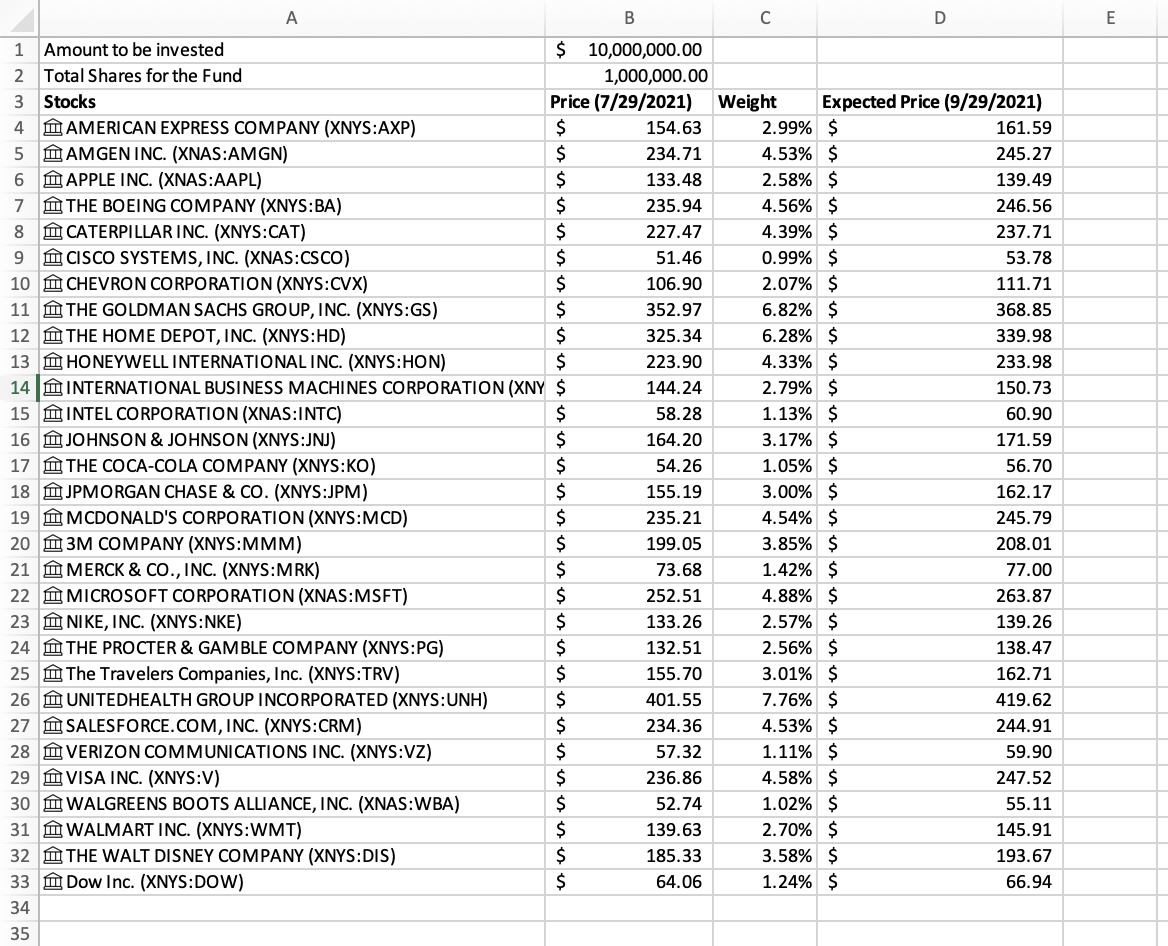

Solve Nyt Connections Puzzle 646 March 18 2025 Hints And Answers

May 25, 2025

Solve Nyt Connections Puzzle 646 March 18 2025 Hints And Answers

May 25, 2025 -

M62 Motorway Closure Westbound Resurfacing From Manchester To Warrington

May 25, 2025

M62 Motorway Closure Westbound Resurfacing From Manchester To Warrington

May 25, 2025 -

West Ham Eyeing Kyle Walker Peters Transfer Update

May 25, 2025

West Ham Eyeing Kyle Walker Peters Transfer Update

May 25, 2025 -

The Bury M62 Relief Road A Forgotten Plan

May 25, 2025

The Bury M62 Relief Road A Forgotten Plan

May 25, 2025

Latest Posts

-

Amsterdam Stock Market 2 Decline In Response To Trumps Tariffs

May 25, 2025

Amsterdam Stock Market 2 Decline In Response To Trumps Tariffs

May 25, 2025 -

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 25, 2025

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 25, 2025 -

Amsterdam Exchange Down 2 Following Latest Us Tariff Announcement

May 25, 2025

Amsterdam Exchange Down 2 Following Latest Us Tariff Announcement

May 25, 2025 -

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 25, 2025

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 25, 2025 -

Aex Index Amsterdam Stock Market Experiences Steepest Fall In Over A Year

May 25, 2025

Aex Index Amsterdam Stock Market Experiences Steepest Fall In Over A Year

May 25, 2025