Individual Investors Vs. Professionals: Who Wins During Market Swings?

Table of Contents

Emotional vs. Rational Decision-Making

The Individual Investor's Emotional Rollercoaster

Individual investors are often significantly influenced by their emotions – fear and greed, primarily – leading to impulsive buying and selling decisions during market volatility. This emotional response frequently leads to suboptimal investment outcomes, underperforming market benchmarks.

- Panic selling: During market downturns, fear can trigger panic selling, locking in losses at the worst possible time.

- Chasing hot tips: The allure of quick profits can lead individuals to chase speculative investments based on unreliable information, increasing risk exposure.

- Overreacting to news: Short-term market fluctuations and news headlines often cause emotional reactions, leading to rash decisions that contradict long-term investment goals.

The Professional's Disciplined Approach

Professional money managers, in contrast, employ a more analytical and disciplined approach to investing. They rely heavily on data, sophisticated financial models, and robust risk management strategies, minimizing emotional influence on their decision-making.

- Diversification: Professionals typically diversify portfolios across various asset classes (stocks, bonds, real estate, etc.) and geographies to mitigate risk.

- Hedging techniques: They may utilize hedging strategies to protect against potential losses during market downturns.

- Long-term investment horizons: Professionals generally focus on long-term growth, weathering short-term market fluctuations without deviating from their investment plans.

- Adherence to a plan: A well-defined investment strategy, based on thorough research and risk assessment, guides their decisions, irrespective of short-term market noise.

Access to Resources and Expertise

The Individual Investor's Limitations

Individual investors often face significant limitations in accessing the resources and expertise available to professionals.

- Limited research tools: Access to sophisticated research tools, comprehensive market data, and advanced analytical platforms is often restricted.

- Publicly available information: Reliance on publicly available information, which can be incomplete, biased, or misleading, hinders informed decision-making.

- Lack of time and expertise: Many individual investors lack the time or specialized knowledge needed to conduct thorough due diligence on investments.

The Professional's Advantage

Professional money managers benefit from considerable advantages in terms of resources and expertise.

- Exclusive research: Access to proprietary research, in-depth market analysis, and exclusive data provides a significant informational advantage.

- Expert teams: Teams of specialized analysts, portfolio managers, and risk managers contribute diverse perspectives and expertise.

- Advanced tools: Sophisticated trading platforms, algorithmic trading systems, and advanced analytical tools enhance efficiency and decision-making.

Performance During Market Swings: Data and Analysis

Historical Performance Comparisons

Numerous studies comparing the average performance of individual investors and professional money managers across various market cycles reveal that professional managers often outperform individual investors over the long term, particularly during periods of high volatility. For instance, a Dalbar study consistently shows individual investors significantly underperform market averages due to emotional decision-making. However, it's crucial to note that this is a generalization, and individual results can vary widely.

Factors Influencing Performance

It's important to acknowledge that the performance difference isn't solely attributed to the "professional vs. individual" dichotomy. Other crucial factors include:

- Investment strategy: The type of investment strategy employed (value, growth, passive, active) significantly impacts performance.

- Risk tolerance: Higher risk tolerance may lead to higher returns but also increased volatility.

- Market conditions: Broad market trends and economic conditions play a substantial role in investment outcomes for both groups.

- Fees and expenses: High management fees and transaction costs can significantly eat into overall returns for both individual and professional investors.

Strategies for Success: Lessons for Both Groups

For Individual Investors

Individual investors can significantly improve their investment outcomes by adopting the following strategies:

- Long-term investing: Focus on long-term growth rather than short-term gains.

- Diversification: Spread investments across various asset classes to reduce risk.

- Professional advice: Consider seeking guidance from a qualified financial advisor.

- Low-cost index funds/ETFs: Utilize these for broad market exposure and low expense ratios.

- Emotional discipline: Avoid impulsive reactions to market noise and stick to a well-defined investment plan.

For Professional Investors

Professional investors should prioritize the following:

- Robust risk management: Continuously refine risk management strategies to adapt to evolving market conditions.

- Transparency and communication: Maintain open and honest communication with clients about investment performance and strategies.

- Adaptation and innovation: Embrace technological advancements and adapt strategies to changing market dynamics.

- Ethical considerations: Uphold the highest ethical standards and act in the best interests of clients.

Conclusion

While individual investors can achieve investment success, historical data and analysis suggest professional money managers generally navigate market swings more effectively due to their access to resources, disciplined approach, and expertise in risk management. However, individual investors can significantly improve their performance by adopting a long-term perspective, diversifying their portfolios, and seeking professional guidance when needed. The question of "who wins" ultimately depends on individual approach, circumstances, and risk tolerance. By understanding the strengths and weaknesses of each approach, both individual and professional investors can make more informed decisions and enhance their chances of success during inevitable market swings. Consider consulting a financial advisor to tailor your investment strategy to your specific needs and risk profile. Remember, a well-defined investment strategy and careful planning are essential, regardless of whether you're an individual or professional investor.

Featured Posts

-

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 28, 2025

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 28, 2025 -

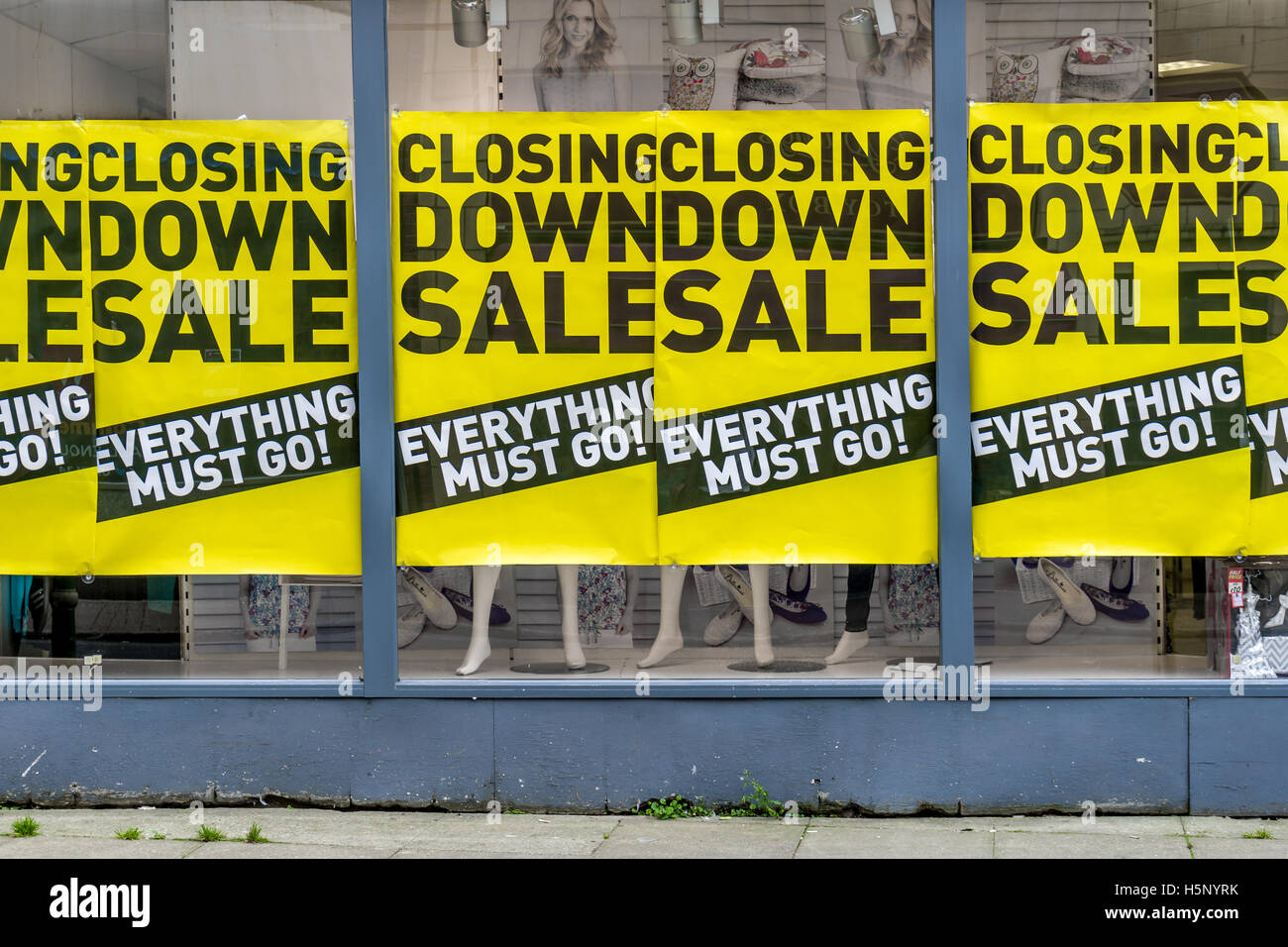

Closing Down Sale Hudsons Bay Offers Up To 70 Off

Apr 28, 2025

Closing Down Sale Hudsons Bay Offers Up To 70 Off

Apr 28, 2025 -

U S Dollars Weak Start Worst 100 Days Since Nixon

Apr 28, 2025

U S Dollars Weak Start Worst 100 Days Since Nixon

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Americas Growing Truck Problem Finding The Right Antidote

Apr 28, 2025

Americas Growing Truck Problem Finding The Right Antidote

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

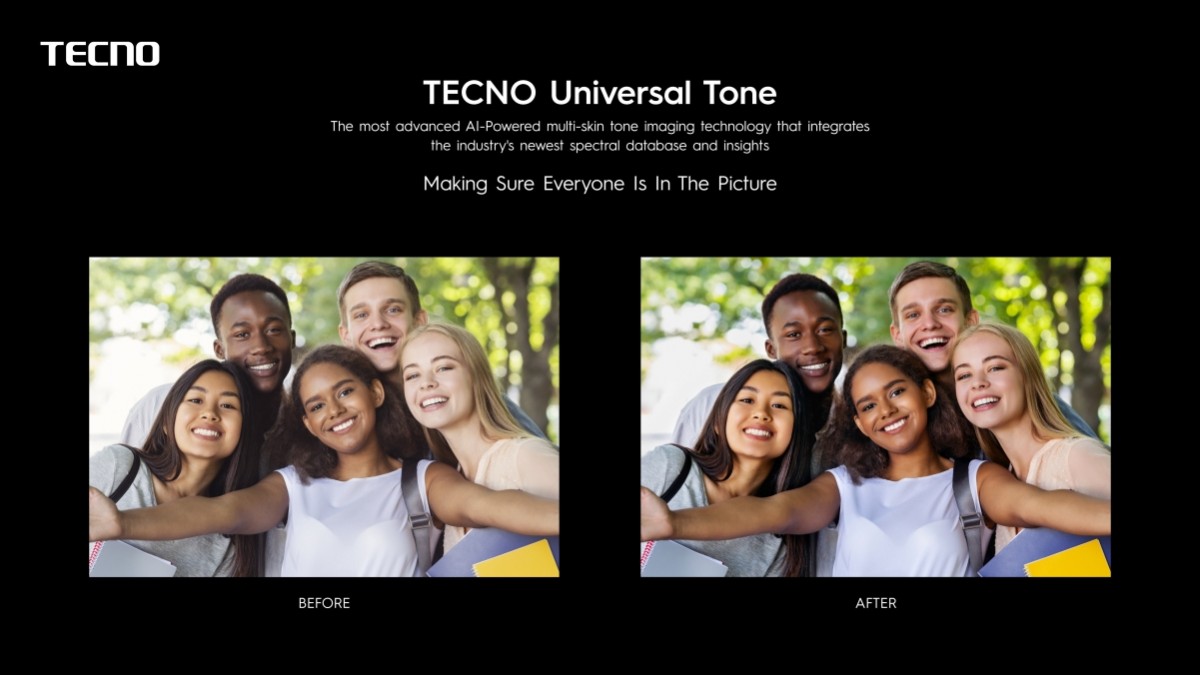

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025