Grim Retail Sales: A Sign Of Looming Bank Of Canada Rate Cuts?

Table of Contents

Weakening Consumer Spending and Retail Sales Decline

Analyzing the Recent Retail Sales Data:

The recent dip in retail sales paints a concerning picture. Statistics Canada reported a 1.0% decrease in July 2024, following a 0.2% decline in June. This represents a significant contraction in consumer spending, indicating a potential slowdown in economic activity.

- Sectors Most Affected: The decline wasn't uniform across all sectors. The automotive sector experienced a particularly sharp drop, mirroring broader trends in vehicle sales. Retail sales of furniture and home furnishings also fell significantly, suggesting a cooling housing market. [Link to Statistics Canada data]

- Geographical Variations: While the national picture is gloomy, some provinces experienced steeper declines than others. For example, Ontario and British Columbia, typically strong economic drivers, showed considerable weakening in retail sales. [Link to Regional Statistics Data]

Underlying Factors Contributing to the Decline:

Several factors are likely contributing to this weakening consumer spending:

- Persistent Inflation: Even with some easing, inflation remains stubbornly high, squeezing household budgets and reducing discretionary spending.

- Rising Interest Rates: The Bank of Canada's previous interest rate hikes, while aimed at curbing inflation, have increased borrowing costs for consumers and businesses, dampening investment and consumer confidence.

- Decreased Consumer Confidence: Surveys indicate a decline in consumer confidence, with Canadians feeling less optimistic about the future economic outlook. This hesitancy translates directly into reduced spending.

- External Factors: Global economic uncertainty, including geopolitical tensions and potential supply chain disruptions, also play a role in influencing consumer behavior and overall economic sentiment.

- High Debt Levels: Canadians carry significant levels of household debt, making them more vulnerable to interest rate increases and potentially contributing to reduced spending capacity.

The Bank of Canada's Current Monetary Policy Stance

Recent Interest Rate Decisions and Their Impact:

The Bank of Canada has maintained a relatively hawkish stance in recent months, citing persistent inflationary pressures as the primary concern. However, the latest retail sales figures could prompt a reassessment of their policy.

Inflationary Pressures and the Bank's Mandate:

The Bank of Canada's primary mandate is to control inflation and maintain price stability. While recent inflation data has shown some improvement, persistent high inflation remains a concern. Grim retail sales, indicating weakening demand, could ease inflationary pressures, potentially influencing the Bank's decision-making process.

Forward Guidance and Market Expectations:

While the Bank of Canada has not explicitly signaled an imminent shift towards rate cuts, the market is increasingly speculating about this possibility given the recent economic data. Analysts are closely monitoring various economic indicators to gauge the likelihood of future policy adjustments.

Evidence Suggesting Potential for Rate Cuts

Correlation Between Retail Sales and Interest Rates:

Historically, there's a notable correlation between significant drops in retail sales and subsequent Bank of Canada rate cuts. This isn't a guaranteed relationship, but it's a significant factor to consider.

Economic Indicators Beyond Retail Sales:

Other economic indicators, such as the unemployment rate and GDP growth, also provide important context. While the unemployment rate remains relatively low, slowing GDP growth could add further pressure for rate cuts. The housing market slowdown further supports the case for easing monetary policy.

Expert Opinions and Analyst Forecasts:

Several prominent economists and financial analysts have suggested that the grim retail sales data, coupled with other weakening economic indicators, increases the likelihood of Bank of Canada rate cuts in the coming months. [Cite specific sources and their predictions].

Conclusion:

The grim retail sales figures for July 2024 represent a significant concern for the Canadian economy. Multiple factors, including persistent inflation, rising interest rates, and reduced consumer confidence, are contributing to this weakening consumer spending. While the Bank of Canada's immediate focus remains on inflation control, the recent data raises the distinct possibility of imminent Bank of Canada rate cuts. The correlation between past retail sales declines and subsequent monetary policy adjustments, coupled with other economic indicators, strengthens the case for such a shift. To stay informed, watch for updates on Bank of Canada rate cuts and follow the grim retail sales data closely to understand the evolving Canadian economic outlook. Stay informed about Canada's economic outlook and potential implications of further grim retail sales reports.

Featured Posts

-

The Ccp United Front In Minnesota Unveiling Its Operations

Apr 29, 2025

The Ccp United Front In Minnesota Unveiling Its Operations

Apr 29, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of Lawsuit

Apr 29, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of Lawsuit

Apr 29, 2025 -

Nyt Strands Solutions Hints And Answers For February 27 2025

Apr 29, 2025

Nyt Strands Solutions Hints And Answers For February 27 2025

Apr 29, 2025 -

Kentucky Congressman Calls Out Usps For Lack Of Transparency In Addressing Mail Delays

Apr 29, 2025

Kentucky Congressman Calls Out Usps For Lack Of Transparency In Addressing Mail Delays

Apr 29, 2025 -

Hollywood And Football Ryan Reynolds On Wrexhams League Return

Apr 29, 2025

Hollywood And Football Ryan Reynolds On Wrexhams League Return

Apr 29, 2025

Latest Posts

-

Exploring The Success Of Italian Footballers In The Bundesliga From Toni To Grifo

Apr 29, 2025

Exploring The Success Of Italian Footballers In The Bundesliga From Toni To Grifo

Apr 29, 2025 -

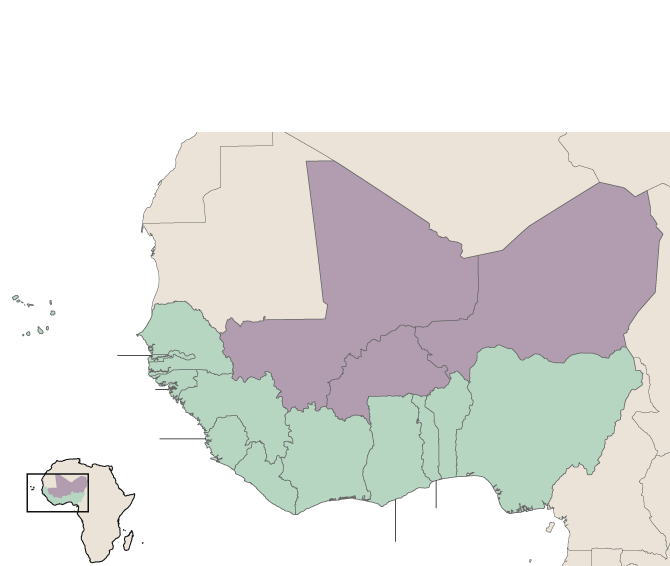

Nine African Countries Pw C Announces Withdrawal From Senegal Gabon Madagascar Etc

Apr 29, 2025

Nine African Countries Pw C Announces Withdrawal From Senegal Gabon Madagascar Etc

Apr 29, 2025 -

Bundesliga Analyse Misstoene Beim Lask Klagenfurt Im Sturzflug

Apr 29, 2025

Bundesliga Analyse Misstoene Beim Lask Klagenfurt Im Sturzflug

Apr 29, 2025 -

Bundesliga Legends The Impact Of Italian Players Like Grifo Immobile And Toni

Apr 29, 2025

Bundesliga Legends The Impact Of Italian Players Like Grifo Immobile And Toni

Apr 29, 2025 -

Pw Cs Withdrawal From Nine African Countries A Detailed Analysis

Apr 29, 2025

Pw Cs Withdrawal From Nine African Countries A Detailed Analysis

Apr 29, 2025