America's Bond Market: 5% 30-Year Yield And Its Impact On Sales

Table of Contents

The Significance of the 5% 30-Year Treasury Yield

The 30-year Treasury yield represents the return an investor receives for lending money to the U.S. government for three decades. A 5% yield is noteworthy because it signifies a significant increase compared to recent historical lows. This rise reflects several intertwined factors impacting investor confidence and the overall economic outlook.

- Definition of 30-year Treasury yield: This is the interest rate the U.S. Treasury pays on its 30-year bonds. It's a key benchmark for long-term interest rates in the U.S. economy.

- Comparison to historical averages: Historically, 5% 30-year yields haven't been consistently seen in recent decades. Comparing this yield to averages from the past 10, 20, and 30 years reveals a significant upward shift, potentially signaling changes in economic expectations.

- Key factors affecting yield levels: Inflation expectations, Federal Reserve monetary policy (interest rate hikes), economic growth projections, and global geopolitical events all play a crucial role in influencing the 30-year Treasury yield. Currently, the combination of higher inflation and the Fed's efforts to combat it is a major driver.

- Impact on investor behavior: Higher yields make bonds more attractive to investors seeking fixed-income returns, potentially diverting capital from other asset classes such as stocks. This shift can influence overall market sentiment and investment strategies.

Impact on Mortgage Rates and Housing Sales

The 5% 30-year yield has a direct and powerful impact on the housing market. There's a strong correlation between Treasury yields and mortgage rates; as Treasury yields rise, so do mortgage rates.

- Mechanism linking Treasury yields to mortgage rates: Mortgage rates are largely influenced by the yield on U.S. Treasury bonds, as they serve as a benchmark for long-term borrowing costs.

- Affordability impact on potential homebuyers: Higher mortgage rates directly reduce affordability for potential homebuyers, leading to decreased demand. A higher interest rate increases the monthly payment, making homeownership less accessible for many.

- Predicted changes in housing market activity: We can expect a slowdown in housing sales and potentially a decrease in home prices as demand softens due to reduced affordability.

- Potential price corrections in the real estate sector: The increased cost of borrowing could trigger price adjustments in the real estate market as sellers may need to lower prices to attract buyers in a cooling market.

Effect on Corporate Borrowing and Business Investment

Higher bond yields increase the cost of borrowing for corporations, impacting their investment decisions. This affects everything from expansion plans to hiring.

- Increased borrowing costs for businesses: Companies rely on borrowing to finance expansion, equipment purchases, and other investments. Higher yields mean higher interest payments, reducing profitability and potentially hindering growth.

- Impact on capital expenditure and expansion projects: Businesses may postpone or scale back expansion projects due to the increased cost of capital. This could lead to slower economic growth.

- Potential job losses or slowed hiring: Reduced investment can lead to a slowdown in hiring or even job losses as companies tighten their budgets.

- Effect on overall economic growth: The reduced investment and hiring can have a dampening effect on the overall economic growth rate.

Impact on the Stock Market and Investor Sentiment

The relationship between bond yields and the stock market is often inverse. Higher bond yields can make bonds more attractive than stocks, potentially diverting investment.

- Relationship between bond yields and stock valuations: As bond yields rise, investors may shift funds from stocks to bonds, potentially leading to lower stock valuations. This happens because bonds offer a safer, albeit lower-growth, alternative.

- Impact on investor risk tolerance: Higher bond yields can indicate a less risky environment, leading some investors to reduce their exposure to riskier assets like stocks.

- Potential portfolio shifts by investors: Investors may rebalance their portfolios, moving from equities to fixed-income securities to take advantage of higher bond yields.

- Effects on stock market volatility: Shifts in investor sentiment can lead to increased volatility in the stock market as investors adjust their portfolios based on changing economic expectations.

Long-Term Implications of a 5% 30-Year Yield

Sustained high yields have significant long-term implications for the economy, with both potential positive and negative outcomes.

- Potential for sustained economic growth or slowdown: High yields could curb inflation, fostering long-term stability, but they could also stifle economic growth by reducing investment and consumer spending.

- Impact on inflation and consumer spending: High yields can help to control inflation but might reduce consumer spending as borrowing becomes more expensive.

- Government policy responses to high yields: Government policies may aim to mitigate the negative effects of high yields through fiscal measures or adjustments to monetary policy.

- Long-term outlook for the bond market: The long-term outlook for the bond market is uncertain and depends on several factors including inflation, economic growth, and government policies.

Conclusion

The 5% 30-year yield is a significant development with far-reaching consequences for the American economy. Its impact on mortgage rates, corporate borrowing, and investor sentiment necessitates careful monitoring and analysis. While higher yields can potentially curb inflation, they also pose risks to economic growth and investment. Understanding this complex interplay is crucial for navigating the current economic climate. The key takeaway is the need to closely observe the fluctuations in the 5% 30-year yield and its ongoing effects. Stay updated on the evolving impact of the 5% 30-year yield on the American economy by subscribing to our newsletter!

Featured Posts

-

Zachary Cunhas Post Us Attorney Career Path

May 20, 2025

Zachary Cunhas Post Us Attorney Career Path

May 20, 2025 -

Resmi Aciklama Fenerbahce Oyuncusu Ajax A Transfer Oluyor

May 20, 2025

Resmi Aciklama Fenerbahce Oyuncusu Ajax A Transfer Oluyor

May 20, 2025 -

New Music Monday 2 24 25 Lightning 100s Best New Tracks

May 20, 2025

New Music Monday 2 24 25 Lightning 100s Best New Tracks

May 20, 2025 -

Federal Investigation Millions Lost In Corporate Email Data Breach

May 20, 2025

Federal Investigation Millions Lost In Corporate Email Data Breach

May 20, 2025 -

Your First Solo Trip A Step By Step Guide

May 20, 2025

Your First Solo Trip A Step By Step Guide

May 20, 2025

Latest Posts

-

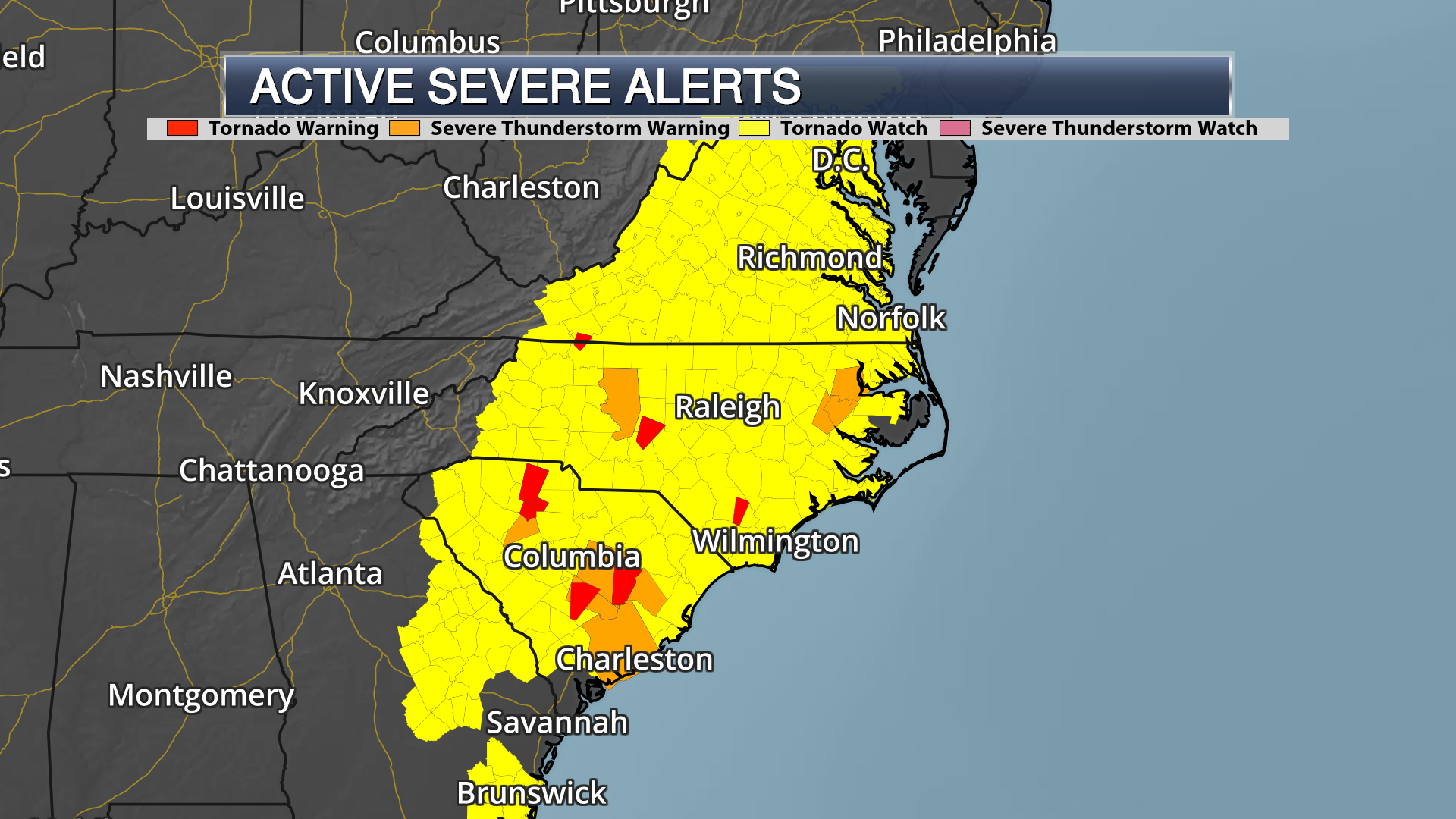

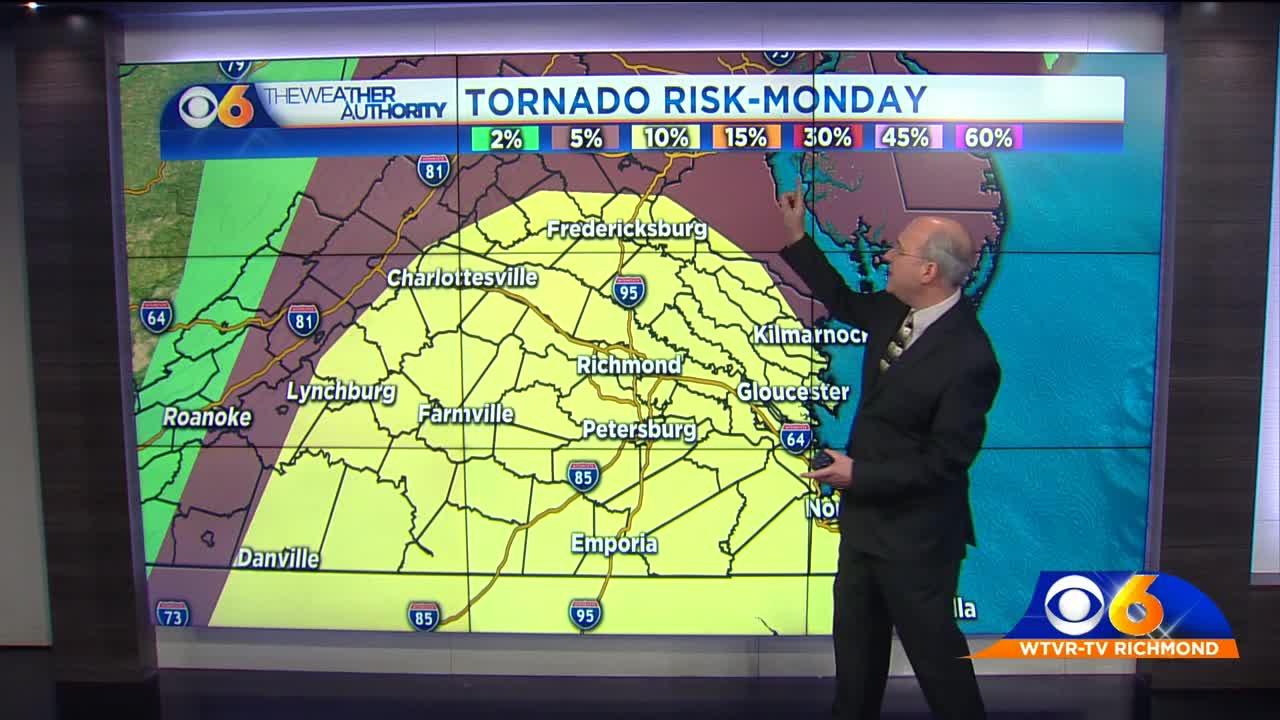

Severe Weather Alert High Storm Chance Overnight Monday Potential

May 20, 2025

Severe Weather Alert High Storm Chance Overnight Monday Potential

May 20, 2025 -

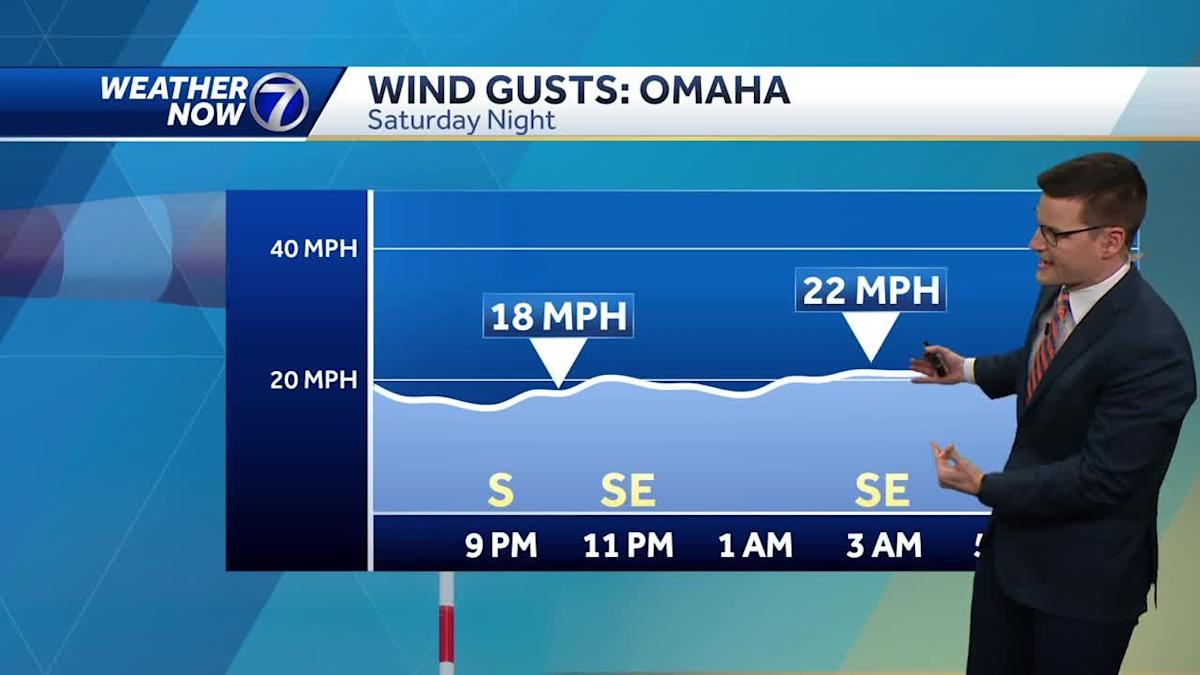

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 20, 2025

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 20, 2025 -

How To Dress For Breezy And Mild Temperatures A Practical Guide

May 20, 2025

How To Dress For Breezy And Mild Temperatures A Practical Guide

May 20, 2025 -

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025 -

Understanding Breezy And Mild Weather Patterns A Comprehensive Guide

May 20, 2025

Understanding Breezy And Mild Weather Patterns A Comprehensive Guide

May 20, 2025