Amsterdam Stock Market: 2% Decline In Response To Trump's Tariffs

Table of Contents

Impact of Trump Tariffs on Dutch Businesses

The Trump tariffs are already having a tangible effect on Dutch businesses, as reflected in the 2% decline of the Amsterdam Stock Market. Several key sectors are bearing the brunt of this trade war.

Specific Sectors Affected

The agricultural sector, a significant contributor to the Netherlands' economy, is among the hardest hit. The technology and manufacturing sectors are also facing considerable challenges.

- Agriculture: Dairy farmers are experiencing reduced export opportunities to the US, impacting companies like FrieslandCampina, whose stock price saw a 1.5% decrease today.

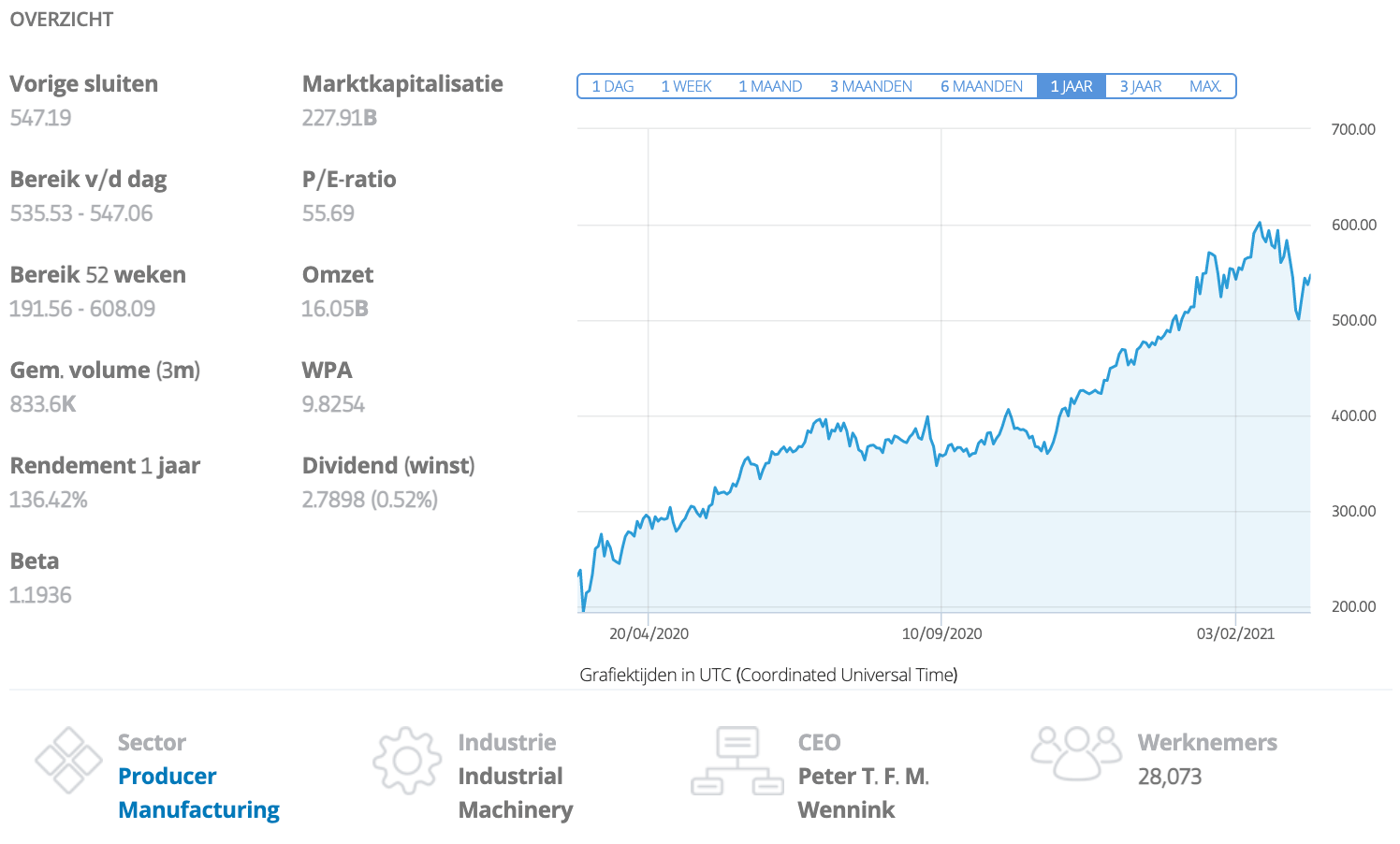

- Technology: Dutch technology firms reliant on US components face increased production costs, potentially impacting their competitiveness. ASML Holding, a major semiconductor equipment manufacturer, saw a 0.8% drop in its share price.

- Manufacturing: Companies involved in the production of goods for the US market face increased tariffs on their exports, squeezing profit margins. Examples include various smaller manufacturing firms whose stocks experienced a collective decline of approximately 1%.

Expert Opinion: "The Trump tariffs represent a significant threat to the Dutch economy," commented Dr. Eva van der Horst, chief economist at ABN AMRO. "The impact on the Amsterdam Stock Market is a clear reflection of the immediate anxieties felt by investors."

Supply Chain Disruptions

The tariffs are causing significant disruptions to supply chains, leading to increased costs and reduced profitability for Dutch businesses.

- Increased Shipping Costs: Tariffs increase the cost of importing raw materials and exporting finished goods, impacting companies' bottom lines.

- Delayed Deliveries: Increased customs checks and bureaucratic hurdles lead to longer shipping times, potentially disrupting production schedules.

- Search for Alternative Suppliers: Businesses are forced to search for alternative suppliers outside the US, adding complexity and potentially impacting quality. This adds up to approximately a 3-5% projected increase in production costs for many Dutch manufacturers.

Investor Sentiment and Market Volatility

The tariff announcement has significantly dampened investor confidence in the Amsterdam Stock Market, contributing to the 2% decline.

Decline in Investor Confidence

The uncertainty surrounding the long-term effects of the tariffs has led to a decrease in trading volumes and an increase in market volatility.

- Decreased Trading Volumes: Investors are adopting a wait-and-see approach, leading to lower trading activity on the Amsterdam Stock Exchange.

- Increased Market Volatility: The uncertainty surrounding the future economic landscape is fueling market volatility, making it difficult for investors to make informed decisions.

- Potential Capital Flight: Some investors may be moving their investments to other, perceived safer, markets, contributing to the decline in the Amsterdam Stock Market. The Amsterdam Exchange's volatility index (AEX VIX) increased by 15% today reflecting increased uncertainty.

Global Market Reaction

The ripple effect of Trump's tariffs is felt worldwide, and the Amsterdam Stock Market is not immune.

- Other major European stock markets also experienced declines, albeit less pronounced than the Amsterdam Stock Market.

- The performance of the Amsterdam Stock Market closely mirrors the trends observed in other export-oriented economies, indicating a broad global impact.

- A comparison of the Amsterdam Stock Exchange index (AEX) to other global indices, such as the Dow Jones and FTSE 100, shows a stronger negative correlation than usual.

Potential Long-Term Effects on the Amsterdam Stock Market

The long-term impact of the Trump tariffs on the Amsterdam Stock Market and the Dutch economy remains uncertain, but several potential scenarios exist.

Economic Growth Projections

The revised GDP growth projections for the Netherlands have been downgraded by most leading financial institutions, further impacting the Amsterdam Stock Market.

- Best-Case Scenario: A swift resolution to the trade dispute and the implementation of effective mitigation strategies by the Dutch government could minimize the long-term economic impact.

- Worst-Case Scenario: A prolonged trade war could lead to a significant decline in economic growth and a prolonged period of uncertainty for the Amsterdam Stock Market.

- Most Likely Scenario: A moderate slowdown in economic growth and a period of adjusted economic strategies is most likely, potentially resulting in a slow recovery for the Amsterdam Stock Market. GDP growth projections for the Netherlands have been reduced by 0.5% for the next year.

Government Response and Mitigation Strategies

The Dutch government is expected to take steps to mitigate the negative impacts of the tariffs.

- Subsidies for Affected Industries: Targeted subsidies could help Dutch businesses overcome the increased costs resulting from tariffs.

- New Trade Agreements: The government may seek to diversify trade relationships and negotiate new trade agreements to reduce reliance on the US market.

- Investment in Innovation and Diversification: Encouraging innovation and diversification can help Dutch businesses become less vulnerable to future trade disruptions.

Conclusion: Navigating the Uncertainty in the Amsterdam Stock Market After Tariff Announcement

The 2% decline in the Amsterdam Stock Market directly reflects the immediate impact of Trump’s tariffs. The agricultural, technology, and manufacturing sectors are particularly vulnerable, experiencing supply chain disruptions and increased production costs. Investor confidence has waned, leading to increased market volatility and potential capital flight. The long-term effects on the Dutch economy and the Amsterdam Stock Market remain uncertain, depending on the duration of the trade war and the effectiveness of government responses. The impact of Trump tariffs on the Amsterdam Stock Market demands close monitoring. Stay tuned for further updates on the Amsterdam Stock Market and consult with a financial advisor to navigate this period of uncertainty.

Featured Posts

-

Krijgt De Recente Marktdraai Tussen Europese En Amerikaanse Aandelen Een Vervolg

May 25, 2025

Krijgt De Recente Marktdraai Tussen Europese En Amerikaanse Aandelen Een Vervolg

May 25, 2025 -

Amsterdam Exchange Aex Index Suffers Significant Losses

May 25, 2025

Amsterdam Exchange Aex Index Suffers Significant Losses

May 25, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekenen De Bewegingen Voor Beleggers

May 25, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekenen De Bewegingen Voor Beleggers

May 25, 2025 -

My Experience Waiting By The Phone

May 25, 2025

My Experience Waiting By The Phone

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025