Ignoring High Stock Valuations: BofA's Rationale For Investors

Table of Contents

BofA's Justification for a Cautious "Buy" Approach

BofA's investment strategy isn't a reckless "buy the dip" mentality. Instead, they advocate for a measured "cautious buy" approach, acknowledging the elevated valuations but emphasizing the potential for long-term growth. Their reasoning hinges on a sophisticated risk assessment, going beyond simple market sentiment analysis. This involves a detailed fundamental analysis, focusing on the underlying strength and future potential of individual companies and sectors.

-

Emphasis on long-term growth potential: BofA's analysts focus on companies with robust earnings growth projections, even if their current valuations appear high based on traditional metrics. They believe that strong fundamentals will ultimately justify the current market capitalization over the long term.

-

Focus on specific sectors and companies with strong earnings growth potential: Rather than a blanket "buy everything," BofA's strategy involves identifying specific sectors and companies poised for significant future earnings growth. This targeted approach aims to mitigate the risks associated with high valuations.

-

Sophisticated valuation models: BofA employs advanced valuation models that incorporate various factors beyond standard price-to-earnings (P/E) ratios and price-to-sales (P/S) ratios. These models consider macroeconomic conditions, interest rate forecasts, and anticipated inflation to arrive at a more nuanced view of fair value.

-

Potential for above-average returns: Despite the high stock valuations, BofA believes that carefully selected investments can still deliver above-average returns, particularly for investors with a long-term horizon. This relies on identifying companies whose earnings growth will outpace the overall market growth.

Analyzing the Limitations of Traditional Valuation Metrics

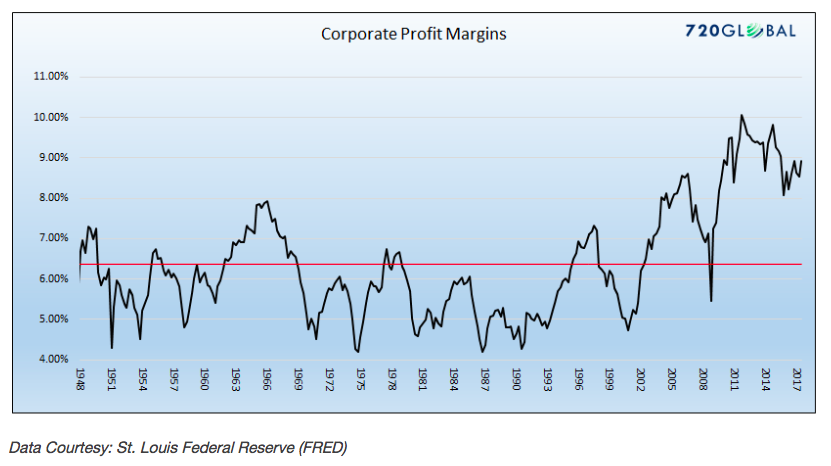

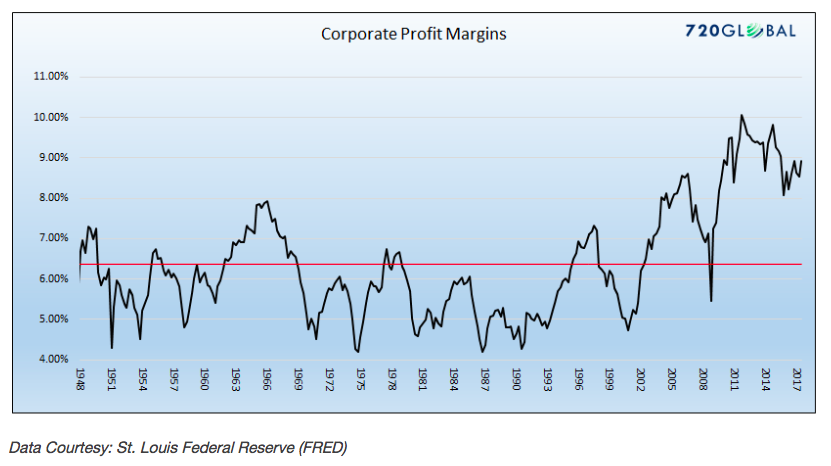

Traditional valuation metrics like P/E ratios and P/S ratios, while useful tools, may not fully capture the complexities of the current market. BofA's analysts likely argue that relying solely on these metrics in today's environment could lead to missed opportunities.

-

Limitations in low interest rate environments: Low interest rates artificially inflate valuations across the board. Companies can borrow cheaply, boosting earnings and leading to higher P/E multiples, even if underlying business performance remains stagnant.

-

Inflation's impact on valuation multiples: High inflation can erode the purchasing power of future earnings, impacting the perceived value of investments. Therefore, traditional valuation metrics might need adjustments to account for inflation's effects.

-

Alternative valuation models and indicators: BofA likely uses more sophisticated models incorporating discounted cash flow analysis, considering factors like anticipated growth rates and risk premiums, providing a more comprehensive valuation than traditional metrics alone.

-

High valuations justified by future earnings potential: For specific companies showing exceptional growth prospects, high valuations might be justified if those growth expectations materialize. BofA’s analysis would focus on identifying these companies.

Mitigating Risks Associated with High Stock Valuations

Investing in a high-valuation market inherently carries risks. Market corrections can lead to significant short-term losses. However, BofA's approach emphasizes mitigating these risks through a disciplined investment strategy.

-

Portfolio diversification: Diversifying across different sectors and asset classes reduces the impact of any single investment performing poorly.

-

Selective stock picking: Focusing on fundamentally strong companies with a proven track record significantly reduces risk compared to investing in speculative assets.

-

Monitoring market conditions and adapting the strategy: Regularly monitoring market conditions and adjusting the investment strategy is crucial in a volatile market. This allows for timely adjustments to minimize losses and seize new opportunities.

-

Dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This mitigates the risk of investing a lump sum at a market peak.

Conclusion

BofA's cautious optimism regarding high stock valuations stems from a long-term investment strategy emphasizing fundamental analysis, selective stock picking, and robust risk management. While acknowledging the inherent risks, they believe that focusing on companies with strong earnings growth potential and employing diversification strategies can lead to positive long-term returns. Their perspective emphasizes the limitations of traditional valuation metrics in the current market environment and advocates for a more nuanced assessment.

However, it's crucial to remember that this is just one perspective. Before making any investment decisions based on high stock valuations, conduct thorough research, consider your risk tolerance, and consult with a qualified financial advisor. Exploring BofA's research reports and market analyses further can significantly inform your own investment strategies concerning high stock valuations.

Featured Posts

-

Willie Nelsons 154th Album And The Controversy Surrounding His Son

Apr 29, 2025

Willie Nelsons 154th Album And The Controversy Surrounding His Son

Apr 29, 2025 -

Grim Retail Sales A Sign Of Looming Bank Of Canada Rate Cuts

Apr 29, 2025

Grim Retail Sales A Sign Of Looming Bank Of Canada Rate Cuts

Apr 29, 2025 -

Join The Conversation Open Thread February 16 2025

Apr 29, 2025

Join The Conversation Open Thread February 16 2025

Apr 29, 2025 -

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025 -

Nyt Report Black Hawk Pilot Disregarded Orders Before Fatal Dc Crash

Apr 29, 2025

Nyt Report Black Hawk Pilot Disregarded Orders Before Fatal Dc Crash

Apr 29, 2025

Latest Posts

-

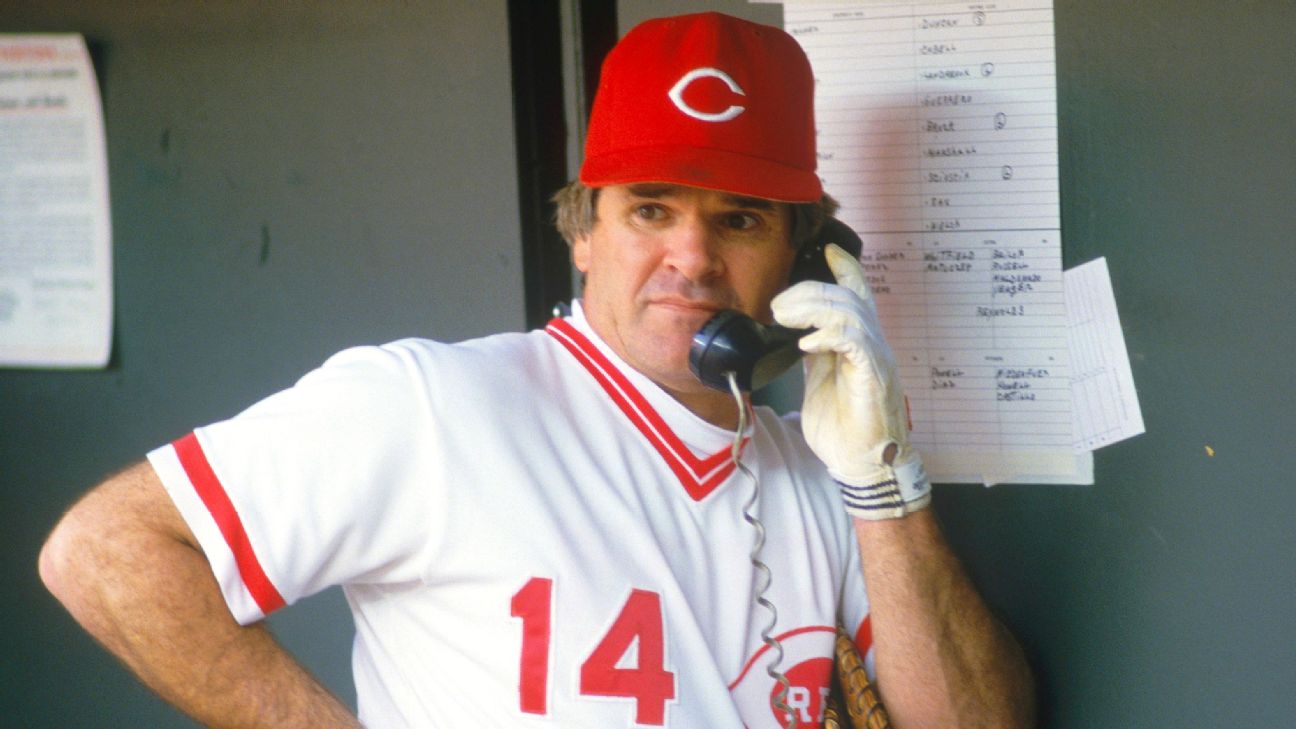

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025 -

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025

Pete Rose Pardon Trumps Statement And Its Implications

Apr 29, 2025 -

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025 -

Trump To Pardon Pete Rose After His Death Details Emerge

Apr 29, 2025

Trump To Pardon Pete Rose After His Death Details Emerge

Apr 29, 2025 -

Pete Rose Presidential Pardon Trumps Statement And Potential Implications

Apr 29, 2025

Pete Rose Presidential Pardon Trumps Statement And Potential Implications

Apr 29, 2025