Federal Student Loan Refinancing: Should You Use A Private Lender?

Table of Contents

Understanding the Benefits of Federal Student Loan Refinancing

Refinancing your federal student loans, whether through a private lender or the federal government, offers several potential advantages. These benefits can significantly improve your financial outlook, but it's crucial to remember that they are potential outcomes, not guarantees.

-

Lower Interest Rates: One of the most attractive benefits is the possibility of securing a lower interest rate. A lower rate translates to substantial savings over the life of your loan. Even a small reduction in your interest rate can lead to thousands of dollars saved. This interest rate reduction can significantly lower your monthly payments and help you pay off your debt faster.

-

Simplified Repayment: If you have multiple federal student loans with varying interest rates and repayment schedules, refinancing can consolidate them into a single loan. This simplifies the repayment process, making it easier to track your payments and manage your debt. This loan consolidation can lead to a more manageable monthly payment.

-

Shorter Loan Terms: Refinancing allows you to potentially shorten your loan term. A shorter term means you'll pay off your loan faster, but be aware that this usually comes with higher monthly payments. Carefully weigh the benefits of faster payoff against the increased monthly financial burden. Consider your budget and financial goals when choosing a loan term.

The Drawbacks of Refinancing Federal Student Loans with a Private Lender

While the allure of lower monthly payments and faster repayment is tempting, refinancing federal student loans with a private lender carries significant risks. Understanding these drawbacks is critical before making a decision.

-

Loss of Federal Protections: This is perhaps the most significant drawback. By refinancing with a private lender, you lose access to crucial federal protections. These include:

- Income-driven repayment (IDR) plans: These plans adjust your monthly payments based on your income and family size. Losing access to IDR can significantly increase your monthly expenses.

- Deferment and forbearance options: These programs provide temporary pauses on your payments during periods of financial hardship. Without these options, you could face serious financial difficulties if unexpected expenses arise.

- Federal loan forgiveness programs: Some federal loan forgiveness programs, like Public Service Loan Forgiveness (PSLF), require borrowers to have federal loans. Refinancing eliminates your eligibility for these programs.

-

Higher Interest Rates (in Some Cases): While the goal of refinancing is usually to lower your interest rate, this isn't guaranteed. Your credit score, income, and the current market conditions all play a role in determining the interest rate you'll receive. You might end up with a higher rate than your current federal loan interest rate.

-

Potential for Predatory Lending: Unfortunately, some private lenders engage in predatory lending practices, targeting borrowers with less financial knowledge. Be wary and thoroughly research any lender before agreeing to a loan.

-

Credit Score Impact: The refinancing process itself can temporarily impact your credit score. Even if approved, the hard inquiry on your credit report can slightly lower your score.

When Refinancing with a Private Lender Might Make Sense

Despite the risks, there are situations where refinancing federal student loans with a private lender could be beneficial. However, these scenarios usually involve borrowers with strong financial profiles:

-

Excellent Credit Score: Lenders offer the most favorable terms (lower interest rates) to borrowers with excellent credit scores (typically 700 or higher). A high credit score significantly increases your chances of securing a better interest rate than your existing federal loans.

-

High Income: Lenders assess your ability to repay the loan based on your income. Higher income generally qualifies you for better interest rates and loan terms.

-

Significant Debt Consolidation: If you have multiple high-interest loans (credit cards, personal loans) along with your federal student loans, refinancing could consolidate all your debt into a single, lower-interest loan, simplifying repayment and potentially saving money overall. However, carefully evaluate the trade-off of losing federal protections.

Alternatives to Private Lender Refinancing

Before rushing into private student loan refinancing, explore alternative options for managing your federal student loans:

-

Income-Driven Repayment Plans: These plans can significantly lower your monthly payments, making them more manageable.

-

Deferment and Forbearance: These options provide temporary pauses on your payments, offering relief during periods of financial hardship.

-

Federal Loan Consolidation: You can consolidate your federal loans through the government without involving a private lender. This simplifies repayment without losing federal protections.

Conclusion: Making the Right Choice for Your Federal Student Loan Refinancing

Refinancing federal student loans with a private lender presents both opportunities and risks. The potential for lower interest rates and simplified repayment is appealing, but the loss of federal protections is a serious consideration. Carefully weigh the potential benefits against the significant drawbacks before making a decision. Before making a decision about federal student loan refinancing, thoroughly research your options and compare rates from both private lenders and explore federal programs to find the best solution for your needs. Refinance your student loans wisely, understanding the full implications of each path. Strategic student loan refinancing requires careful planning and consideration of your unique financial circumstances.

Featured Posts

-

Fortnite Item Shop 1000 Day Old Skins Return

May 17, 2025

Fortnite Item Shop 1000 Day Old Skins Return

May 17, 2025 -

Avaliacao Mec 4 Cursos Do Vale E Regiao Recebem Nota Maxima Descubra Quais

May 17, 2025

Avaliacao Mec 4 Cursos Do Vale E Regiao Recebem Nota Maxima Descubra Quais

May 17, 2025 -

Iseljavanje Srba Analiza Kupovine Nekretnina Preko Granice

May 17, 2025

Iseljavanje Srba Analiza Kupovine Nekretnina Preko Granice

May 17, 2025 -

Perkins Tells Brunson To Ditch Podcast

May 17, 2025

Perkins Tells Brunson To Ditch Podcast

May 17, 2025 -

Diddy Trial Update Key Testimony From Cassie Ventura

May 17, 2025

Diddy Trial Update Key Testimony From Cassie Ventura

May 17, 2025

Latest Posts

-

Fortnite Cosmetic Policy Update A Refund Case Study

May 17, 2025

Fortnite Cosmetic Policy Update A Refund Case Study

May 17, 2025 -

Epic Games Hit With New Fortnite Lawsuit In Game Store Practices Under Fire

May 17, 2025

Epic Games Hit With New Fortnite Lawsuit In Game Store Practices Under Fire

May 17, 2025 -

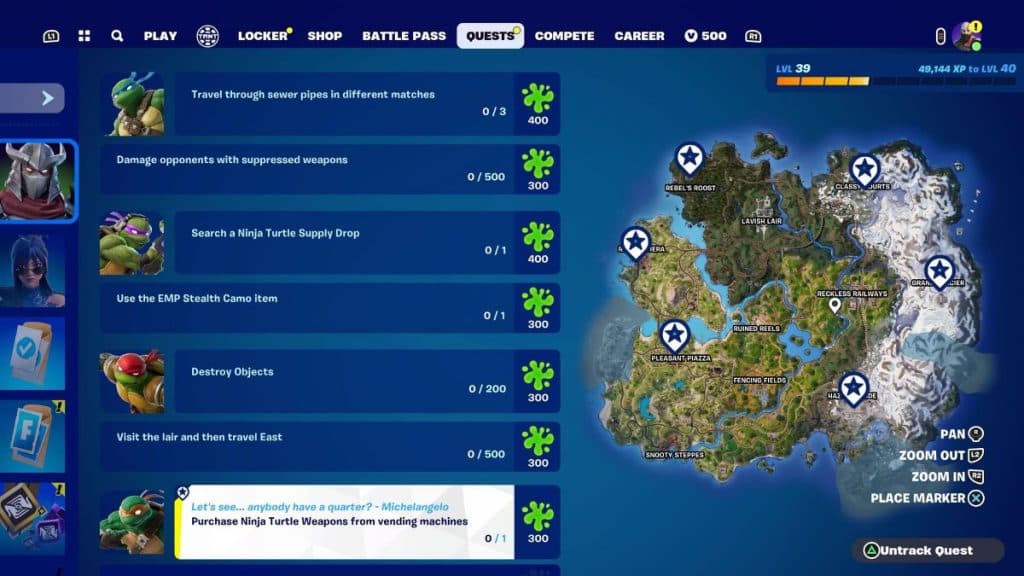

Unlock All Fortnite Teenage Mutant Ninja Turtles Skins

May 17, 2025

Unlock All Fortnite Teenage Mutant Ninja Turtles Skins

May 17, 2025 -

Complete List Of Fortnite Tmnt Skins And Unlock Methods

May 17, 2025

Complete List Of Fortnite Tmnt Skins And Unlock Methods

May 17, 2025 -

How To Get Every Teenage Mutant Ninja Turtles Skin In Fortnite

May 17, 2025

How To Get Every Teenage Mutant Ninja Turtles Skin In Fortnite

May 17, 2025