IMF's Review Of Pakistan's $1.3 Billion Package: Amidst India Tensions And Other News

Table of Contents

The IMF's Conditions and Pakistan's Compliance

The IMF's approval of the next tranche of the IMF Pakistan loan is contingent upon Pakistan meeting a series of stringent conditions. These conditions broadly fall under fiscal reforms and structural reforms aimed at improving governance and economic stability.

Fiscal Reforms and Austerity Measures

The IMF has demanded significant fiscal reforms and austerity measures to address Pakistan's unsustainable fiscal deficit. These include:

- Tax Reforms: Broadening the tax base, improving tax collection efficiency, and reducing tax evasion.

- Subsidy Cuts: Reducing energy subsidies, which have placed a heavy burden on the national budget.

- Privatization Plans: Selling off state-owned enterprises to reduce the government's financial burden and improve efficiency.

- Increased Revenue Generation: Implementing measures to significantly boost government revenue streams.

Pakistan's progress in meeting these conditions has been uneven. While some progress has been made in tax reforms, the budget deficit remains stubbornly high. For instance, the budget deficit for the fiscal year 2023 was reported at X% (replace X with actual data if available), significantly exceeding the target set by the IMF. The political and social implications of these austerity measures are substantial, leading to public discontent and protests. The government faces a difficult balancing act between satisfying IMF demands and maintaining social stability.

Structural Reforms and Governance

Beyond fiscal reforms, the IMF requires significant structural reforms aimed at improving governance and tackling corruption. These include:

- Strengthening Institutions: Improving the effectiveness and transparency of government institutions.

- Combating Corruption: Implementing measures to reduce corruption at all levels of government.

- Improving the Business Environment: Creating a more favorable climate for investment and economic growth.

- State-Owned Enterprise Reforms: Restructuring and improving the efficiency of state-owned enterprises.

Implementing these reforms faces significant challenges. Deep-rooted corruption and weak institutional capacity hinder progress. The long-term impact of successful structural reforms, however, could significantly improve Pakistan's economic outlook and attract much-needed foreign investment. The effectiveness of these reforms will be crucial in determining the long-term success of the IMF Pakistan loan program.

Geopolitical Implications: India Tensions and Regional Instability

The ongoing tensions between India and Pakistan significantly complicate the IMF's assessment and its willingness to release further funds under the IMF Pakistan loan program.

The Impact of India-Pakistan Relations

Heightened tensions divert resources away from economic development towards defense spending, exacerbating Pakistan's already strained finances. Furthermore, regional instability can deter foreign investment and hinder economic growth. Any escalation in the India-Pakistan conflict could severely impact the IMF's decision-making process, potentially delaying or even jeopardizing the release of further funds. Statements by IMF officials regarding geopolitical factors remain carefully worded, but the underlying concern is evident.

Regional Security and Economic Uncertainty

Broader regional instability, including ongoing conflicts and economic uncertainty in neighboring countries, further impacts Pakistan's economic outlook. The IMF carefully considers these external factors when assessing Pakistan's economic stability and its ability to repay the loan. While the IMF is primarily focused on Pakistan's domestic economic situation, regional stability is a crucial factor in their assessment. Alternative sources of funding, such as friendly nations or multilateral development banks, may become increasingly important if the IMF’s support is threatened.

Domestic Challenges and Economic Indicators

Pakistan faces significant domestic challenges that further complicate its economic situation and the prospects for the IMF Pakistan loan.

Inflation and Currency Devaluation

Pakistan is grappling with high inflation and a rapidly depreciating currency. The inflation rate currently stands at X% (replace X with actual data if available), impacting the purchasing power of ordinary citizens. The IMF is working with Pakistan to implement policies aimed at stabilizing the currency and controlling inflation. However, the effectiveness of these policies remains uncertain. The impact on the average Pakistani citizen is severe, with rising food and energy prices hitting the most vulnerable segments of the population the hardest.

Energy Crisis and Debt Sustainability

Pakistan's ongoing energy crisis significantly hampers economic growth and increases the country's debt burden. The energy sector requires substantial investment, further straining the national budget. Debt sustainability is a major concern for the IMF. The ability of Pakistan to repay its loans, including the IMF Pakistan loan, is a key factor in the IMF's decision-making process. The IMF is closely monitoring Pakistan's debt levels and its progress in addressing the energy crisis.

Conclusion

The IMF's review of the IMF Pakistan loan is a critical juncture for Pakistan's economic future. The country's progress in meeting the IMF's conditions, particularly in fiscal and structural reforms, is uneven. Geopolitical tensions with India and broader regional instability further complicate the situation. Domestic challenges, including high inflation, currency devaluation, the energy crisis, and debt sustainability, pose significant hurdles. Continued monitoring of the situation and understanding the implications of the IMF's decision are crucial for investors, policymakers, and the Pakistani people. Stay informed about further developments concerning the IMF Pakistan loan and its impact on the nation's economic trajectory. The success or failure of the IMF Pakistan loan program will significantly shape Pakistan's economic destiny in the coming years.

Featured Posts

-

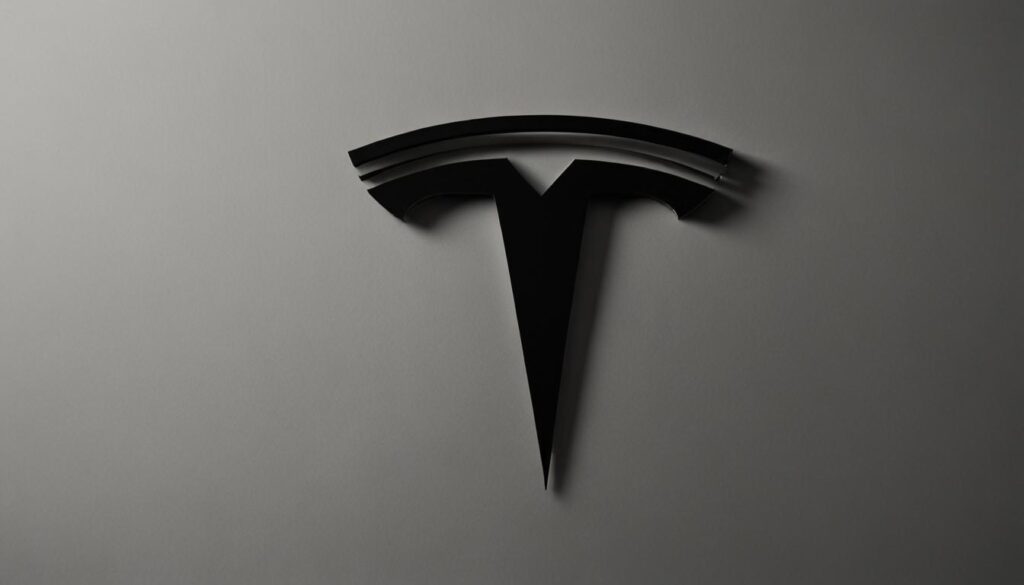

Elizabeth Line Strikes February And March Disruption Dates And Routes

May 09, 2025

Elizabeth Line Strikes February And March Disruption Dates And Routes

May 09, 2025 -

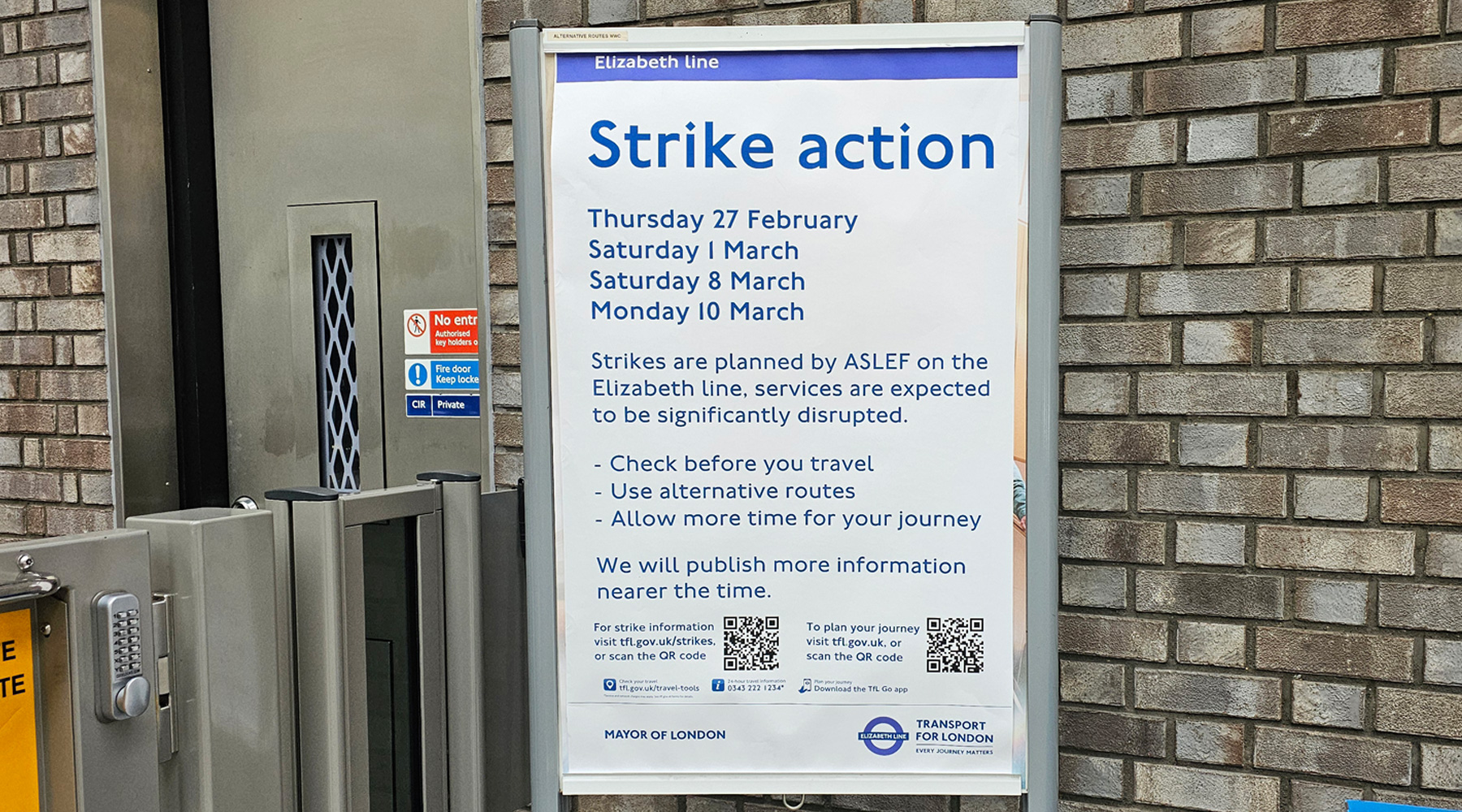

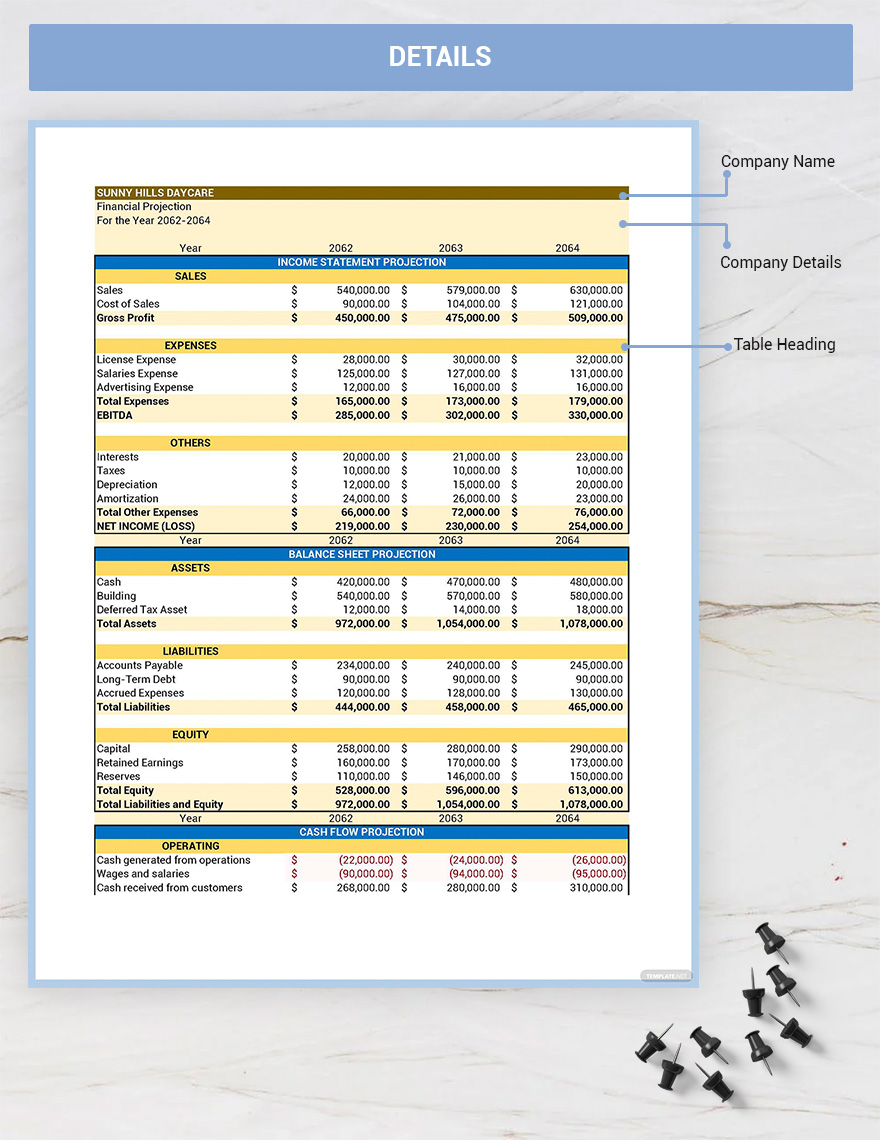

3 000 On Babysitting 3 600 On Daycare A Financial Nightmare For One Father

May 09, 2025

3 000 On Babysitting 3 600 On Daycare A Financial Nightmare For One Father

May 09, 2025 -

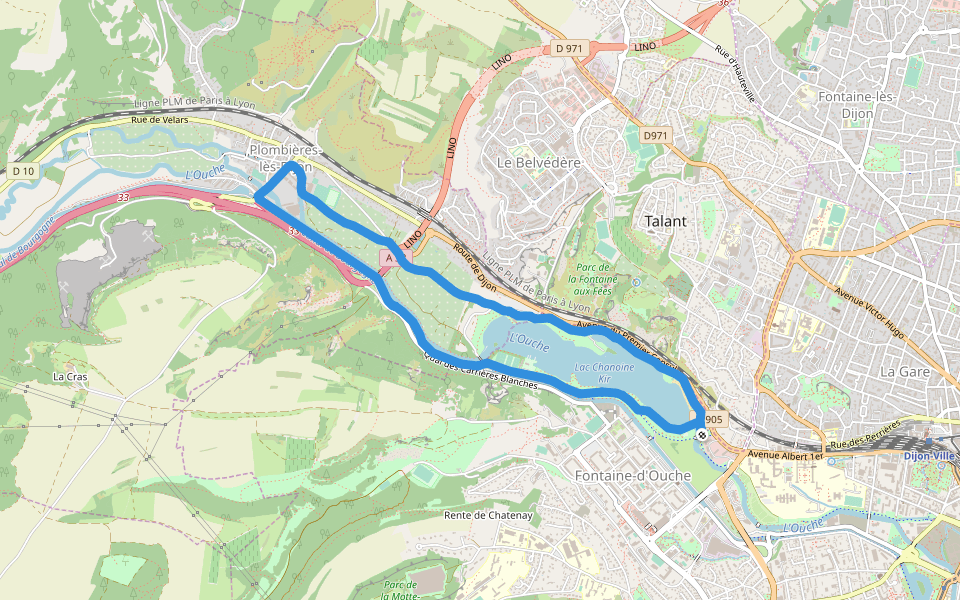

Dijon Enquete Apres Une Agression Au Lac Kir Bilan De Trois Blesses

May 09, 2025

Dijon Enquete Apres Une Agression Au Lac Kir Bilan De Trois Blesses

May 09, 2025 -

Uk Visa Policy Changes Impact On International Applicants

May 09, 2025

Uk Visa Policy Changes Impact On International Applicants

May 09, 2025 -

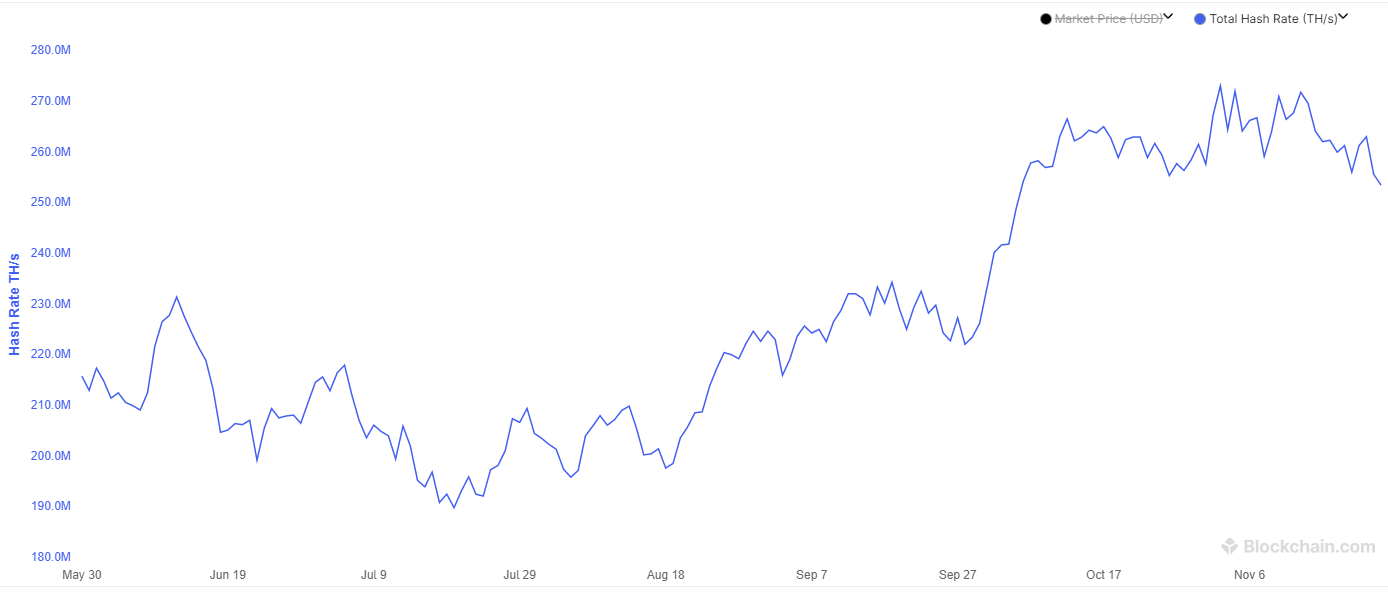

Understanding The Recent Increase In Bitcoin Mining Difficulty And Hashrate

May 09, 2025

Understanding The Recent Increase In Bitcoin Mining Difficulty And Hashrate

May 09, 2025

Latest Posts

-

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025 -

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025 -

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025