India's Greenko: Founders Seek New Deal For Orix Stake Acquisition

Table of Contents

The Original Greenko-ORIX Deal and its Challenges

The initial agreement between Greenko and ORIX involved ORIX selling a significant stake in Greenko Group. While the exact percentage and initial acquisition price remain undisclosed publicly, it's understood the deal encountered several significant challenges that led to the current renegotiation.

These challenges stemmed from a confluence of factors:

- Valuation Discrepancies: Disagreements arose regarding the fair valuation of Greenko's assets, a common hurdle in complex private equity transactions involving renewable energy assets in India. The fluctuating market conditions and the future projections of the renewable energy sector added to the complexity.

- Financing Hurdles: Securing the necessary financing for such a large acquisition, especially in the current financial climate, presented a significant challenge. Finding suitable lenders willing to finance a deal of this magnitude in India's renewable energy space required intricate negotiations.

- Regulatory Issues: Navigating the complexities of Indian regulatory frameworks related to foreign investment and renewable energy projects likely added to the delays and difficulties. The approvals and clearances required for such a significant transaction involving foreign entities can be lengthy and intricate.

Bullet Points:

- ORIX held a substantial stake, although the precise percentage hasn't been publicly disclosed.

- The proposed initial acquisition price was reportedly significantly high, leading to the need for renegotiation.

- Regulatory approvals, particularly those concerning foreign direct investment (FDI) in the Indian renewable energy sector, faced unforeseen delays.

- Disagreements centered around the valuation of Greenko's extensive renewable energy portfolio, impacting the deal's viability.

The Founders' Pursuit of a Revised Deal

Faced with the challenges of the original agreement, Greenko's founders have actively pursued a revised deal with ORIX. This involves exploring different strategies to make the acquisition more palatable to all parties involved.

This renegotiation likely includes:

- Revised Terms: The proposed revised terms likely involve adjustments to the acquisition price, payment schedules, and other contractual conditions to reflect the changed circumstances and valuations.

- Financing Restructuring: The founders are probably exploring alternative financing options, potentially involving a mix of debt and equity from different sources, including domestic and international financial institutions specializing in renewable energy finance in India.

- Involvement of Other Investors: To mitigate risk and enhance the deal's appeal, Greenko might be seeking participation from other strategic investors or private equity firms experienced in the Indian renewable energy sector.

- Impact on Debt Structure: The revised deal will undoubtedly have an impact on Greenko's overall debt structure, potentially leading to refinancing or a restructuring of existing debt obligations.

Bullet Points:

- The revised terms are expected to include a lower acquisition price and possibly a phased payment structure.

- New financing partners might include Indian banks or specialized renewable energy funds.

- The involvement of other investors could dilute the ownership of Greenko’s founders but could also secure the deal.

- The renegotiation process aims to optimize Greenko's capital structure and improve its financial stability.

Impact on India's Renewable Energy Landscape

The outcome of the Greenko-ORIX deal will significantly influence India's renewable energy landscape. A successful acquisition strengthens Greenko's position, enabling it to accelerate its expansion plans and contribute further to India's renewable energy targets. However, a failure could create uncertainty in the market and potentially deter future foreign investment in this vital sector.

Bullet Points:

- A successful acquisition could lead to significant job creation within Greenko and its supply chain.

- Greenko's expansion plans, including new projects and technological advancements, depend heavily on this deal.

- The deal's success or failure could impact India's commitment to achieving its ambitious renewable energy goals.

- Competitors in the Indian renewable energy market will keenly observe the outcome and adjust their strategies accordingly.

Financial Implications and Market Reaction

The financial implications are considerable for both Greenko and ORIX. For Greenko, a successful acquisition strengthens its financial position and allows for further growth. For ORIX, a successful sale represents a positive return on their investment. However, a failed deal could negatively affect both companies' valuations.

Bullet Points:

- Greenko's stock performance (if publicly traded) would be directly affected by the outcome of these negotiations.

- Credit rating agencies will closely monitor the deal's progress and may adjust their assessments accordingly.

- The outcome of the deal will significantly influence investor confidence in the Indian renewable energy sector.

- The potential risks and rewards are substantial for both parties, impacting their financial outlook and strategic positioning.

Conclusion

The Greenko-ORIX stake acquisition negotiations highlight the complexities and dynamism of India’s renewable energy investment landscape. The initial deal faced challenges related to valuation, financing, and regulatory issues, prompting a renegotiation. The revised deal's outcome will have significant implications for Greenko's growth, India's renewable energy targets, and investor confidence. The successful completion of this acquisition would signal a significant vote of confidence in India's burgeoning renewable energy sector, attracting further investment from both domestic and international players.

Call to Action: The Greenko-ORIX deal exemplifies the complexities and dynamism of India’s renewable energy investment landscape. Stay tuned for further updates on this significant acquisition and its impact on the future of Greenko and the broader renewable energy market in India. Follow us for ongoing coverage of the Greenko acquisition and other key developments in the Indian renewable energy sector.

Featured Posts

-

Thibodeau Blasts Refs After Knicks Game 2 Defeat

May 17, 2025

Thibodeau Blasts Refs After Knicks Game 2 Defeat

May 17, 2025 -

How The Ultra Wealthy Are Weathering Economic Storms Through Luxury Property

May 17, 2025

How The Ultra Wealthy Are Weathering Economic Storms Through Luxury Property

May 17, 2025 -

Unpaid Role Unsettled Debt Tom Cruise And Tom Hanks 1 Obligation

May 17, 2025

Unpaid Role Unsettled Debt Tom Cruise And Tom Hanks 1 Obligation

May 17, 2025 -

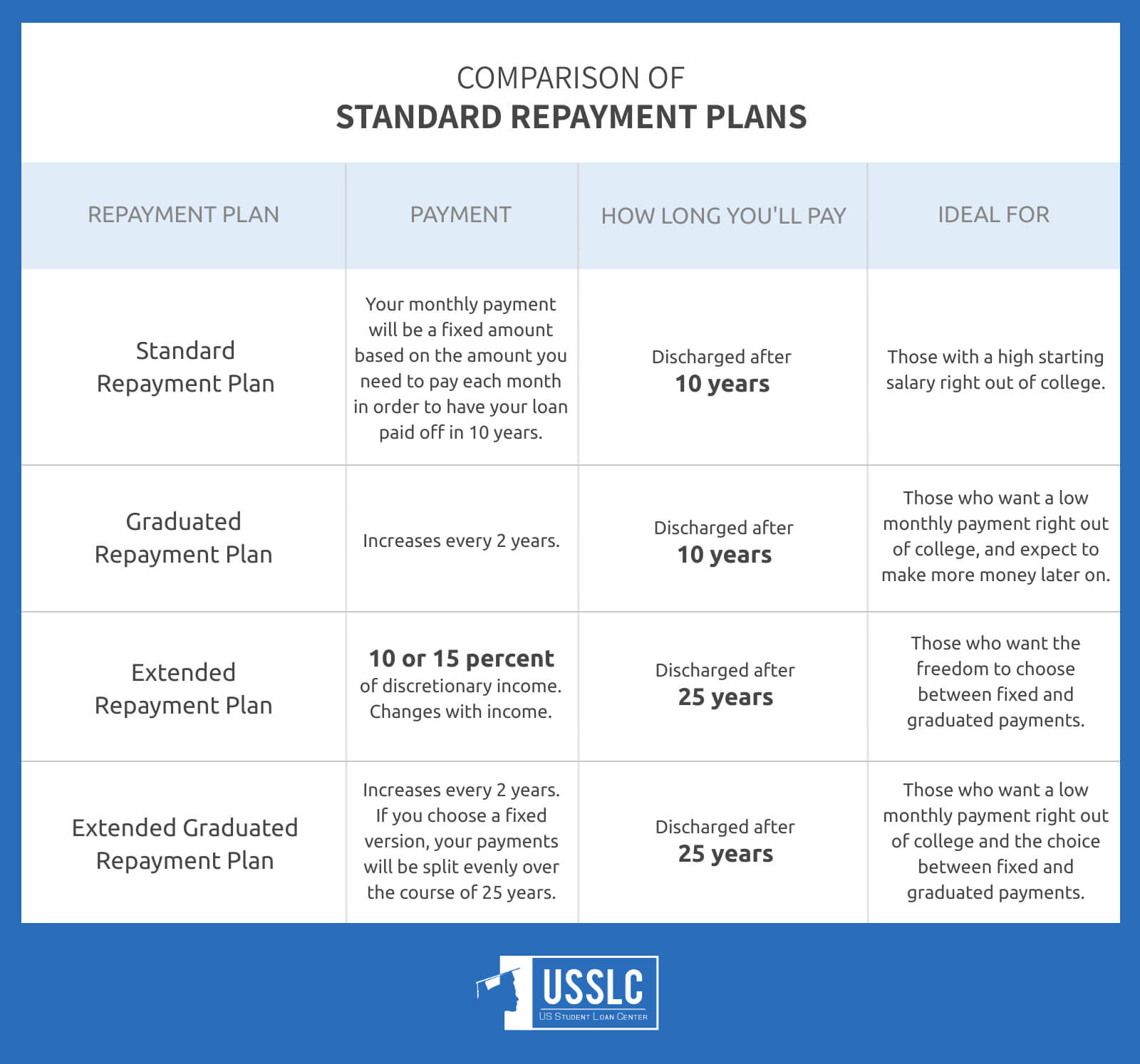

A Financial Planners Guide To Student Loan Repayment

May 17, 2025

A Financial Planners Guide To Student Loan Repayment

May 17, 2025 -

Todays News Supercharged Seaweed Crumbling Condos And Corporate Crisis

May 17, 2025

Todays News Supercharged Seaweed Crumbling Condos And Corporate Crisis

May 17, 2025

Latest Posts

-

Securing A Stem Future Local Students Awarded Scholarships

May 17, 2025

Securing A Stem Future Local Students Awarded Scholarships

May 17, 2025 -

Trumps Student Loan Plan Perspectives From The Black Community

May 17, 2025

Trumps Student Loan Plan Perspectives From The Black Community

May 17, 2025 -

Stem Scholarships Supporting Local Student Achievement

May 17, 2025

Stem Scholarships Supporting Local Student Achievement

May 17, 2025 -

Celebrating Success Local Students Receive Stem Scholarships

May 17, 2025

Celebrating Success Local Students Receive Stem Scholarships

May 17, 2025 -

Local Students Awarded Stem Scholarships Funding Opportunities And Resources

May 17, 2025

Local Students Awarded Stem Scholarships Funding Opportunities And Resources

May 17, 2025