Check Your Payslip: Are You Due A HMRC Refund?

Table of Contents

Common Reasons for Overpaying Tax and Receiving a HMRC Refund

Overpaying income tax is more common than you might think. Several factors can contribute to an incorrect tax calculation, leading to a potential HMRC refund. Understanding these reasons is the first step to reclaiming your money.

-

Incorrect Tax Code: This is the most frequent cause of overpaid tax. Your tax code, found on your payslip, tells HMRC how much tax to deduct. An incorrect code, often resulting from a change in circumstances not reported to HMRC, can lead to significant overpayments. Using HMRC's online tax code checker is vital to verify its accuracy.

-

Changes in Circumstances: Life events significantly impact your tax liability. These include marriage, divorce, starting a new job, changes in income, or even becoming self-employed. Failing to update your details with HMRC can result in an incorrect tax code and subsequent overpayment.

-

Pension Contributions: If you contribute to a pension, you're entitled to tax relief. Your employer should deduct tax at a lower rate reflecting this relief. Check your payslip to ensure this is being applied correctly. Any discrepancies could mean you’ve overpaid.

-

Student Loan Repayments: The amount you repay depends on your income bracket. Ensure your payslip accurately reflects your repayment plan and income level. An incorrectly calculated repayment plan could lead to excessive tax deductions.

-

Marriage Allowance: This allows a lower-earning spouse to transfer some of their personal allowance to their higher-earning partner, potentially reducing the overall tax bill. If eligible, ensure you've claimed this allowance to avoid unnecessary tax payments.

How to Check Your Payslip for Potential HMRC Refunds

Analyzing your payslip thoroughly is crucial for identifying potential tax overpayments. Pay close attention to the following aspects:

-

Review Your Tax Code: Your tax code is a crucial piece of information. Locate it on your payslip and verify it using HMRC's online tools. Any inconsistencies should be addressed immediately.

-

Compare Gross and Net Pay: The difference between your gross pay (before tax deductions) and net pay (after tax deductions) should be consistent with your tax code and other deductions. A significantly lower net pay compared to what you expect based on your gross pay and tax code could indicate an overpayment.

-

Examine Tax Deductions: Scrutinize the amounts deducted for income tax and National Insurance contributions. Compare these deductions to previous years or to colleagues in similar roles to identify any anomalies. Unusually high deductions might suggest a problem.

-

Check Your P60: Your P60, received annually, summarizes your earnings and tax deductions for the tax year. Compare the information on your P60 to your payslips throughout the year to identify any inconsistencies or errors.

-

Keep Records: Organize and retain copies of your payslips and P60s for at least four years. This ensures you have the necessary documentation if you need to claim a tax refund.

Understanding Your Tax Year and Relevant Deadlines

Understanding the UK tax year and claim deadlines is vital for successfully reclaiming any overpaid tax.

-

Tax Year: The UK tax year runs from 6 April to 5 April the following year. All your tax calculations are based on this period.

-

Claiming a Refund: You generally have four years from the end of the tax year to claim a tax refund. Don't delay; act swiftly to secure your money.

-

Online Portal: HMRC’s online portal provides a convenient way to check your tax details, view your tax code, and submit a claim for a tax repayment.

-

Self Assessment: If you're self-employed, you'll need to complete a Self Assessment tax return to claim a refund. Make sure you file your return on time to avoid penalties.

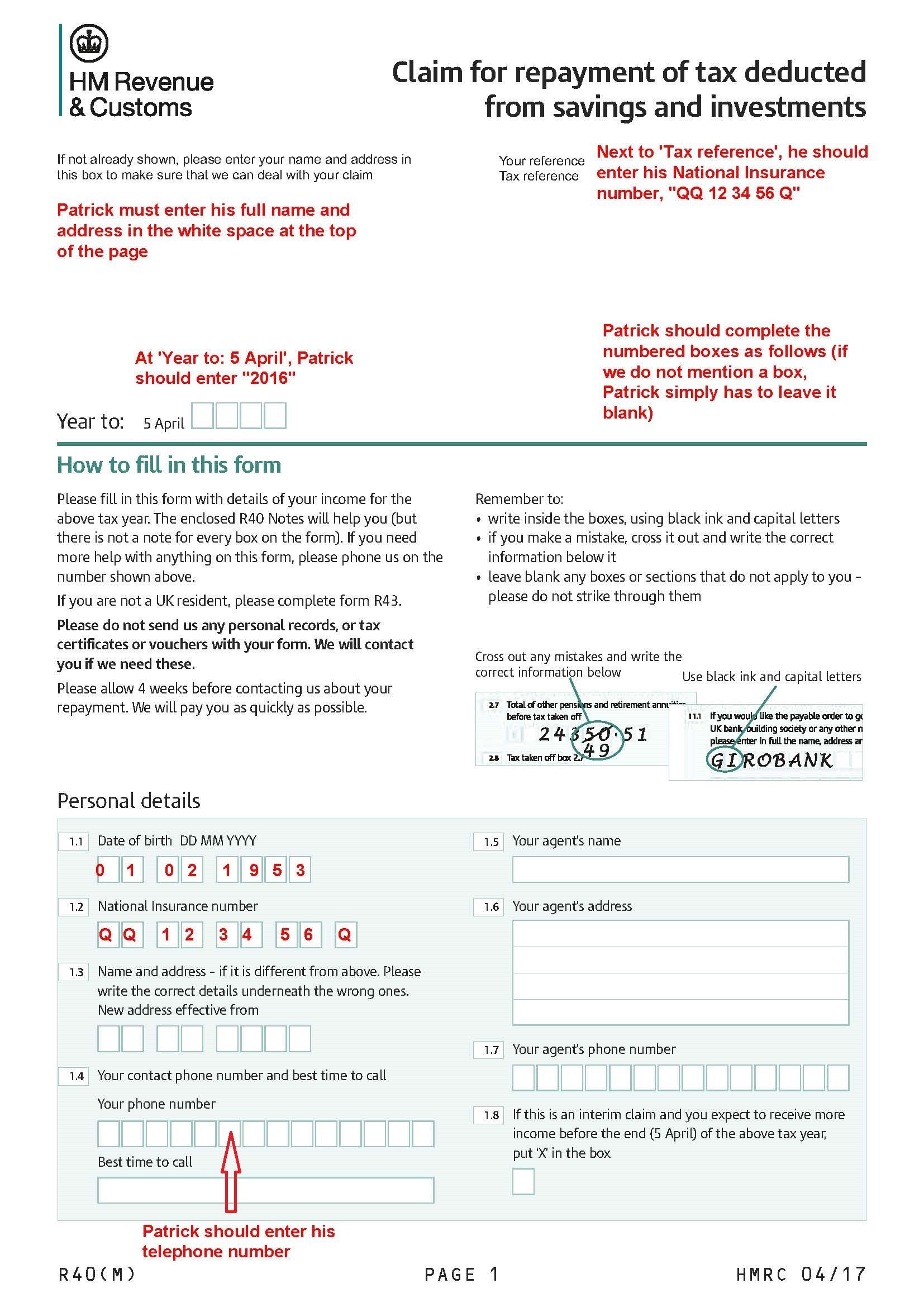

How to Claim Your HMRC Refund

Once you've identified a potential overpayment, follow these steps to claim your HMRC refund:

-

Gather Necessary Documents: Collect all relevant payslips, P60s, and any supporting documentation that justifies your claim. Having this organized will streamline the process.

-

Online Claim Form: Use the HMRC online portal to submit your claim. The online system is generally the quickest and most efficient method.

-

Contact HMRC Directly: If you encounter difficulties or require assistance, don't hesitate to contact HMRC directly. They can provide guidance and support throughout the process.

-

Allow Processing Time: HMRC requires time to process your claim. Allow a reasonable waiting period before inquiring about the status of your refund.

Conclusion

Regularly checking your payslip is crucial for ensuring you aren't overpaying tax. By understanding the common reasons for overpayment and following the steps outlined above, you can potentially identify and claim a significant HMRC refund. Don't leave money on the table – check your payslip today and see if you're due a HMRC refund! Visit the HMRC website for further information and to access the online claim portal. Start your HMRC refund claim now and get the money you deserve!

Featured Posts

-

Find Your Missing Hmrc Refund Check Your Savings Account Now

May 20, 2025

Find Your Missing Hmrc Refund Check Your Savings Account Now

May 20, 2025 -

Highfield Rugby Appoints James Cronin As Head Coach

May 20, 2025

Highfield Rugby Appoints James Cronin As Head Coach

May 20, 2025 -

Novaya Sharapova Perspektivy Molodoy Tennisistki Iz Rossii

May 20, 2025

Novaya Sharapova Perspektivy Molodoy Tennisistki Iz Rossii

May 20, 2025 -

Le Maintien En Pro D2 Decryptage De La Situation De Valence Romans Et Su Agen

May 20, 2025

Le Maintien En Pro D2 Decryptage De La Situation De Valence Romans Et Su Agen

May 20, 2025 -

Pro D2 L Asbh A Biarritz Un Defi Mental

May 20, 2025

Pro D2 L Asbh A Biarritz Un Defi Mental

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025