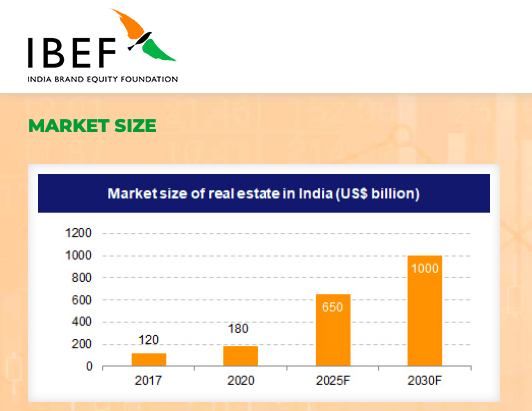

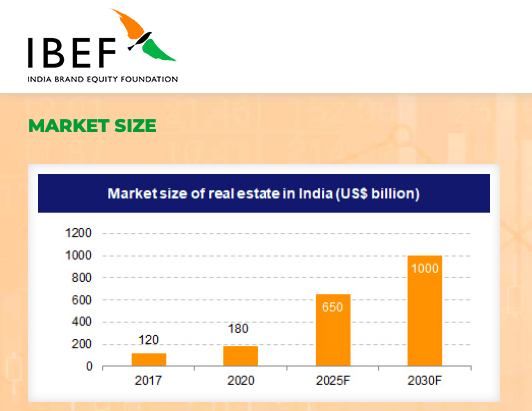

India Real Estate Investment: A 47% Jump In Q1 2024

Table of Contents

Factors Driving the Surge in India Real Estate Investment

Several key factors have contributed to the impressive 47% increase in India real estate investment during Q1 2024. Understanding these drivers is crucial for anyone looking to navigate this dynamic market.

Economic Growth and Stability

India's robust economic growth has significantly boosted investor confidence. The consistent rise in GDP, coupled with a stable political environment, creates a favorable climate for real estate investment.

- GDP Growth: India's GDP has shown consistent growth in recent years, exceeding expectations in several quarters. This positive economic outlook instills confidence in investors, leading to increased investment in various sectors, including real estate.

- Positive Economic Indicators: Other positive economic indicators, such as low inflation and a stable currency, further enhance investor sentiment and contribute to the growth of the India real estate market.

- Stable Political Environment: A stable political landscape fosters a sense of security and predictability, encouraging both domestic and foreign investment in the real estate sector.

Government Initiatives and Policies

The Indian government has actively implemented various policies to stimulate growth within the real estate sector. These initiatives have played a pivotal role in attracting investment.

- Affordable Housing Schemes: Government schemes aimed at providing affordable housing have increased demand and spurred development in this segment.

- Infrastructure Development Projects: Massive infrastructure development projects across the country have improved connectivity and boosted property values in strategic locations. Examples include the Bharatmala Project and Smart Cities Mission.

- Tax Benefits: Tax benefits and incentives offered to real estate investors have further encouraged investment in the sector. These incentives can significantly reduce the overall cost of investment. (Links to relevant government websites would be inserted here).

Increased Disposable Incomes and Rising Middle Class

A burgeoning middle class with significantly increased disposable incomes is fueling the demand for housing in India. This demographic shift is a major driver of the real estate boom.

- Income Growth: Rising incomes across various socioeconomic groups are translating into increased purchasing power, leading to higher demand for homes.

- Middle-Class Expansion: The significant expansion of the middle class has created a substantial pool of potential homebuyers, further driving up demand.

- Shift in Consumer Preferences: There's a noticeable shift towards homeownership, with many Indians prioritizing owning a home over renting.

Low Interest Rates

Low interest rates on home loans have made mortgages significantly more affordable, increasing accessibility to homeownership for a larger segment of the population.

- Impact on Affordability: Lower interest rates directly translate to lower monthly mortgage payments, making homeownership more attractive to potential buyers.

- Increased Borrowing: Favorable interest rates have encouraged increased borrowing for property purchases, further stimulating the market.

- Comparison with Previous Years: Comparing current interest rates to those of previous years highlights the significant impact on affordability and market growth.

Technological Advancements

The integration of technology (proptech) is revolutionizing the real estate sector, leading to increased transparency and efficiency.

- Online Property Portals: Online platforms have simplified property searching and streamlined the buying process.

- Virtual Tours and 3D Models: These technologies allow potential buyers to view properties remotely, expanding reach and convenience.

- Digital Transactions: Digital payment systems have made transactions faster, safer, and more transparent.

Investment Opportunities in Different Sectors of India Real Estate

The growth in India real estate investment presents diverse opportunities across various sectors.

Residential Real Estate

The residential sector continues to be a dominant force, with robust growth across various segments.

- Luxury Housing: Demand for luxury apartments in prime locations remains high, driven by high net worth individuals.

- Affordable Housing: The affordable housing segment offers significant potential, given the large target market.

- Mid-Segment Housing: This segment is witnessing consistent growth, catering to the expanding middle class. (Data on property prices in major cities like Mumbai, Delhi, Bangalore, etc. would be included here)

Commercial Real Estate

Commercial real estate, encompassing office spaces, retail spaces, and industrial properties, also presents attractive investment opportunities.

- Office Space Demand: The growth of IT and other sectors is driving demand for office spaces in major cities.

- Retail Real Estate: The rise of e-commerce is transforming retail spaces, with a focus on experience-driven retail formats.

- Industrial Properties: Expansion of manufacturing and logistics is boosting demand for industrial properties and warehouses.

Land Investment

Land investment offers significant long-term potential, though it carries higher risk.

- High Growth Potential Areas: Investing in land in areas with planned infrastructure development can yield substantial returns.

- Risks and Considerations: Thorough due diligence, including legal verification and environmental assessments, is crucial before investing in land.

Challenges and Risks in the India Real Estate Market

Despite the positive outlook, several challenges and risks need to be considered.

Regulatory Hurdles

Navigating the regulatory landscape can be complex, involving bureaucratic processes and obtaining necessary approvals and licenses.

- Regulatory Changes: Keeping abreast of regulatory changes and their impact on investment is essential.

Infrastructure Gaps

Infrastructure deficits in some areas can impact property values and development.

- Inadequate Infrastructure: Issues like water supply, power outages, and poor connectivity can hinder growth in certain regions.

Property Price Volatility

Property prices can fluctuate, impacting investment returns.

- Price Fluctuations: Understanding historical price trends and potential market cycles is vital for managing risk.

Real Estate Market Cycles

The real estate market is cyclical, experiencing periods of boom and bust. Understanding these cycles is crucial for making informed investment decisions.

Conclusion: Capitalize on the Booming India Real Estate Investment Market

The 47% surge in India real estate investment during Q1 2024 signifies a dynamic and promising market. While numerous factors contribute to this growth, including robust economic growth, government initiatives, and technological advancements, it’s crucial to acknowledge potential challenges such as regulatory hurdles and infrastructure gaps. However, with thorough due diligence and careful consideration of the risks involved, India real estate investment offers significant opportunities for substantial returns. Explore India real estate investment opportunities today and learn more about profitable India property investment. Invest wisely in the growing Indian real estate sector. (Links to relevant resources such as property portals and financial advisors would be included here).

Featured Posts

-

Federal Student Loan Refinancing Should You Use A Private Lender

May 17, 2025

Federal Student Loan Refinancing Should You Use A Private Lender

May 17, 2025 -

Panduan Lengkap Mengelola Dan Menganalisis Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025

Panduan Lengkap Mengelola Dan Menganalisis Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025 -

Onibus Universitario Se Envolve Em Grave Acidente

May 17, 2025

Onibus Universitario Se Envolve Em Grave Acidente

May 17, 2025 -

Warner Bros Pictures At Cinema Con 2025 A Comprehensive Overview

May 17, 2025

Warner Bros Pictures At Cinema Con 2025 A Comprehensive Overview

May 17, 2025 -

Jackbit A Leading Crypto Casino For 2025 And Beyond

May 17, 2025

Jackbit A Leading Crypto Casino For 2025 And Beyond

May 17, 2025

Latest Posts

-

Donald And Melania Trumps Relationship Fact Vs Speculation

May 17, 2025

Donald And Melania Trumps Relationship Fact Vs Speculation

May 17, 2025 -

The Trump Marriage An Examination Of Donald And Melanias Union

May 17, 2025

The Trump Marriage An Examination Of Donald And Melanias Union

May 17, 2025 -

Lawrence O Donnell Highlights Trumps Live Tv Humiliation

May 17, 2025

Lawrence O Donnell Highlights Trumps Live Tv Humiliation

May 17, 2025 -

Melania Trump Current Status And Role As Former First Lady

May 17, 2025

Melania Trump Current Status And Role As Former First Lady

May 17, 2025 -

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025

Trumps Public Humiliation A Lawrence O Donnell Show Moment

May 17, 2025