Impact Of G-7 De Minimis Tariff Discussions On Chinese Goods

Table of Contents

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. These thresholds vary significantly across G-7 nations and play a vital role in determining the cost-effectiveness of importing goods, especially from countries like China, a major global exporter. Changes to these thresholds can significantly impact the cost of importing Chinese goods, affecting businesses, consumers, and overall trade dynamics. This article aims to dissect these potential impacts.

Potential Changes in De Minimis Thresholds for Chinese Goods

Currently, de minimis thresholds for Chinese goods vary considerably across G-7 countries. For instance, some nations may have a threshold of $800 per shipment, while others might have a higher or lower limit. G-7 discussions currently underway are exploring proposals to either raise or lower these thresholds. A decrease in the threshold would mean more Chinese goods would be subject to tariffs, potentially increasing import costs. Conversely, an increase could lead to lower costs and increased imports.

The potential implications of these changes are substantial for businesses. Increased costs due to tariff changes could significantly impact profitability, especially for small and medium-sized enterprises (SMEs) relying on inexpensive Chinese imports.

- Impact on small businesses importing from China: Higher tariffs could force many small businesses to either absorb the increased costs or pass them on to consumers, potentially impacting their competitiveness.

- Effect on the pricing of Chinese consumer goods in G-7 markets: Changes in de minimis thresholds will directly influence the final price paid by consumers for a wide range of goods.

- Potential for increased customs processing time: Lower thresholds might lead to an increase in the volume of goods requiring customs processing, potentially leading to delays and administrative burdens.

Impact on Chinese Exporters and Supply Chains

Changes in G-7 de minimis thresholds will undoubtedly impact Chinese exporters and global supply chains. Industries heavily reliant on exporting to G-7 markets, such as textiles, electronics, and consumer goods, could experience significant disruptions. This could lead to adjustments in production strategies, pricing models, and even sourcing locations for some businesses.

- Impact on Chinese SMEs: Smaller Chinese businesses may be disproportionately affected by changes in tariff policies due to their limited resources and capacity to adapt.

- Shift in sourcing strategies by G-7 importers: Businesses might diversify their sourcing to countries with more favorable tariff regimes, reducing dependence on Chinese suppliers.

- Potential for increased production costs in China: To offset the impact of increased tariffs, Chinese manufacturers might be forced to raise their prices, potentially making their goods less competitive in the global market.

Geopolitical Implications and Trade Tensions

The G-7 de minimis tariff discussions have significant geopolitical implications and the potential to exacerbate trade tensions between China and the G-7 nations. Changes perceived as unfairly targeting Chinese goods could lead to retaliatory measures from China, potentially escalating into a broader trade war. This complex situation needs careful consideration of existing trade agreements and WTO rules.

- Potential for bilateral trade negotiations: The G-7's decisions might trigger a wave of bilateral trade negotiations between individual member states and China to address specific concerns.

- Impact on existing trade agreements: The changes could put pressure on existing trade agreements, requiring renegotiation or adaptation to account for the new tariff landscape.

- Influence of the WTO: The WTO's role in mediating and resolving any disputes arising from the G-7's decisions will be crucial in maintaining a stable international trading system.

Consumer Impact and Market Adjustments

Ultimately, changes to de minimis tariffs will affect consumers in G-7 countries. Increased tariffs on Chinese goods will likely translate into higher prices for consumers, potentially impacting inflation and consumer spending patterns. This could create opportunities for domestic producers, especially those manufacturing goods that can substitute for Chinese imports.

- Impact on inflation: Higher prices for imported goods contribute directly to inflationary pressures in G-7 economies.

- Changes in consumer spending patterns: Consumers may adjust their spending habits, opting for cheaper alternatives or reducing overall consumption due to increased prices.

- Opportunities for domestic producers: Higher tariffs on Chinese goods could provide a competitive advantage to domestic producers, leading to increased production and job creation in G-7 countries.

Conclusion: Navigating the Impact of G-7 De Minimis Tariff Discussions on Chinese Goods

The G-7 de minimis tariff discussions have the potential to significantly alter the landscape of trade between China and the G-7 nations. The potential effects are far-reaching, impacting businesses of all sizes, consumers, and global supply chains. Understanding these potential impacts is crucial for both businesses and policymakers.

Stay ahead of the curve by continuously monitoring changes to G-7 de minimis tariffs affecting Chinese goods. Consult with a trade specialist to navigate these complex regulations and mitigate potential risks. Understanding these evolving dynamics is essential for success in navigating the changing global trade environment.

Featured Posts

-

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Overload

May 25, 2025

Tik Tok Tourism Backlash Amsterdam Residents Sue City Over Snack Bar Overload

May 25, 2025 -

Planning Your Country Escape Essential Tips And Considerations

May 25, 2025

Planning Your Country Escape Essential Tips And Considerations

May 25, 2025 -

Pabrik Zuffenhausen Jejak Sejarah Porsche 356 Di Jerman

May 25, 2025

Pabrik Zuffenhausen Jejak Sejarah Porsche 356 Di Jerman

May 25, 2025 -

Impact Of G 7 De Minimis Tariff Discussions On Chinese Goods

May 25, 2025

Impact Of G 7 De Minimis Tariff Discussions On Chinese Goods

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Overview

May 25, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Overview

May 25, 2025

Latest Posts

-

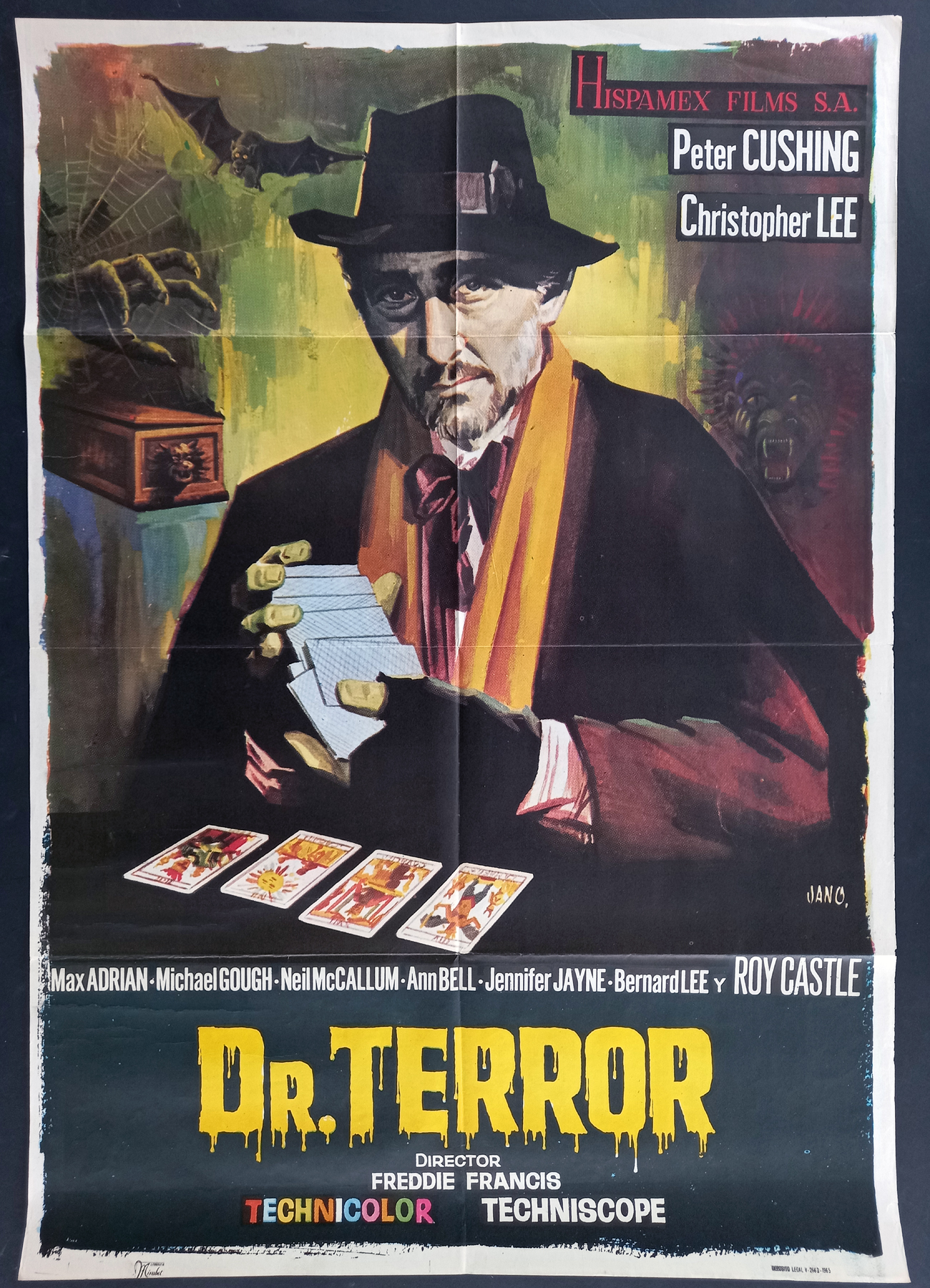

Dr Terrors House Of Horrors Review And Walkthrough

May 25, 2025

Dr Terrors House Of Horrors Review And Walkthrough

May 25, 2025 -

Jenson And The Fw 22 Extended Collection Details And Analysis

May 25, 2025

Jenson And The Fw 22 Extended Collection Details And Analysis

May 25, 2025 -

Jenson And The Fw 22 Extended Collection Unveiled

May 25, 2025

Jenson And The Fw 22 Extended Collection Unveiled

May 25, 2025 -

Dr Terrors House Of Horrors A Complete Guide

May 25, 2025

Dr Terrors House Of Horrors A Complete Guide

May 25, 2025 -

Jenson And The Fw 22 Extended A Comprehensive Guide

May 25, 2025

Jenson And The Fw 22 Extended A Comprehensive Guide

May 25, 2025